Credit Reporting Agencies Report Format

Description

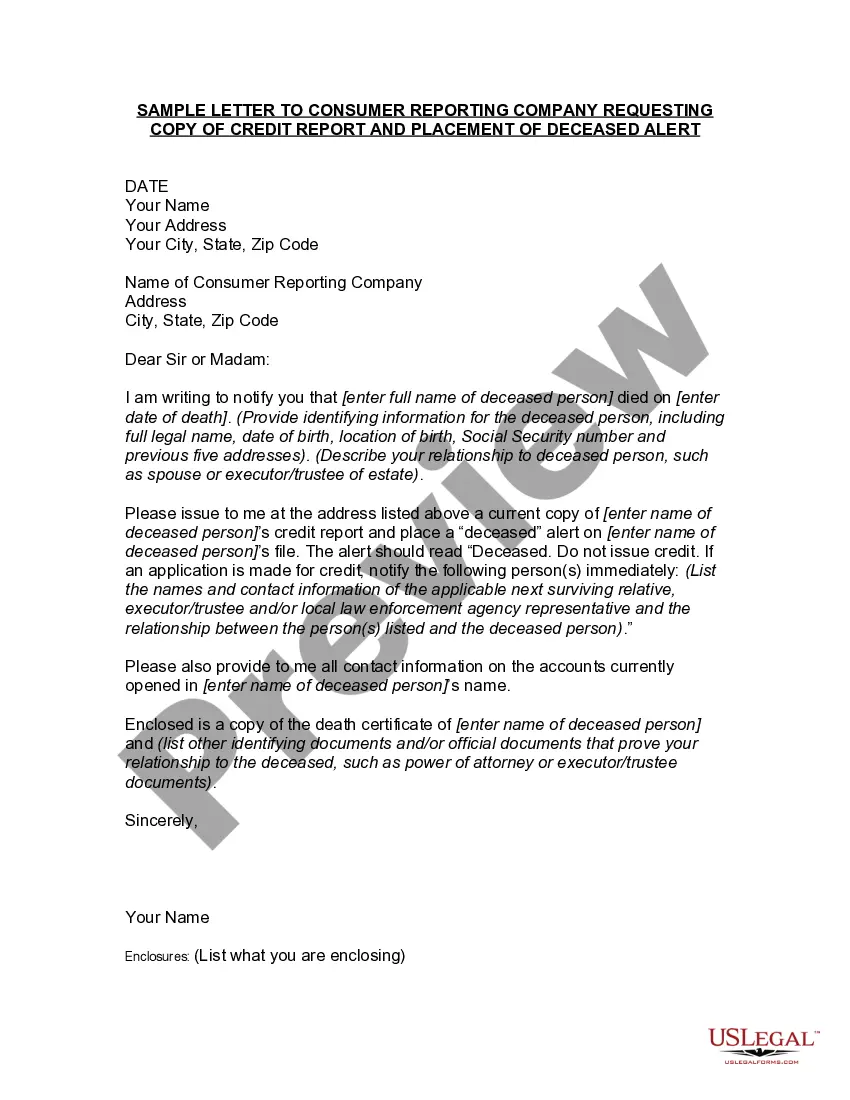

How to fill out Letter To Credit Reporting Bureaus Or Agencies Requesting Copy Of Deceased Person's Credit Report And Placement Of Deceased Alert?

Regardless of whether it's for commercial reasons or personal matters, everyone encounters legal scenarios at some stage in their lives.

Filling out legal documents requires meticulous attention, starting with selecting the appropriate form template.

With an extensive catalog of US Legal Forms available, you won't need to waste time searching for the correct template online. Utilize the library's straightforward navigation to find the right template for any occasion.

- Obtain the template you require by using the search bar or browsing the catalog.

- Review the form's description to verify it aligns with your situation, state, and locality.

- Click on the form's preview to inspect it.

- If it is not the correct document, return to the search feature to locate the Credit Reporting Agencies Report Format sample you need.

- Obtain the template if it satisfies your needs.

- If you already possess a US Legal Forms account, click Log in to access previously stored documents in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Fill out the profile registration form.

- Select your payment method: either a credit card or PayPal account.

- Choose the document format you desire and download the Credit Reporting Agencies Report Format.

- Once saved, you can complete the form using editing software or print it out and fill it in manually.

Form popularity

FAQ

The credit bureaus also accept disputes online or by phone: Experian (888) 397-3742. Transunion (800) 916-8800. Equifax (866) 349-5191.

Nationwide consumer reporting companies There are three big nationwide providers of consumer reports: Equifax, TransUnion, and Experian. Their reports contain information about your payment history, how much credit you have and use, and other inquiries and information.

Metro2 Format is the current standard format for reporting credit. It meets all the requirements of the Fair Credit Reporting Act (FCRA), the Fair Credit Billing Act (FCBA), and the Equal Credit Opportunity Act (ECOA). It allows most accurate and complete information on consumers' credit history.

Information to include in your dispute letter Full name. Date of birth. Current address. Driver's license number. Social Security number (optional). The account number of the tradeline you're disputing (e.g., account number found on your utility bill, student loan bill or mortgage statement).

Your dispute letter should include the following information: Your full name. Your date of birth. Your Social Security number. Your current address and any other addresses at which you have lived during the past two years. A copy of a government-issued identification card such as a driver's license or state ID.