Age Minor Regarding Withdrawal

Description

How to fill out Affidavit Regarding Age Of Minor Or Child?

Creating legal documents from the beginning can frequently be daunting.

Some situations may require extensive research and significant financial investment.

If you're seeking a more uncomplicated and budget-friendly method of generating Age Minor Regarding Withdrawal or any other documents without having to go through complicated processes, US Legal Forms is always accessible to you.

Our online collection of over 85,000 current legal papers encompasses nearly every facet of your financial, legal, and personal affairs. With just a few clicks, you can quickly obtain state- and county-compliant forms meticulously prepared for you by our legal experts.

Verify that the template you choose aligns with the stipulations of your state and county. Select the appropriate subscription option to acquire the Age Minor Regarding Withdrawal. Download the form, then complete, validate, and print it out. US Legal Forms has an excellent reputation and over 25 years of experience. Join us today and simplify your document completion process!

- Utilize our platform whenever you require dependable and trustworthy services to effortlessly locate and download the Age Minor Regarding Withdrawal.

- If you're familiar with our site and have previously registered an account with us, simply Log In to your account, select the form and download it or re-download it anytime in the My documents section.

- Not registered yet? No problem. Setting it up and exploring the catalog takes just a few minutes.

- But before rushing to download Age Minor Regarding Withdrawal, keep these pointers in mind.

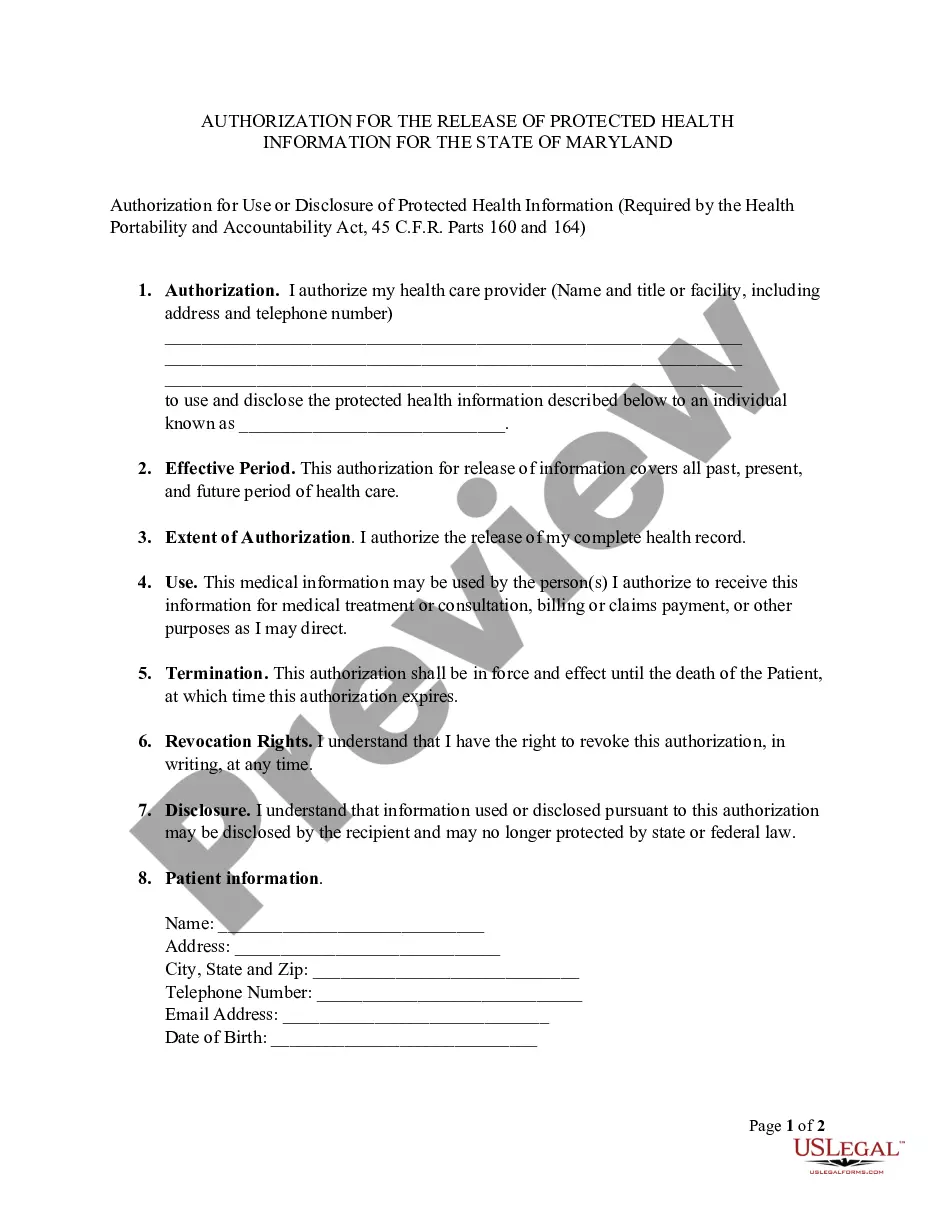

- Examine the document preview and descriptions to ensure you have the correct form you are looking for.

Form popularity

FAQ

Note: The RMD age changed to 73 when the SECURE Act 2.0 passed in 2022. If you turned 72 before 2023, you may be subject to RMDs. If you turned 72 in 2023, your RMDs will begin at age 73.

Enter your early withdrawal penalty on line 18 of the 2021 Schedule 1, located in Part II of the schedule, "Adjustments to Income." Total all of your adjustments to income from Part II on line 26 of the schedule, and then transfer this sum to line 10 of your 2021 Form 1040.

Fortunately, you don't have to worry about counting days; you're considered 59 ½ when you reach the same calendar day of your birthday in the six month after your birthday (1 in the above example). The 59 ½ rule only applies to IRAs and not to employer-sponsored plans like 401(k)s or 403(b)s.

For simplicity's sake, let's assume a hypothetical investor has one IRA with an account balance of $100,000 as of December 31. To calculate the RMD the year they turn 73, they would use a life expectancy factor of 26.5. So the RMD would be $100,000 ÷ 26.5, or $3,773.58.

You cannot keep retirement funds in your account indefinitely. You generally have to start taking withdrawals from your IRA, SIMPLE IRA, SEP IRA, or retirement plan account when you reach age 72 (73 if you reach age 72 after Dec. 31, 2022).