Income For Spouse

Description

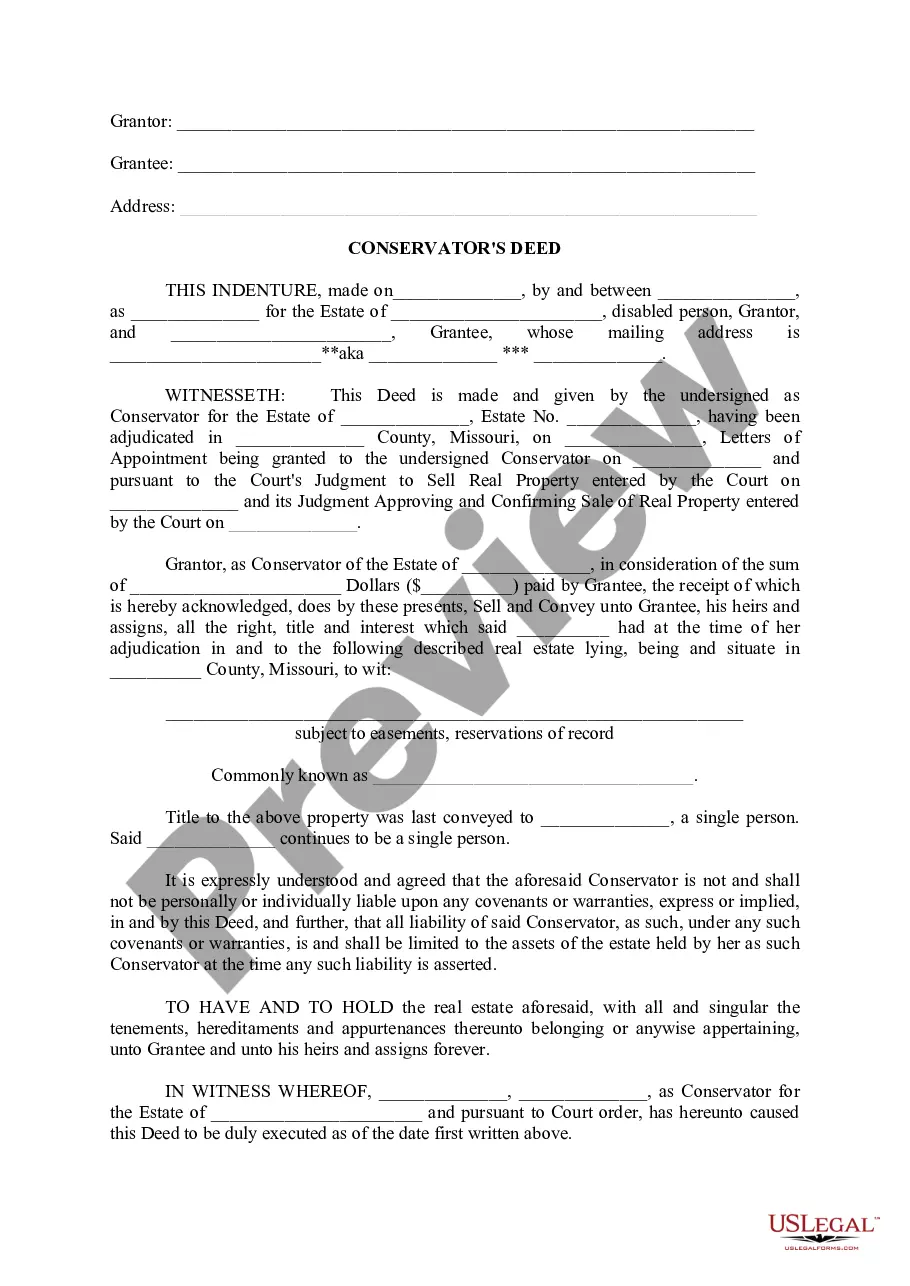

How to fill out Complex Will - Income Trust For Spouse?

Securing a reliable source for obtaining the latest and suitable legal templates is part of the challenge of managing bureaucracy.

Identifying the correct legal documents requires precision and careful consideration, which highlights the importance of sourcing Income For Spouse samples solely from trustworthy providers, such as US Legal Forms. An incorrect template can be a waste of your time and delay your current situation. With US Legal Forms, you have minimal concerns. You can access and verify all the specifics regarding the document’s applicability and significance for your scenario and in your jurisdiction.

After you have the form on your device, you can modify it using the editor or print it out and fill it out manually. Eliminate the hassle associated with your legal documentation. Explore the extensive US Legal Forms catalog to discover legal templates, assess their relevance to your situation, and download them immediately.

- Utilize the catalog navigation or search bar to find your sample.

- Review the form’s description to determine if it meets the criteria of your jurisdiction and locality.

- Examine the form preview, if available, to confirm that the template is indeed the one you are seeking.

- Return to the search and find the appropriate template if the Income For Spouse does not meet your needs.

- When you are certain about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your selected templates in My documents.

- If you do not yet have an account, click Buy now to purchase the form.

- Choose the pricing plan that best fits your needs.

- Proceed with the registration to complete your transaction.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Income For Spouse.

Form popularity

FAQ

This tax filing status is often the best choice when one spouse earns significantly more money than the other. Married filing jointly allows a couple to use only one tax return. Both spouses are equally responsible for the return and any taxes and penalties owed.

You can't claim spouses as dependents whether he or she maintains residency with you or not. However, you can claim an exemption for your spouse in certain circumstances: If you and your spouse are married filing jointly, you can claim one exemption for your spouse and one exemption for yourself.

Under no circumstance can a spouse be claimed as a dependent, even if they have no income.

The Department of Education is trying to understand your whole financial picture ? whether that means your parents, your spouse or just you ? then offer you no more or less than what you need for college. Marital status is just one part of that overall picture, and it can impact how you pay for college.

If you file jointly, you both must include all your income, deductions, and credits on that return. You can file a joint return even if one of you had no income or deductions.