Security Self Employed Forms Tax

Description

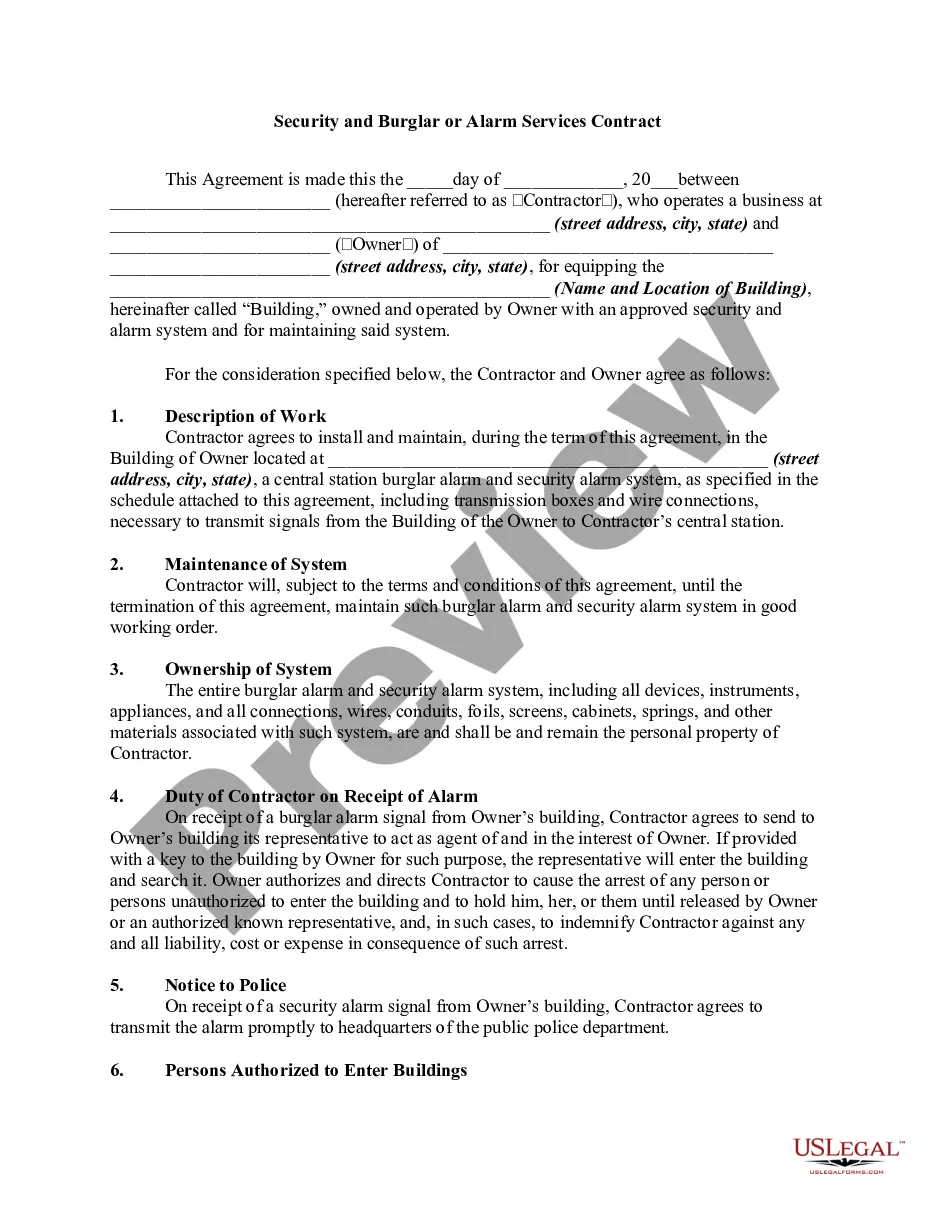

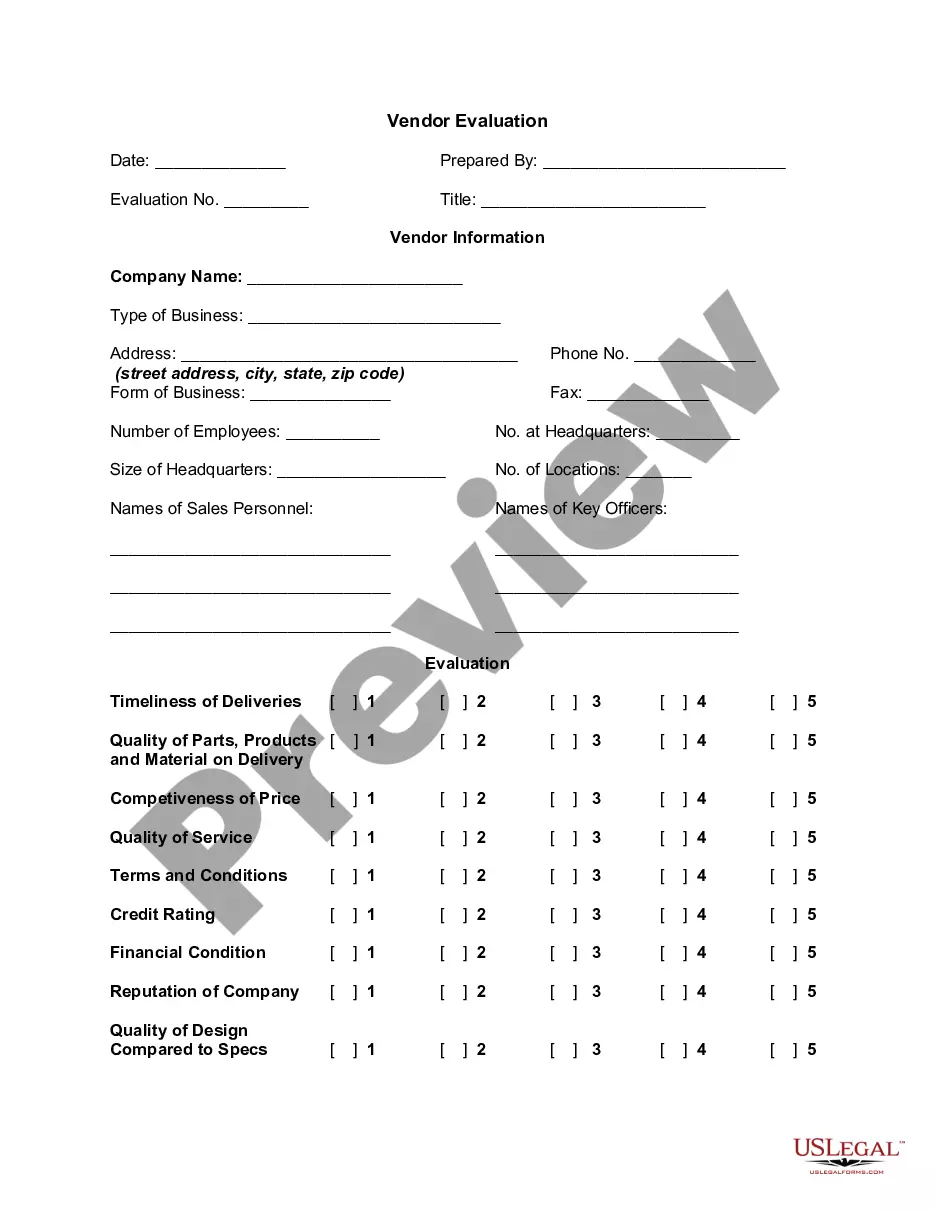

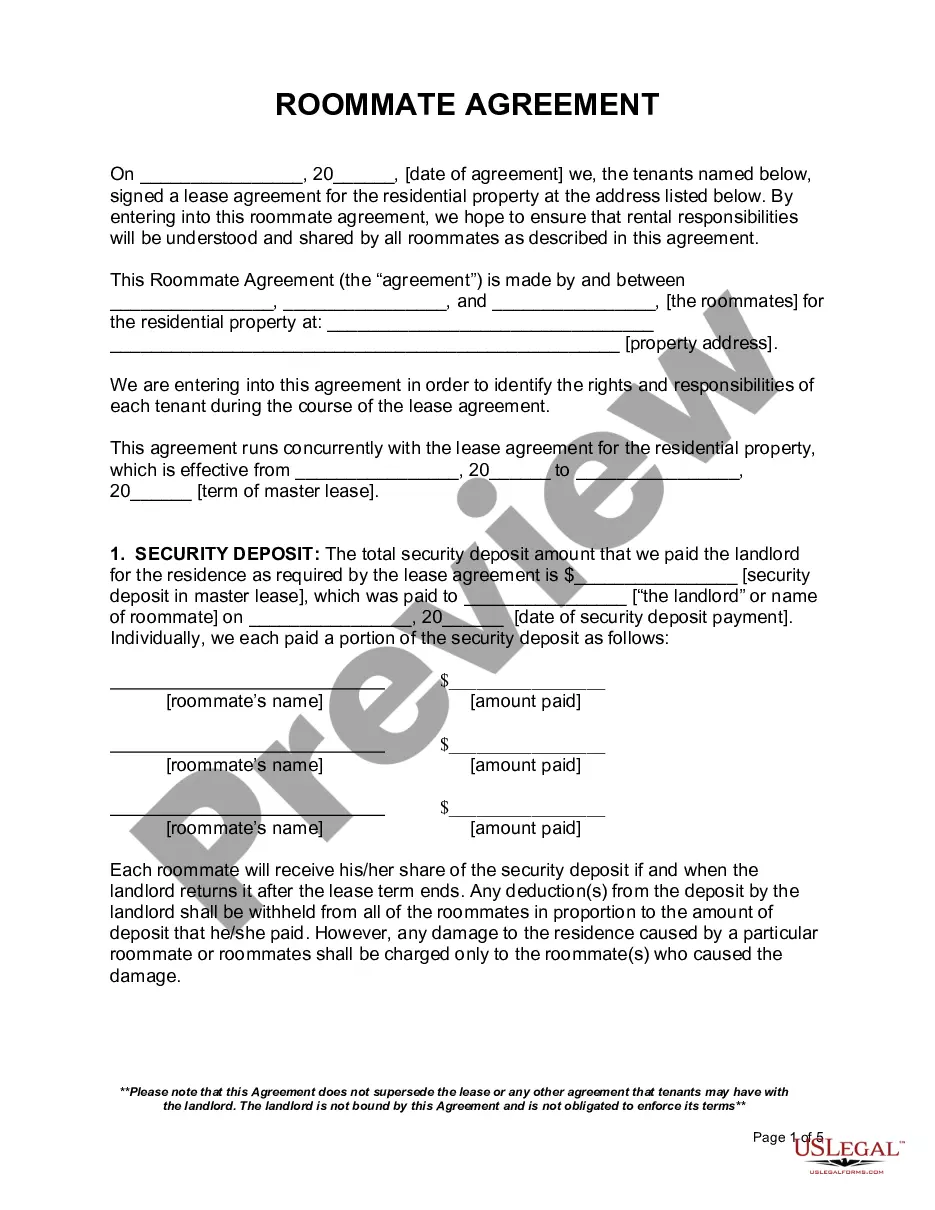

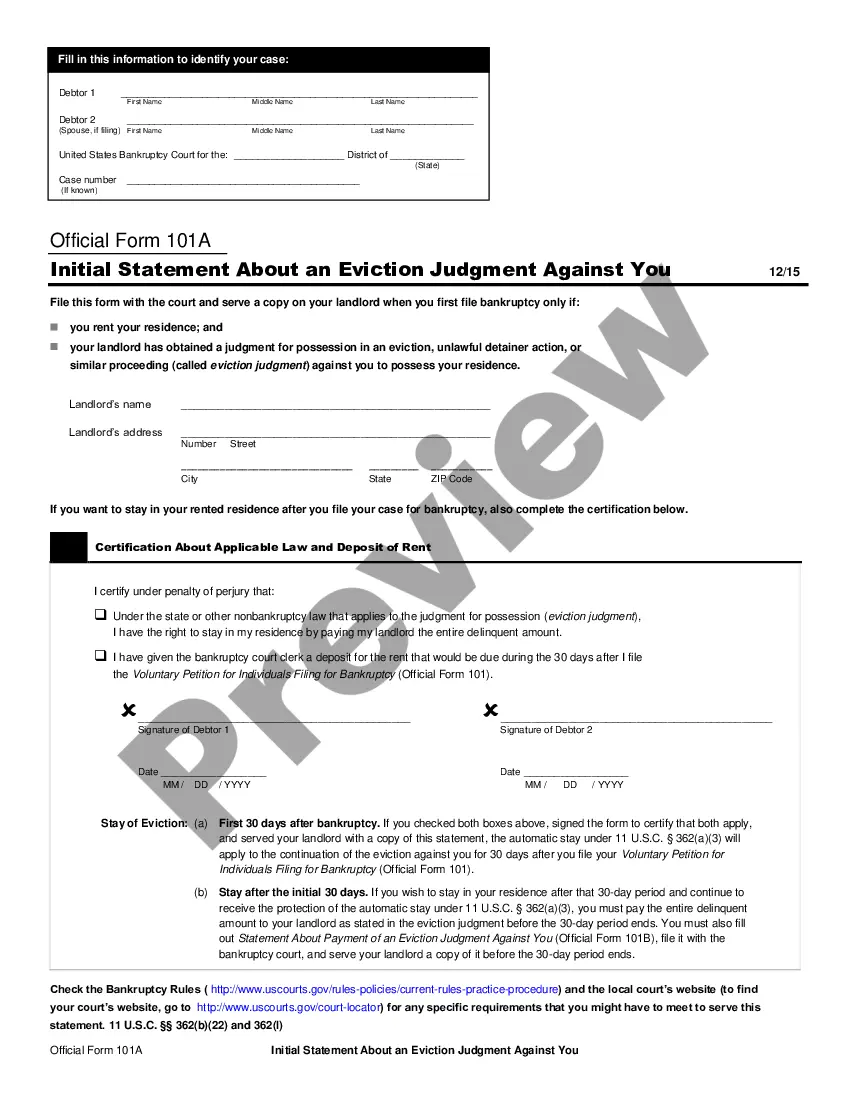

How to fill out Security And Alarm Services Contract - Self-Employed?

It’s clear that you cannot instantly become a legal expert, nor can you easily learn how to swiftly create Security Self Employed Forms Tax without possessing a specialized background.

Drafting legal documents is a lengthy endeavor that demands specific education and expertise.

So why not entrust the drafting of the Security Self Employed Forms Tax to professionals.

You can regain access to your documents from the My documents section at any time.

If you’re an existing client, you can simply Log In and locate and download the template from the same section.

- Navigate to the document you require using the search bar located at the top of the website.

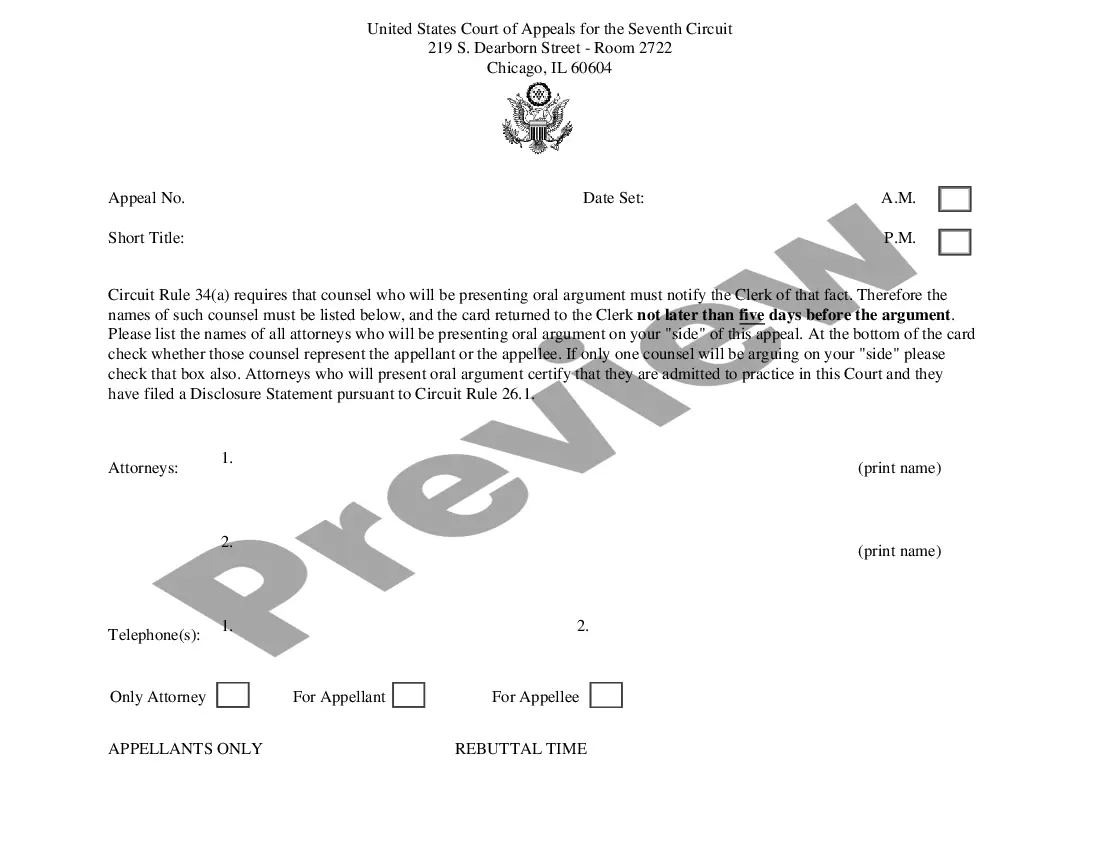

- View a preview (if this option is available) and read the accompanying description to determine if Security Self Employed Forms Tax meets your needs.

- If you require a different template, start your search over.

- Sign up for a complimentary account and select a subscription plan to purchase the template.

- Click Buy now. Once the transaction is completed, you can obtain the Security Self Employed Forms Tax, complete it, print it, and send it or mail it to the necessary parties or organizations.

Form popularity

FAQ

Self-employed individuals often overlook deducting business expenses or fail to keep accurate records, which can lead to tax liabilities. Additionally, miscalculating estimated tax payments is a frequent error that can result in penalties. Using the right Security self employed forms tax can help you avoid these pitfalls, ensuring you stay compliant and maximize your deductions with confidence.

To fill out a self-employment income report, start by documenting all sources of income and relevant expenses related to your business. You'll need to calculate your net profit or loss, which is reported on Schedule C. Utilizing the Security self employed forms tax available through US Legal Forms can enhance your efficiency, providing templates that guide you through the reporting process step by step.

Filing taxes as a self-employed person requires you to gather your income records and deduct business expenses. You will typically use Schedule C to report your earnings and expenses, and Schedule SE for self-employment tax. The US Legal Forms platform offers a variety of Security self employed forms tax that can simplify this process, ensuring you have the necessary documentation to complete your return accurately.

As a self-employed individual, you are responsible for paying both the employer and employee portions of Social Security tax, which totals 12.4% of your net earnings. It's important to note that this tax applies up to a certain income limit, which may change annually. You will report this on your tax return using the appropriate Security self employed forms tax. Keeping accurate records can help you calculate your contributions correctly.

To obtain proof of income as a self-employed individual, you can use various methods. One effective way is to gather your Security self employed forms tax, which include your income statements and tax returns from previous years. Additionally, you may consider creating a profit and loss statement to summarize your earnings and expenses. Using the US Legal Forms platform can simplify this process, providing you with templates and resources to accurately document your income.

Many self-employed individuals make mistakes when it comes to filing their taxes. One common error is failing to keep accurate records of income and expenses, which can lead to incorrect reporting. Additionally, some overlook the importance of using the appropriate Security self employed forms tax, which can result in penalties or overpayment. To avoid these pitfalls, consider utilizing platforms like USLegalForms, which provide the necessary forms and resources to help you navigate your tax responsibilities confidently.

To maximize your tax refund as a self-employed individual, keep thorough records of all your business expenses. Utilize deductions like home office expenses, supplies, and travel costs. Additionally, consider using platforms like US Legal Forms to ensure you fill out the necessary security self employed forms tax accurately. This approach helps you claim every deduction available, ultimately boosting your refund.

To calculate social security tax as a self-employed individual, you first need to determine your net earnings. This involves subtracting your business expenses from your gross income. Once you've established your net earnings, multiply that amount by 15.3%. This percentage includes both the employee and employer portions of the social security tax, ensuring you meet your obligations for security self employed forms tax.

To obtain a 1099 form, you should first ensure that the businesses or clients you worked with issue one to you for any payments made over a certain amount during the year. If you need to create your own 1099 form, resources like USLegalForms offer templates that simplify this process. With these forms, you can accurately report your income while adhering to Security self employed forms tax guidelines.

You can find the self-employment tax form, also known as Schedule SE, directly on the IRS website. Additionally, many tax software services, including USLegalForms, provide easy access to this form and related documentation. This ensures you have everything you need to file correctly and efficiently.