Release Of Mortgage Document With Promissory Note

Description

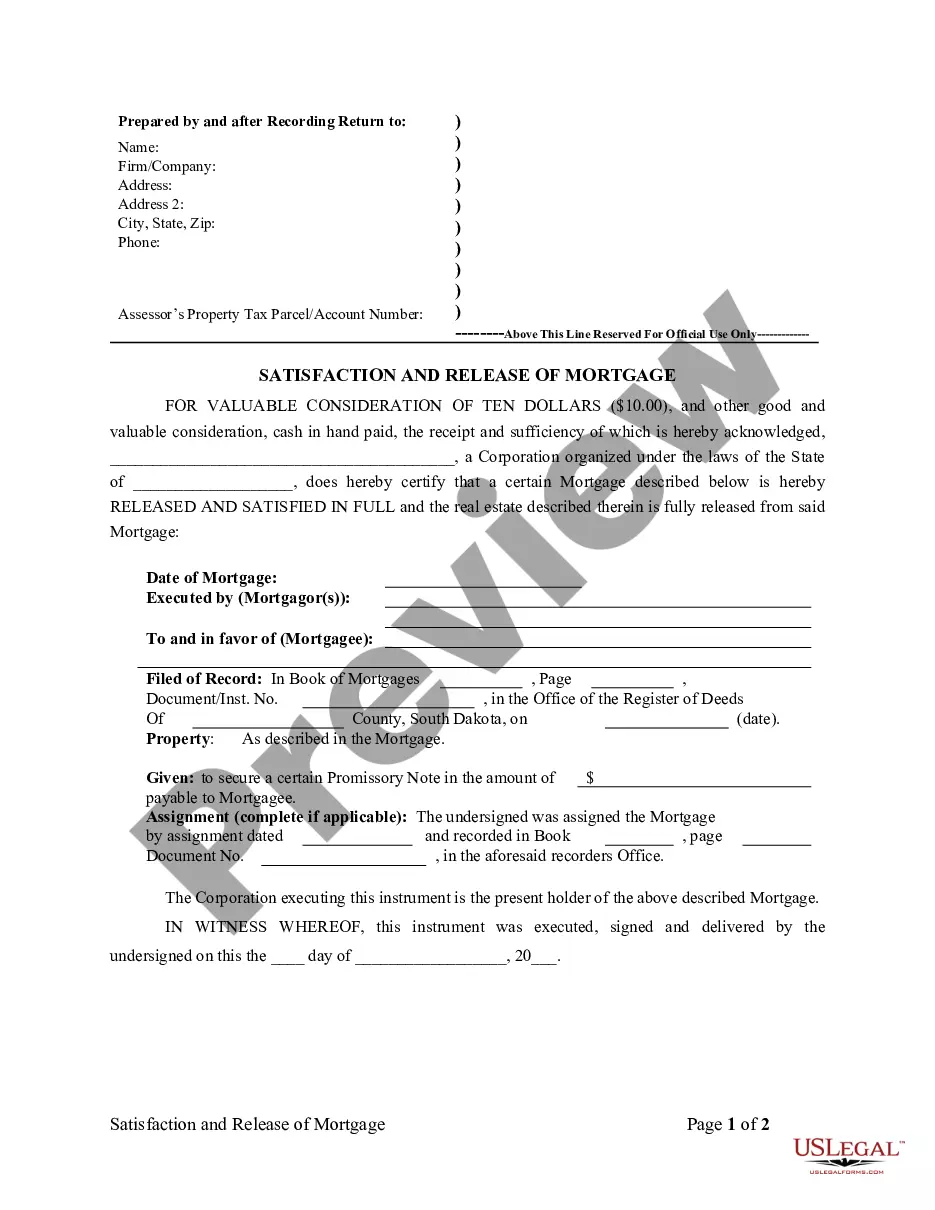

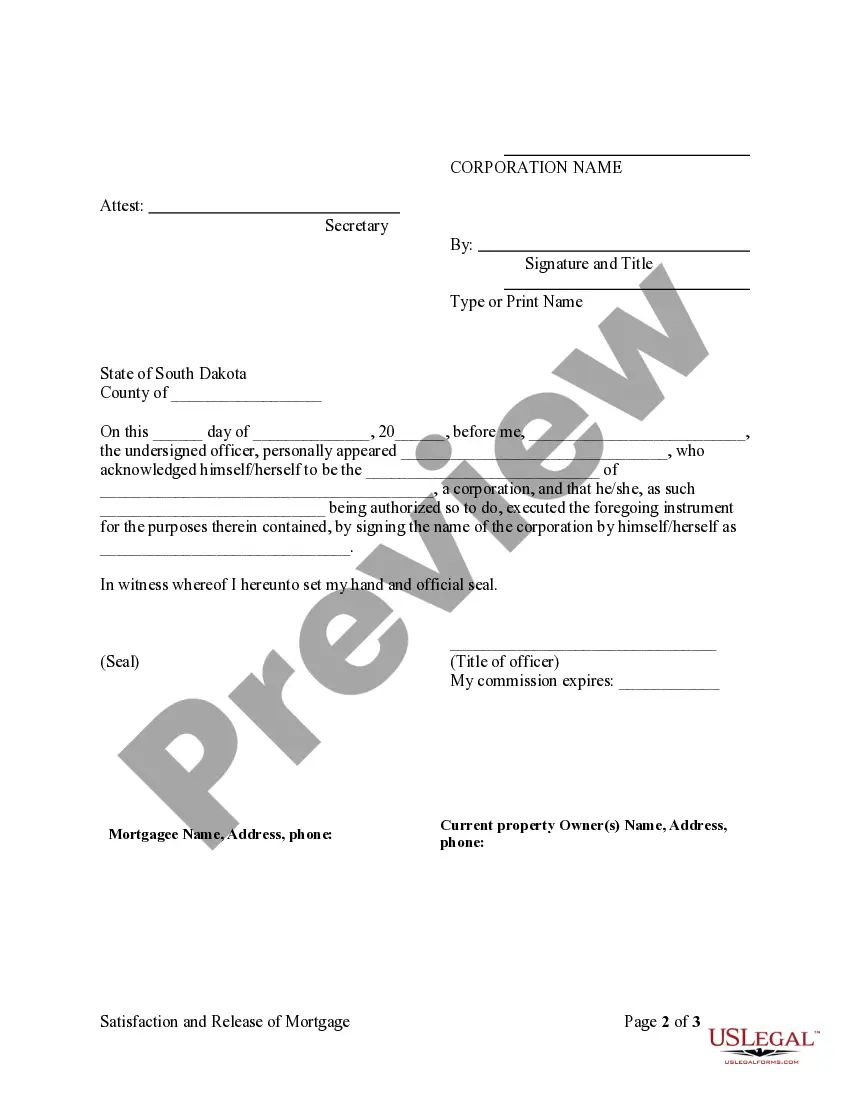

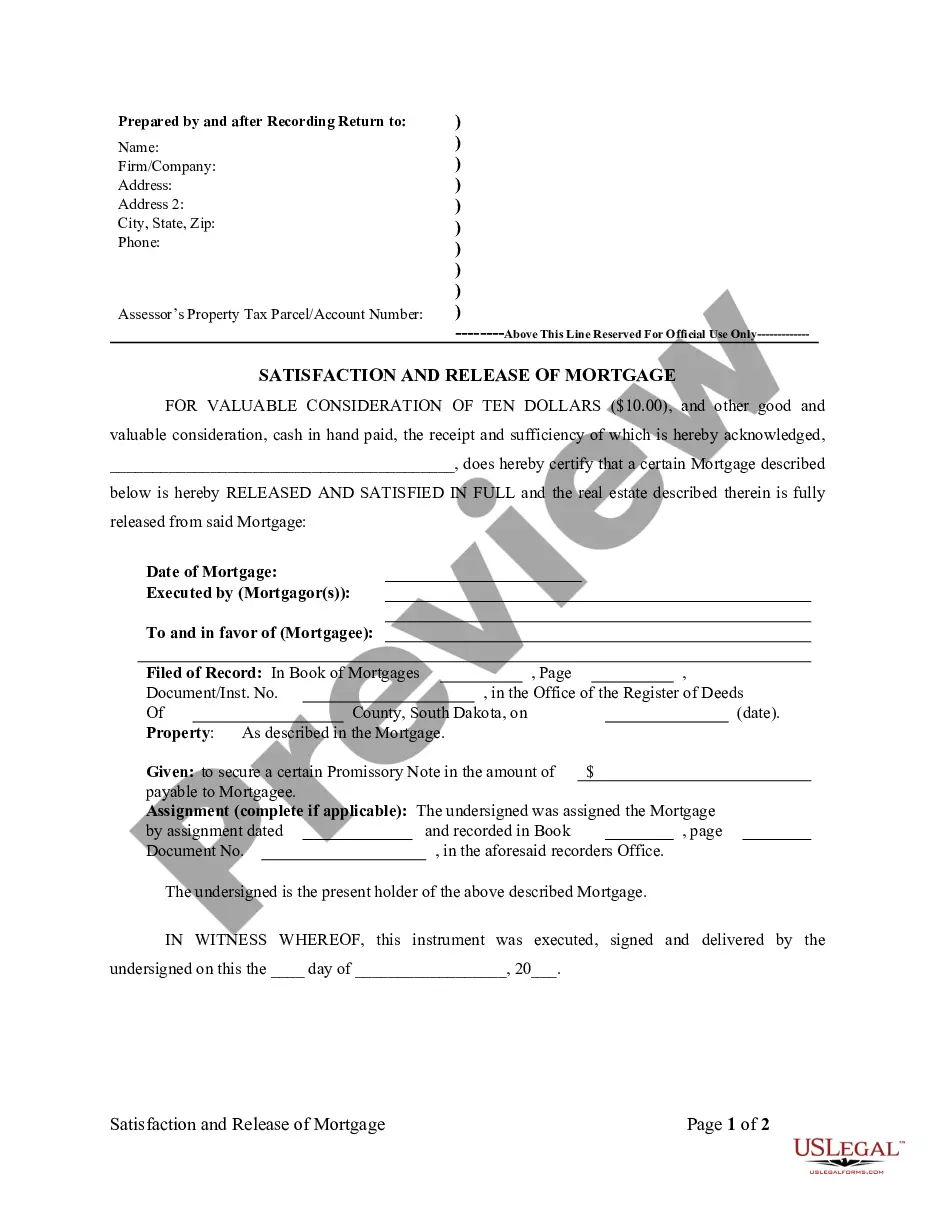

How to fill out South Dakota Release Of Mortgage By Lender - By Corporate Lender?

When you must finalize the Release Of Mortgage Document With Promissory Note that adheres to the laws and regulations of your local jurisdiction, there might be numerous alternatives to choose from.

There's no necessity to inspect every document to ensure it fulfills all legal requirements if you are a subscriber of US Legal Forms. It is a reliable service that can assist you in obtaining a reusable and current template on any subject.

US Legal Forms represents the most comprehensive online collection with an archive of over 85k ready-to-use documents for both business and personal legal matters. All templates are authenticated to conform with the regulations of each state. Therefore, when downloading the Release Of Mortgage Document With Promissory Note from our site, you can be confident that you have a valid and up-to-date document.

Select the most appropriate subscription plan, sign in to your account, or create a new one. Pay for the subscription (options for PayPal and credit cards are available). Download the template in your preferred file format (PDF or DOCX). Print the document or fill it out electronically using an online editor. Acquiring professionally drafted official documents becomes effortless with US Legal Forms. Moreover, Premium users can also enjoy the powerful integrated tools for online PDF editing and signing. Experience it today!

- Obtaining the required template from our platform is very easy.

- If you already possess an account, simply Log In to the system, ensure your subscription is active, and save the selected file.

- Subsequently, you can access the My documents section in your profile and retain access to the Release Of Mortgage Document With Promissory Note at any time.

- If it is your inaugural experience with our library, please follow the instructions below.

- Browse the recommended page and verify it against your criteria.

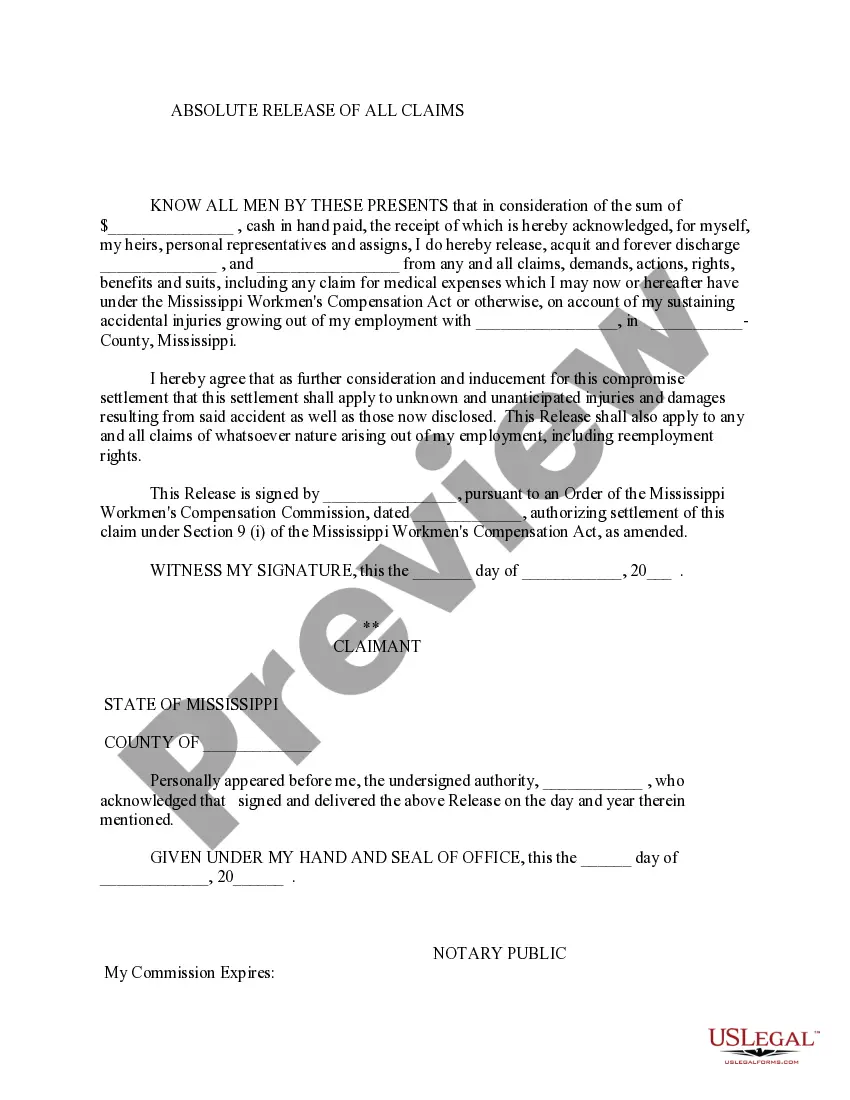

- Utilize the Preview mode and review the form description if available.

- Search for another sample via the Search bar in the header if necessary.

- Click Buy Now once you locate the appropriate Release Of Mortgage Document With Promissory Note.

Form popularity

FAQ

Write in the identifying information about the promissory note, including the original amount and its effective date. If there is only one noteholder signing the release, delete all references to we or to more than one noteholder. Enter an address for each party in the blanks provided.

The main difference between a promissory note and a mortgage is that a promissory note is the written agreement containing the details of the mortgage loan, whereas a mortgage is a loan that is secured by real property.

To transfer a promissory note, it must be negotiable and/or have a provision that allows and explains transfer. In addition, it must comply with state statutes governing promissory notes and assignments thereof. Create a Promissory Note Transfer Agreement.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

If you're signing a promissory note, make sure it includes these details:Date. The promissory note should include the date it was created at the top of the page.Amount.Loan terms.Interest rate.Collateral.Lender and borrower information.Signatures.