Vacation Request Form Template For Employees

Description

How to fill out Vacation Request Form?

Accessing legal document samples that adhere to federal and state regulations is essential, and the internet provides numerous options to choose from.

However, what is the purpose of spending time searching for the appropriate Vacation Request Form Template For Employees sample online if the US Legal Forms digital library already has these templates gathered in one location.

US Legal Forms stands as the largest online legal repository with over 85,000 editable templates created by attorneys for every professional and life scenario. They are straightforward to navigate with all documents categorized by state and purpose of use. Our experts stay updated with legislative modifications, ensuring you can always trust that your form is current and compliant when acquiring a Vacation Request Form Template For Employees from our platform.

Click Buy Now once you find the suitable form and choose a subscription plan. Register for an account or Log In and complete the payment using PayPal or a credit card. Choose the most suitable format for your Vacation Request Form Template For Employees and download it. All documents you discover through US Legal Forms are multi-usable. To re-download and complete previously acquired forms, navigate to the My documents section in your profile. Enjoy the most comprehensive and user-friendly legal document service!

- Obtaining a Vacation Request Form Template For Employees is quick and easy for both existing and new users.

- If you already possess an account with an active subscription, Log In and retrieve the document sample you need in the appropriate format.

- If you are unfamiliar with our site, adhere to the guidelines below.

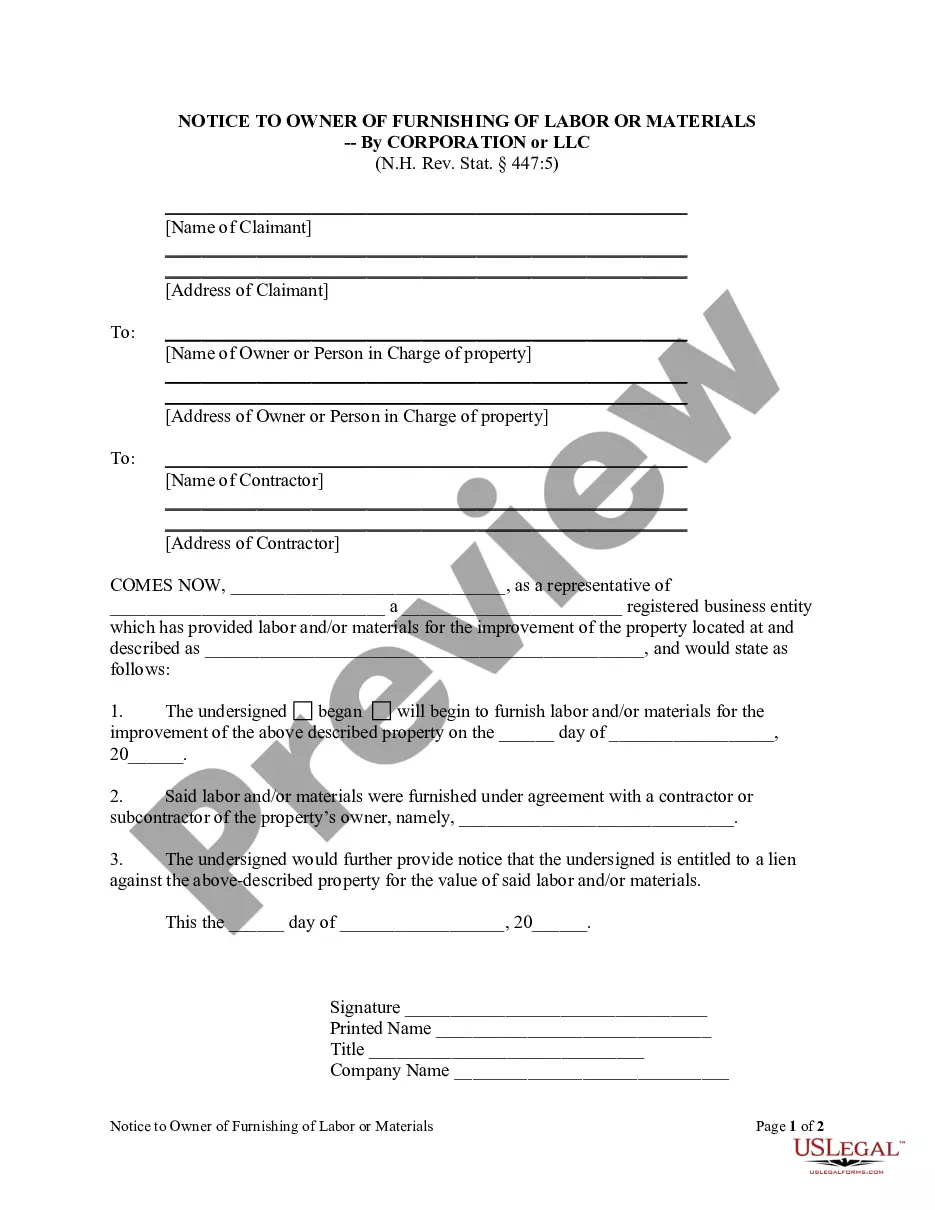

- Examine the template using the Preview function or through the text outline to ensure it satisfies your needs.

- If necessary, search for an alternative sample using the search feature at the top of the page.

Form popularity

FAQ

Yes, you can be your own registered agent in Arkansas. With that said, however, after considering the registered agent requirements most business owners elect to hire a registered agent service instead.

Starting an LLC in Arkansas will include the following steps: #1: Choose a Name for Your Arkansas LLC. #2: Hire a Registered Agent in Arkansas. #3: Request a Federal Employer Identification Number (EIN) #4: File Your Certificate of Organization. #5: Create an Operating Agreement. #6: Fulfill Your Ongoing Obligations.

Arkansas LLC Cost. Arkansas charges a $45 state fee to form an LLC ($50 by mail). You'll also need to pay $150 every year to file a franchise tax report, and you may have to pay for additional services for your LLC?such as filing a DBA or hiring a professional registered agent.

There are two types of corporations in Arkansas, C and S corporations, also known as "C-corp" and "S-corp." A C corporation is taxed as a separate entity, which means the corporation pays taxes, and then the shareholders pay taxes on individual dividends they receive.

The individual member should report the single member LLC's income and deductions on a Federal Schedule C included with their individual income tax return. All resident and non-resident partners, including corporations, must report and pay taxes on any income derived from an Arkansas partnership.

Learn How to Form an Arkansas Professional Corporation Choose a name for your Arkansas PC. Select an Arkansas registered agent. Complete your Arkansas Certificate of Incorporation. Establish a corporate record in Arkansas. Designate an Arkansas PC board of directors. Create Arkansas corporate bylaws.

To form an Arkansas S corp, you'll need to ensure your company has an Arkansas formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

Limited Liability Company Must file Articles of Organization with the Arkansas Secretary of State. Allow members to manage a company themselves or to elect managers.