Agreement Debt Payment Template For Excel

Description

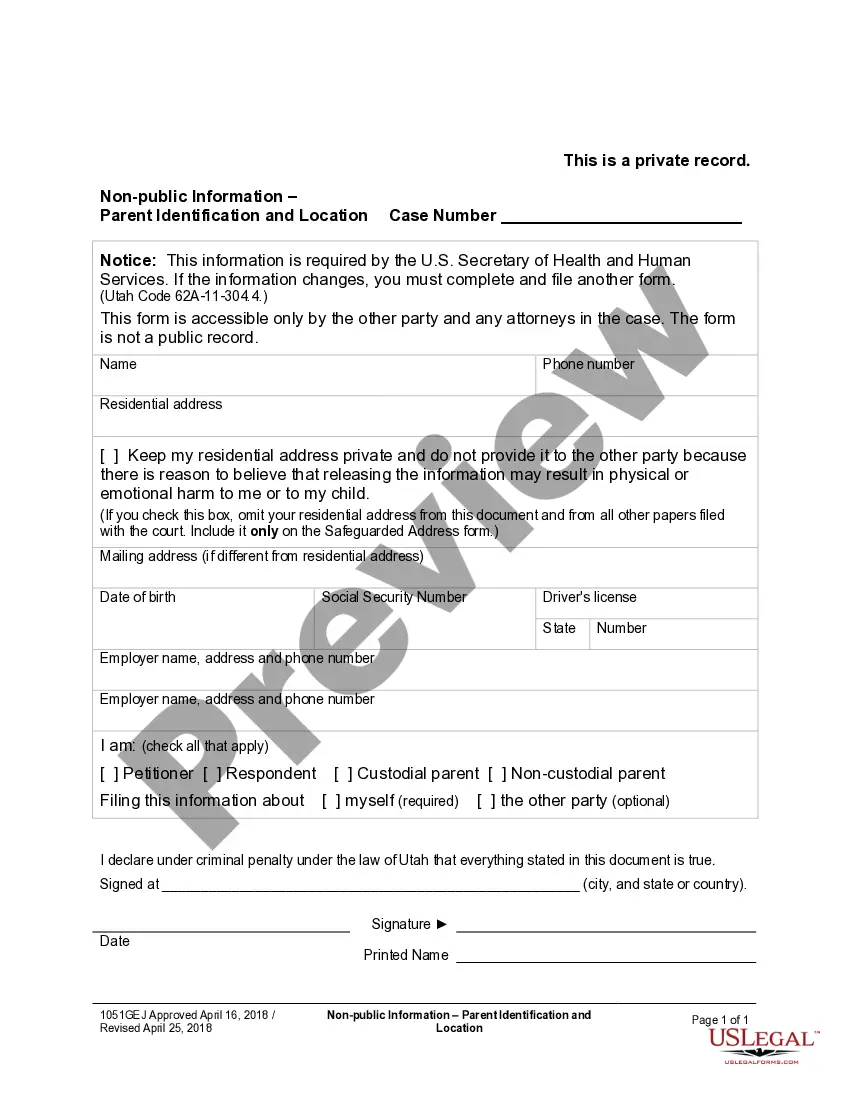

How to fill out Agreement To Extend Debt Payment?

Handling legal documents and procedures can be a time-consuming addition to your entire day. Agreement Debt Payment Template For Excel and forms like it often need you to look for them and understand how to complete them properly. Consequently, whether you are taking care of financial, legal, or individual matters, having a thorough and hassle-free web library of forms at your fingertips will greatly assist.

US Legal Forms is the best web platform of legal templates, boasting more than 85,000 state-specific forms and a variety of resources that will help you complete your documents quickly. Explore the library of appropriate documents open to you with just a single click.

US Legal Forms provides you with state- and county-specific forms offered at any moment for downloading. Shield your papers administration operations by using a high quality services that allows you to put together any form within a few minutes with no additional or hidden cost. Simply log in in your account, locate Agreement Debt Payment Template For Excel and acquire it right away within the My Forms tab. You can also access previously downloaded forms.

Could it be your first time using US Legal Forms? Sign up and set up up an account in a few minutes and you’ll have access to the form library and Agreement Debt Payment Template For Excel. Then, follow the steps below to complete your form:

- Be sure you have the right form using the Review feature and reading the form description.

- Choose Buy Now as soon as ready, and choose the monthly subscription plan that meets your needs.

- Press Download then complete, eSign, and print the form.

US Legal Forms has 25 years of expertise assisting users deal with their legal documents. Find the form you want right now and improve any process without breaking a sweat.

Form popularity

FAQ

How to Create an Invoice in Excel from Scratch Open a Blank Excel Workbook. ... Create an Invoice Header. ... Add the Client's Information. ... List the Payment Due Date. ... Add an Itemized List of Services. ... Add the Total Amount Owing. ... Include Your Payment Terms.

To calculate net debt using Microsoft Excel, examine the balance sheet to find the following information: total short-term liabilities, total long-term liabilities, and total current assets. Enter these three items into cells A1 through A3. In cell A4, enter the formula "=A1+A2?A3" to render the net debt.

So, to get your monthly loan payment, you must divide your interest rate by 12. Whatever figure you get, multiply it by your principal. A simpler way to look at it is monthly payment = principal x (interest rate / 12). The formula might seem complex, but it doesn't have to be.

P = Ai / (1 ? (1 + i)-N) where: P = regular periodic payment. A = amount borrowed. i = periodic interest rate. N = total number of repayment periods.

To calculate your total debt, add up all your loans. Then, divide total interest by total debt to get your cost of debt. The cost of debt you just calculated is also your weighted average interest rate.