Assignment Of Deposit Account As Security

Description

How to fill out Assignment Of Certificate Of Deposit Agreement?

Obtaining legal templates that meet the federal and regional laws is essential, and the internet offers a lot of options to choose from. But what’s the point in wasting time looking for the appropriate Assignment Of Deposit Account As Security sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the largest online legal catalog with over 85,000 fillable templates drafted by attorneys for any professional and life situation. They are simple to browse with all documents organized by state and purpose of use. Our specialists stay up with legislative updates, so you can always be sure your paperwork is up to date and compliant when acquiring a Assignment Of Deposit Account As Security from our website.

Obtaining a Assignment Of Deposit Account As Security is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the right format. If you are new to our website, adhere to the steps below:

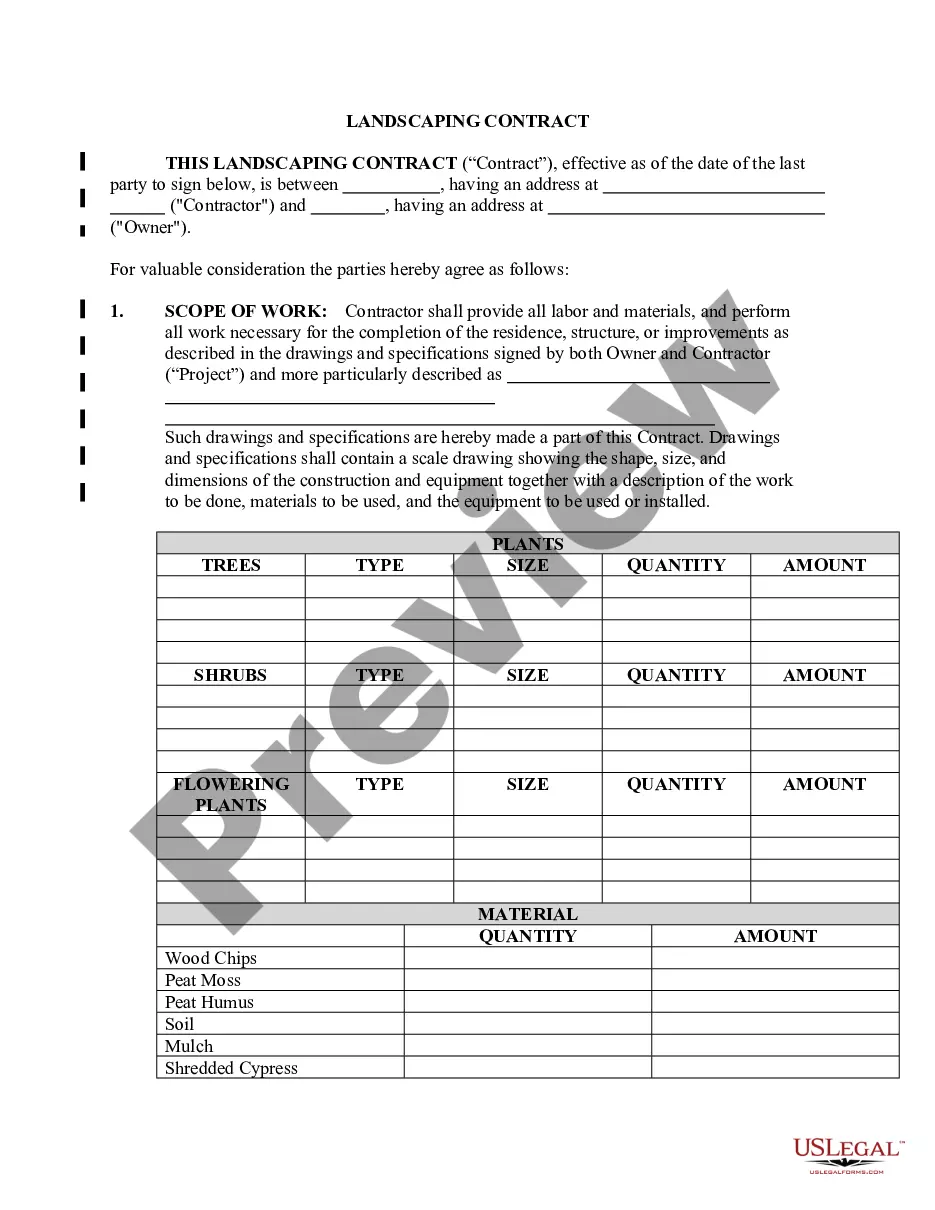

- Examine the template utilizing the Preview feature or via the text outline to ensure it fits your needs.

- Browse for a different sample utilizing the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the correct form and select a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Assignment Of Deposit Account As Security and download it.

All documents you locate through US Legal Forms are multi-usable. To re-download and complete earlier saved forms, open the My Forms tab in your profile. Enjoy the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

SECURED TRANSACTIONS: TERMINOLOGY ? Secured Transaction: A transaction in which the payment of a debt is guaranteed, or secured, by collateral. (i) owned by the debtor or. (ii) in which the debtor has a legal interest.

Cash collateral is cash and equivalents held for the benefit of creditors during Chapter 11 bankruptcy proceedings. Cash and cash equivalents include negotiable instruments, documents of title, securities, and deposit accounts.

A lender can perfect a lien on a borrower's deposit account only by obtaining "control" over the account, which requires one of the following arrangements: (1) the borrower maintains its deposit account directly with the lender; (2) the lender becomes the actual owner of the borrower's deposit accounts with the ...

However, generally speaking, the primary ways for a secured party to perfect a security interest are: by filing a financing statement with the appropriate public office. by possessing the collateral. by "controlling" the collateral; or. it's done automatically when the security interest attaches.

In finance, a security interest is a legal right granted by a debtor to a creditor over the debtor's property (usually referred to as the collateral) which enables the creditor to have recourse to the property if the debtor defaults in making payment or otherwise performing the secured obligations.