Release Of Mortgage Document Without Satisfaction Of Debt

Definition and meaning

A Release of mortgage document without satisfaction of debt is a legal instrument that indicates a mortgage has been released but without formally satisfying the underlying debt. This situation can arise from clerical errors or misunderstandings during the mortgage release process. Essentially, it means that while the lender has released the lien on the property, the borrower still owes money on the loan.

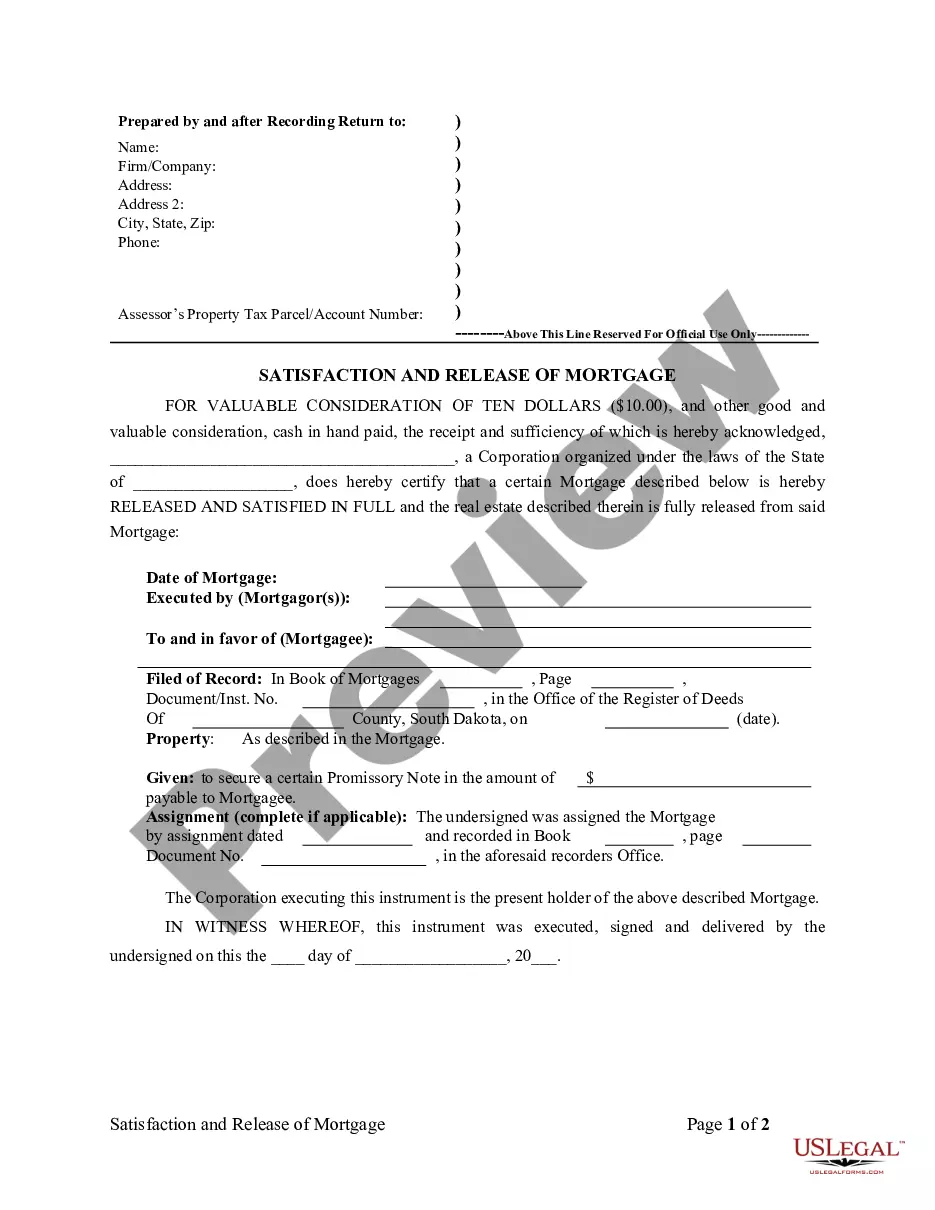

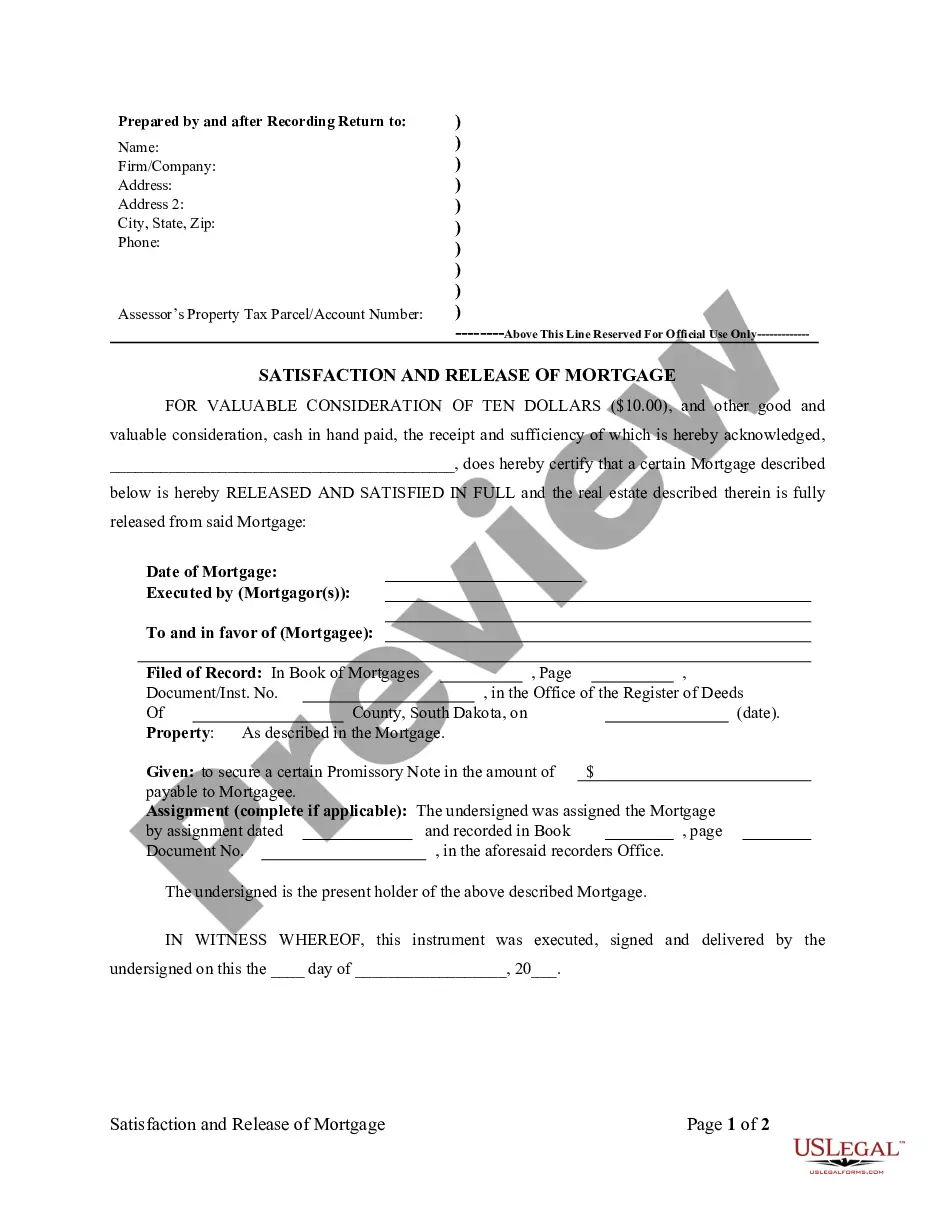

Key components of the form

The Release of mortgage document without satisfaction of debt contains several important elements including:

- Mortgagor(s): The person or entity that took out the mortgage.

- Mortgagee: The lender or financial institution that issued the mortgage.

- Date of Mortgage: The date when the original mortgage was executed.

- Property Description: Detailed information about the property involved in the mortgage.

- Notary Signature: Required verification of the document's execution by a notary public.

Who should use this form

This form is typically used by:

- Borrowers who have received a release of mortgage but still have outstanding debts.

- Lenders who need to formally document the release of a mortgage lien.

- Real estate professionals ensuring that mortgage records are accurate.

Common mistakes to avoid when using this form

When filling out the Release of mortgage document without satisfaction of debt, it is crucial to avoid these common mistakes:

- Failing to provide accurate property descriptions.

- Not obtaining the correct signatures from all relevant parties.

- Disregarding the need for notarization, which may invalidate the document.

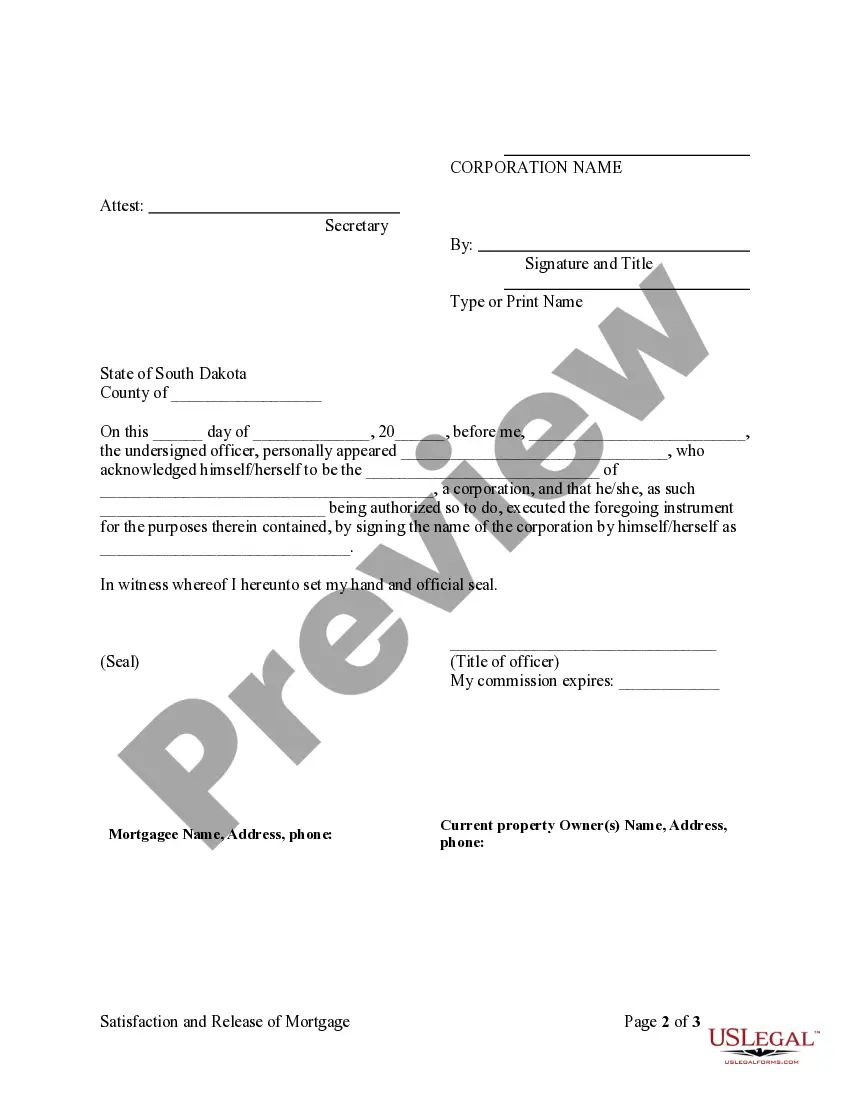

What to expect during notarization or witnessing

During the notarization process, you will typically experience the following:

- The notary public will verify the identity of the signers.

- All parties involved will need to be present to sign the document.

- The notary will affix their seal and sign the document to confirm its legitimacy.

It is important to have valid identification and to understand that the notary's role is to ensure authenticity, not to provide legal advice.

State-specific requirements

Specific handling of a Release of mortgage document without satisfaction of debt may vary by state. It is essential to check local laws to ensure compliance with:

- Filing requirements at the county level.

- Notary regulations specific to the state.

- Any additional forms or documentation that may be required during the process.

Benefits of using this form online

Utilizing online resources for a Release of mortgage document without satisfaction of debt has several advantages:

- Accessibility: Users can easily access and fill out the form from anywhere with an internet connection.

- Time-saving: Online forms often come with built-in guidance, streamlining the process.

- Error reduction: Digital forms can include validation features to help minimize mistakes.

How to fill out South Dakota Release Of Mortgage By Lender - By Corporate Lender?

Maneuvering through the red tape of official documents and templates can be challenging, particularly when one is not involved in that professionally.

Even selecting the appropriate template for the Release Of Mortgage Document Without Satisfaction Of Debt will be labor-intensive, as it must be accurate and precise to the last numeral.

However, you will have to spend significantly less time selecting a fitting template from a reliable source.

Obtain the correct form in a few simple steps: Enter the document name in the search field. Identify the relevant Release Of Mortgage Document Without Satisfaction Of Debt from the results. Review the outline of the sample or view its preview. If the template meets your requirements, click Buy Now. Then select your subscription plan. Use your email to create an account at US Legal Forms. Choose a payment option via credit card or PayPal. Finally, save the template file on your device in your preferred format. US Legal Forms will save you considerable time researching whether the form you found online suits your requirements. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a service that streamlines the process of finding the appropriate forms online.

- US Legal Forms is a single destination you need to acquire the latest samples of forms, consult their utilization, and download these samples to complete them.

- This is a repository with over 85K forms that are applicable in various sectors.

- When searching for a Release Of Mortgage Document Without Satisfaction Of Debt, you won't need to question its validity as all forms are validated.

- Having an account at US Legal Forms will ensure you have all the required samples at your disposal.

- Store them in your history or add them to the My documents list.

- You can access your saved forms from any device by simply clicking Log In on the library website.

- If you still do not possess an account, you can always search for the template you require.

Form popularity

FAQ

A satisfaction of mortgage is a document serving as evidence that you've paid off your mortgage in full, releasing the lien associated with the loan from your property and transferring the title to you. This document typically includes: Borrower and lender contact information.

What is a Satisfaction of Mortgage? A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.

In addition the following information should be included:The Payee Name.The Owner(s) of the mortgage holder.Total amount of mortgage.Mortgage date of execution.Full and legal description of the property to include tax parcel number.Acknowledgement that all payments have been made in full.More items...?

A satisfaction of mortgage is a signed document confirming that the borrower has paid off the mortgage in full and that the mortgage is no longer a lien on the property.

A satisfaction of mortgage is a document serving as evidence that you've paid off your mortgage in full, releasing the lien associated with the loan from your property and transferring the title to you. This document typically includes: Borrower and lender contact information. Loan and property information.