Lien Codified Laws Without Lease

Description

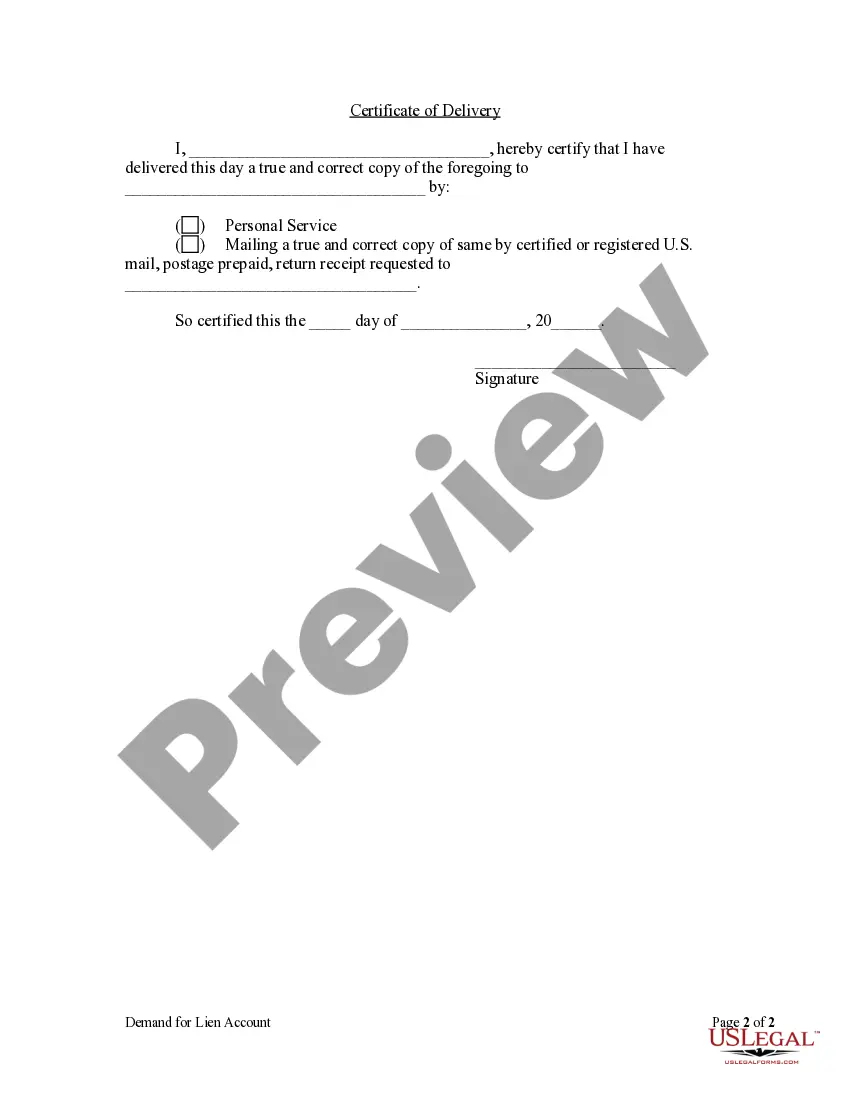

How to fill out South Dakota Demand For Lien Account By Corporation?

The Lien Codified Laws Without Lease displayed on this page is a reusable legal format created by expert attorneys in compliance with national and local legislation.

For over 25 years, US Legal Forms has offered individuals, enterprises, and legal experts more than 85,000 authenticated, state-specific documents for any corporate and personal circumstances. It is the quickest, easiest, and most reliable means to acquire the necessary paperwork, as the service ensures top-notch data safety and anti-malware defense.

Subscribe to US Legal Forms to access verified legal templates for all of life's situations at your convenience.

- Search for the document you require and verify it.

- Browse through the file you looked up and preview it or review the form description to ensure it meets your specifications. If it does not, use the search feature to find the correct one. Click Buy Now after locating the template you need.

- Register and Log In.

- Choose the pricing plan that fits you and create an account. Use PayPal or a credit card for immediate payment. If you already possess an account, Log In and check your subscription to continue.

- Obtain the editable template.

- Select the format you desire for your Lien Codified Laws Without Lease (PDF, DOCX, RTF) and store the sample on your device.

- Complete and sign the document.

- Print the template to fill it out by hand. Alternatively, use an online multifunctional PDF editor to efficiently and accurately complete and sign your form with a legally-binding electronic signature.

- Download your documents again.

- Access the same document anytime as needed. Go to the My documents tab in your profile to redownload any previously saved forms.

Form popularity

FAQ

Renters in South Dakota have various rights, including the right to safe and habitable living conditions, privacy, and protection against discrimination. Understanding lien codified laws without lease agreements can further empower you in your rental journey. Awareness of your rights is crucial, and uslegalforms offers resources to help you understand and assert them effectively.

To complete the form and submit transactions for processing, you must: Obtain a Form DLA-12, which is available on the SCDMV web site.

- Automobile or life insurance bill or payment receipt (cards or policies are not accepted). - Health insurance statement, payment receipt, explanation of benefits (cards or policies are not accepted). - Homeowner's insurance policy, payment receipt, or bill. first and last name, state and zip code.

LATE REGISTRATION PENALTIES You will be billed by DMV for any late registration fee due. First 14 days - $10.00 15 to 30 days - $25.00 31 to 90 days - $50.00 91 days or more - $75.00 When assessing penalties, the Department of Motor Vehicles considers the postmark as the date of receipt.

This document is used to certify that a vehicle has changed ownership. You must return your plate to the South Carolina Department of Motor Vehicles (SCDMV) and submit a 5051 receipt with this affidavit in order to qualify for a tax adjustment.

TI-006. Statement of Vehicle Operation in South Carolina. TI-006A. Affidavit of Vehicle Principally Garaged at South Carolina Residence.

To complete the form and submit transactions for processing, you must: Obtain a Form DLA-12, which is available on the SCDMV web site.

Does a vehicle title have to be notarized in South Carolina? No. A notary does not have to witness the buyer and the seller signing the vehicle title.

Applications are processed in the order received. To find out if your application has been processed, call our office at (803) 896-4426 or access our Verification of S.C.