Claim Damages Statement With Gst

Description

How to fill out Assignment Of A Claim For Damages?

Legal documents management can be daunting, even for the most experienced professionals.

When you are seeking a Claim Damages Statement With Gst and lack the time to search for the correct and current version, the process can be stressful.

US Legal Forms caters to any requirements you may have, from personal to business documentation, all in one place.

Leverage innovative tools to complete and manage your Claim Damages Statement With Gst.

Here are the steps to follow after obtaining the form you need: Verify it is the correct form by previewing it and reviewing its details. Ensure that the template is accepted in your state or county. Click Buy Now when you are ready. Select a subscription plan. Choose the file format you need, and Download, fill out, eSign, print, and send your documents. Take advantage of the US Legal Forms online library, supported by 25 years of experience and reliability. Streamline your daily document management into a straightforward and user-friendly process today.

- Access a valuable resource library of articles, guides, and manuals pertinent to your circumstances and needs.

- Save time and effort searching for the documents you require, and use US Legal Forms’ advanced search and Preview feature to find Claim Damages Statement With Gst and obtain it.

- If you have a membership, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to view the documents you have previously saved and to manage your folders as you see fit.

- If this is your first time using US Legal Forms, create an account for unlimited access to all the platform's benefits.

- An extensive online form library can be a transformative tool for anyone aiming to handle these scenarios effectively.

- US Legal Forms is a leader in online legal documents, offering over 85,000 state-specific legal forms accessible to you at any time.

- With US Legal Forms, you can access state- or county-specific legal and business forms.

Form popularity

FAQ

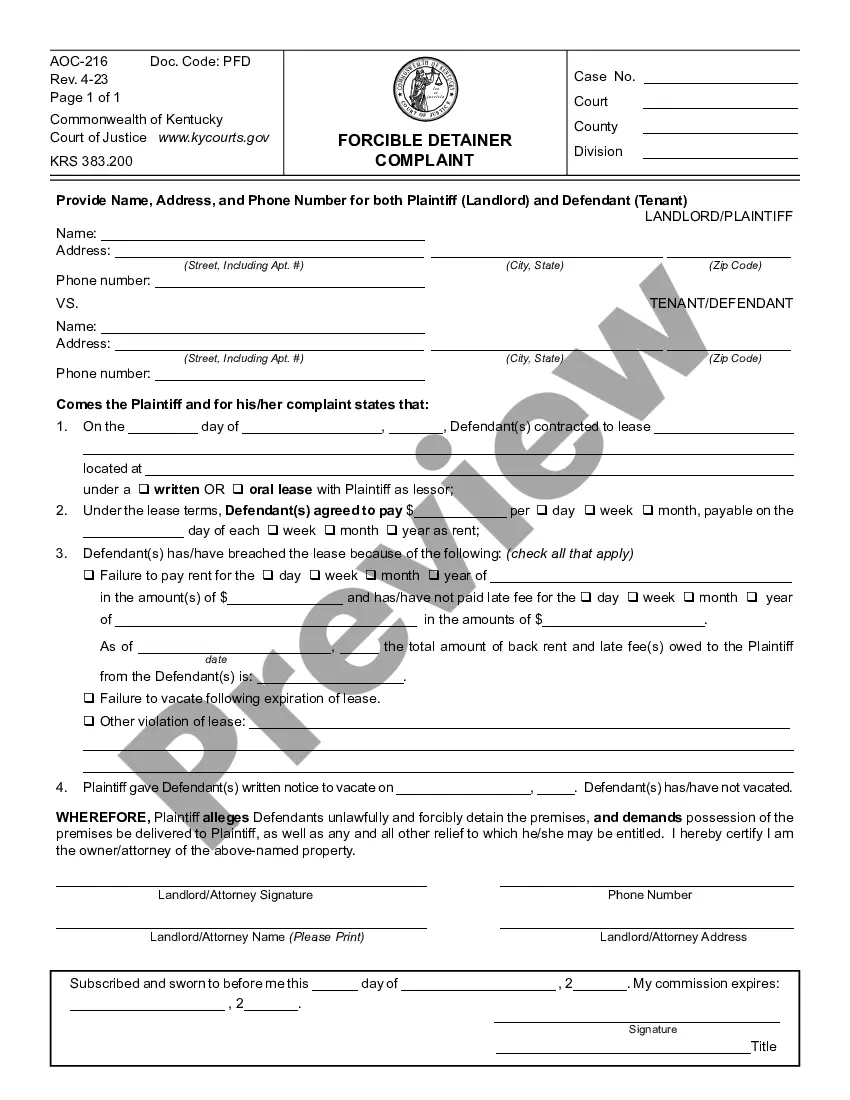

For example, if the insured party has suffered a loss of Rs. 1,00,000 and the insurance company settles the claim for the same amount, then no GST is applicable on the claim amount. However, if the insurance company charges a processing fee of Rs. 5,000, then GST is applicable on the processing fee.

Tax cost is also to be indemnified to an Insured in case the liability falls on the Insured. As per provision of Sec. 17 (5) (h) of the Central GST Act, 2017, ITC will not be available to a taxable person in case the goods are lost or destroyed or stolen or they are written off.

Liquidated damages are mere a flow of money from the party who causes breach of the contract to the party who suffers loss or damage due to such breach. Such payments do not constitute consideration for a supply and do not attract GST.

FAQs > Refund of Excess Amount from the Electronic Cash Ledger Login to GST portal for filing refund application under refunds section. Navigate to Services > Refunds > Application for Refund option. Select the reason of Refund as 'Refund on account of excess balance in cash ledger'.

Liquidated Damages are not taxable under GST They are rather amounts recovered for not tolerating an act or situation and to deter such acts, i.e., such amounts are for preventing breach of contract or non-performance and thus, no GST liability arises on liquidated damages.