Grant Of Stock Options Without Cash

Description

How to fill out Stock Option Grants And Exercises And Fiscal Year-End Values?

Getting a go-to place to access the most recent and relevant legal samples is half the struggle of handling bureaucracy. Choosing the right legal documents needs accuracy and attention to detail, which is why it is very important to take samples of Grant Of Stock Options Without Cash only from reliable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to worry about. You may access and check all the details regarding the document’s use and relevance for the situation and in your state or county.

Consider the following steps to complete your Grant Of Stock Options Without Cash:

- Utilize the library navigation or search field to locate your template.

- Open the form’s information to ascertain if it suits the requirements of your state and county.

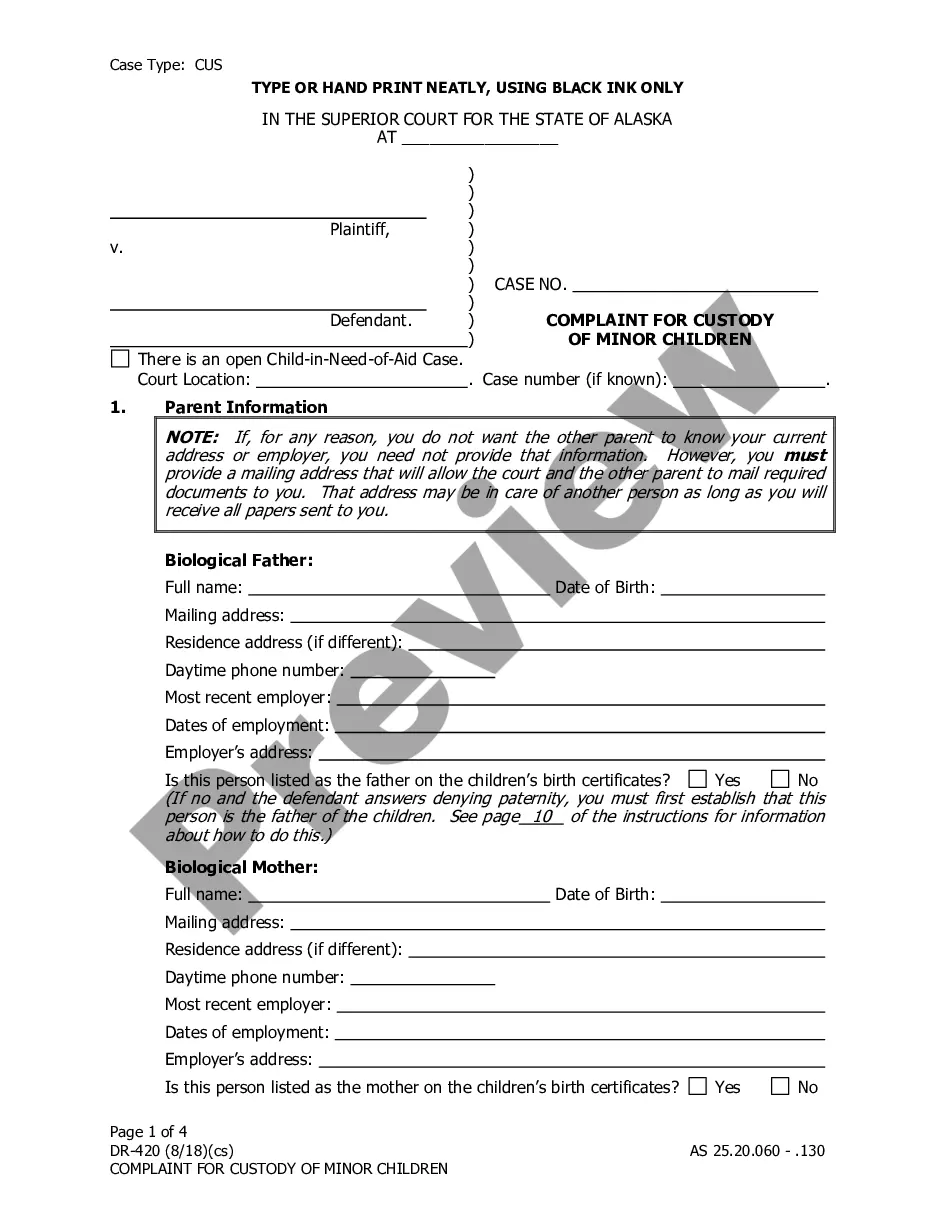

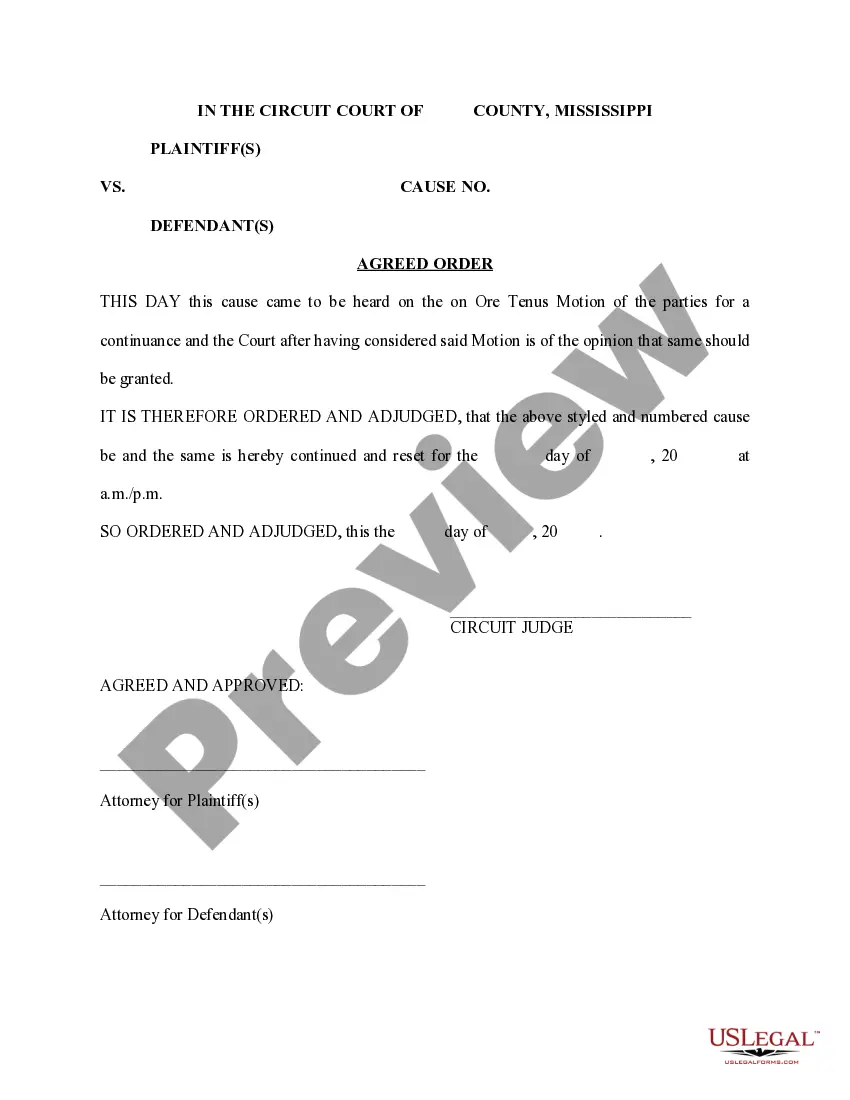

- Open the form preview, if available, to make sure the form is the one you are interested in.

- Return to the search and find the right document if the Grant Of Stock Options Without Cash does not fit your requirements.

- When you are positive about the form’s relevance, download it.

- If you are an authorized customer, click Log in to authenticate and access your picked forms in My Forms.

- If you do not have an account yet, click Buy now to get the form.

- Select the pricing plan that suits your preferences.

- Proceed to the registration to complete your purchase.

- Complete your purchase by choosing a payment method (credit card or PayPal).

- Select the file format for downloading Grant Of Stock Options Without Cash.

- When you have the form on your device, you may alter it with the editor or print it and complete it manually.

Eliminate the inconvenience that comes with your legal documentation. Explore the comprehensive US Legal Forms catalog where you can find legal samples, check their relevance to your situation, and download them on the spot.

Form popularity

FAQ

A cash exercise may be a good strategy if you expect the future stock price of your company to increase, but you must pay cash when you exercise your options.

Regardless of whether you're exercising incentive stock options (ISOs) or non-qualified stock options (NSOs or NQSOs), in a cashless exercise you will pay ordinary income tax rates on the difference between the strike price (the amount you can buy the stock for ing to your options agreement) and the price you ...

A cashless exercise, also known as a "same-day sale," is a transaction in which an employee exercises their stock options by using a short-term loan provided by a brokerage firm. The proceeds from exercising the stock options are then used to repay the loan.

Ways to finance stock option exercise Self-finance ? The employee can finance the exercise on their own by using funds that are available such as cash, relatives, and other personal loans. ... Loan from financing companies ? Sometimes, employees are able to get a loan in order to finance the exercise.

A cashless exercise, also known as a "same-day sale," is a transaction in which an employee exercises their stock options by using a short-term loan provided by a brokerage firm. The proceeds from exercising the stock options are then used to repay the loan.