Real Estate Statement Form For Taxes

Description

How to fill out Pennsylvania Residential Real Estate Sales Disclosure Statement?

Handling legal papers and procedures might be a time-consuming addition to the day. Real Estate Statement Form For Taxes and forms like it usually require that you search for them and understand the way to complete them correctly. For that reason, regardless if you are taking care of financial, legal, or individual matters, having a comprehensive and practical online library of forms at your fingertips will significantly help.

US Legal Forms is the number one online platform of legal templates, boasting over 85,000 state-specific forms and a number of resources to assist you complete your papers quickly. Discover the library of appropriate documents accessible to you with just one click.

US Legal Forms offers you state- and county-specific forms available at any moment for downloading. Protect your document administration operations by using a top-notch support that lets you prepare any form in minutes without any additional or hidden charges. Just log in to the account, locate Real Estate Statement Form For Taxes and download it immediately within the My Forms tab. You can also access previously downloaded forms.

Could it be your first time using US Legal Forms? Register and set up up a free account in a few minutes and you will get access to the form library and Real Estate Statement Form For Taxes. Then, adhere to the steps below to complete your form:

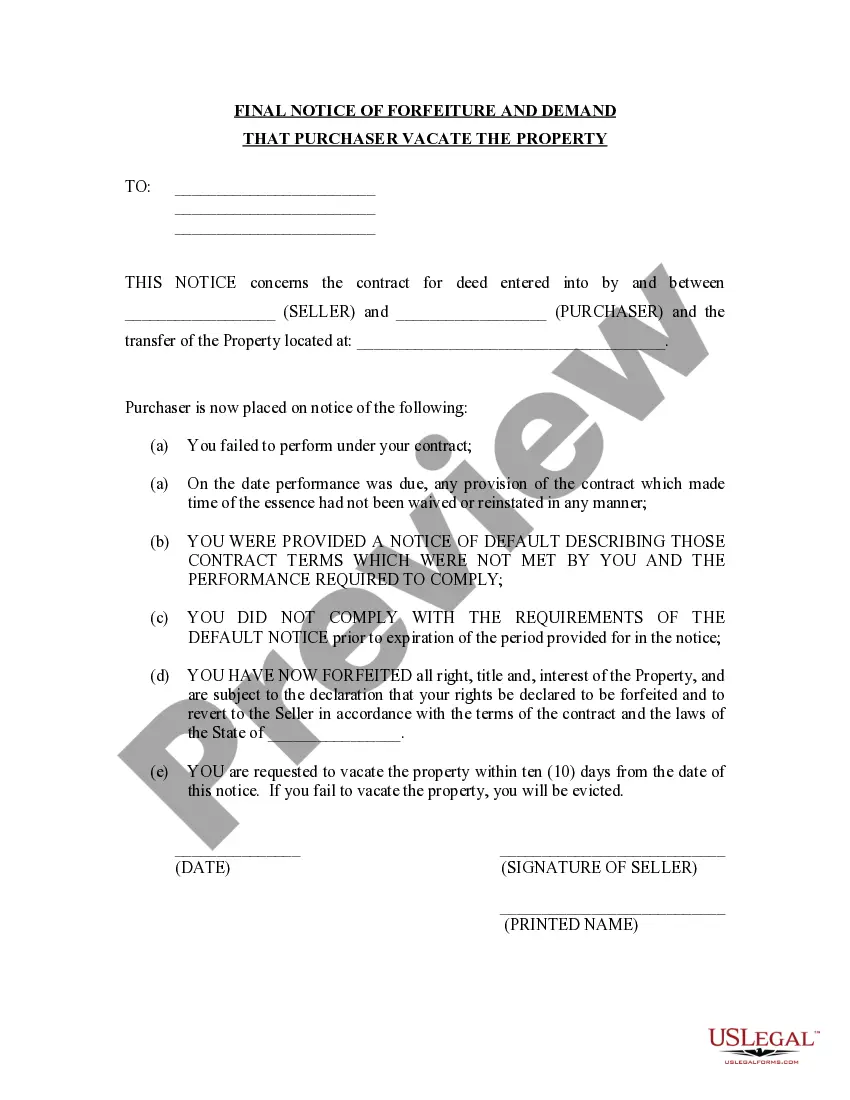

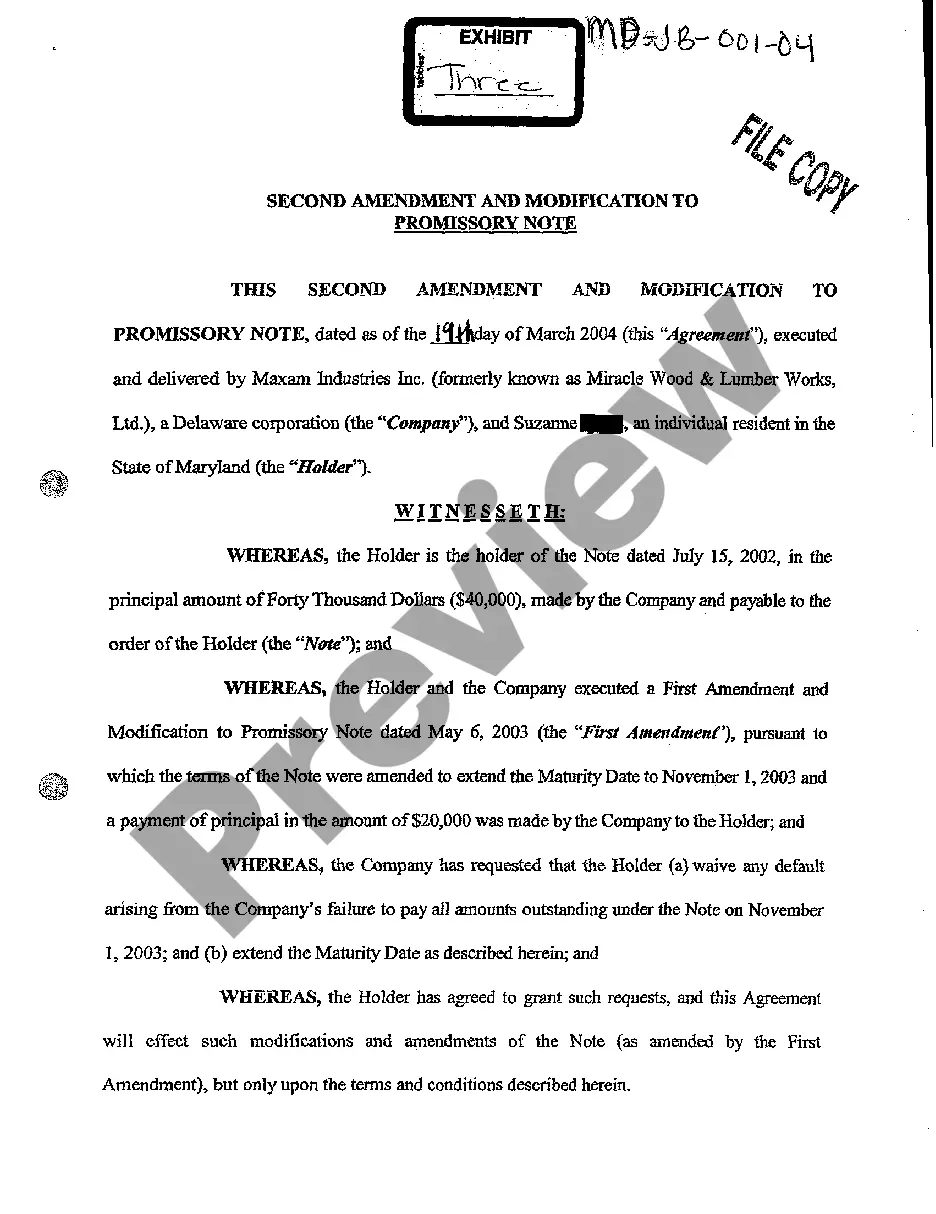

- Make sure you have the proper form by using the Preview feature and reading the form description.

- Select Buy Now once all set, and choose the subscription plan that meets your needs.

- Choose Download then complete, eSign, and print out the form.

US Legal Forms has twenty five years of experience helping consumers control their legal papers. Get the form you require today and streamline any process without having to break a sweat.

Form popularity

FAQ

3. Form 1099-S Instructions - A complete overview In Box 1, the filer must enter the date of closing for the property. In Box 2, enter the gross proceeds, this is the cash amount that the transferor will receive in exchange for the property. In Box 3, enter the address and/or legal description of the property.

The Bottom Line. Form 1098: Mortgage Interest Deduction is an IRS form for notifying a borrower how much interest they have paid in one year on a qualified home mortgage. You should receive one in January if you have a mortgage, and are able to claim the interest as a deduction if you itemize your tax return.

On your 1098 tax form is the following information: Box 1 ? Interest paid, not including points. Box 2 ? Outstanding mortgage principle. Box 3 ? Mortgage origination date. Box 4 ? Refund of overpaid interest. Box 5 ? Mortgage insurance premiums. Box 6 ? Mortgage points you might be able to deduct.

If you did not receive a Form 1098 from the bank or mortgage company you paid interest to, contact them to get a Form 1098 issued. If you purchased the home from an individual and paid the interest directly to them, use this section to report the amount you paid and record the individual's information.

If you did not receive a Form 1098 from the bank or mortgage company you paid interest to, contact them to get a Form 1098 issued. If you purchased the home from an individual and paid the interest directly to them, use this section to report the amount you paid and record the individual's information.