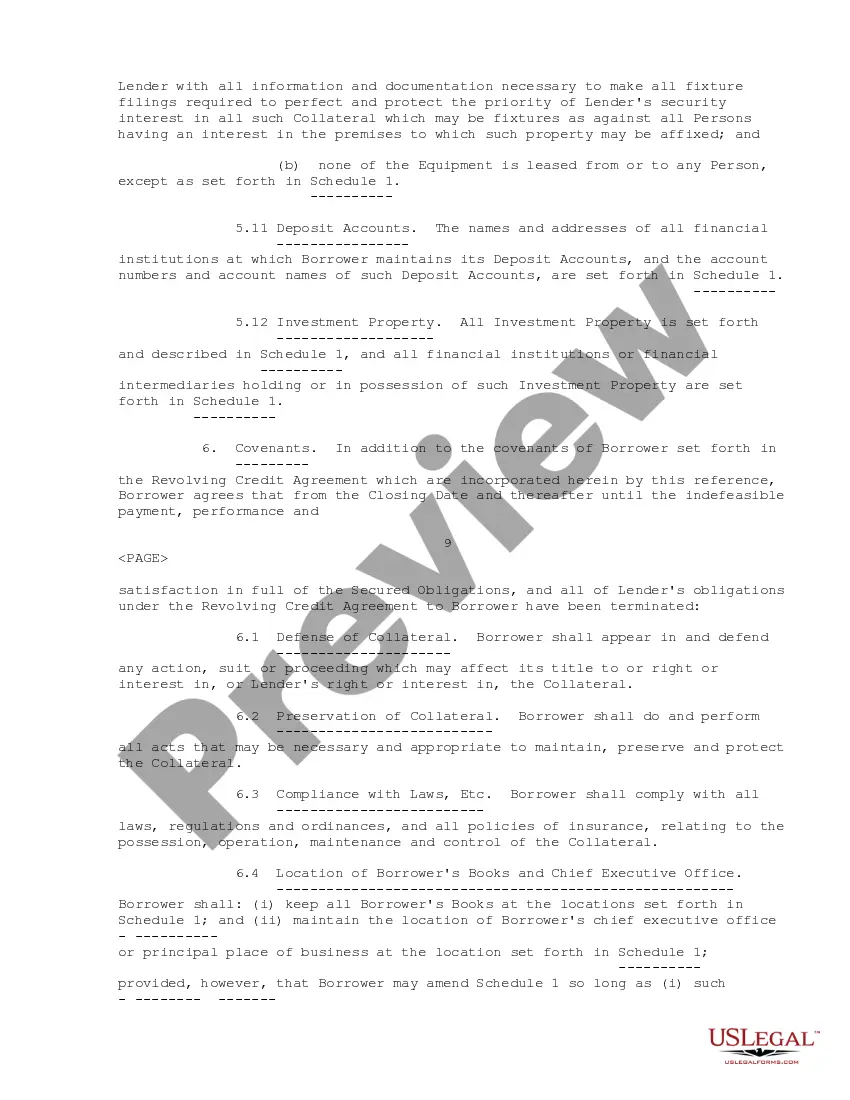

What Is A Security Agreement

Description

How to fill out Security Agreement Between PCSupport.com, Inc. And ICE Holdings North America?

- If you are a returning user, visit the US Legal Forms website and log into your account. Ensure your subscription is active to download your necessary form template by selecting the Download button.

- For first-time users, start by reviewing the Preview mode and form descriptions to choose the document that meets your specific legal requirements.

- Should you find that your selected form does not meet your needs, use the Search tab to explore other templates that may be more suitable.

- Once you’ve chosen the correct document, click on the Buy Now button and select your desired subscription plan. Create an account to gain access to US Legal Forms’ extensive library.

- Complete your purchase using a credit card or PayPal. After payment, you’ll be able to download your form.

- Save the template on your device and access it in the My Forms section of your profile whenever necessary.

By using US Legal Forms, you benefit from a diverse collection of legal templates that is more extensive than competitors. With over 85,000 easily editable forms, you can ensure accuracy and compliance with local laws.

Make the process of securing your legal documents efficient and precise. Start utilizing US Legal Forms today to create your security agreement with confidence.

Form popularity

FAQ

To establish an enforceable security interest, you must have a secured party, a debtor, and collateral. Additionally, there should be a clear agreement that details these parties and the collateral involved. By understanding these essentials, you can better navigate what is a security agreement, and you can use uslegalforms to ensure all necessary components are included in your documentation.

Recording a security agreement is not always mandatory but can be beneficial. Recording provides public notice of the interest, which can protect your rights against claims from other creditors. To learn more about what is a security agreement and whether recording is right for you, explore resources on uslegalforms that clarify these important aspects.

To ensure a security agreement is valid, it must clearly identify the collateral and be signed by the parties involved. Additionally, the agreement should demonstrate intent to create a security interest. Understanding what is a security agreement is crucial for knowing these elements, and the uslegalforms platform offers templates that help you draft such agreements correctly.

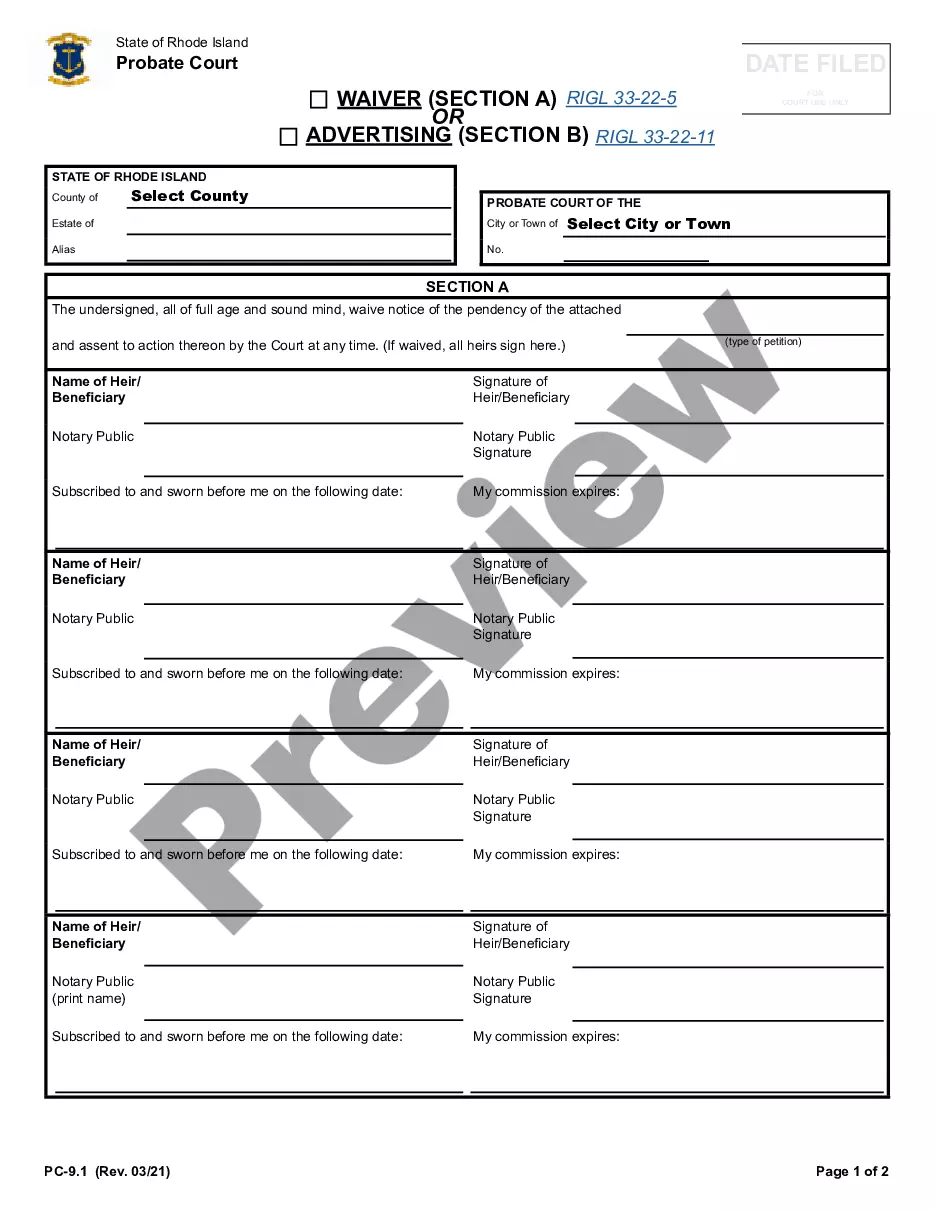

Security agreements generally do not need to be notarized to be enforceable. That said, notarization can help establish authenticity and protect against disputes. If you are unsure, consider using the uslegalforms platform, where you can find guidance on whether notarization is necessary for your specific situation regarding what is a security agreement.

A written security agreement does not necessarily need to be notarized to be valid. However, notarization can add an extra layer of protection and may be required by certain lenders or jurisdictions. It's best to understand the specific laws in your area and consult with experts when drafting your agreement on what is a security agreement.

A promissory note is not a form of security by itself; however, it can be part of a larger security arrangement. While it establishes the obligation of the borrower to repay, it does not inherently provide rights to collateral. In contrast, a security agreement formalizes the collateral arrangements, ensuring lenders have recourse if the borrower defaults.

While both a security agreement and a Uniform Commercial Code (UCC) filing are essential in secured transactions, they serve different purposes. The security agreement specifies the rights and obligations between the borrower and lender regarding the collateral. In contrast, a UCC filing publicly records the security interest, informing potential creditors about the lender's claims on the collateral, thus protecting their interests.

A security agreement is not the same as a mortgage, although they both deal with securing loans. A mortgage specifically relates to real estate and grants the lender the right to claim the property if the borrower defaults. In contrast, a security agreement can apply to various types of collateral, making it broader in scope while still providing necessary protection for lenders.

The primary difference between a promissory note and an agreement lies in their functions. A promissory note focuses on the borrower's promise to repay a debt, while a security agreement outlines the collateral securing that debt. In the context of loans and financing, both documents play significant roles, but they fulfill different legal functions important for both parties.

Writing a security contract agreement involves detailing the parties involved, the collateral being secured, and the terms and conditions of the agreement. Clearly articulate the responsibilities of each party, specifying what happens if any party defaults on its obligations. It's advisable to consult resources like USLegalForms to create a comprehensive and legally-binding agreement.