Agreement Independent Contract Format

Description

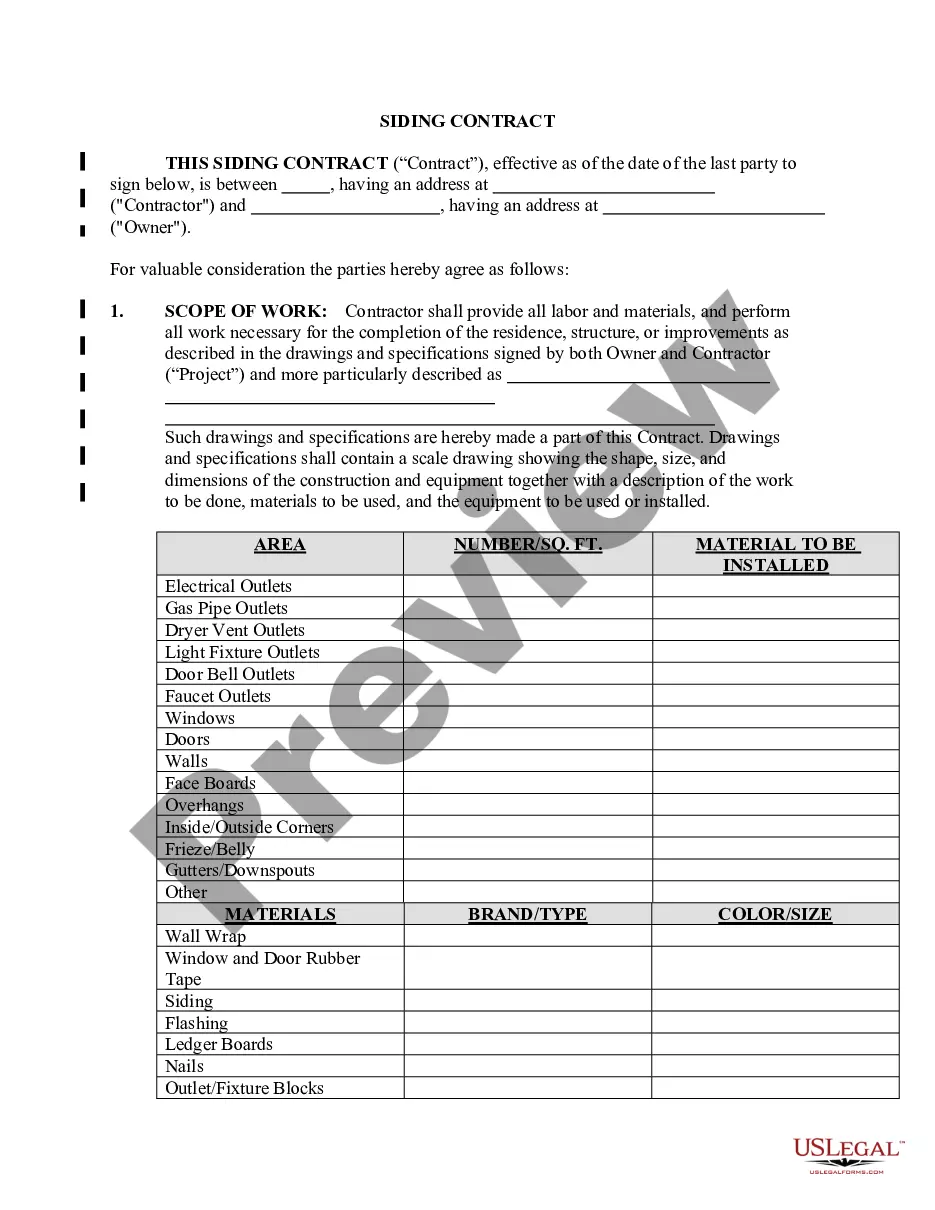

How to fill out Dietitian Agreement - Self-Employed Independent Contractor?

Legal documentation management can be exasperating, even for the most adept experts.

If you require an Agreement Independent Contract Format but lack the time to dedicate to finding the appropriate and current version, the process can be stressful.

Tap into a resource repository of articles, tutorials, and guides pertinent to your circumstances and needs.

Save time and energy searching for the documents you require, and utilize US Legal Forms’ advanced search and Preview feature to locate Agreement Independent Contract Format and acquire it.

Ensure the template is sanctioned in your state or county.

- If you have a subscription, Log In to your US Legal Forms account, find the form, and procure it.

- Check your My documents section to review documents you previously accessed and manage your folders as needed.

- If this is your first experience with US Legal Forms, create an account and gain unlimited access to all platform advantages.

- Here are the actions to follow post-download of the necessary form.

- Verify it is the correct form by previewing it and reviewing its details.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses all requirements you might have, ranging from personal to corporate papers, all in a single location.

- Utilize sophisticated tools to complete and manage your Agreement Independent Contract Format.

Form popularity

FAQ

How Do You Recover Money From a Bounced Check? As the recipient of a bounced check, you will need to get in touch with the check issuer and request payment. If you're unable to resolve it with a conversation, you could take further action by sending a demand letter via certified mail.

Knowingly writing a bad check is an act of fraud and it's punishable by law. Criminal penalties for people who tender checks knowing that there are insufficient funds in their accounts can vary by state. Some states require an intent to commit fraud.

Send certified mail. The check you wrote for $________, dated ______, which was made payable to _____________(write your/payee's name here), was returned by ______________ (write name of bank) because ____________(account was closed OR the account had insufficient funds).

It is also a crime to forge a check or write a check. If you believe you are a victim of a crime, report this to your police department, sheriff's office, or district attorney's office. You may also sue someone who writes you a bad check without having a valid reason for doing so.

Generally, if your bank credited your account, it can later reverse the funds if the check is found to be fraudulent. You should check your deposit account agreement for information on the bank's policies regarding fraudulent checks. Fraudulent checks may be part of an overpayment/money order scam.

The Demand Letter Your demand letter must request that you be paid the full amount of the check, any bank fees and the cost of mailing the demand. It also tells the person who gave you the bad check, that if they do not pay within 30 days of your mailing the demand letter, you can sue for the check plus damages.

California penal Code 476a defines writing or passing bad checks as follows: Anyone who willfully, with intent to defraud, makes or delivers a check for the payment of money when they know at the time there are not sufficient funds for full payment of the check.

Send certified mail. The check you wrote for $________, dated ______, which was made payable to _____________(write your/payee's name here), was returned by ______________ (write name of bank) because ____________(account was closed OR the account had insufficient funds).