Sample Notification Letter Without Name

Description

How to fill out Sample WARN Notification Letter - To Individual Employee?

Creating legal documents from scratch can frequently be slightly daunting.

Certain situations may require hours of investigation and considerable financial investment.

If you’re searching for a simpler and more economical method of generating Sample Notification Letter Without Name or any other forms without unnecessary complications, US Legal Forms is consistently available to assist you.

Our online library of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal needs. With merely a few clicks, you can swiftly obtain state- and county-specific templates meticulously prepared for you by our legal professionals.

US Legal Forms has a strong reputation and over 25 years of experience. Join us today and transform document handling into a straightforward and efficient process!

- Utilize our platform whenever you require a dependable and trusted service through which you can promptly find and download the Sample Notification Letter Without Name.

- If you’re familiar with our website and have previously registered with us, simply Log In to your account, find the form, and download it immediately or access it later in the My documents section.

- Not a member yet? No problem. Registering and browsing the catalog requires minimal time.

- However, before proceeding to download Sample Notification Letter Without Name, follow these suggestions.

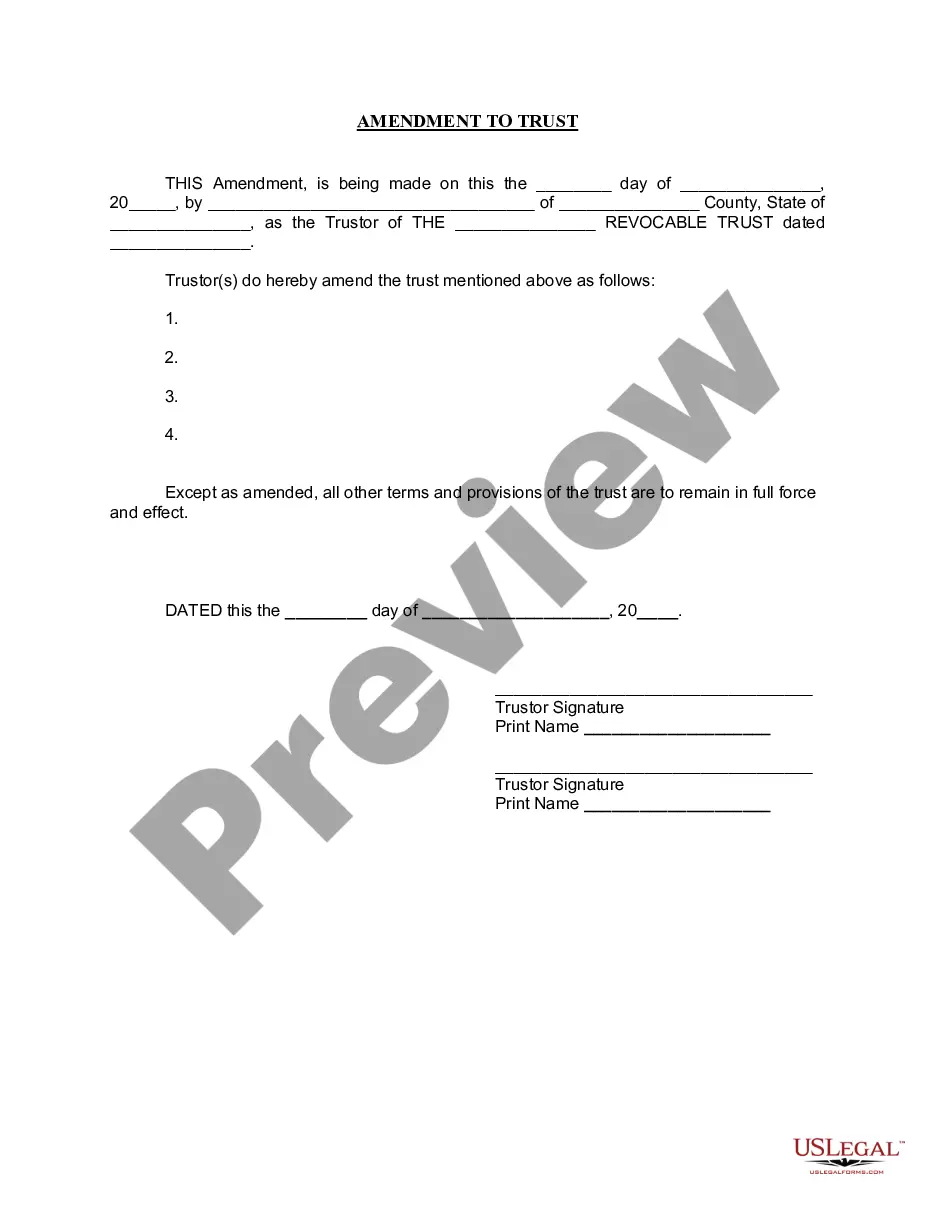

- Examine the document preview and descriptions to confirm that you are looking at the document you need.

Form popularity

FAQ

To check the status of your New Jersey refund online, go to . You may also call 1-609-292-6400 or 1-800-323-4400.

Use this form to designate a representative(s) and grant the representative(s) the authority to obligate, bind, and/or appear on your behalf before the New Jersey Division of Taxation. Section 3 of the form allows you to list which tax matters your representative is authorized to handle on your behalf.

The State of New Jersey does not mail Form 1099-G, Certain Government Payments, to report the amount of a State tax refund a taxpayer received. State Income Tax refunds may be taxable income for federal purposes for individuals who itemized their deductions on their federal tax return in the previous year.

To order State of New Jersey tax forms, call the Division's Customer Service Center (609-292-6400) to request income tax forms and instructions. To obtain State of New Jersey tax forms in person, make an appointment to visit a Division of Taxation Regional Office.

You (or your spouse/civil union partner) were: 65 or older as of December 31, 2021; or. Actually receiving federal Social Security disability benefit payments (not benefit payments received on behalf of someone else) on or before December 31, 2021, and on or before December 31, 2022.

Employers use the Form NJ-500 Monthly Remittance of Gross Income Tax Withheld to remit tax for either of the first two months of a quarter whenever the amount due for either month is $500 or more. Form NJ-500 is due on or before the 15th day of the month following the end of the reporting period.

File Form NJ-1040NR if you had in- come from New Jersey sources. Part-year residents: If you had a per- manent home in New Jersey for only part of the year and you received income from New Jersey sources while you were a nonresident, also file NJ-1040NR.

For all other types of New Jersey tax, Form M-5008-R is completed by the member to designate a representative to act on behalf of that member. Form M-5008-R is not required: When an individual appears with you or with a representative who is authorized to act on your behalf.