Unsecured Loan Form With Check

Description

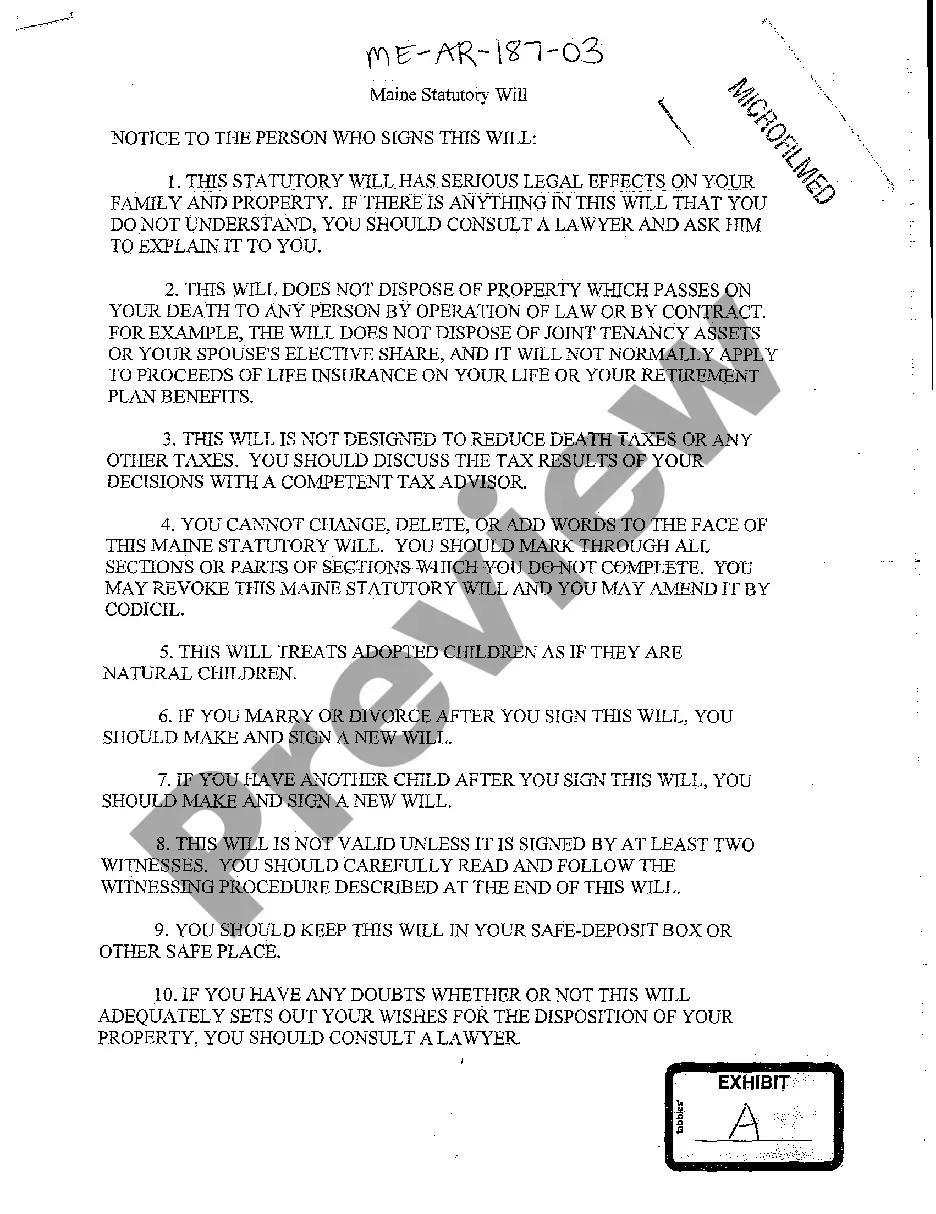

How to fill out Multistate Promissory Note - Unsecured - Signature Loan?

Managing legal documents can be perplexing, even for the most seasoned experts.

When you are looking for an Unsecured Loan Form With Check and lack the time to search for the correct and updated version, the process can be overwhelming.

Access state- or county-specific legal and business documents.

US Legal Forms meets all your requirements, from personal to business paperwork, all in one place.

If this is your first experience with US Legal Forms, create a free account and gain unlimited access to all the benefits of the library. Follow these steps after accessing the form you need: Confirm it is the correct form by previewing it and reviewing its details. Ensure that the sample is approved in your state or county. Click Buy Now when you are ready. Select a subscription plan. Choose the format you require, and Download, complete, sign, print, and deliver your documents. Enjoy the US Legal Forms online library, supported by 25 years of experience and reliability. Transform your daily document management into a smooth and user-friendly process today.

- Utilize advanced tools to fill out and manage your Unsecured Loan Form With Check.

- Access a valuable resource hub of articles, guides, and materials relevant to your circumstances and requirements.

- Save time and effort searching for the documents you need, and use US Legal Forms’ advanced search and Preview feature to find Unsecured Loan Form With Check and obtain it.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check the My documents tab to view the documents you've previously saved and manage your folders as desired.

- A comprehensive online form library can be transformative for anyone aiming to navigate these scenarios effectively.

- US Legal Forms is a frontrunner in online legal documents, offering over 85,000 state-specific legal forms accessible at any time.

- With US Legal Forms, you can.

Form popularity

FAQ

You have to prove that your income can match the repayment plus interest; pay stubs help you to do exactly that. Additionally, a bank-verified pay stub allows you to borrow personal loans, car loans, and emergency loans against your next payday for very low interest rates.

You'll fill in how much you pay for housing (rent or mortgage payments) and might have to include information on any other debts you have. You typically need to provide your annual or monthly income as well. Bank statements and tax returns might be required to back up your information.

Those seeking a loan go to a payday lending service and procure a cash loan, with their full payment due when the borrower next gets paid. In the US, the finance fees on a payroll loan are usually in the range of 15 to 30 percent of the total sum for the two-week period.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan. Some of the documents you'll be asked to provide include, copies of your state- or government-issued ID, copies of paystubs, tax returns or bank statements.