Claims Chapter 13 Without An Attorney

Description

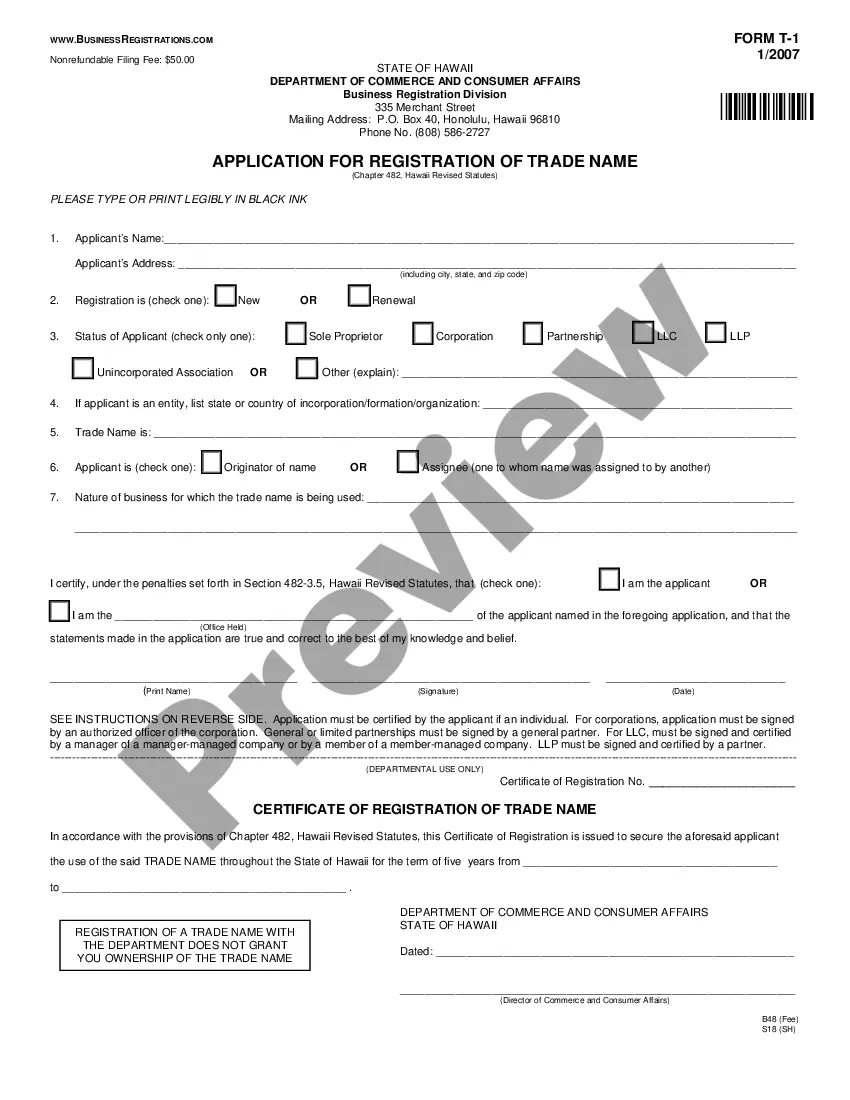

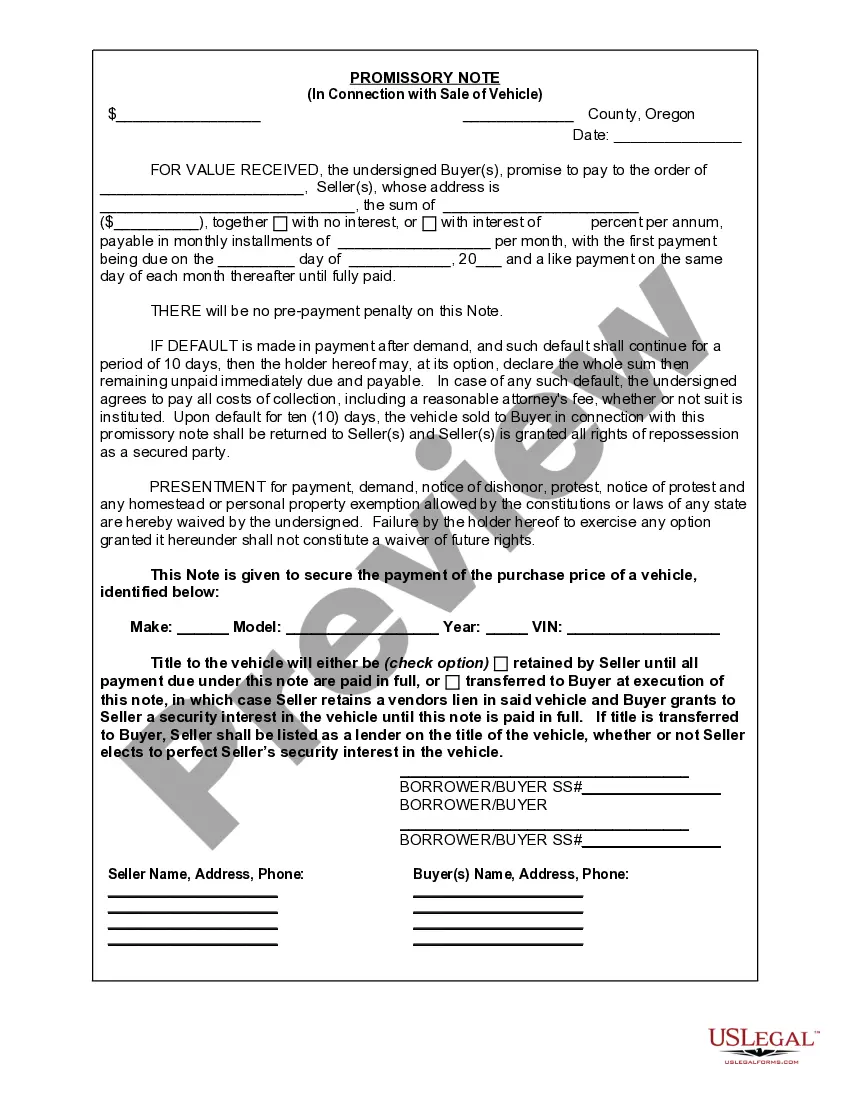

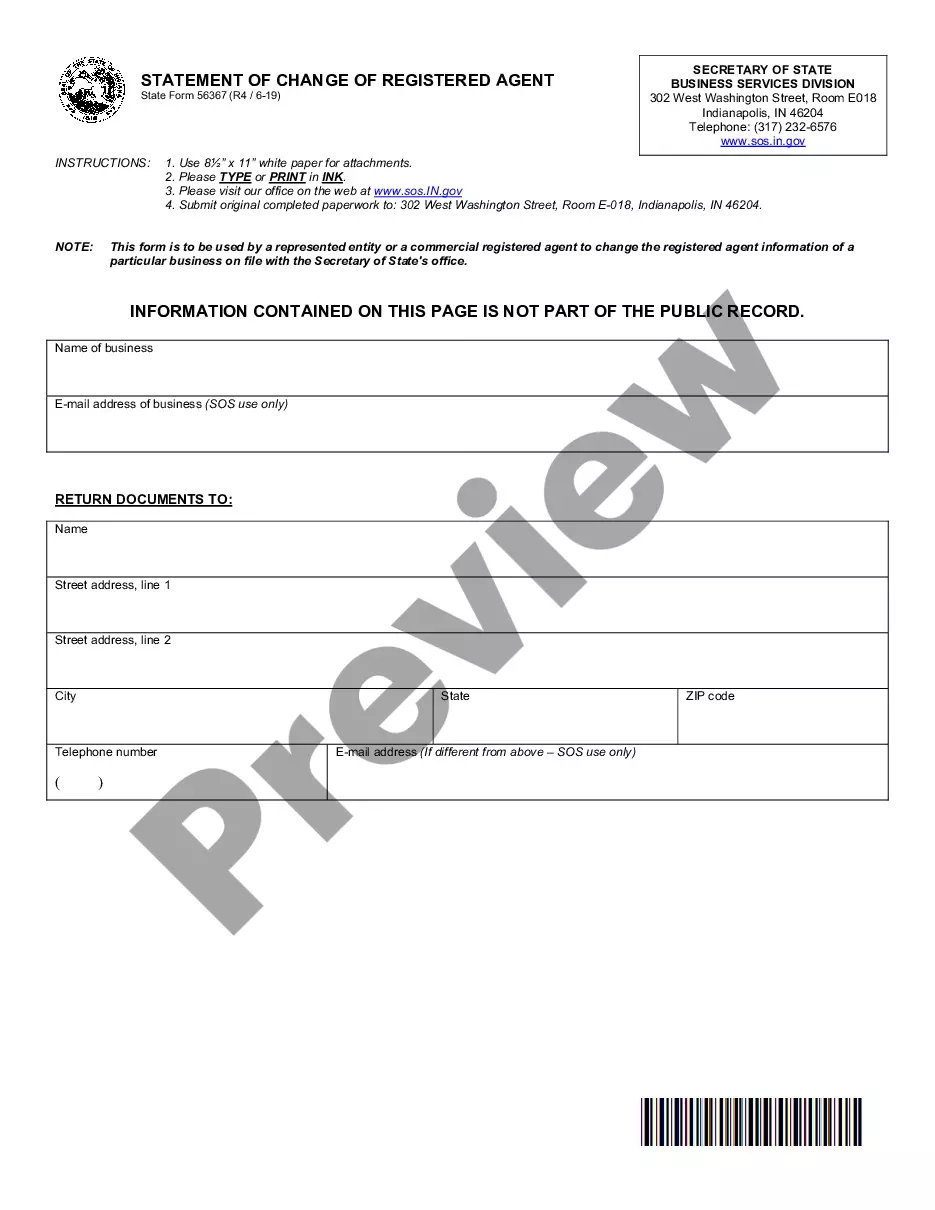

How to fill out List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

It’s obvious that you can’t become a legal professional immediately, nor can you learn how to quickly prepare Claims Chapter 13 Without An Attorney without having a specialized background. Putting together legal documents is a long process requiring a particular training and skills. So why not leave the preparation of the Claims Chapter 13 Without An Attorney to the pros?

With US Legal Forms, one of the most extensive legal document libraries, you can find anything from court documents to templates for internal corporate communication. We understand how crucial compliance and adherence to federal and local laws are. That’s why, on our platform, all forms are location specific and up to date.

Here’s start off with our website and get the document you need in mere minutes:

- Discover the document you need with the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to figure out whether Claims Chapter 13 Without An Attorney is what you’re looking for.

- Begin your search again if you need a different template.

- Register for a free account and choose a subscription plan to purchase the template.

- Pick Buy now. As soon as the transaction is through, you can get the Claims Chapter 13 Without An Attorney, fill it out, print it, and send or send it by post to the necessary people or organizations.

You can re-access your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your paperwork-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

The person filing for bankruptcy is the one who pays for the bankruptcy, either the individual or the creditor in a forced bankruptcy.

If you accidentally forget to add an unsecured creditor's name to the list, not much of consequence happens in this particular case. As is the case with no asset bankruptcy, unsecured creditors, listed or not, get nothing in such cases. The debt gets discharged with creditor having no claim to collect.

This chapter of the Bankruptcy Code provides for adjustment of debts of an individual with regular income. Chapter 13 allows a debtor to keep property and pay debts over time, usually three to five years.

Unlike chapter 7, creditors do not have standing to object to the discharge of a chapter 12 or chapter 13 debtor. Creditors can object to confirmation of the repayment plan, but cannot object to the discharge if the debtor has completed making plan payments.

If a creditor objects to your repayment plan, you will have an opportunity to respond to the objection. If you are able to overcome the objection, then your repayment plan will be approved, and you can proceed with your bankruptcy case.