How Does Supplemental Needs Trust Work

Description

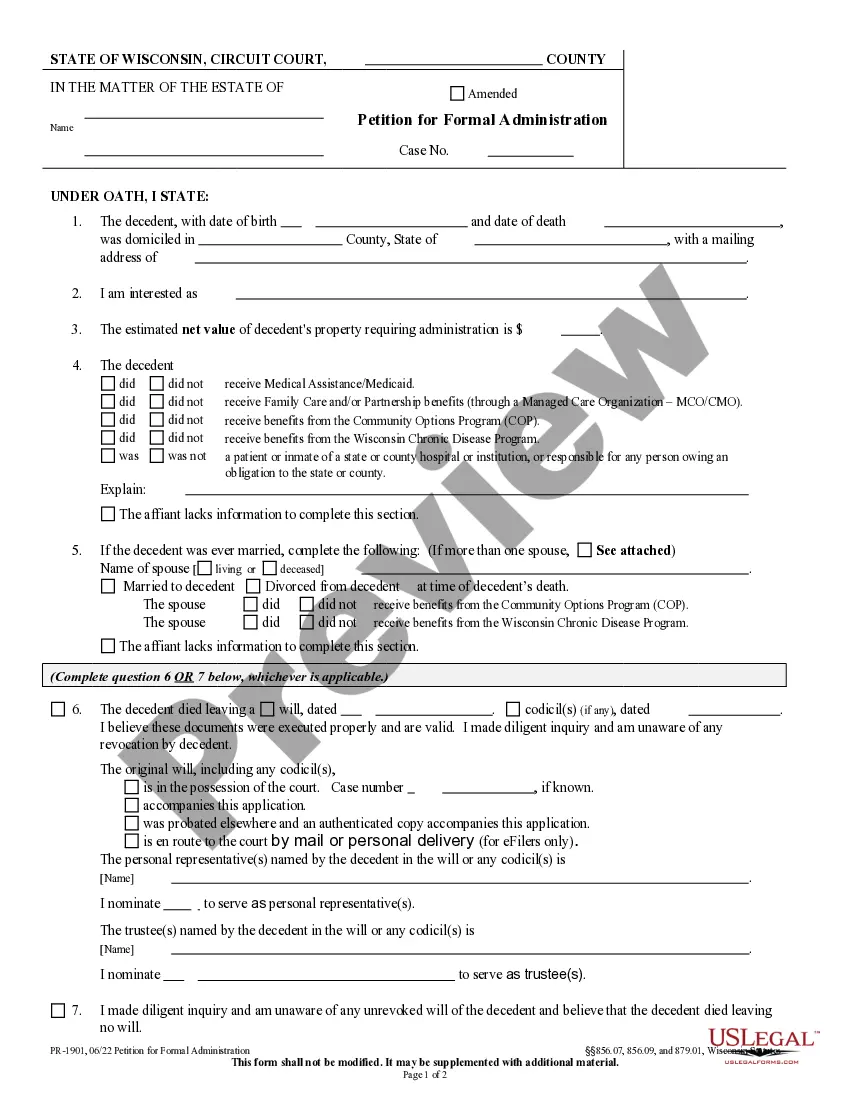

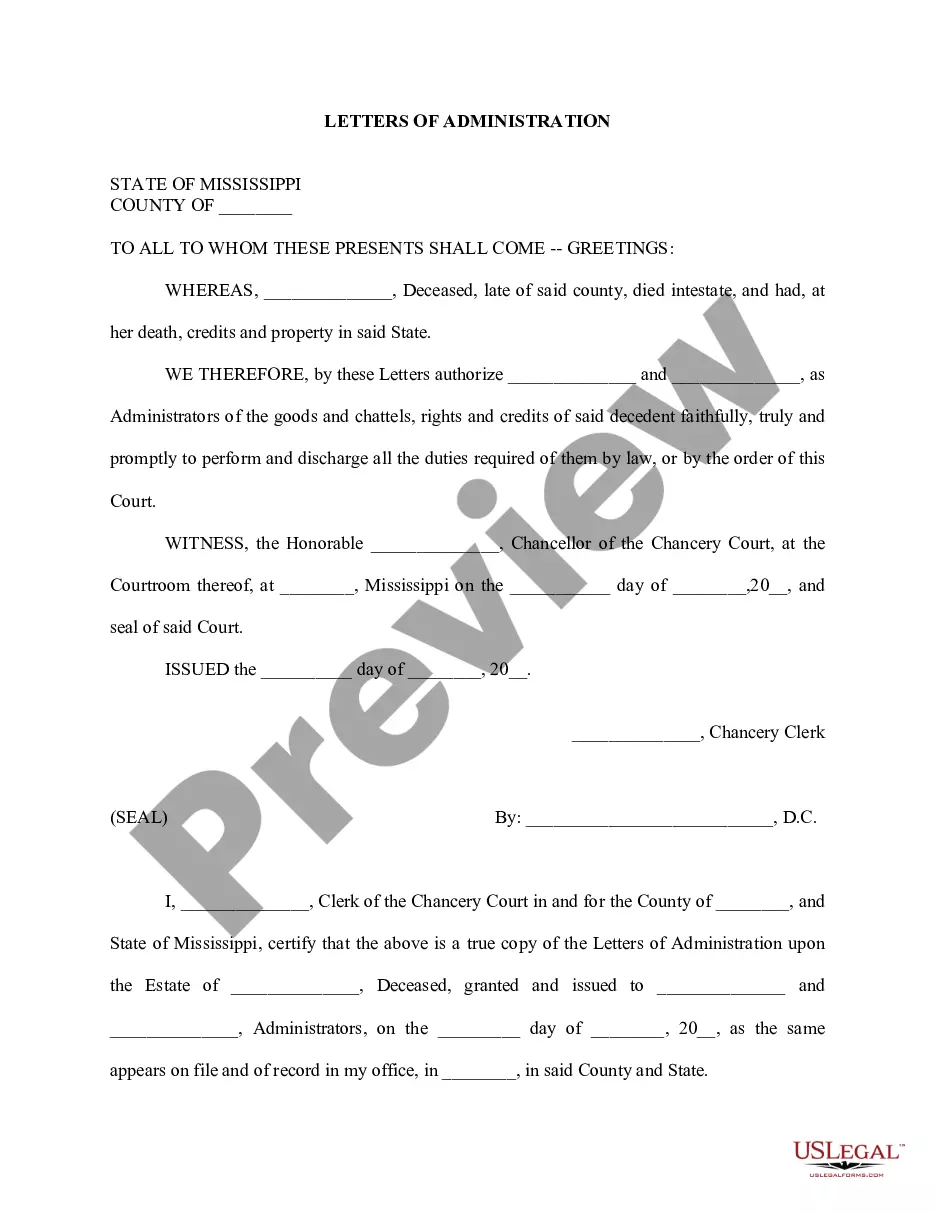

How to fill out Supplemental Needs Trust For Third Party - Disabled Beneficiary?

- If you already have an account with US Legal Forms, log in and download your desired template by clicking the Download button. Ensure that your subscription is active, or renew it as needed.

- For first-time users, start by exploring the form previews and descriptions to ensure you select the right document that meets your specific legal requirements.

- If you need to find more forms, utilize the Search tab to look for alternatives that fit your criteria. Proceed to the next step once you find the correct form.

- Purchase your document by clicking the Buy Now button and selecting your preferred subscription plan. You must create an account to access the extensive library.

- Finalize your transaction by entering your credit card information or using PayPal for payment.

- Download your form to save it on your device, and you can access this template anytime from the My Forms menu in your profile.

Using US Legal Forms not only streamlines your document acquisition but also provides you with access to a vast library of over 85,000 fillable legal forms. This empowers users with a unique advantage in securing the right legal documents quickly and effectively.

In conclusion, understanding how supplemental needs trust work is made easy with US Legal Forms. Start your journey today, and ensure your legal matters are handled with precision. Visit US Legal Forms now to explore your options!

Form popularity

FAQ

The primary purpose of a supplemental needs trust is to enhance the quality of life for individuals with disabilities without affecting their eligibility for government benefits. This trust allows for funds to be used for supplemental expenses such as medical care, education, and recreational activities. By grasping how supplemental needs trust work, you can appreciate how they serve as a financial safety net while ensuring essential benefits remain intact.

In a supplemental needs trust, the term 'owner' refers to the trust rather than an individual. The trust is established to benefit a person with special needs, ensuring that the assets are used exclusively for the beneficiary. Understanding how supplemental needs trust work allows you to see how this structure protects valuable resources without jeopardizing government aid.

The owner of the trust is the supplemental needs trust itself, which is a legal entity created by the grantor. While the grantor contributes assets, the trust holds and manages these assets for the beneficiary's benefit. Learning how does supplemental needs trust work will help you see how this arrangement protects the beneficiary’s eligibility for essential public assistance programs.

The grantor of a supplemental needs trust is the individual who creates the trust. This individual typically funds the trust with assets intended to benefit a person with disabilities. Understanding how supplemental needs trust work is essential, as it allows for the proper management of these assets while ensuring the beneficiary still qualifies for government benefits.

Most trusts are required to file a tax return if they generate income. Specifically, if a trust produces income above a certain level, it needs to file IRS Form 1041. This underscores the importance of understanding how supplemental needs trust work and their tax obligations. Engaging a tax advisor can help ensure that all necessary forms are filed correctly and on time.

Yes, a special needs trust typically requires its own tax identification number, known as an Employer Identification Number (EIN). This is necessary for tax reporting and filing purposes. Understanding how supplemental needs trust work in this context can simplify the management of trust finances. It’s advisable to obtain this number from the IRS as part of the trust's setup process.

While supplemental needs trusts offer significant benefits, they also have some disadvantages. One drawback is the restriction on how funds can be used, as they cannot be used for basic needs covered by government programs. Additionally, setting up and maintaining a trust can incur legal and administrative costs. Weighing these factors helps in understanding how supplemental needs trust work and if it's the right option for your situation.

Filing taxes on a special needs trust involves reporting income generated by the trust on IRS Form 1041. It's essential to keep thorough records of income and distributions throughout the year. Understanding how supplemental needs trust work regarding tax filing can streamline the process and help avoid potential issues. Consider working with a tax professional to navigate the filing requirements smoothly.

Yes, special needs trusts typically need to file tax returns depending on their income. If the trust generates income above a certain threshold, it must submit an annual income tax return. This aspect is crucial when considering how supplemental needs trust work, as it directly impacts financial planning. Consulting with a tax expert can ensure compliance and optimize tax benefits.

Qualified disability trusts, like supplemental needs trusts, have specific tax treatments. Generally, the income generated by these trusts is taxed at the beneficiary's rate, provided the requirements are met. This means that understanding how supplemental needs trust work in terms of taxation can help maintain financial security for the trust beneficiary. It’s always wise to consult with a tax professional for detailed guidance.