Acknowledgement Of Receipt Form With Promissory Note

Description

How to fill out Notice To Trustor Of Acceptance By Trustee And Acknowledgment Of Receipt Of Amendment To Trust Agreement?

Navigating through the red tape of traditional forms and templates can be challenging, particularly if one does not engage in that professionally.

Even locating the appropriate template for the Acknowledgement Of Receipt Form With Promissory Note will be laborious, as it must be legitimate and precise to the very last digit.

However, you will need to spend considerably less time acquiring a suitable template from a source you can depend on.

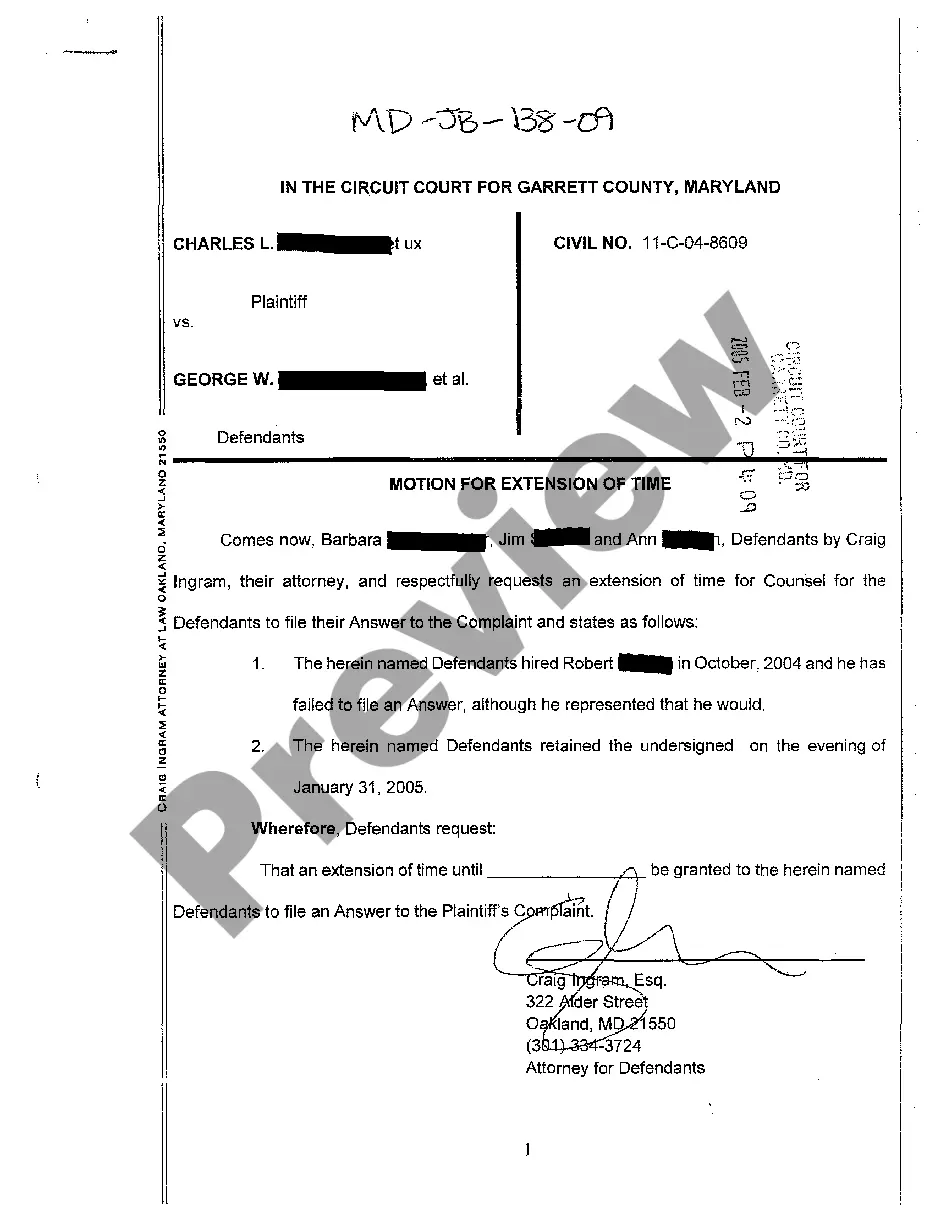

Acquire the appropriate form in a few easy steps: Enter the name of the document in the search box. Find the correct Acknowledgement Of Receipt Form With Promissory Note among the results. Review the description of the sample or open its preview. If the template aligns with your requirements, click Buy Now. Proceed to select your subscription plan. Utilize your email and create a secure password to register an account at US Legal Forms. Choose a credit card or PayPal payment option. Save the template document on your device in the format of your choice. US Legal Forms will save you time and effort verifying if the form you encountered online is suitable for your needs. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the process of searching for the correct forms online.

- US Legal Forms is a single destination you require to obtain the most recent samples of forms, inquire about their use, and download these samples to complete them.

- It is a compilation with over 85K forms that are applicable in various fields of work.

- When searching for an Acknowledgement Of Receipt Form With Promissory Note, you will not have to doubt its authenticity as all the forms are verified.

- An account at US Legal Forms will ensure you possess all the necessary samples at your fingertips.

- Store them in your history or add them to the My documents catalog.

- You have access to your saved forms from any device by simply clicking Log In at the library website.

- If you still do not have an account, you can always search around for the template you require.

Form popularity

FAQ

The promissory note journal entry is recorded by debiting the account that receives value, commonly the cash account, and crediting the notes payable account.

If you're signing a promissory note, make sure it includes these details:Date. The promissory note should include the date it was created at the top of the page.Amount.Loan terms.Interest rate.Collateral.Lender and borrower information.Signatures.17-Apr-2019

How to Create a Promissory Note (5 steps)Step 1 Agree to Terms.Step 2 Run a Credit Report.Step 3 Security and Co-Signers.Step 4 Writing the Note.Step 5 Paying Back the Money.04-Apr-2022

A banknote is frequently referred to as a promissory note, as it is made by a bank and payable to bearer on demand. Mortgage notes are another prominent example. If the promissory note is unconditional and readily saleable, it is called a negotiable instrument.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.