Payroll Independent Contractor With Fedex

Description

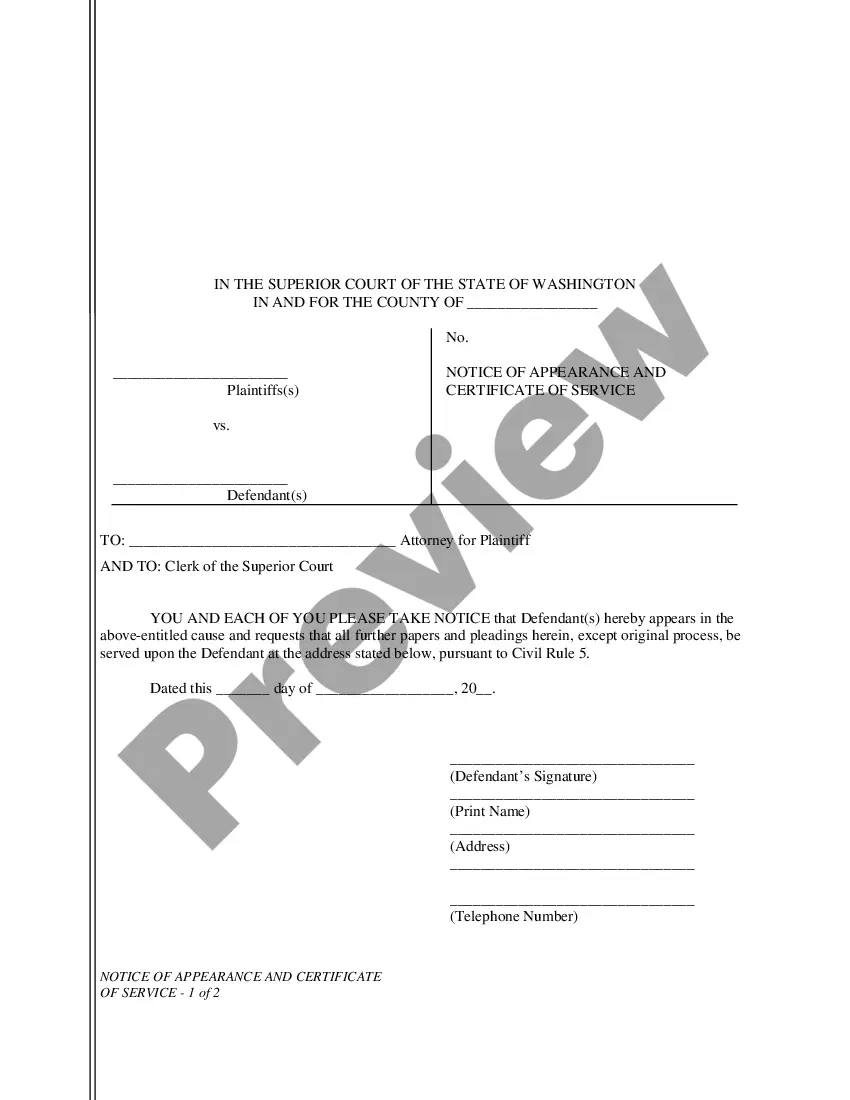

How to fill out Payroll Specialist Agreement - Self-Employed Independent Contractor?

Utilizing legal templates that adhere to federal and state regulations is crucial, and the internet provides a plethora of selections to choose from.

However, what is the purpose of squandering time looking for the accurately drafted Payroll Independent Contractor With Fedex example online when the US Legal Forms digital library already compiles such templates in one location.

US Legal Forms stands as the most extensive online legal repository featuring over 85,000 editable templates created by attorneys for any professional and personal circumstance.

Explore the template using the Preview feature or through the text outline to ensure it meets your requirements.

- They are straightforward to navigate with all documents categorized by state and intended use.

- Our experts stay updated with legislative changes, ensuring your form is always current and compliant when obtaining a Payroll Independent Contractor With Fedex from our platform.

- Acquiring a Payroll Independent Contractor With Fedex is effortless and speedy for both existing and new users.

- If you have an account with an active subscription, Log In and save the document sample you require in the appropriate format.

- If you are visiting our website for the first time, follow these steps.

Form popularity

FAQ

By classifying the drivers as independent contractors, FedEx has avoided paying legally required benefits like health insurance, worker's compensation, and other fringe benefits. However, a Federal Court has decided that FedEx ground drivers were misclassified as independent contractors in the past.

In addition to their weekly compensation, contractors receive bonuses for things such as customer service and safety, among other items. From the weekly revenues paid by FedEx, contractors are then required to pay their business expenses, including employee salaries, fuel, insurance, etc.

FedEx Ground route businesses operate as 1099 contractors to FedEx Ground. There are plentiful tax write-offs available to 1099 contractors that you should discuss with your CPA.

It used independent contractors as a lower-cost, flexible workforce, which FedEx found attractive. Primarily an airline, FedEx wanted to get into the ground business, so it acquired RPS in 1998. By 2004, it had 16,200 owner-operators, who each took on a route and all the responsibilities of running their own business.