Assignment Of Partnership Interest To Revocable Trust

Description

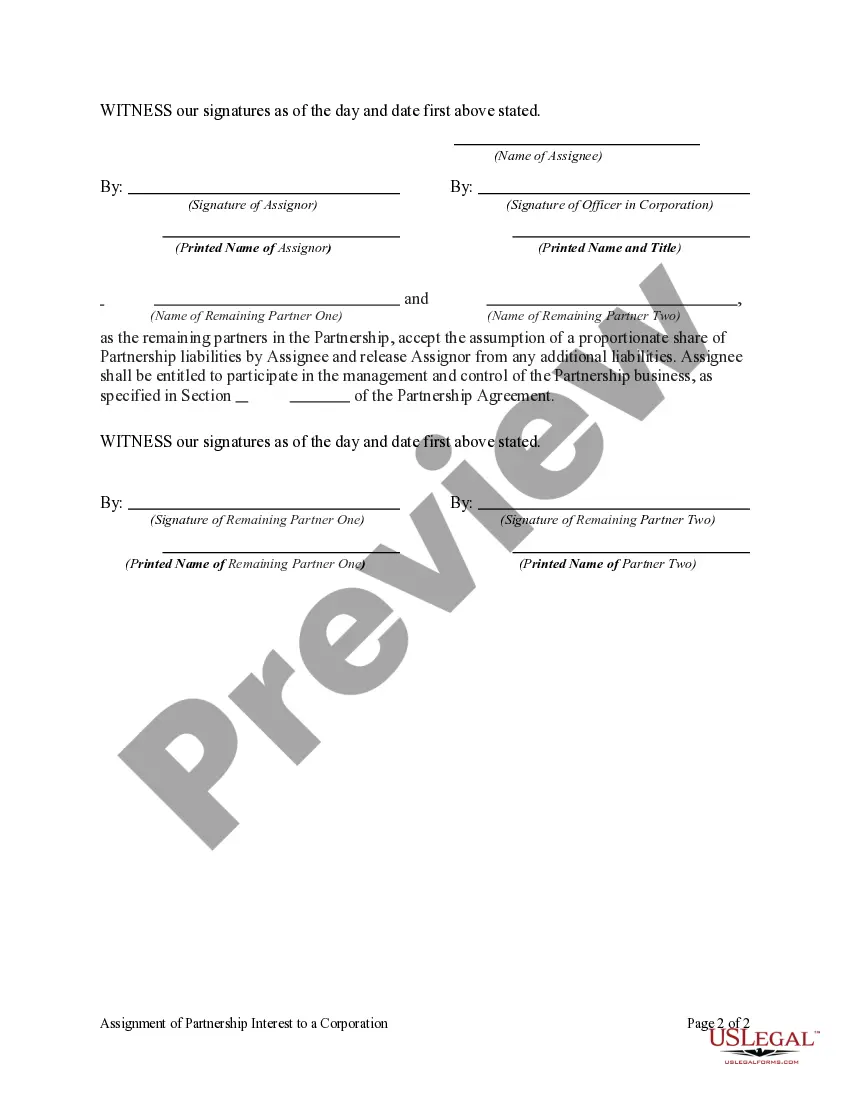

How to fill out Assignment Of Partnership Interest To A Corporation With Consent Of Remaining Partners?

Drafting legal paperwork from scratch can sometimes be a little overwhelming. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re searching for a simpler and more affordable way of creating Assignment Of Partnership Interest To Revocable Trust or any other documents without jumping through hoops, US Legal Forms is always at your disposal.

Our virtual library of more than 85,000 up-to-date legal forms covers almost every aspect of your financial, legal, and personal matters. With just a few clicks, you can instantly access state- and county-specific templates diligently prepared for you by our legal professionals.

Use our website whenever you need a trustworthy and reliable services through which you can easily locate and download the Assignment Of Partnership Interest To Revocable Trust. If you’re not new to our website and have previously set up an account with us, simply log in to your account, locate the form and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No problem. It takes minutes to register it and explore the catalog. But before jumping straight to downloading Assignment Of Partnership Interest To Revocable Trust, follow these tips:

- Check the form preview and descriptions to ensure that you have found the form you are looking for.

- Make sure the form you select conforms with the regulations and laws of your state and county.

- Choose the right subscription option to purchase the Assignment Of Partnership Interest To Revocable Trust.

- Download the form. Then complete, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of expertise. Join us today and turn document execution into something simple and streamlined!

Form popularity

FAQ

An Assignment of Partnership Interest is a legal document establishing the terms under which stake in a partnership is transferred from an assignor to an assignee. In other words, the new partner (assignee) acquires the right to receive benefits from the partnership per the stake granted.

An Assignment of Partnership Interest is a legal document establishing the terms under which stake in a partnership is transferred from an assignor to an assignee. In other words, the new partner (assignee) acquires the right to receive benefits from the partnership per the stake granted.

The effort to make an interest in a partnership trust property could be either by a declaration by a partner that he held all or part of his interest in the partnership in trust; or by an attempt to transfer to a third person as trustee a part or all of the partner's interest.

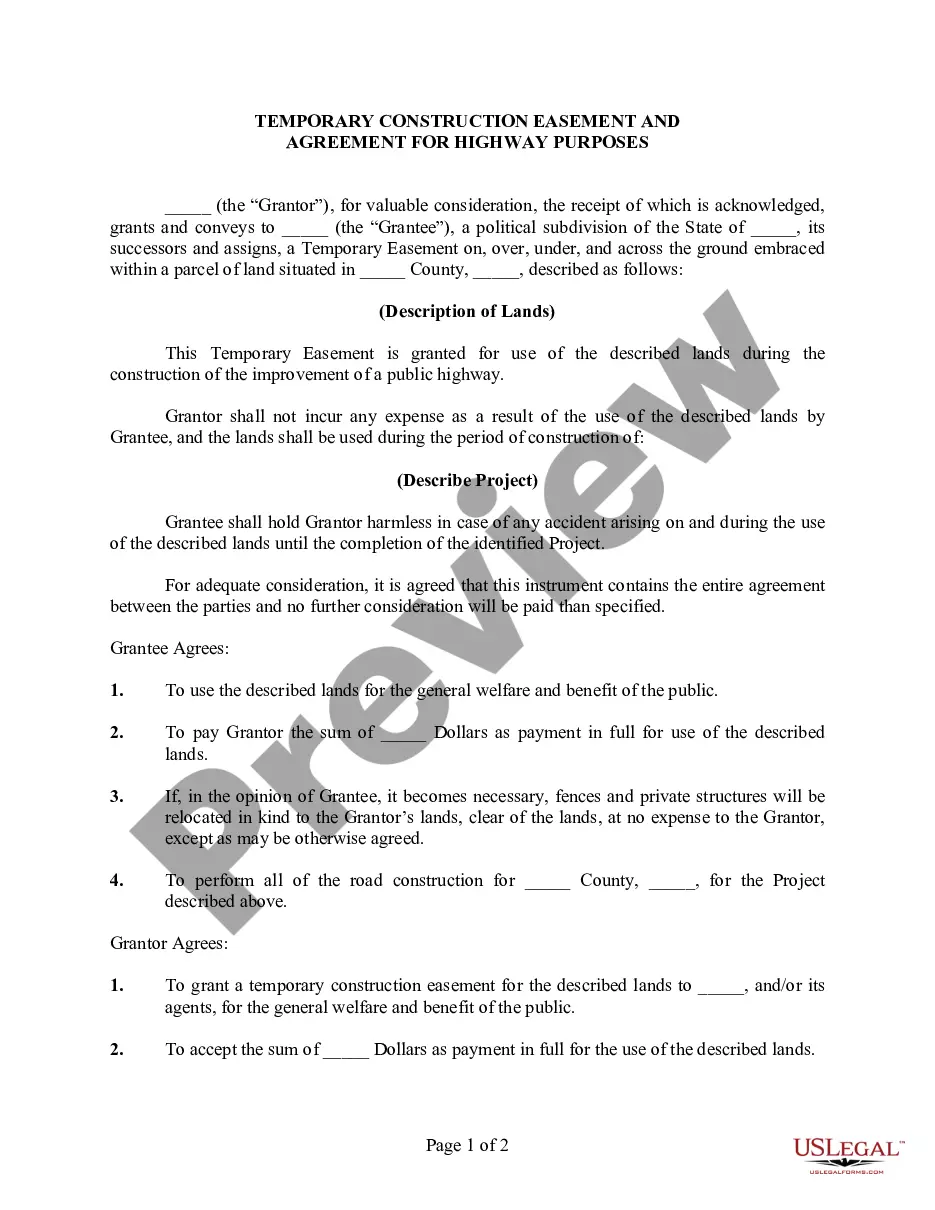

When it comes to limited partnerships and LLCs, or limited liability companies, the business interest of the company is only partly yours. However, you can transfer your portion of the business interest to a Trust as long as you secure a document of transfer, sometimes called an Assignment of Interest.

A revocable trust does not pay taxes. For federal and California income tax purposes, the assets in the trust are treated as belonging to you.