Loan Agreement Form With Collateral

Description

How to fill out Security Agreement - Short Form?

Dealing with legal documents and processes can be a lengthy addition to your agenda.

Loan Agreement Document With Security and similar forms frequently require you to search for them and find your way to fill them out correctly.

Thus, whether you are managing financial, legal, or personal issues, utilizing an all-inclusive and user-friendly online directory of forms readily available will be extremely beneficial.

US Legal Forms is the leading online resource for legal templates, providing over 85,000 state-oriented forms and a wide array of tools to assist you in completing your documents efficiently.

Is this your first time using US Legal Forms? Sign up and create an account in just a few minutes, and you will gain access to the form directory and Loan Agreement Document With Security. Next, follow the instructions below to fill out your form.

- Explore the directory of relevant documents available to you with just one click.

- US Legal Forms offers state- and county-specific documents accessible at any time for download.

- Protect your document management activities with a high-quality service that enables you to create any document in minutes without extra or concealed charges.

- Simply Log In to your account, find Loan Agreement Document With Security, and download it instantly from the My documents section.

- You can also retrieve forms you have saved previously.

Form popularity

FAQ

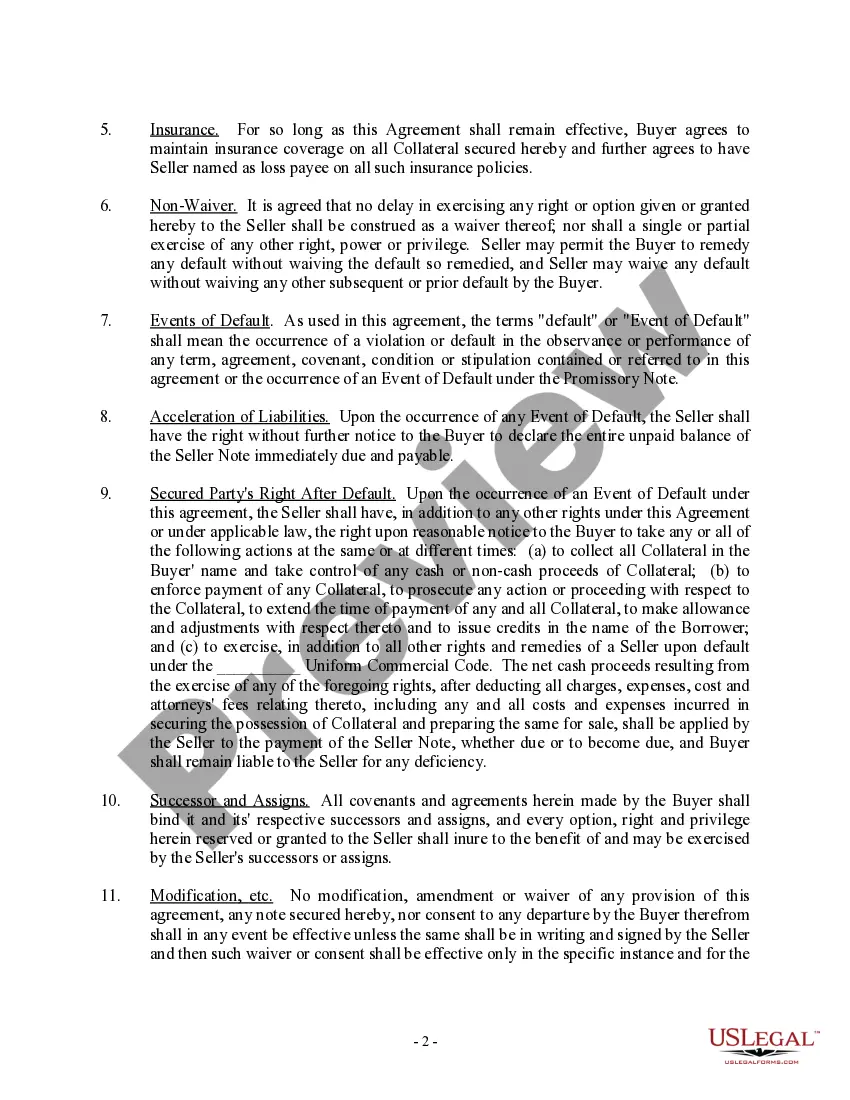

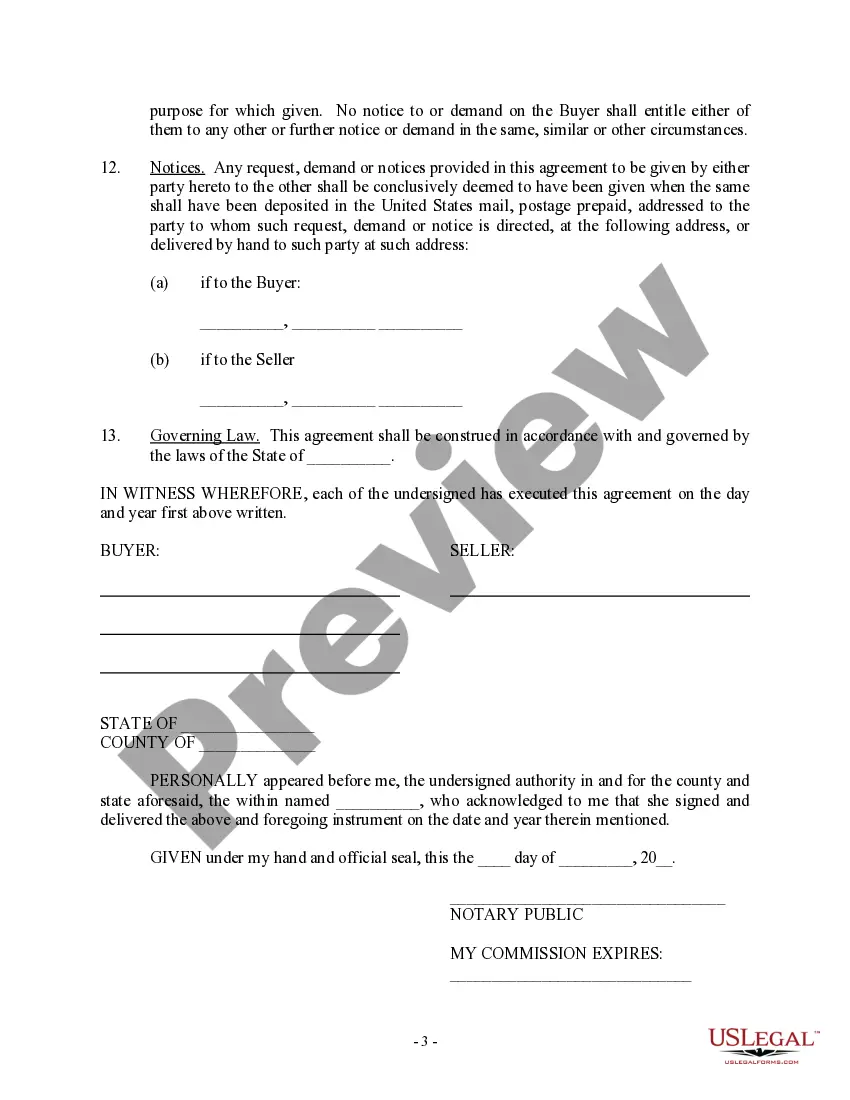

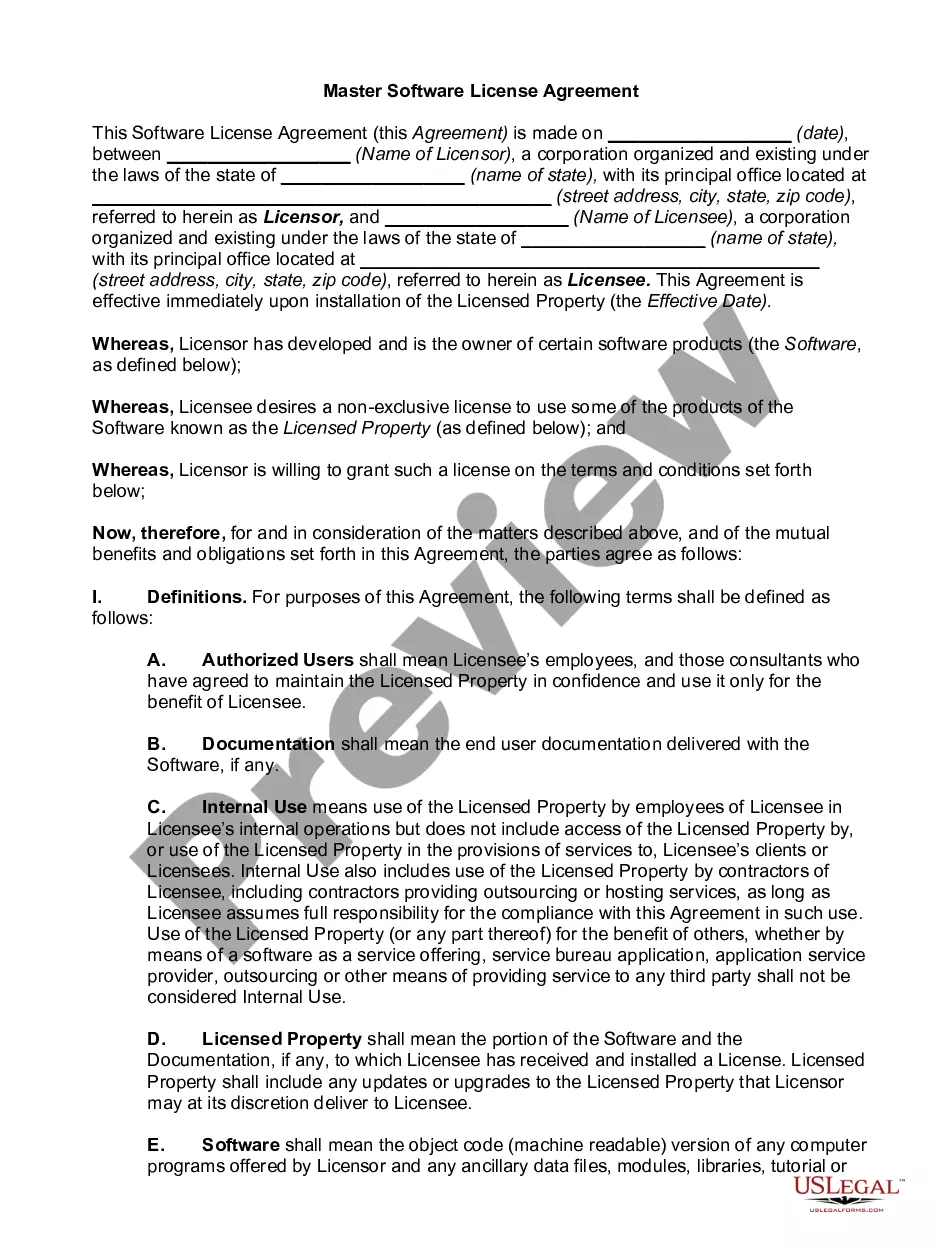

An example of a collateral agreement is a loan where a borrower uses their vehicle as collateral for a personal loan. If the borrower fails to repay the loan, the lender has the right to take possession of the vehicle. Utilizing a loan agreement form with collateral can help you create a clear and enforceable example of such an agreement.

A loan agreement with property as collateral is a contract where the borrower secures a loan by offering real estate as collateral. This type of agreement provides additional security for the lender, as they can claim the property if the borrower defaults. When you use a loan agreement form with collateral, it helps you clearly outline the terms related to the property involved.

Creating a collateral contract involves drafting a document that specifies the terms of the loan and the collateral involved. You need to include details like loan amount, repayment schedule, and what happens in case of default. Using a loan agreement form with collateral can help ensure you cover all critical points and comply with legal requirements.

To write a loan agreement with collateral, specify the loan amount, interest rate, repayment terms, and a detailed description of the collateral. It is also essential to include clauses that address default and the rights of both parties. Utilizing a loan agreement form with collateral can streamline this process and ensure clarity.

The legal documents for collateral typically include the collateral loan agreement, a promissory note, and possibly a security agreement. These documents outline the terms of the loan and the specifics of the collateral. When using a loan agreement form with collateral, you can easily create these documents to protect both parties.

To write a simple loan agreement, start by including essential details such as the loan amount, interest rate, repayment schedule, and collateral description. Ensure both parties sign the document to make it legally binding. Using a loan agreement form with collateral from US Legal Forms can simplify this process and ensure you cover all necessary elements.

A collateral loan agreement is a legal document that outlines the terms of a loan secured by collateral. This type of agreement protects the lender by allowing them to claim the collateral if the borrower defaults. When using a loan agreement form with collateral, both parties can clearly understand their rights and obligations.

You do not necessarily need a lawyer to draft a loan agreement, especially if you use a loan agreement form with collateral. Many online platforms, such as US Legal Forms, provide templates that guide you through the process. However, if your agreement involves significant amounts or complex terms, consulting a lawyer can be beneficial.

To write a legally binding loan agreement form with collateral, start by outlining the basic terms of the loan such as the amount, interest rate, and repayment schedule. Ensure that you clearly identify the collateral that secures the loan, such as property or assets, to protect your interests. It is crucial to include both parties' names, addresses, and signatures to validate the agreement. Utilizing a resource like US Legal Forms can simplify this process by providing templates specifically designed for creating comprehensive loan agreements.

Yes, you can write your own loan agreement. However, creating a loan agreement form with collateral requires careful attention to detail, ensuring that all critical elements are included. It is advisable to follow a clear template to avoid any potential legal issues down the road. Platforms like USLegalForms provide handy templates and guidance to help you draft a robust loan agreement form with collateral that protects your interests.