Lien Codified Laws With Parents

Description

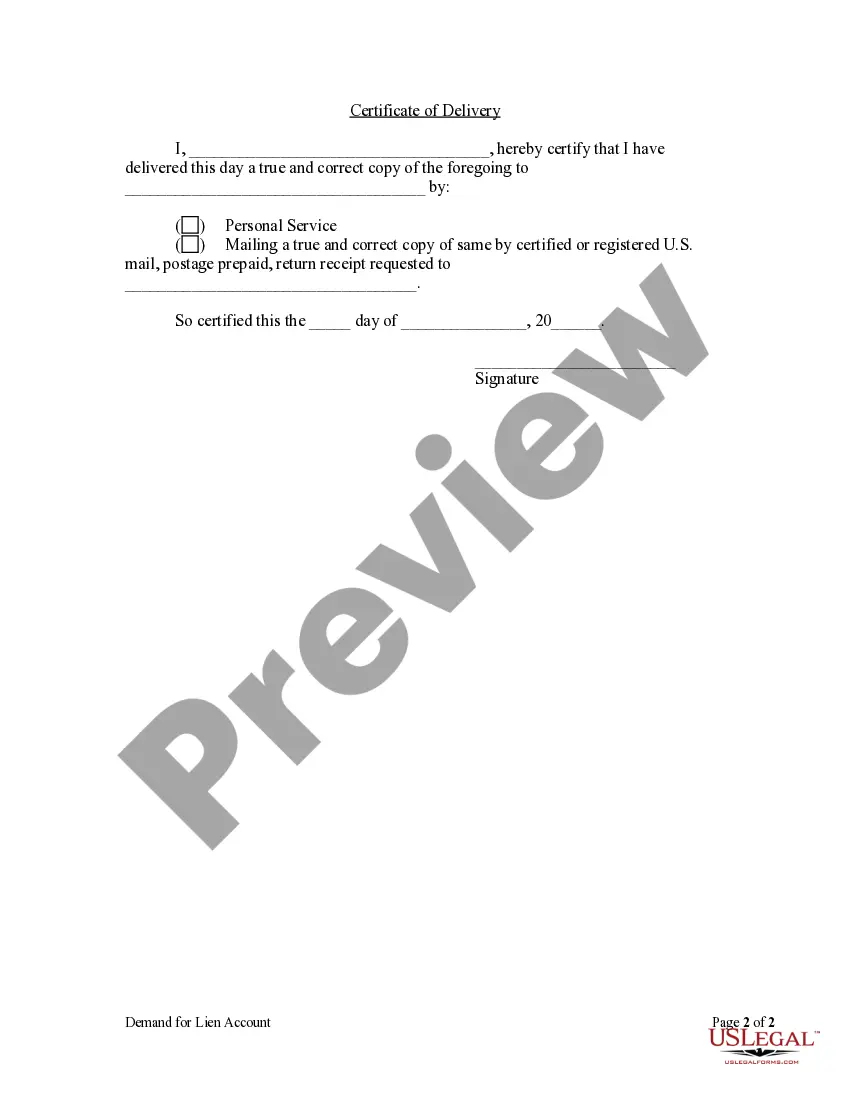

How to fill out South Dakota Demand For Lien Account By Corporation?

Creating legal documents from the ground up can frequently be daunting.

Certain situations may require extensive research and significant amounts of money spent.

If you’re searching for a more straightforward and cost-effective method of crafting Lien Codified Laws With Parents or any other documentation without the hassle of complex processes, US Legal Forms is always accessible to you.

Our online collection of over 85,000 current legal forms addresses nearly every aspect of your financial, legal, and personal issues.

However, before proceeding to download Lien Codified Laws With Parents, adhere to these suggestions: Review the form preview and descriptions to guarantee you have located the document you require. Ensure that the form you select aligns with the laws and regulations of your state and county. Choose the appropriate subscription option to acquire the Lien Codified Laws With Parents. Download the document. Afterwards, complete, sign, and print it. US Legal Forms boasts a flawless reputation and over 25 years of expertise. Join us today and turn the process of executing forms into something effortless and efficient!

- With just a few clicks, you can swiftly obtain state- and county-compliant forms meticulously crafted for you by our legal professionals.

- Utilize our platform whenever you require trusted and dependable services through which you can effortlessly find and download the Lien Codified Laws With Parents.

- If you’re already familiar with our site and have previously set up an account with us, simply Log In to your account, choose the template, and download it or re-download it anytime in the My documents section.

- Don’t have an account? No worries. Setting it up and browsing the catalog takes only minutes.

Form popularity

FAQ

Ing to South Carolina Code Section 15-49-10(B) a parent may petition the Family Court to have their child's name changed. If the Family Court finds that the name change is in the best interest of the minor child, the court must grant the petition. S.C. Code Section 15-49-10(B).

Canceled debts and foreign income are typically reported as other income. Child support, alimony, Roth IRA distributions, gifts, and self-employment income aren't reported as other income. You report other income by filling in line 10 on Schedule 1 and transferring the total to line 8 on Form 1040.

The full text of South Carolina Bills and Resolutions is available from 1980 forward on the Legislation page of the South Carolina Legislature's website.

You are eligible for a South Carolina tax rebate if you file a 2021 South Carolina state income tax return by February 15, 2023, and you owe state income tax for the 2021 tax year (i.e., you have a state tax liability).

Liability. Line 10(d): Attach the I-385 if claiming the refundable Motor Fuel Income Tax Credit. The allowable credit is the lesser of the increase in South Carolina Motor Fuel User Fee you paid during the tax year, or the preventative maintenance costs you incurred in South Carolina during the tax year.

Your adjusted gross income (AGI) consists of the total amount of income and earnings you made for the tax year minus certain adjustments to income. For tax year 2023, your AGI is on Line 11 on Form 1040, 1040-SR, and 1040-NR.

Check the status of your South Carolina refund using these resources. State: South Carolina. Tax Refund Website: South Carolina Department of Revenue. Refund Status Phone Support: 1-803-898-5300. Hours: Mon. ... General Tax Information: 1-844-898-8542. Email Support: MyDORWAY@dor.sc.gov.

Liability. Line 10(d): Attach the I-385 if claiming the refundable Motor Fuel Income Tax Credit. The allowable credit is the lesser of the increase in South Carolina Motor Fuel User Fee you paid during the tax year, or the preventative maintenance costs you incurred in South Carolina during the tax year.