Birth Social Security Withholding

Description

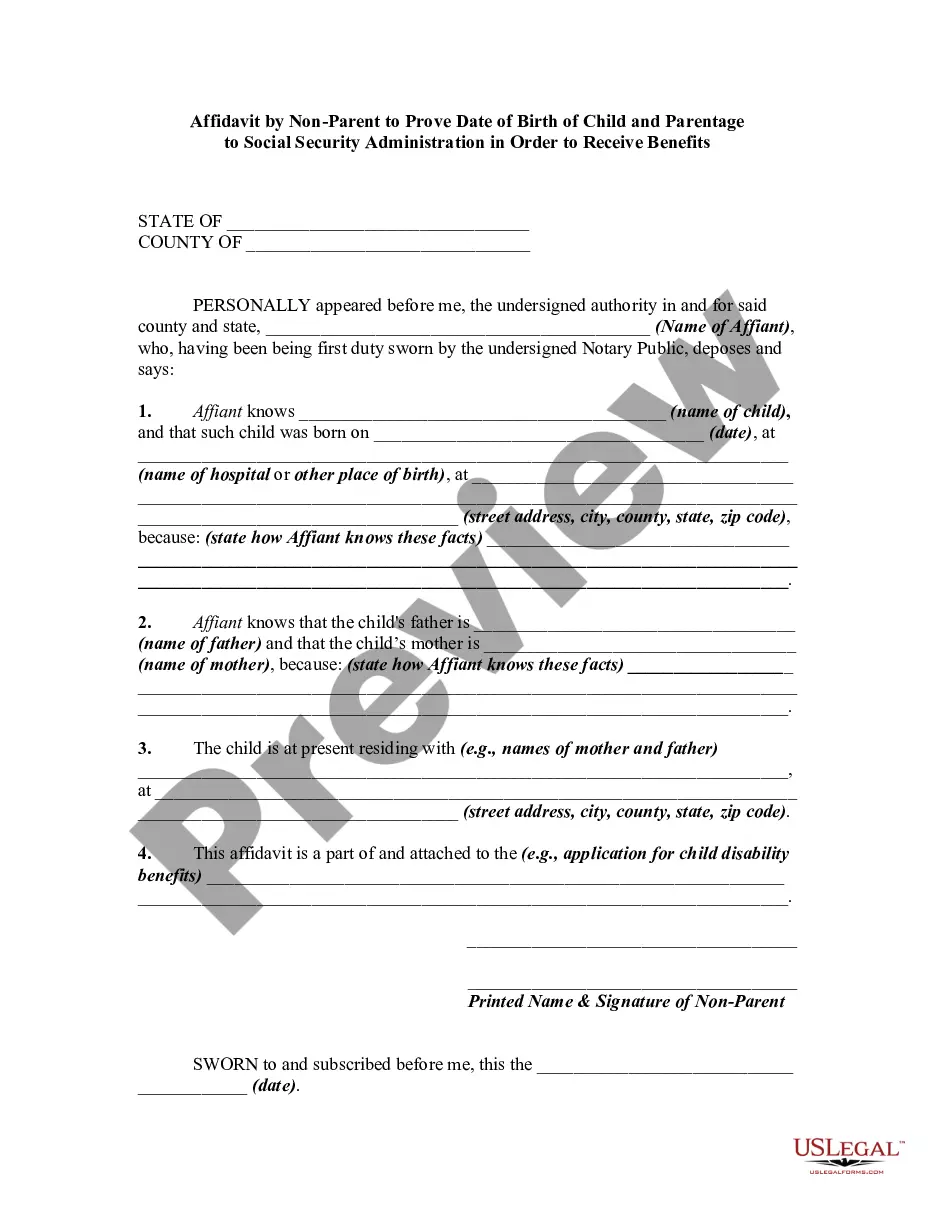

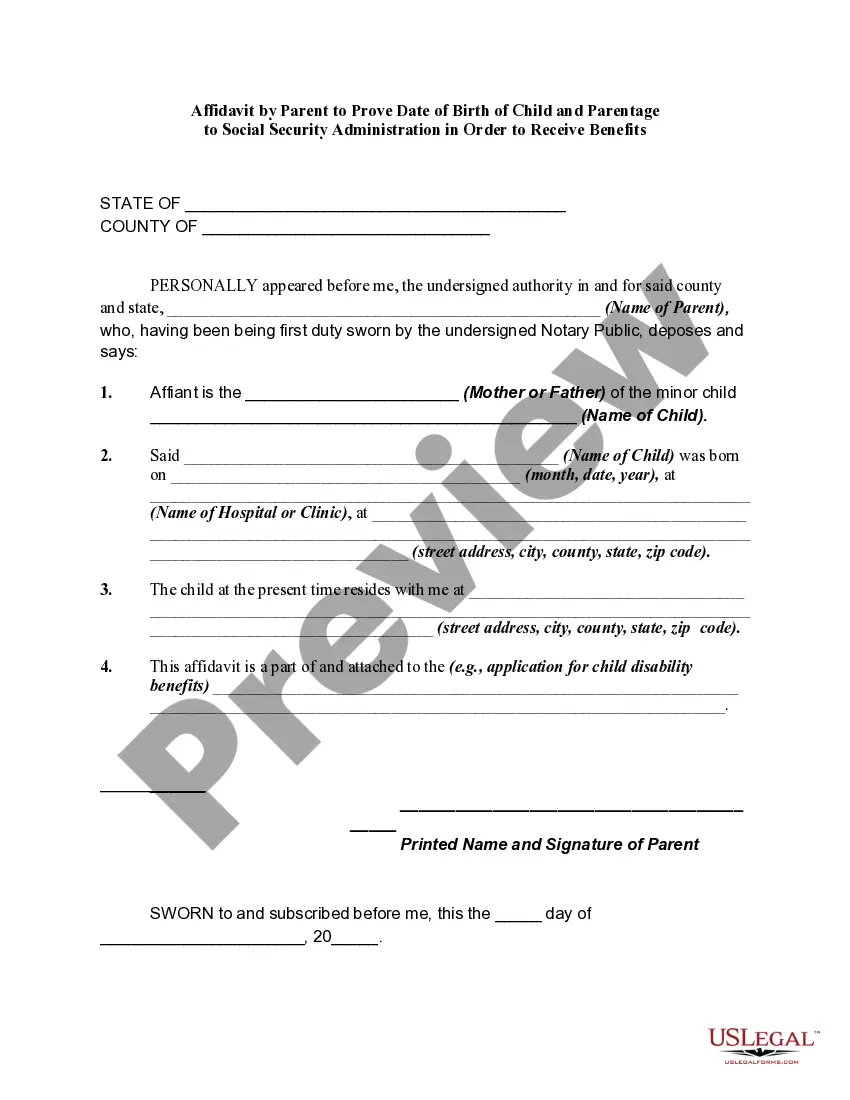

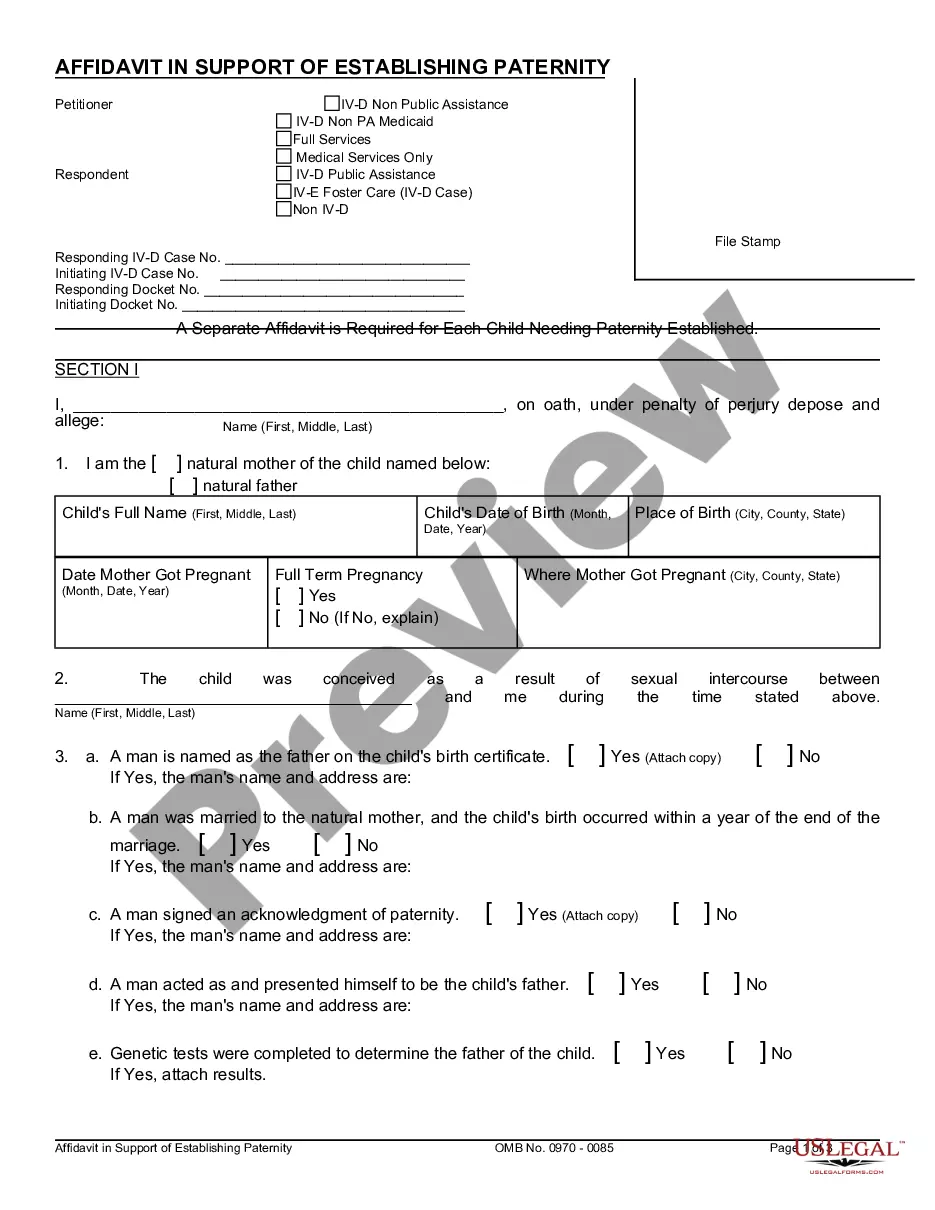

How to fill out Affidavit By Non-Parent To Prove Date Of Birth Of Child And Parentage To Social Security Administration In Order To Receive Benefits?

Legal documentation management can be exasperating, even for the most seasoned experts. When you need a Birth Social Security Withholding and lack the time to dedicate to finding the correct and current version, the process may be taxing. A comprehensive online form repository can significantly improve the efficiency for anyone wishing to handle these matters proficiently. US Legal Forms is a frontrunner in digital legal documents, offering over 85,000 state-specific legal forms at your convenience.

With US Legal Forms, you can.

Conserve time and effort searching for the documents you require, and use US Legal Forms’ advanced search and Review feature to locate and download the Birth Social Security Withholding. If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it. Check your My documents tab to view the documents you have previously downloaded and to organize your folders as desired.

If this is your first experience with US Legal Forms, create an account and gain unlimited access to all the platform's benefits. Here are the steps to follow after downloading the form you need.

Leverage the US Legal Forms online catalog, backed by 25 years of expertise and reliability. Transform your daily document management into a seamless and user-friendly experience today.

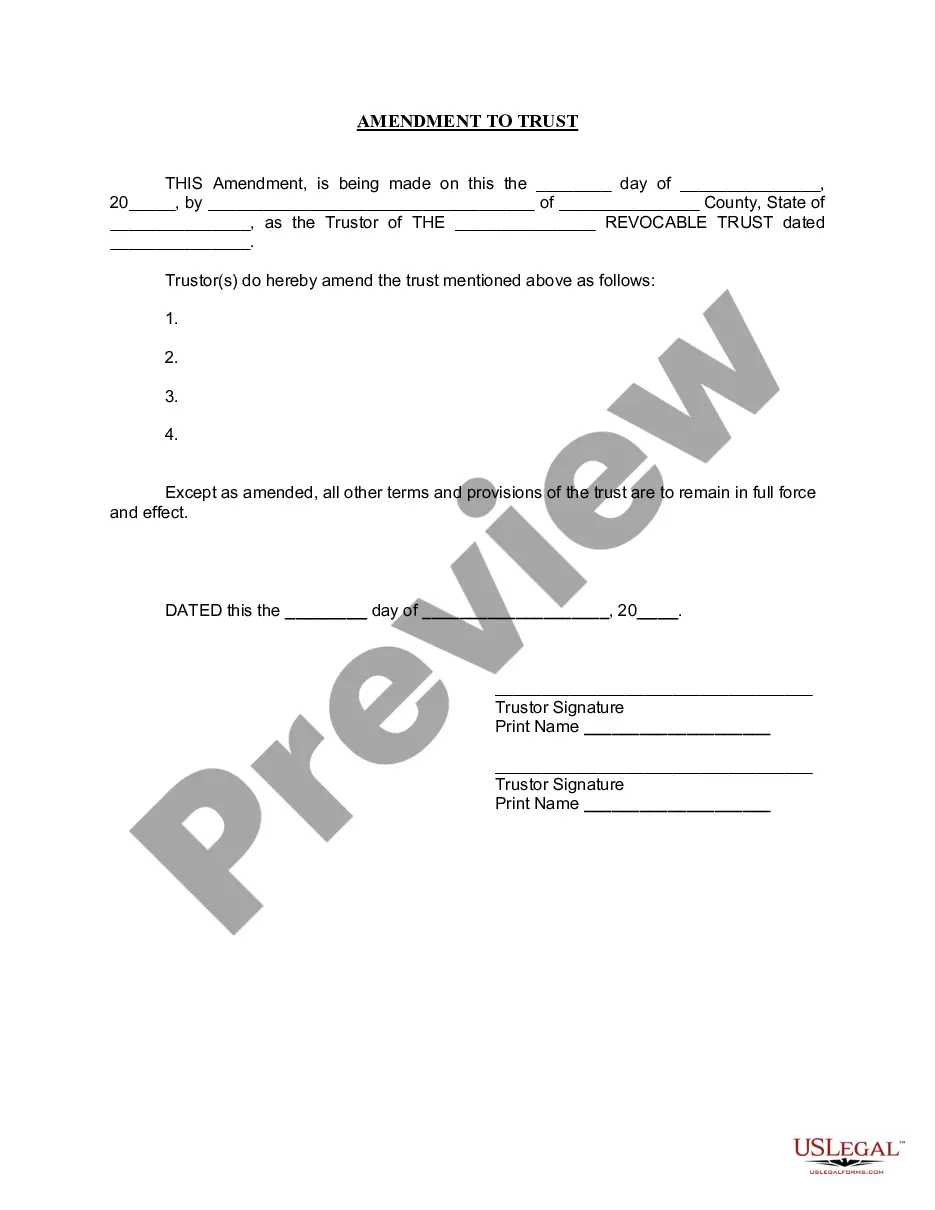

- Ensure it is the correct form by previewing it and reviewing its details.

- Confirm that the template is valid in your state or county.

- Click Buy Now when you are ready.

- Select a monthly subscription plan.

- Choose the desired file format, and Download, fill out, sign, print, and send your document.

- Access state- or county-specific legal and business documents. US Legal Forms caters to any requirements you may have, from personal to business paperwork, all in one place.

- Utilize advanced features to fill out and manage your Birth Social Security Withholding.

- Access a resource library of articles, guides, handbooks, and materials related to your situation and needs.

Form popularity

FAQ

Claiming Benefits From an Ex-Spouse Although the spousal benefit might fly a bit under the radar, a true ?loophole? that is easy to overlook is that even ex-spouses may qualify. That's right, even if you're divorced, you may be able to receive a benefit based on your ex-spouse's work record.

The flagship welfare programme in the US has rigid and specific rules for how much one's monthly check will be; there are no extra bonuses to receive. There is no such thing as an ?annual bonus? of $16,728? for Social Security.

If you are receiving retirement or disability benefits, your spouse may be eligible for spouse benefits if they are: At least age 62. Any age and caring for a child who is under age 16 or who has a disability that began before age 22.

Yes. If you qualify for your own retirement and spouse's benefits, we will always pay your own benefits first. If your benefit amount as a spouse is higher than your own retirement benefit, you will get a combination of the two benefits that equals the higher amount.

If your spouse is not receiving any retirement benefits yet, then you could technically take your regular Social Security benefit as early as age 62. When your spouse files for their benefit later you could switch to spousal benefits.