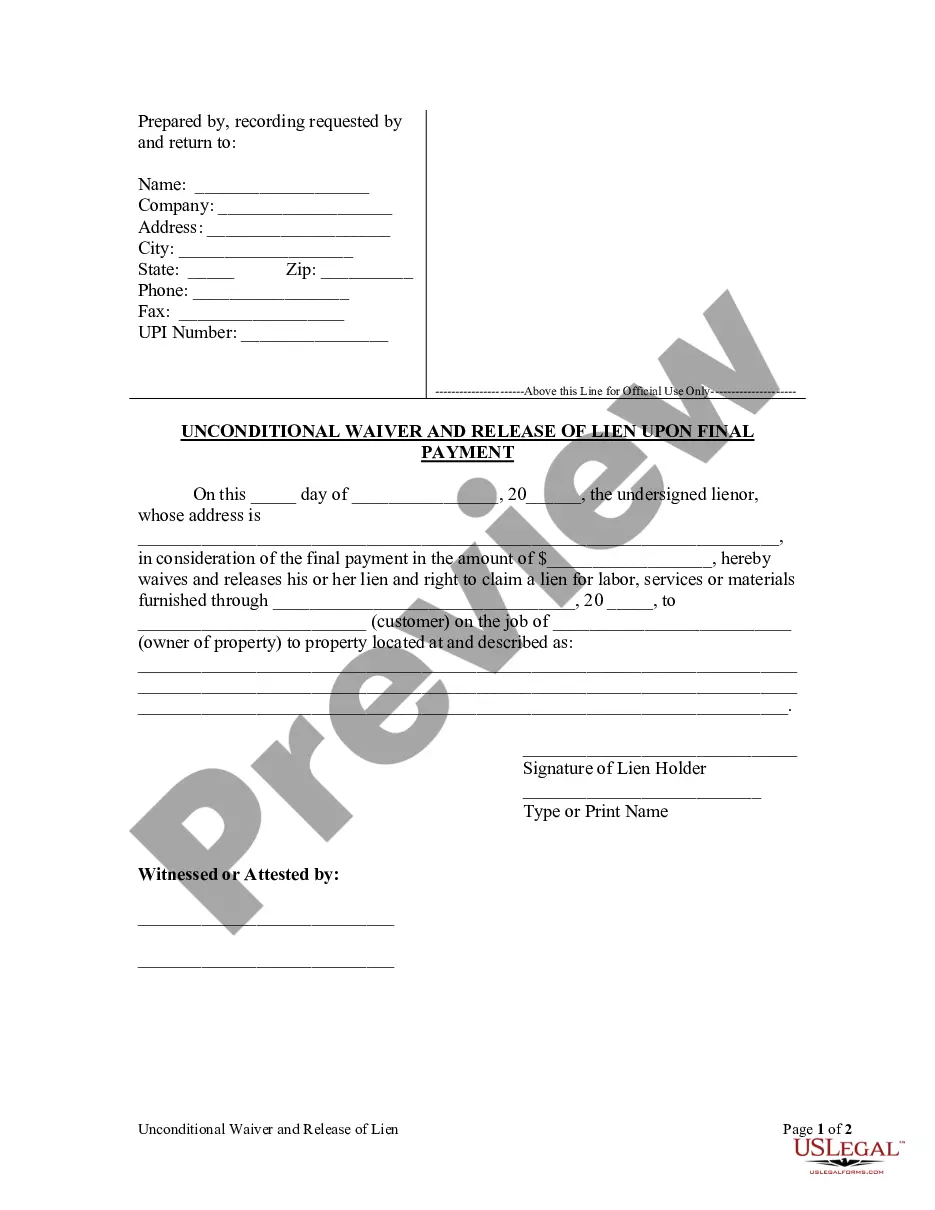

South Carolina Lien Waiver Form With Check

Description

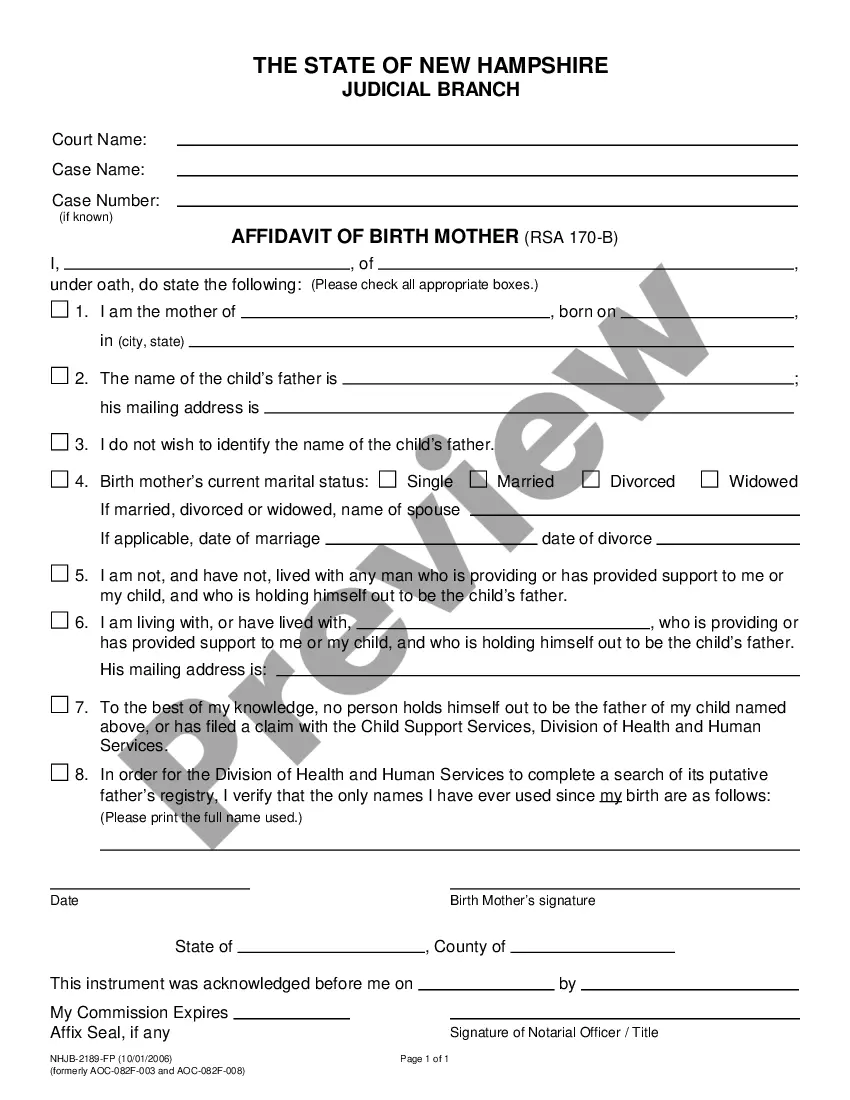

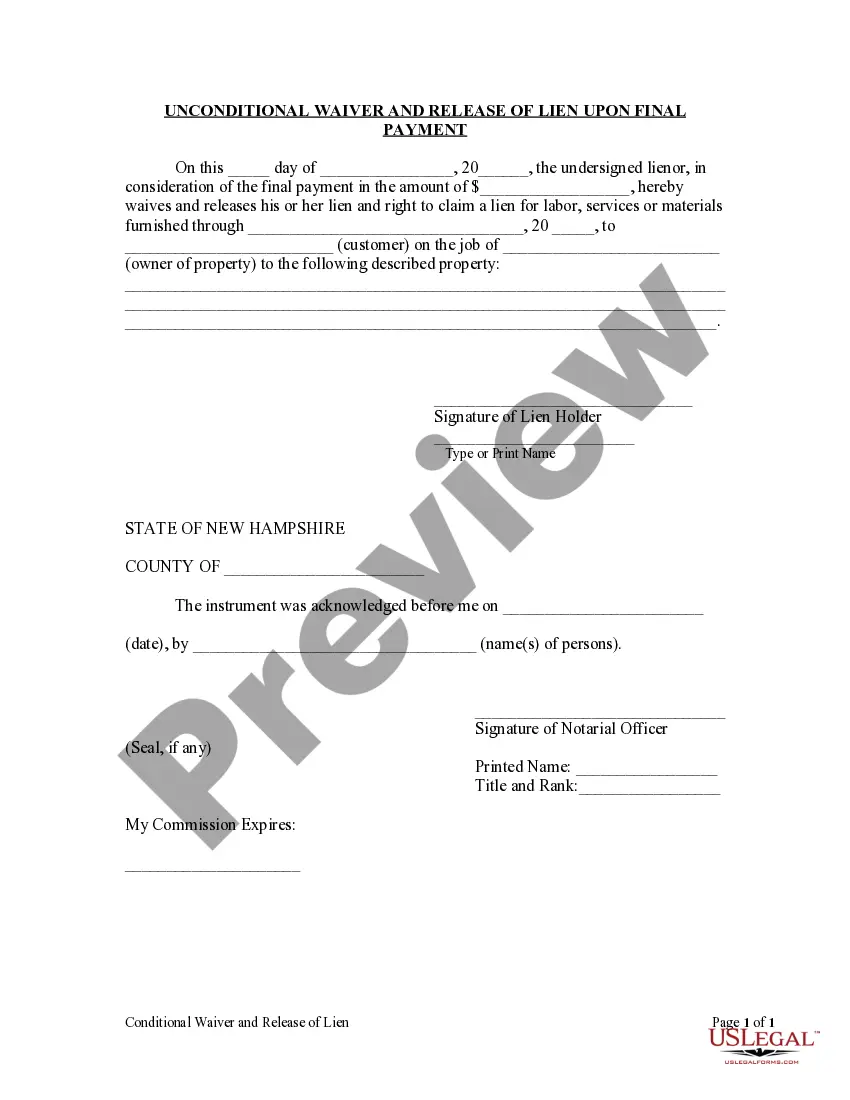

How to fill out South Carolina Unconditional Waiver And Release Of Claim Of Lien Upon Final Payment?

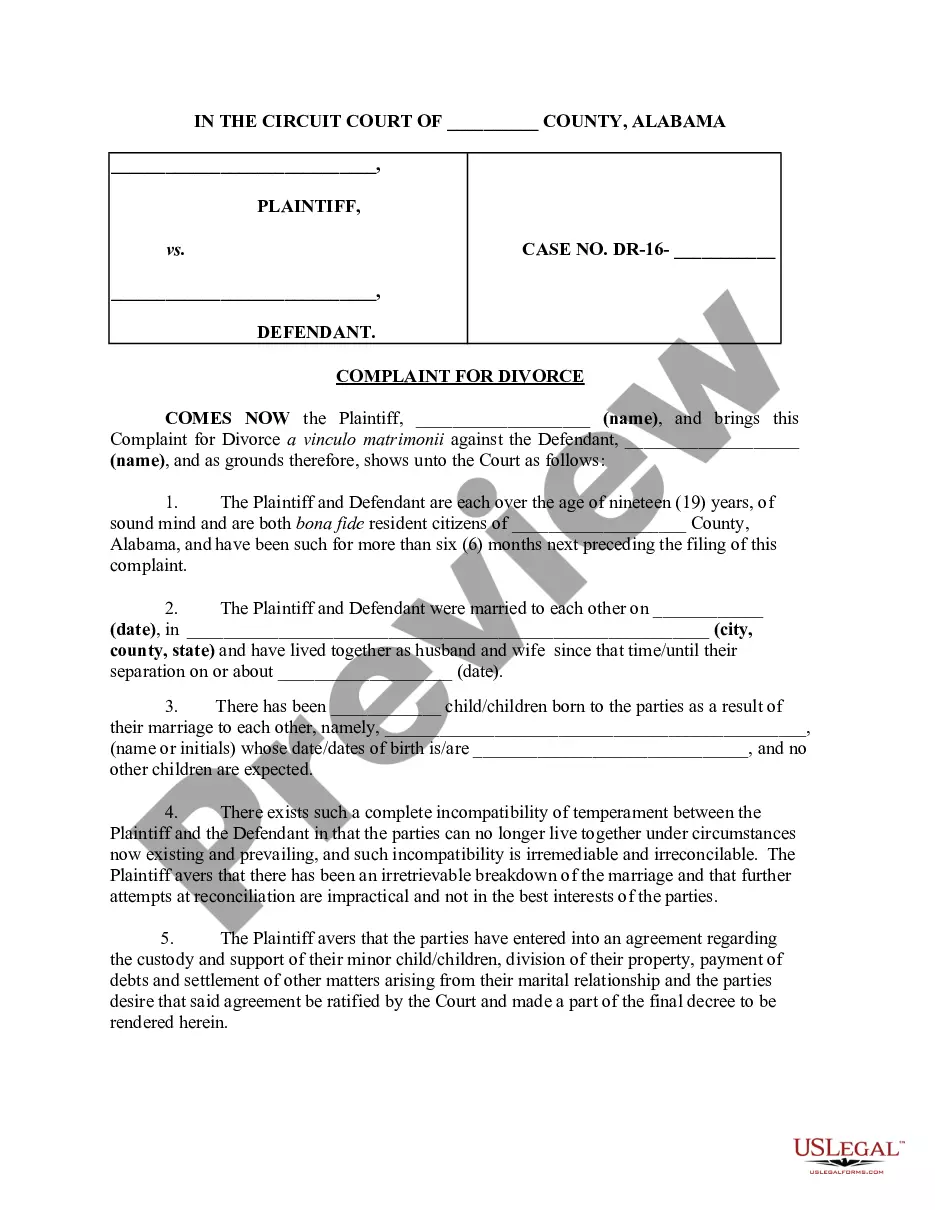

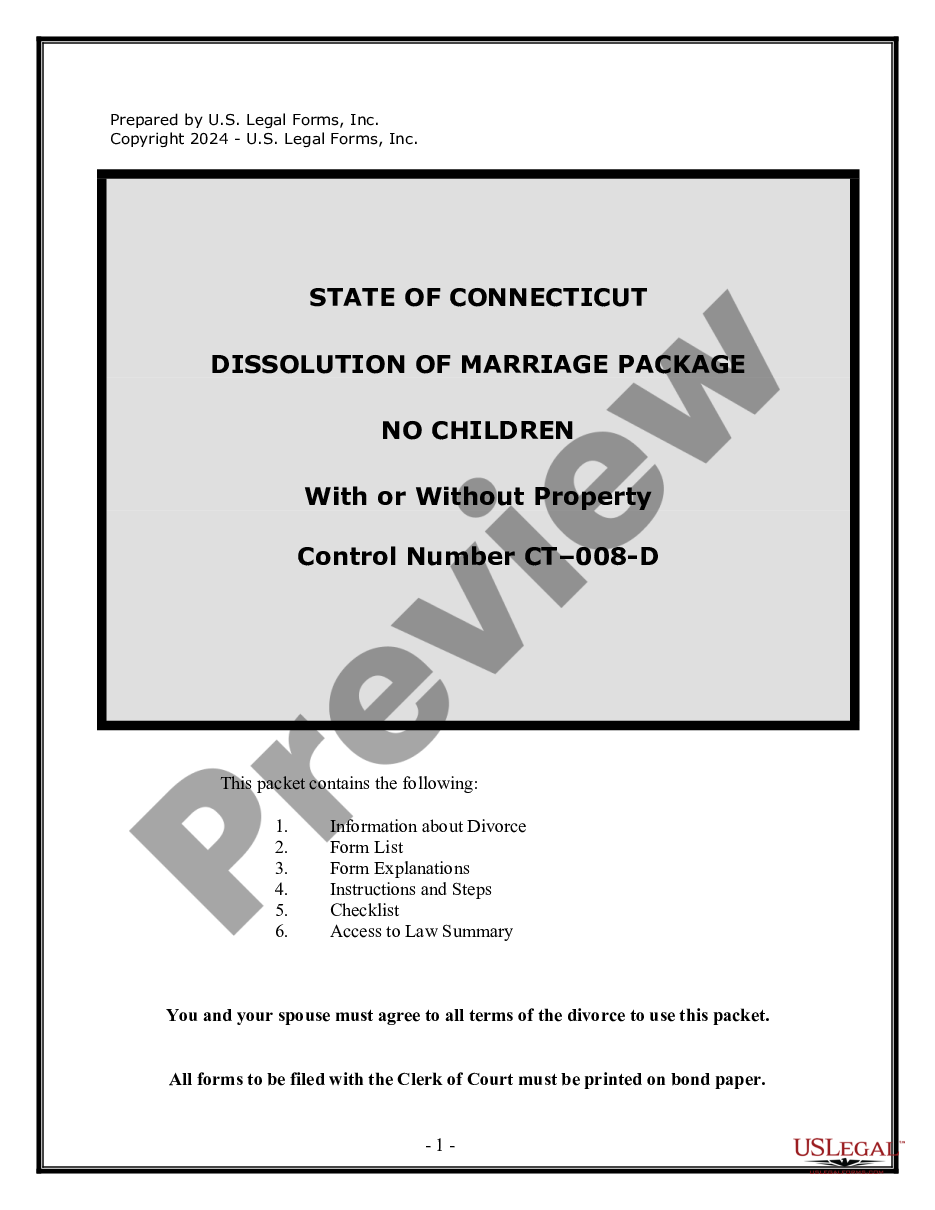

Regardless of whether it's for professional reasons or personal issues, everyone must navigate legal matters at some stage in their life.

Filling out legal documents necessitates meticulous care, beginning with selecting the correct form template. For example, if you select an incorrect version of a South Carolina Lien Waiver Form With Check, it will be denied upon submission.

With an extensive US Legal Forms catalog available, you won’t need to waste time searching for the correct template across the web. Leverage the library's straightforward navigation to locate the appropriate template for any situation.

- Locate the template you require by using the search bar or browsing the catalog.

- Examine the information of the form to ensure it aligns with your situation, location, and state.

- Click on the form's preview to review it.

- If it is not the correct form, return to the search function to find the South Carolina Lien Waiver Form With Check sample you require.

- Download the document if it satisfies your needs.

- If you already possess a US Legal Forms profile, simply click Log in to access previously saved files in My documents.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Select the suitable pricing option.

- Fill out the profile registration form.

- Choose your payment method: utilize a credit card or PayPal account.

- Choose the document format you prefer and download the South Carolina Lien Waiver Form With Check.

- Once downloaded, you can fill out the form using editing software or print it to complete it by hand.

Form popularity

FAQ

To fill out a conditional waiver and release on progress payment, start by obtaining a template specific to South Carolina. Input essential information, such as the payment amount, project description, and conditions for the release. Using the South Carolina lien waiver form with check simplifies this process, as it provides structured guidelines for completion.

A lien waiver is a document that confirms a contractor or supplier has received payment for their work, preventing them from claiming a lien on the property. It acts as legal proof that payment has been made and accepted. By using the South Carolina lien waiver form with check, you can ensure that all parties are on the same page regarding payments.

To complete a waiver of lien, first obtain the South Carolina lien waiver form with check, ensuring you have the correct version for your situation. Fill in all required fields accurately, including the names of all parties and the payment details. Finish the process by having all involved parties sign the document, thus officially releasing the lien.

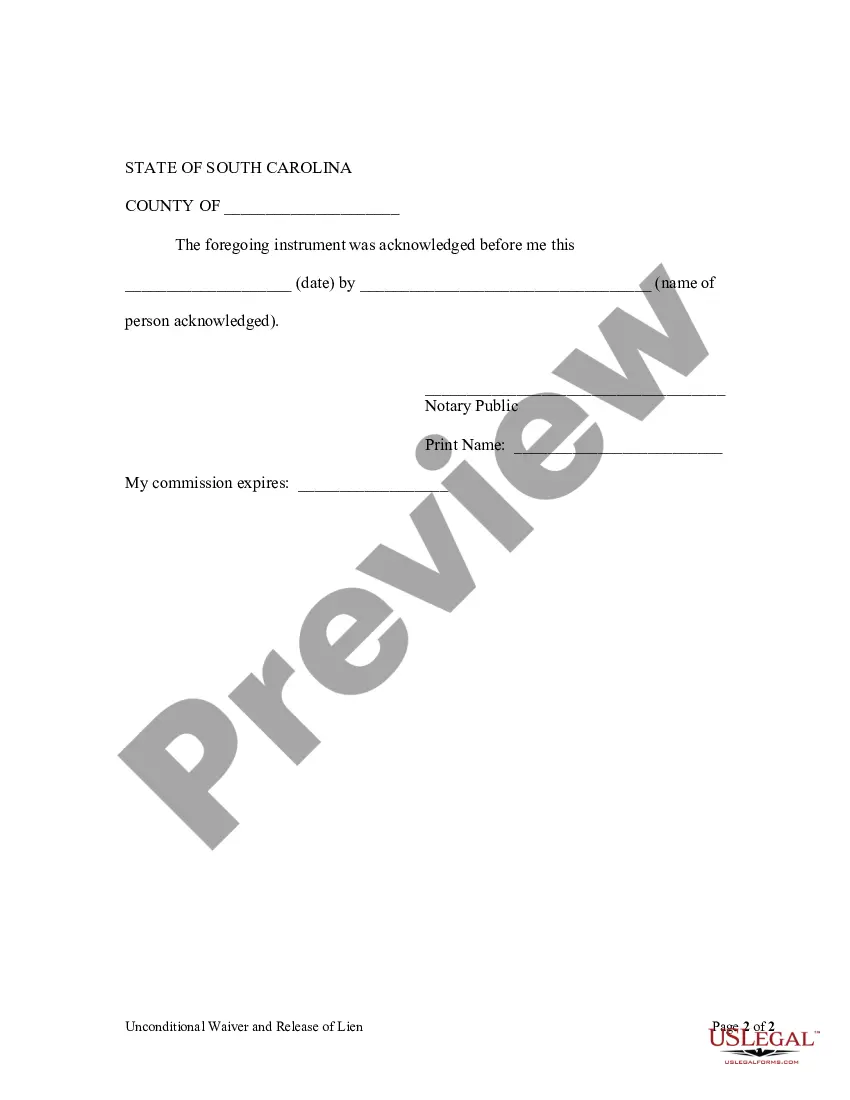

While notarization of lien waivers is not a requirement in South Carolina, it is often recommended. Notarization can help prevent disputes by confirming the identity of the parties involved. If you wish to ensure authenticity, completing the South Carolina lien waiver form with check and having it notarized may provide you with peace of mind.

To fill out a lien affidavit, begin by securing the proper form and entering all necessary information, including your name, the property address, and details about the amount owed. This process also often includes citing relevant dates and payment terms. For added efficiency, consider using the South Carolina lien waiver form with check for relevant payments.

In South Carolina, lien waivers are not necessarily required to be notarized for them to be valid. However, having a notarized signature can add an additional layer of assurance and credibility to the document. By utilizing the South Carolina lien waiver form with check, you can choose to have it notarized if preferred.

A final waiver is a formal document that releases any claims related to a lien once payment has been made and accepted. This document signifies that the contractor or supplier has received full payment and relinquishes all rights to future claims on that particular project. Using the South Carolina lien waiver form with check helps ensure clarity and prevents misunderstandings.

To complete a final waiver of lien, start by obtaining the appropriate South Carolina lien waiver form with check. Ensure you fill out the form with accurate information, including the project name, payment amount, and any relevant dates. After filling it out, both the payer and the payee should sign the document to finalize it.

Filling out a conditional waiver of lien follows a straightforward process. Begin by identifying all parties involved and outlining the specific amount related to the waiver. Clearly state that the waiver is conditional upon receiving the check. Finally, review the South Carolina lien waiver form with check for accuracy and sign it before providing it to the relevant parties.

Filing a lien waiver involves completing the waiver form accurately by providing necessary details such as the parties involved and the amount covered by the waiver. After filling it out, present the South Carolina lien waiver form with check to the party who issued the funds. Keep a copy for your records to ensure you have proof of the waiver for future reference.