Pay Child Any With Joint Custody

Description

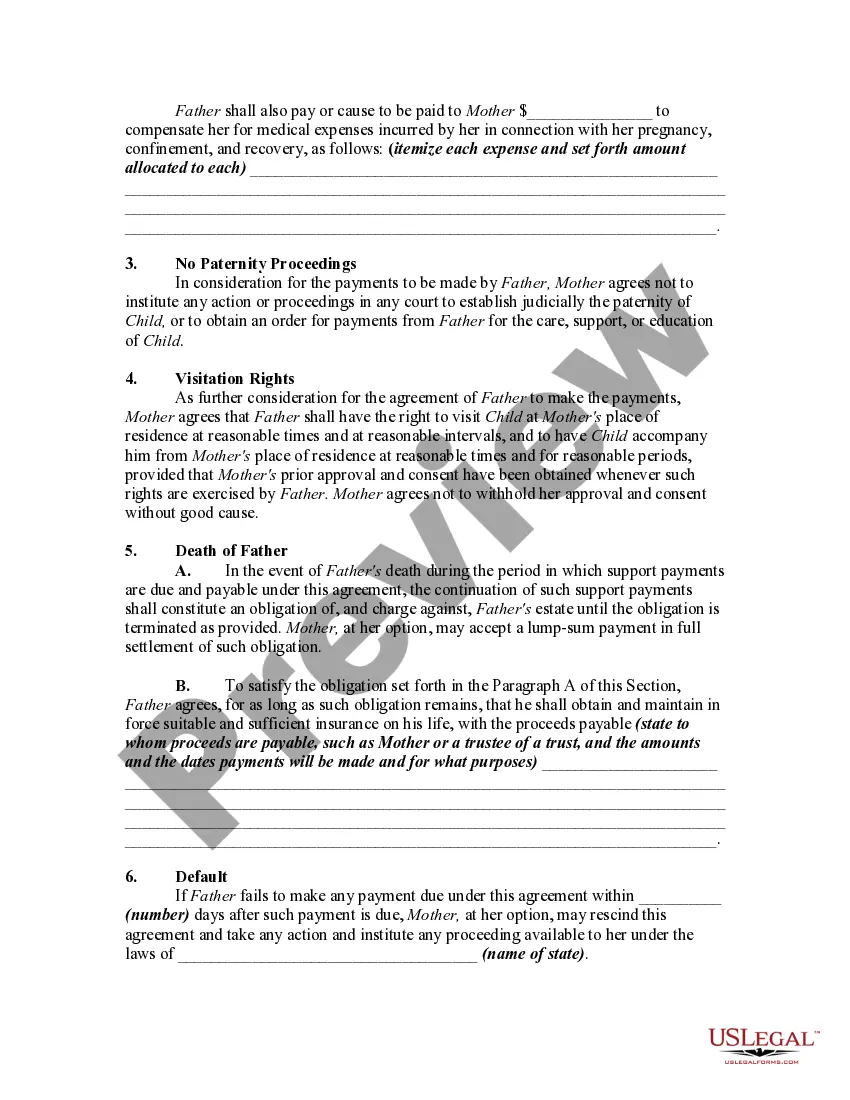

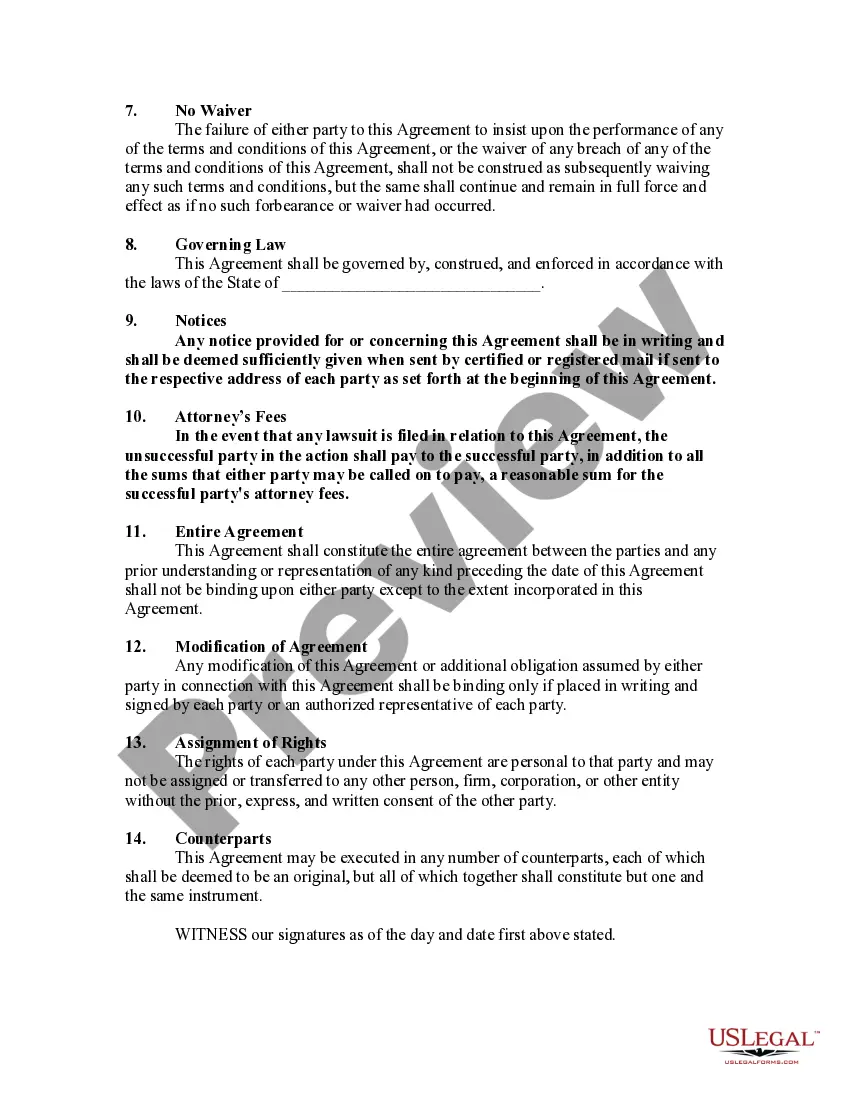

How to fill out Agreement By Natural Father To Support Child Born Out Of Lawful Wedlock?

Employing legal document templates that adhere to federal and state laws is essential, and the web provides numerous choices to choose from.

However, why squander time hunting for the appropriate Pay Child Any With Joint Custody template online when the US Legal Forms digital repository already houses such documents in one location.

US Legal Forms is the premier online legal resource with over 85,000 customizable templates created by lawyers for various business and personal situations.

- They are simple to navigate with all forms categorized by state and intended use.

- Our experts keep current with legal changes, ensuring your form is always accurate and compliant when obtaining a Pay Child Any With Joint Custody from our site.

- Acquiring a Pay Child Any With Joint Custody is straightforward and fast for both returning and first-time users.

- If you hold an account with an active subscription, Log In and retrieve the document template you need in the desired format.

- If you are unfamiliar with our site, follow the steps below.

Form popularity

FAQ

In 50/50 custody arrangements, both parents typically share equal responsibility for the child, which affects child support payments. Generally, the parent with the higher income may be responsible for paying child support to the other parent to maintain the child's standard of living. However, the calculation can vary based on the financial obligations of each parent. Understanding how to pay child any with joint custody can be complex, so it's advisable to utilize platforms like uslegalforms to navigate these situations effectively.

In the UK, some individuals may be exempt from paying child support under specific circumstances. For example, parents who share joint custody of a child may not have to pay child support if their financial contributions balance out. Furthermore, a parent may be exempt if they have limited income or different financial obligations that affect their ability to pay child any with joint custody effectively. It is important to consult legal advice to understand your particular situation.

In a 60/40 custody arrangement, typically the parent with the greater custodial time, in this case, the parent with 60% custody, can claim the child on their taxes. However, parents can agree to alternate years or share the claim if it benefits both parties financially. If you share custody, consider using the IRS's Form 8332 to allow the other parent to claim the child. Understanding how tax benefits work can help you maximize your financial situation when you pay child any with joint custody.

One of the biggest mistakes in a custody battle is failing to understand how joint custody impacts child support. Parents might wrongly assume that paying child any with joint custody is unnecessary. It's essential to document all financial contributions and time spent with the child. Miscommunication can lead to conflicts that complicate custody arrangements.

Some parents are able to manage a roughly 50/50 custody split, meaning that the child lives with each parent an equal amount of time. This can work if both parents live close to one another and to the child's school, and are able to exchange the child regularly without difficulty.

Generally speaking, the parent with whom the child has lived for the most part of the year will be able to make that claim. This rule applies even if both parents have shared physical custody and provide financial support equally during the year.

The simple answer is yes, apart from in very specific circumstances, which we will explore further down the page. This is because even joint managing conservators who share absolutely equal parenting time, responsibility, and money spent on the child will have some difference in how much income they bring in.

How Does Shared Custody Affect Child Support? People often think that the parent who has physical custody will receive child support but in Minnesota child support is not affected by custody; instead, the amount of court-ordered parenting time (visitation) is considered in calculating child support.

Difficult for children to adjust While 50/50 custody can provide many benefits, it can also be challenging for children to adjust to. Moving between two households can be stressful and disruptive, and children may feel like they are constantly packing and unpacking.