Interest States Statement With Text

Description

How to fill out Assignment Of Interest In United States Patent?

Creating legal documents from the ground up can occasionally feel daunting.

Some situations may require extensive research and substantial financial investment.

If you seek a more straightforward and cost-effective method for preparing Interest States Statement With Text or other necessary forms without unnecessary complications, US Legal Forms is readily available to assist you.

Our online library of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal matters.

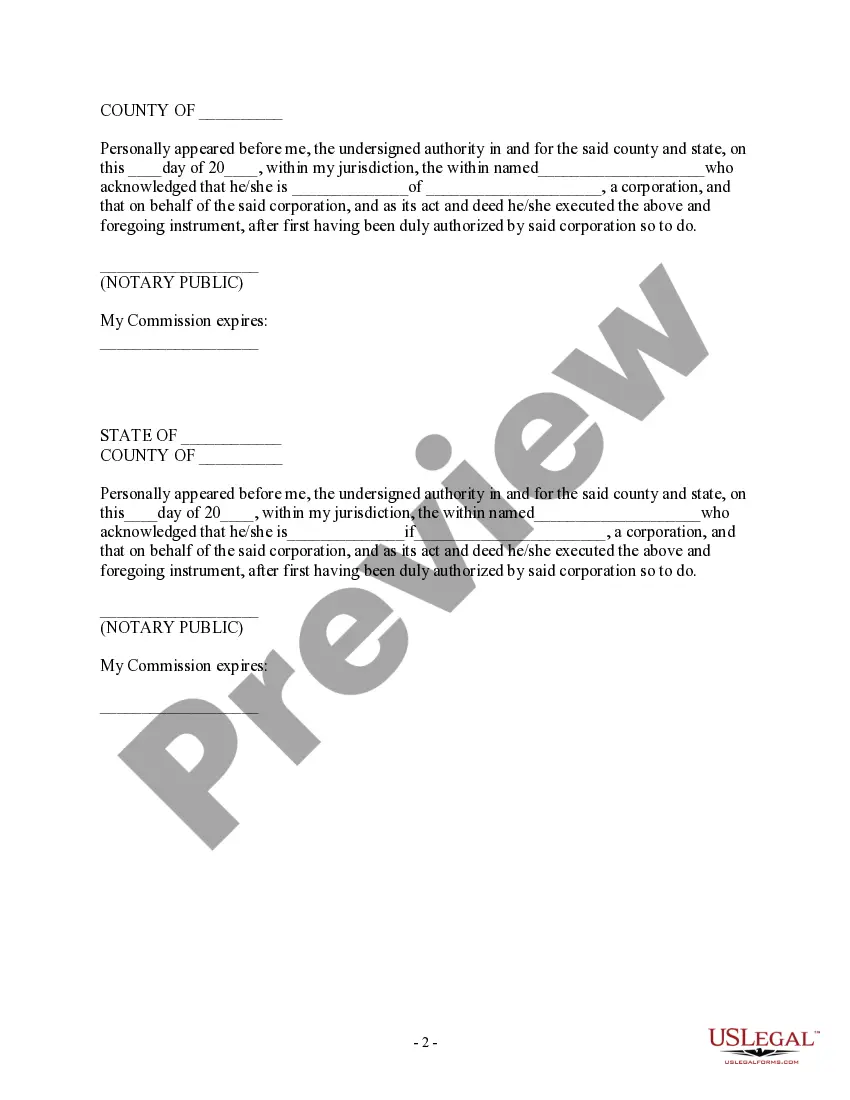

Examine the document preview and descriptions to confirm that you are selecting the correct form. Ensure the form you select meets your state and county's criteria. Choose the most appropriate subscription plan to acquire the Interest States Statement With Text. Download the file, then complete, sign, and print it out. US Legal Forms enjoys an impeccable reputation and over 25 years of experience. Join us today and simplify the document preparation process!

- With just a few clicks, you can quickly obtain state- and county-specific forms meticulously prepared by our legal professionals.

- Utilize our platform whenever you require a dependable and trustworthy service to easily locate and download the Interest States Statement With Text.

- If you're familiar with our website and have an account with us, simply Log In, choose the template, and download it immediately or access it again anytime in the My documents section.

- Don't have an account? No problem. It takes just a few minutes to register and explore the catalog.

- However, before proceeding to download the Interest States Statement With Text, consider the following suggestions.

Form popularity

FAQ

While debt validation requests can be a useful tool, they are not effective at resolving the issue. In most cases, creditors and collection agencies are able to provide the necessary documentation to prove the validity of the debt.

In the new changes to Regulation F, the frequency at which a collections agency can contact a consumer has changed. This change, presented in Section 1006.14B21A, addresses telephone call frequency and restricts agencies to contacting a consumer seven times within seven consecutive days.

The Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive, unfair, or deceptive practices to collect debts from you, including: Misrepresenting the nature of the debt, including the amount owed. Falsely claiming that the person contacting you is an attorney.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

If the agency can't provide proof, you owe the money, by law, they must stop collection efforts. If you don't owe the bill, don't pay anything ? ever. Even if you're willing to pay cash so the agency will go away, it's not a good idea. Payment is considered an acknowledgment that you are responsible.

Once you receive the validation information or notice from the debt collector during or after your initial communication with them, you have 30 days to dispute all or part of the debt, if you don't believe that you owe it. If you receive a validation notice, the end date of the 30-day period will be specified.

Validation and Verification Letter Limitations and Benefits Validation and verification letters can be helpful but won't solve all debt collection problems. For example, a collector can continue trying to collect a debt that is past the statute of limitations. They just can't force you to pay it.

Debt collectors have a legal obligation to send a debt validation letter and it's important for consumers to be aware of that. If you receive information over the phone, ask for it to be sent in a letter. Do not give payment or personal financial information until you confirm that the collector is legitimate.