Promissory Note With Balloon Payment With Amortization Schedule In Contra Costa

Category:

State:

Multi-State

County:

Contra Costa

Control #:

US-00425BG

Format:

Word;

Rich Text

Instant download

Description

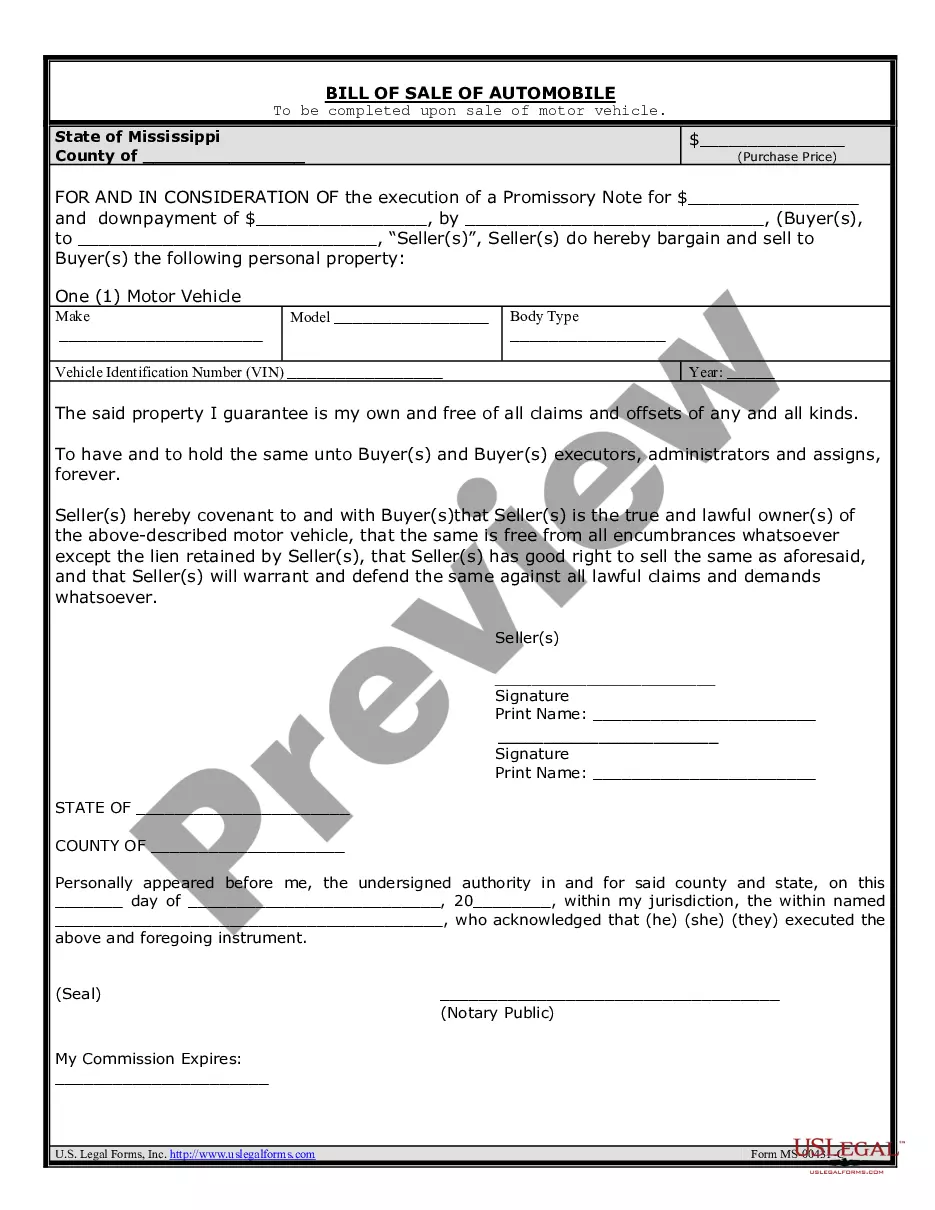

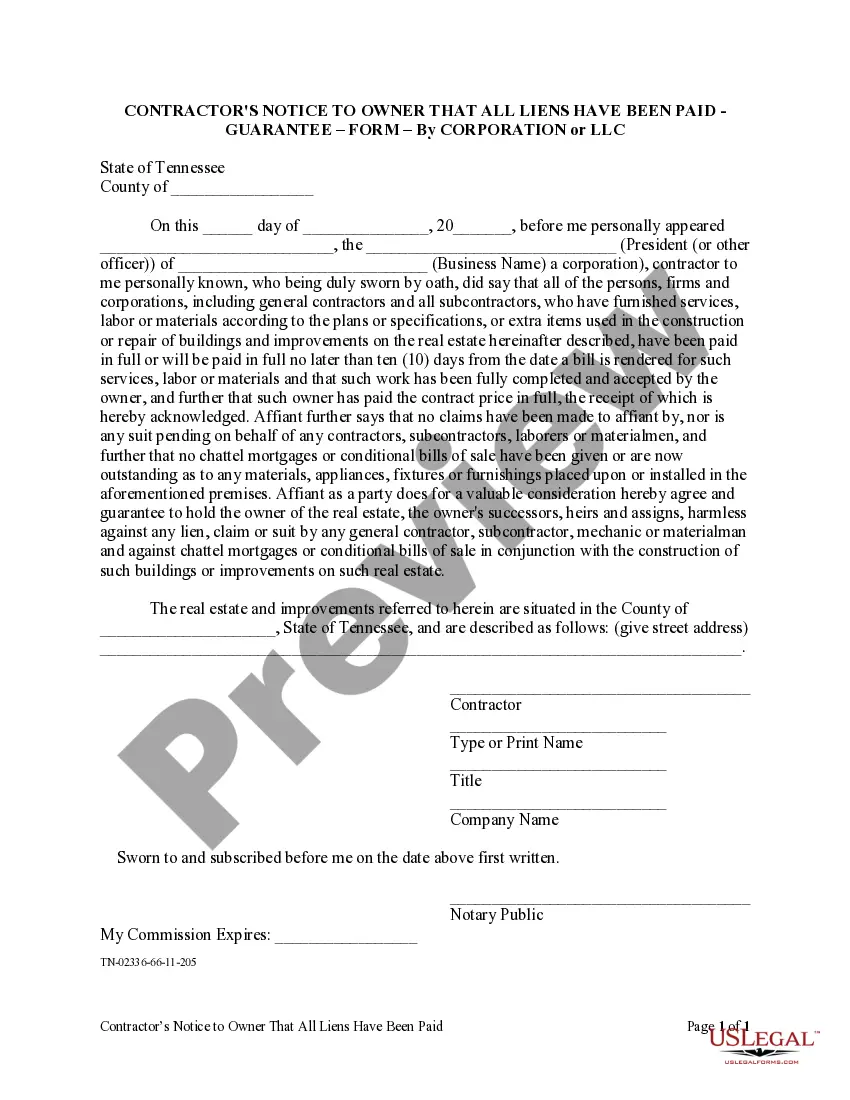

The Promissory Note with balloon payment with amortization schedule in Contra Costa is a legal document outlining a borrower's promise to repay a specified loan amount to a lender. This form includes crucial details such as the principal amount, interest rate, payment schedule, and the due date for both regular monthly installments and the final balloon payment. It operates on an amortization schedule, allowing for gradual repayment over a set period. Users can customize the form by filling in specific fields like names, addresses, amounts, and percentages. This note is particularly useful for attorneys, partners, and paralegals involved in real estate transactions or lending agreements. It serves as a vital tool for legal assistants in preparing documentation for loans and understanding repayment terms. Additionally, the inclusion of prepayment penalties and potential default terms necessitates careful consideration for users managing client debts or advising on financial agreements.

Free preview

Form popularity

FAQ

But what exactly do you need to write a promissory note? Include their full legal names, addresses, and contact numbers—include any co-signers if applicable. The terms of this note should specify the amount borrowed, repayment terms (including interest rate, if applicable), and the due date or schedule of payments.

Disadvantages of a Balloon Payment Usage Restrictions. Car finance with a final balloon payment typically requires usage restrictions. Not Ideal for Those With Lower Credit Scores. Not Optional for Lease Agreements. Expensive Final Payment.