State Bar Of Texas Probate Forms In Florida

Description

Form popularity

FAQ

ALTHOUGH YOU ARE NOT REQUIRED TO HAVE AN ATTORNEY FOR CERTAIN PROBATE PROCEEDINGS, ONLY AN ATTORNEY CAN GIVE LEGAL ADVICE. IF YOU CHOOSE TO PROCEED WITHOUT AN ATTORNEY, AT ANY TIME IN YOUR CASE YOU MAY OPT TO HIRE ONE.

Formal Administration: This main probate process will definitely need an attorney. The process is described in greater detail below. Summary Administration: The family will likely need an attorney due to the complexity. Disposition without Administration: This process is designed to operate without probate.

ALTHOUGH YOU ARE NOT REQUIRED TO HAVE AN ATTORNEY FOR CERTAIN PROBATE PROCEEDINGS, ONLY AN ATTORNEY CAN GIVE LEGAL ADVICE. IF YOU CHOOSE TO PROCEED WITHOUT AN ATTORNEY, AT ANY TIME IN YOUR CASE YOU MAY OPT TO HIRE ONE.

Probate opens in the deceased's state of residence. You cannot move probate to your state. If the decedent owned property in other states, you must also open ancillary proceedings in those states. You may need to retain legal counsel in each state to help with ancillary probate.

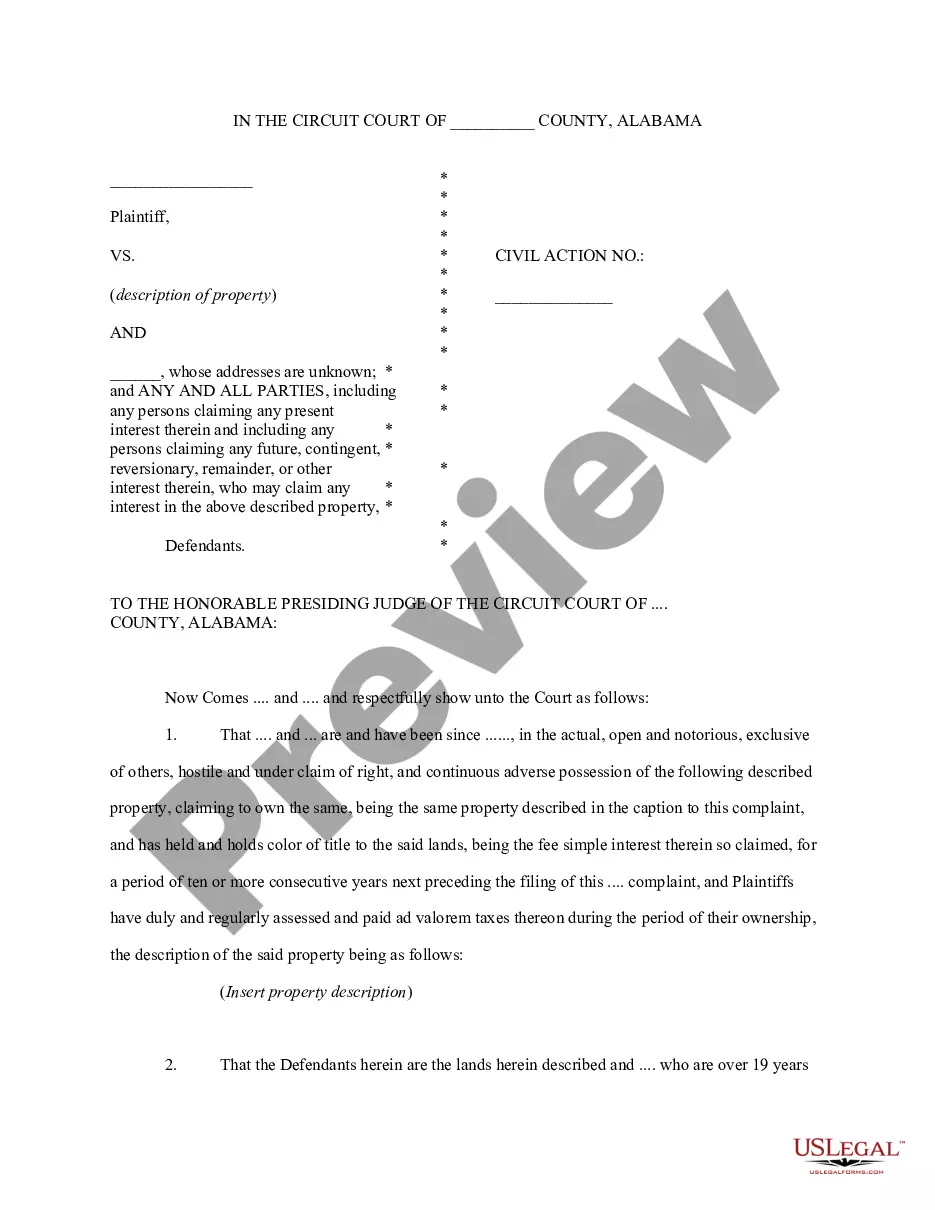

Independent Administration Application for Probate of Will and Issuance of Letters Testamentary. Form 7-2. Application for Probate of Copy of Will and Issuance of Letters Testamentary. Form 7-3. Application for Probate of Will and Issuance of Letters of Independent Administration. Form 7-4.

In Florida, probate must usually be initiated a short time after death. The will, if there is one, must be filed with the court within 10 days of the death. Even though there is no legal penalty for missing this window, it's very important to file promptly to avoid unnecessary delays in the probate process.

In FL, estates worth $75,000 or more, where the decedent died within the last two years, must go through formal probate proceedings, but there's a lot that goes into this calculation. At Vollrath Law, we've guided countless grieving clients through this territory, equipping them to make informed choices amid grief.

Under most circumstances, you will need to hire an attorney to assist you in the probate process. First, you will know you have to probate an asset when it is in the decedent's own, individual name. This includes bank accounts, stocks, bonds, land and more.

ALTHOUGH YOU ARE NOT REQUIRED TO HAVE AN ATTORNEY FOR CERTAIN PROBATE PROCEEDINGS, ONLY AN ATTORNEY CAN GIVE LEGAL ADVICE. IF YOU CHOOSE TO PROCEED WITHOUT AN ATTORNEY, AT ANY TIME IN YOUR CASE YOU MAY OPT TO HIRE ONE.