Late Fees For Form 8 Llp

Description

How to fill out Sample Letter For Notification Of Late Payment?

Managing legal documents may seem daunting, even for experienced professionals.

When you require a Late Fees For Form 8 Llp and lack the time to dedicate to finding the correct and current version, the process can be distressing.

Access a collection of articles, guides, handbooks, and materials relevant to your situation and requirements.

Save time and energy searching for the documents you need, and take advantage of US Legal Forms’ enhanced search and Review tool to find and download Late Fees For Form 8 Llp.

Enjoy the US Legal Forms web library, backed by 25 years of expertise and reliability. Revolutionize your daily document management into a seamless and user-friendly process today.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to view your previously saved documents and manage your folders as you see fit.

- If it's your first time using US Legal Forms, create a free account to gain unlimited access to all the benefits of the platform.

- Here are the steps to follow after downloading the form you need.

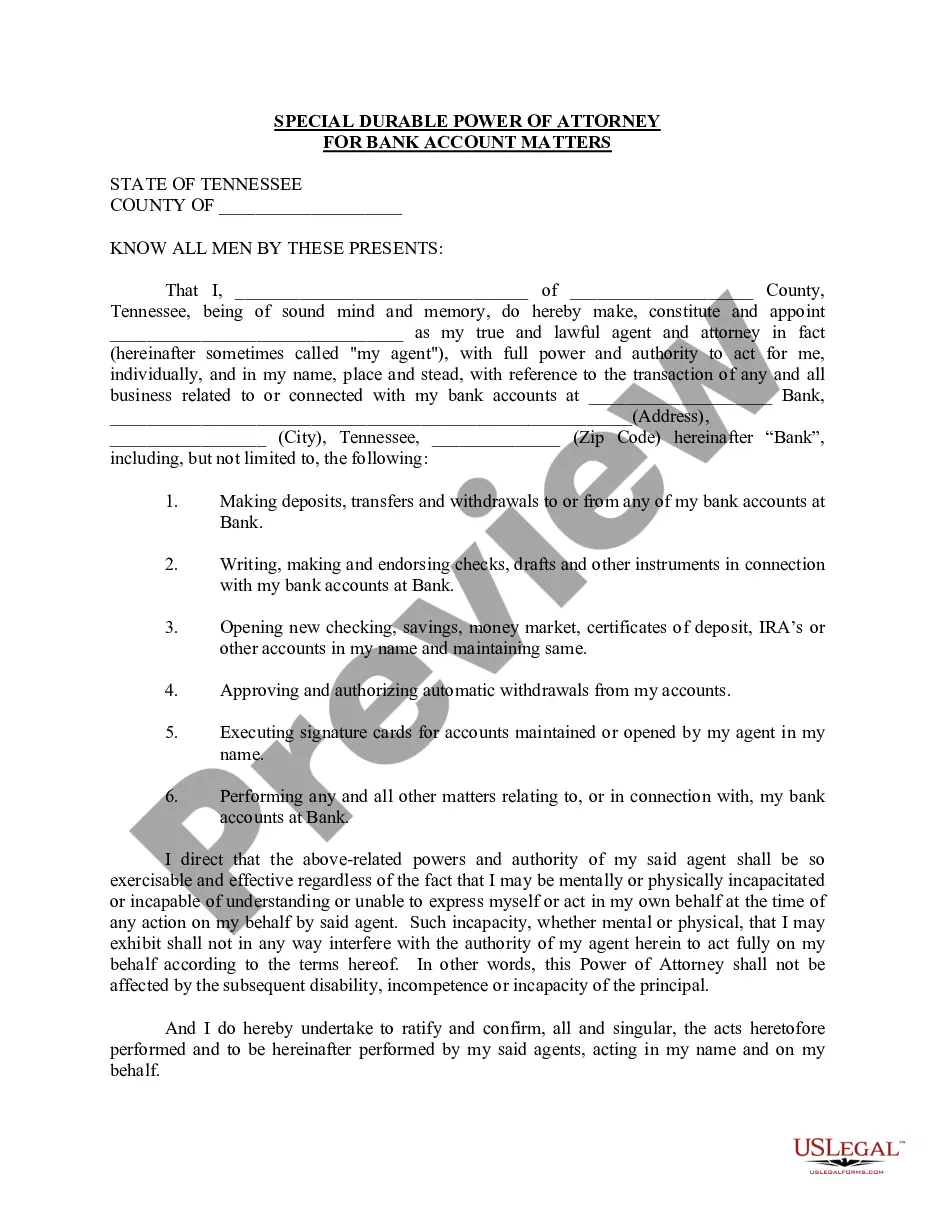

- Confirm that this is the correct form by previewing it and reviewing its details.

- Ensure that the template is accepted in your state or county.

- Click Buy Now when you're ready.

- Choose a monthly subscription plan.

- Select the format you need, and Download, complete, eSign, print, and submit your document.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses any needs you may have, ranging from personal to corporate paperwork, all in one location.

- Utilize sophisticated tools to complete and manage your Late Fees For Form 8 Llp.

Form popularity

FAQ

The maximum late filing penalty can vary widely depending on the jurisdiction and the specific regulations in place. When it comes to late fees for form 8 llp, understanding these limits is crucial to managing your pending obligations. These penalties can pose serious risks to your partnership's financial situation. To avoid reaching this maximum penalty, ensure timely compliance with all filing requirements.

The penalties for submitting your LLP agreement late can vary, but they generally result in fines designed to encourage timely compliance. The late fees for form 8 llp also reflect the importance of having a properly filed agreement in place. A missing submission can lead to legal complications for your partnership. Therefore, stay proactive in managing your LLP documentation.

The penalty for late ITR filing can differ based on how overdue your filing is. Additionally, late fees for form 8 llp can help you understand the importance of timely tax returns. Late filings can lead to increased scrutiny from tax authorities and potential financial penalties. It's wise to file your ITR on time to maintain compliance and financial health.

LLP accounts usually need to be filed annually, with specific deadlines that vary by state. It is vital to check the exact date to avoid the late fees for form 8 llp. Remember that timely filings not only help you avoid penalties but also keep your business in good standing. Consider using platforms like uslegalforms for reminders and filing assistance.

The time limit for an LLP agreement is typically dependent on state regulations. Generally, it is advisable to finalize your LLP agreement as soon as you establish your partnership. The late fees for form 8 llp highlight the importance of having your agreement in place to avoid future penalties. Always consult your state's guidelines to ensure compliance.

When an LLP misses the 30 day filing requirement, it faces penalties that escalate over time. The late fees for form 8 llp can start small but increase significantly if not addressed quickly. This can impose a significant financial strain on the business. Therefore, it's crucial to stay aware of filing deadlines to avoid these penalties.

Filling Form 8 LLP involves providing details about your limited liability partnership's financial position, including profit and loss accounts and balance sheets. Start by gathering the necessary documents and financial statements to ensure accuracy. If you feel uncertain, consider using platforms like USLegalForms, which provide guidance and templates to complete your Form 8 correctly. This can help minimize the risk of errors and potential late fees for Form 8 LLP.

The penalty for filing Form 8 LLP after the due date can include late fees that can accumulate rapidly. Specifically, you might incur a daily penalty of INR 100 for each day the form is overdue. To avoid these penalties, it is advisable to submit your Form 8 on time. Understanding these penalties can help you manage your compliance better and avoid unexpected costs.

If you file a late LLP return, you may face penalties that can escalate over time. Specifically, the penalties for late fees for Form 8 LLP can range from INR 100 per day until the date of filing. This accumulative penalty can lead to significant costs if you delay further. Therefore, timely filing can save you from incurring these additional charges.

The last date for filing LLP Form 8 is usually within 30 days from the end of the financial year. You should aim to submit the form by May 30 each year to avoid penalties. Missing this deadline can lead to late fees for Form 8 LLP, which increase with time. It's essential to be proactive and file on time to ensure compliance.