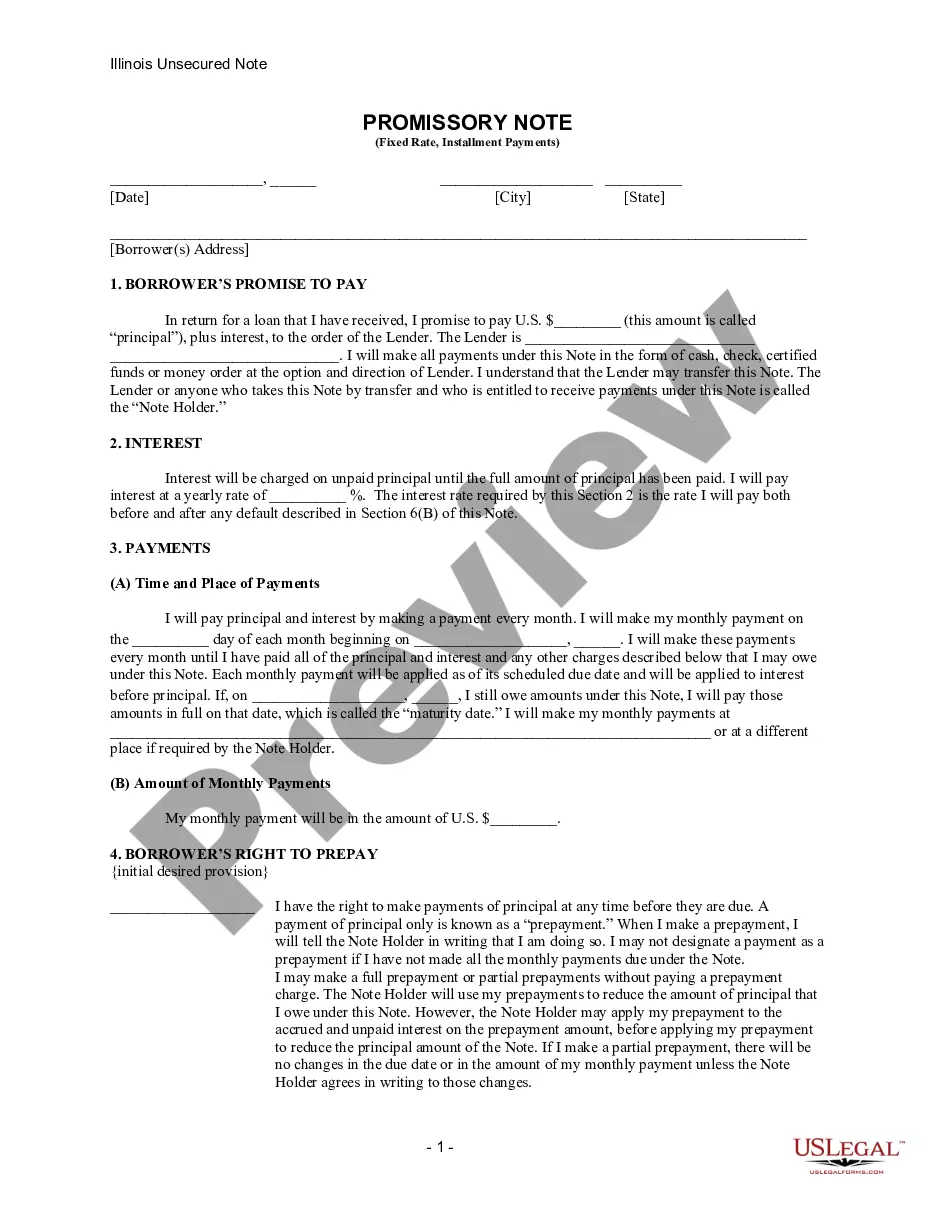

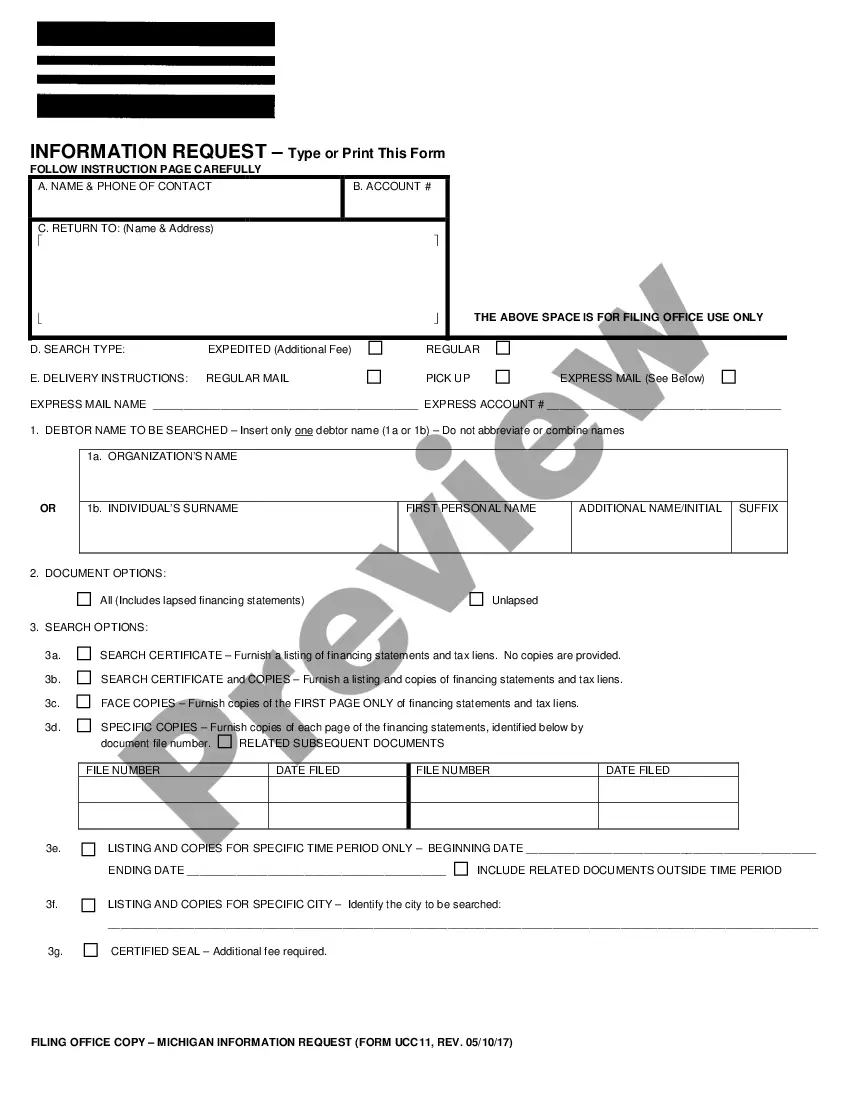

Agreement Mortgage Application Withdrawn

Description

How to fill out Agreement To Purchase Note And Mortgage?

Managing legal paperwork and processes can be an arduous addition to your daily tasks.

Documents like the Agreement Mortgage Application Withdrawn typically require you to search for them and find the best approach to fill them out correctly.

Therefore, if you are dealing with financial, legal, or personal issues, having a comprehensive and user-friendly online collection of forms readily available will be beneficial.

US Legal Forms is the leading online platform for legal templates, providing over 85,000 state-specific documents and a variety of tools to assist you in promptly completing your paperwork.

Is it your first time using US Legal Forms? Register and set up your account in a matter of minutes to gain access to the form library and the Agreement Mortgage Application Withdrawn. Then, follow the instructions below to complete your form.

- Explore the collection of pertinent documents accessible to you with just a single click.

- US Legal Forms provides you with state- and county-specific templates available for download at any time.

- Protect your document management tasks with a high-quality service that enables you to create any form within minutes without any added or hidden fees.

- Simply Log In to your account, find the Agreement Mortgage Application Withdrawn and obtain it instantly from the My documents section.

- You can also access previously downloaded documents.

Form popularity

FAQ

You can cancel a loan application at any time before you sign the loan agreement and the funds are dispersed. One exception is mortgage refinancing loans which offer a longer window. The easiest ways to initiate the cancellation are by phone or email. Either way, the procedure is the same.

If your lender informs you that its mortgage offer is being withdrawn and will be replaced with another offer with a higher interest rate, get advice from your mortgage broker. It may be able to advise you on what your options are and the next best deal.

You may have a three-day window to cancel the application and recover any paid fees. Tell the lender you want to cancel the pending application and provide a reason. Explaining the situation will help the lender understand any future needs. Next, go through your application with your lender.

It might delay your house purchase, as you'll likely have to reapply for a mortgage. After exchange of contracts - Offers withdrawn after exchange of contracts usually happen because the offer has expired, and you'll usually need to reapply for a mortgage. You may lose your deposit and need to pay conveyancing fees.

If you are buying a home with a mortgage, you do not have a right to cancel the loan once the closing documents are signed. If you are refinancing a mortgage, you have until midnight of the third business day after the transaction to rescind (cancel) the mortgage contract.