Creditors Chapter 13 Within

Description

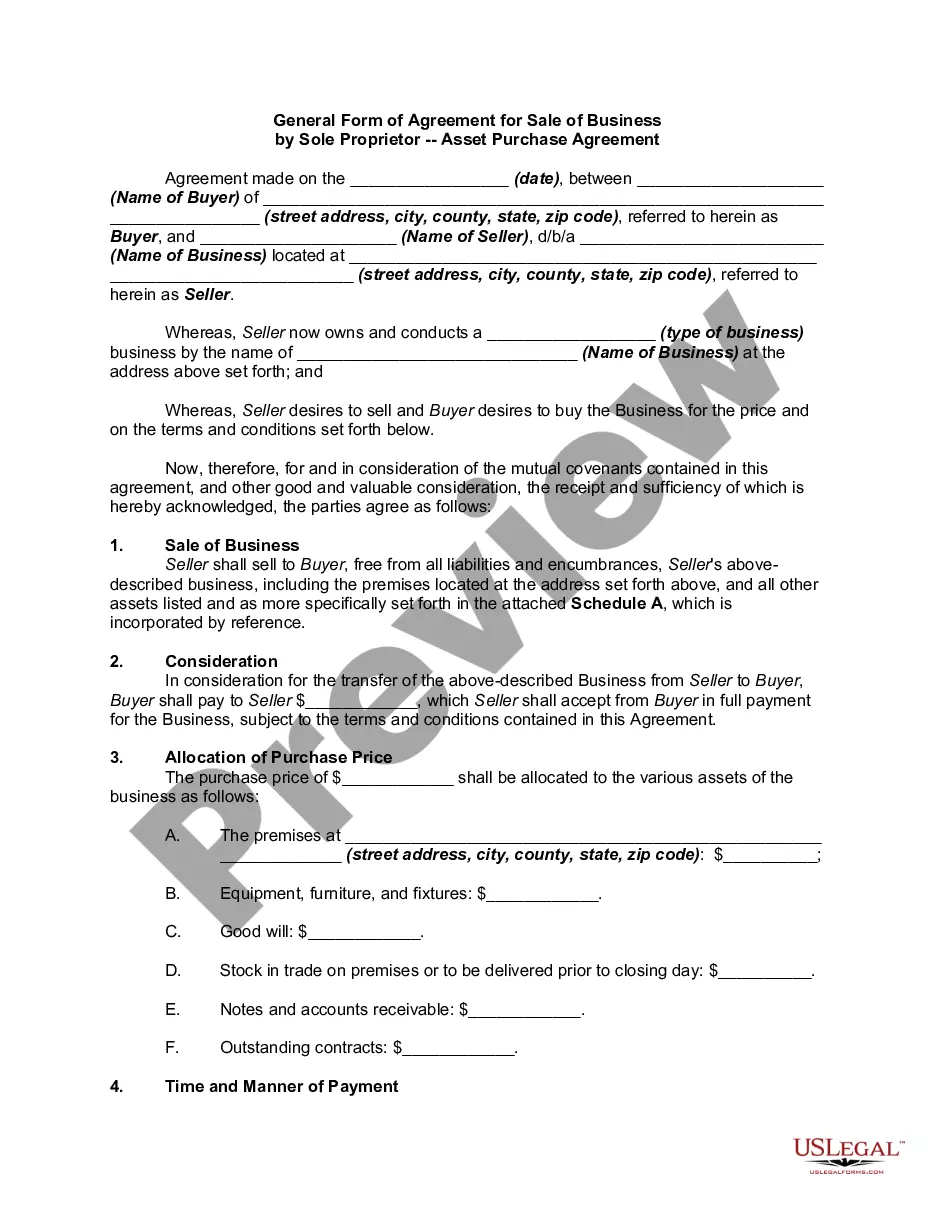

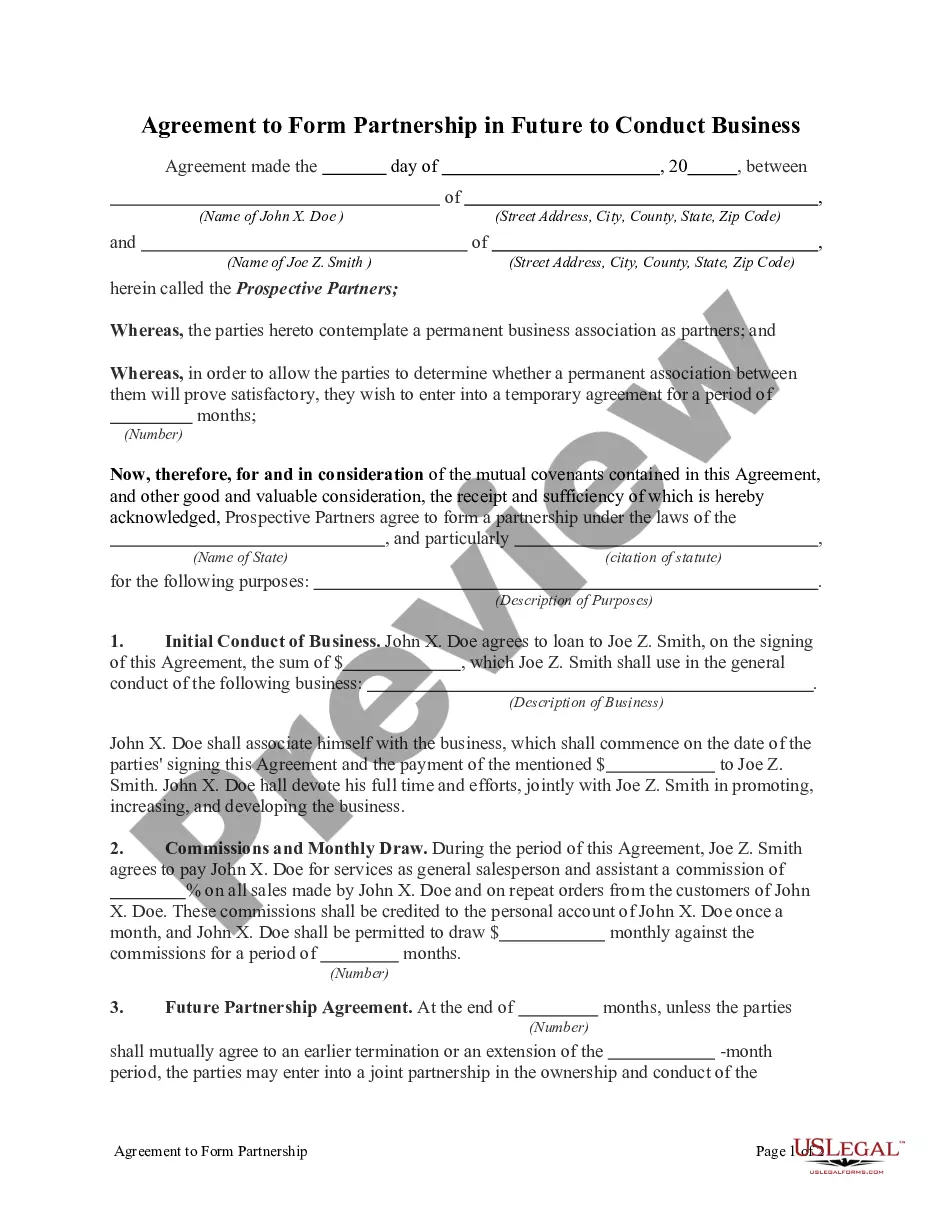

How to fill out List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

Drafting legal documents from scratch can often be intimidating. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re searching for a simpler and more cost-effective way of preparing Creditors Chapter 13 Within or any other paperwork without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our online collection of over 85,000 up-to-date legal documents addresses almost every aspect of your financial, legal, and personal matters. With just a few clicks, you can instantly get state- and county-compliant templates diligently prepared for you by our legal experts.

Use our website whenever you need a trusted and reliable services through which you can easily locate and download the Creditors Chapter 13 Within. If you’re not new to our services and have previously created an account with us, simply log in to your account, locate the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No worries. It takes little to no time to register it and explore the catalog. But before jumping directly to downloading Creditors Chapter 13 Within, follow these recommendations:

- Review the document preview and descriptions to ensure that you have found the document you are looking for.

- Check if template you choose complies with the regulations and laws of your state and county.

- Pick the best-suited subscription option to buy the Creditors Chapter 13 Within.

- Download the file. Then complete, sign, and print it out.

US Legal Forms boasts a good reputation and over 25 years of expertise. Join us today and transform document execution into something easy and streamlined!

Form popularity

FAQ

The discharge releases the debtor from all debts provided for by the plan or disallowed (under section 502), with limited exceptions. Creditors provided for in full or in part under the chapter 13 plan may no longer initiate or continue any legal or other action against the debtor to collect the discharged obligations.

Unlike chapter 7, creditors do not have standing to object to the discharge of a chapter 12 or chapter 13 debtor. Creditors can object to confirmation of the repayment plan, but cannot object to the discharge if the debtor has completed making plan payments.

If you accidentally forget to add an unsecured creditor's name to the list, not much of consequence happens in this particular case. As is the case with no asset bankruptcy, unsecured creditors, listed or not, get nothing in such cases. The debt gets discharged with creditor having no claim to collect.

You can prepare a List of Creditors by creating one using a computer and word?processing software. After completing the List of Creditors, you then submit the List of Creditors to the Court as a . txt file on electronic media (such as a CD, DVD, or flash / thumb drive).

If a creditor objects to your repayment plan, you will have an opportunity to respond to the objection. If you are able to overcome the objection, then your repayment plan will be approved, and you can proceed with your bankruptcy case.