Continuing Writ Garnishment Florida Without Cause

Description

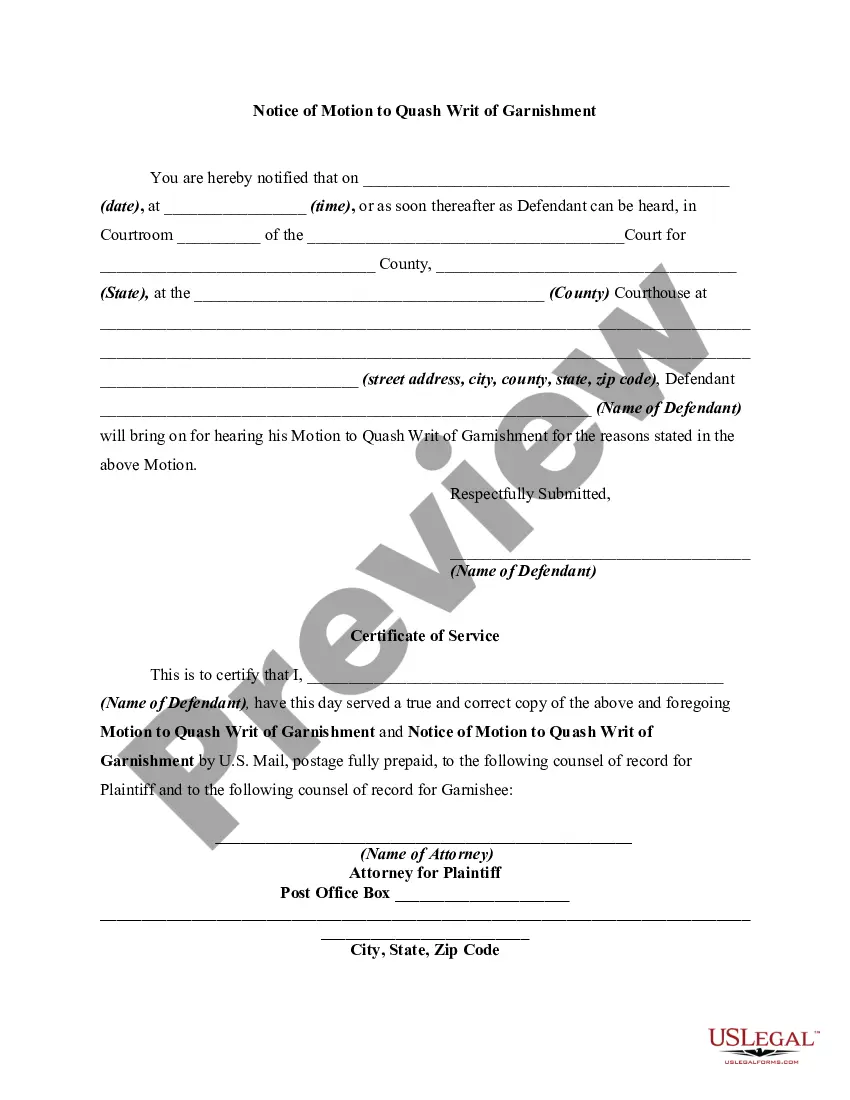

How to fill out Motion Of Defendant To Discharge Or Quash Writ Of Garnishment And Notice Of Motion?

Identifying a reliable location to obtain the most up-to-date and suitable legal templates constitutes a significant portion of navigating bureaucracy. Securing the correct legal paperwork demands accuracy and meticulousness, which is why it is essential to source Continuing Writ Garnishment Florida Without Cause templates exclusively from trustworthy providers, such as US Legal Forms. An incorrect document will consume your time and prolong the matter at hand. With US Legal Forms, you have minimal concerns to address. You can review and verify all particulars regarding the document’s applicability and significance for your circumstances and within your state or county.

Follow these outlined steps to complete your Continuing Writ Garnishment Florida Without Cause.

Eliminate the hassle associated with your legal paperwork. Explore the extensive US Legal Forms collection where you can discover legal templates, evaluate their suitability for your case, and download them instantly.

- Use the library navigation or search bar to find your template.

- Open the form’s details to determine if it fits your state's requirements.

- Access the form preview, if available, to confirm it meets your expectations.

- Return to the search to locate an appropriate template if the Continuing Writ Garnishment Florida Without Cause does not fulfill your criteria.

- Once you are confident about the form’s applicability, download it.

- If you are a registered member, click Log in to authenticate and access your selected forms in My documents.

- If you do not possess an account yet, click Buy now to purchase the form.

- Select the pricing plan that best fits your needs.

- Proceed with the registration process to complete your purchase.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Continuing Writ Garnishment Florida Without Cause.

- Once the form is on your device, you can edit it with the editor or print it for manual completion.

Form popularity

FAQ

How to start a sole proprietorship: 7 steps to take Choose a business name. ... Register your business name. ... Purchase a website domain name. ... Obtain a business license and other permits. ... File for an employer identification number (EIN) ... Open a business bank account. ... Get insurance coverage.

Sole proprietors will need to pay their employees, file and remit payroll taxes, and comply with employment regulations. Different tax requirements may apply, however, if the employee is a spouse or a child.

Does a sole proprietor need a business license in Hawaii? Even a sole proprietor is required to obtain a General Excise Tax License in Hawaii. Any business engaged in commercial activities must get one.

Most businesses need to register with the provinces and territories where they plan to do business. In some cases, sole proprietorships operating under the name of the business owner do not need to register. See the website of your provincial or territorial business registrar for more information on their requirements.

Sole proprietors pay taxes on business income on their personal tax returns. As a sole proprietor, you must report all business income or losses on your personal income tax return; the business itself isn't taxed separately.

To register as a sole proprietor or partnership, you may need to: register your business with the provinces and territories where you plan to do business. get a federal business number and tax accounts. apply for any permits and licences your business may need.

Sole proprietors and partners pay themselves simply by withdrawing cash from the business. Those personal withdrawals are counted as profit and are taxed at the end of the year. Set aside a percentage of earnings in a separate bank account throughout the year so you have money to pay the tax bill when it's due.

The life span of a sole proprietorship can be uncertain. The owner may lose interest, experience ill health, retire, or die. The business will cease to exist unless the owner makes provisions for it to continue operating or puts it up for sale. Losses are the owner's responsibility.