Line Of Credit Form With Interest

Description

How to fill out Line Of Credit Promissory Note?

Legal documentation management may be overwhelming, even for seasoned professionals.

When you are looking for a Line Of Credit Form With Interest and do not have the time to spend searching for the correct and updated version, the process can become anxiety-inducing.

Access a repository of articles, guides, handbooks, and resources pertinent to your situation and needs.

Save time and energy looking for the documents you require, and leverage US Legal Forms’ sophisticated search and Preview feature to find Line Of Credit Form With Interest and obtain it.

Take advantage of the US Legal Forms online catalogue, supported by 25 years of expertise and dependability. Transform your daily document management into a seamless and user-friendly experience today.

- If you have a membership, Log In to the US Legal Forms account, search for the document, and acquire it.

- Check your My documents section to view the documents you saved and manage your folders as you desire.

- If this is your first time using US Legal Forms, create a free account to gain unlimited access to all features of the library.

- Here are the steps to follow after obtaining the form you need.

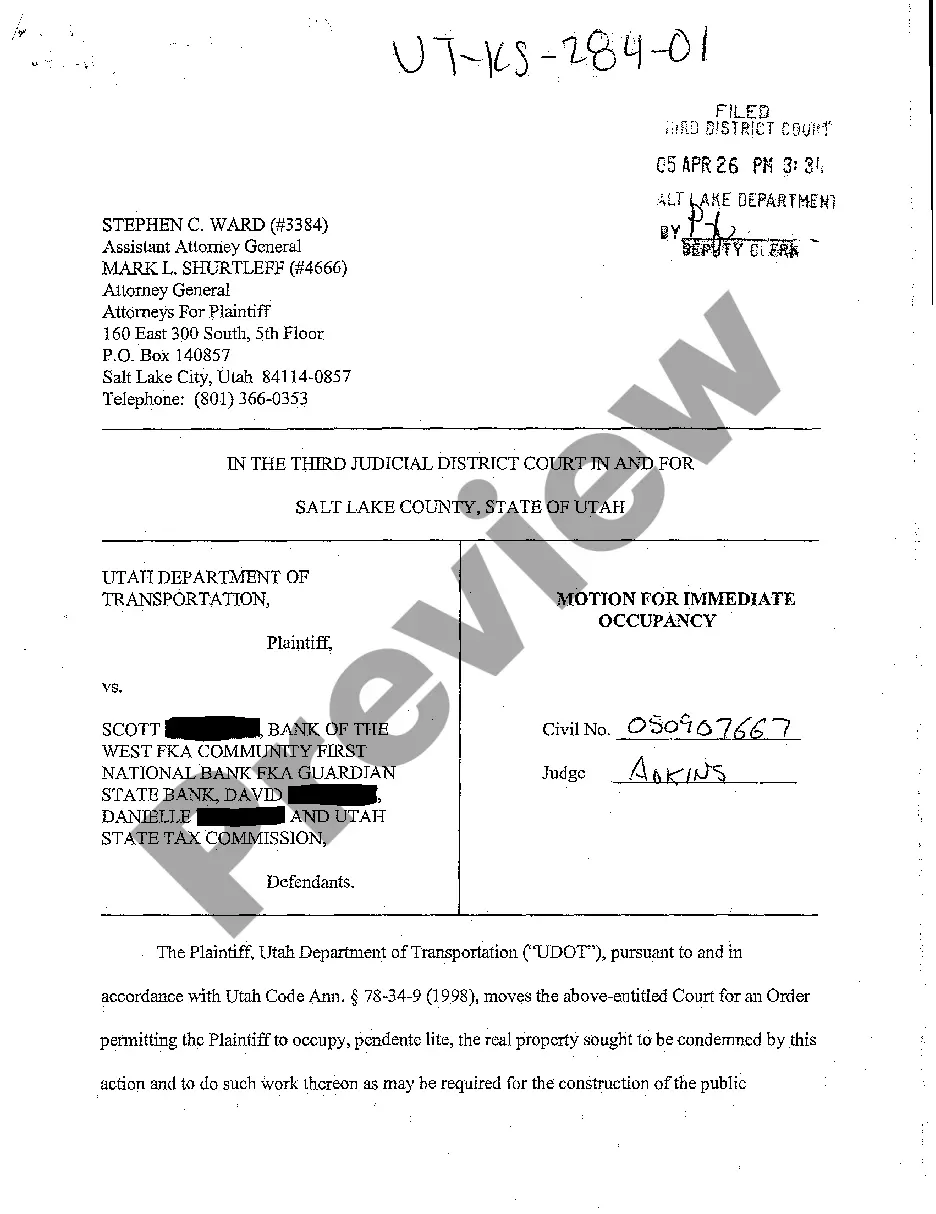

- Verify it is the correct document by previewing it and reviewing its details.

- Ensure that the template is accepted in your state or county.

- Select Buy Now when you are ready.

- Choose a subscription plan.

- Select the format you prefer, and Download, complete, sign, print, and deliver your document.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses any needs you might have, ranging from personal to corporate papers, all in a single location.

- Utilize innovative tools to complete and manage your Line Of Credit Form With Interest.

Form popularity

FAQ

You can find your interest rate on a line of credit by reviewing your credit agreement or logging into your online banking portal. Most lenders list the current rates, allowing you to see how they apply to your line. If you need more details, consider utilizing a line of credit form with interest available on platforms like uslegalforms for clarity.

General warranty deeds give the grantee the most protection, special warranty deeds give the grantee more limited protection, and a quitclaim deed gives the grantee the least protection under the law.

A general warranty deed is the gold standard of property transfers. This type of deed is overwhelmingly used in residential purchases. Most lenders require a warranty deed for properties they finance. It offers buyers the greatest possible protection from future claims against the title.

General Warranty Deed It offers the highest level of protection to the buyer because it guarantees that there are absolutely no problems with the home ? even dating back to prior property owners. This quality of coverage is why most lenders will require you to get a general warranty deed when buying your house.

The quitclaim deed provides the least protection of any deed as it carries no covenants or warranties, and conveys only whatever interest the grantor may have when the deed is delivered.

Quitclaim Deed There are no covenants or warranties by the grantor and this deed offers the lowest amount of protection to the grantee. This type of deed is also frequently used in transfers between family members and related transactions.

A full covenant and warranty deed is the strongest and broadest form of guarantee of title. As such, it includes several covenants. Which of these covenants are included in the warranty deed?

What Is the Strongest Type of Deed? For real estate buyers, a general warranty deed provides greater protection than any other type of deed. While it's the best deed for the grantee, it gives the grantor the most liability.