Pennsylvania Estate Form Withdrawal

Description

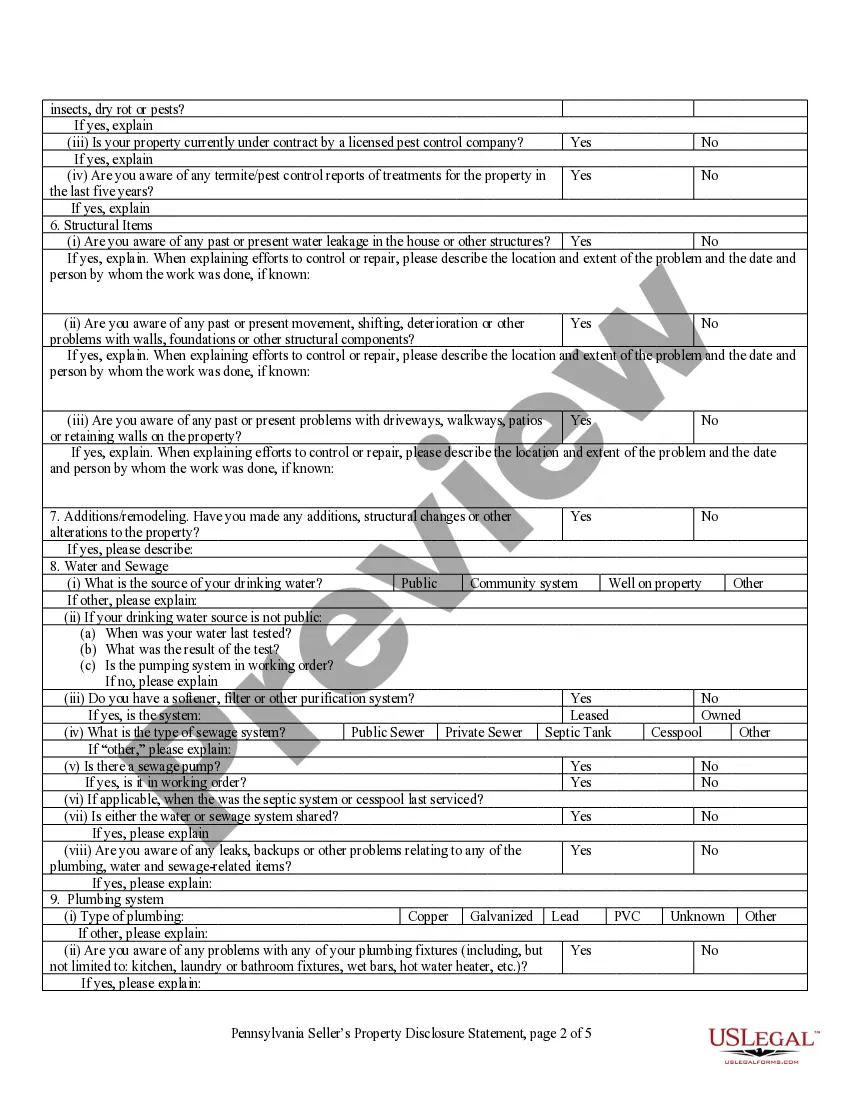

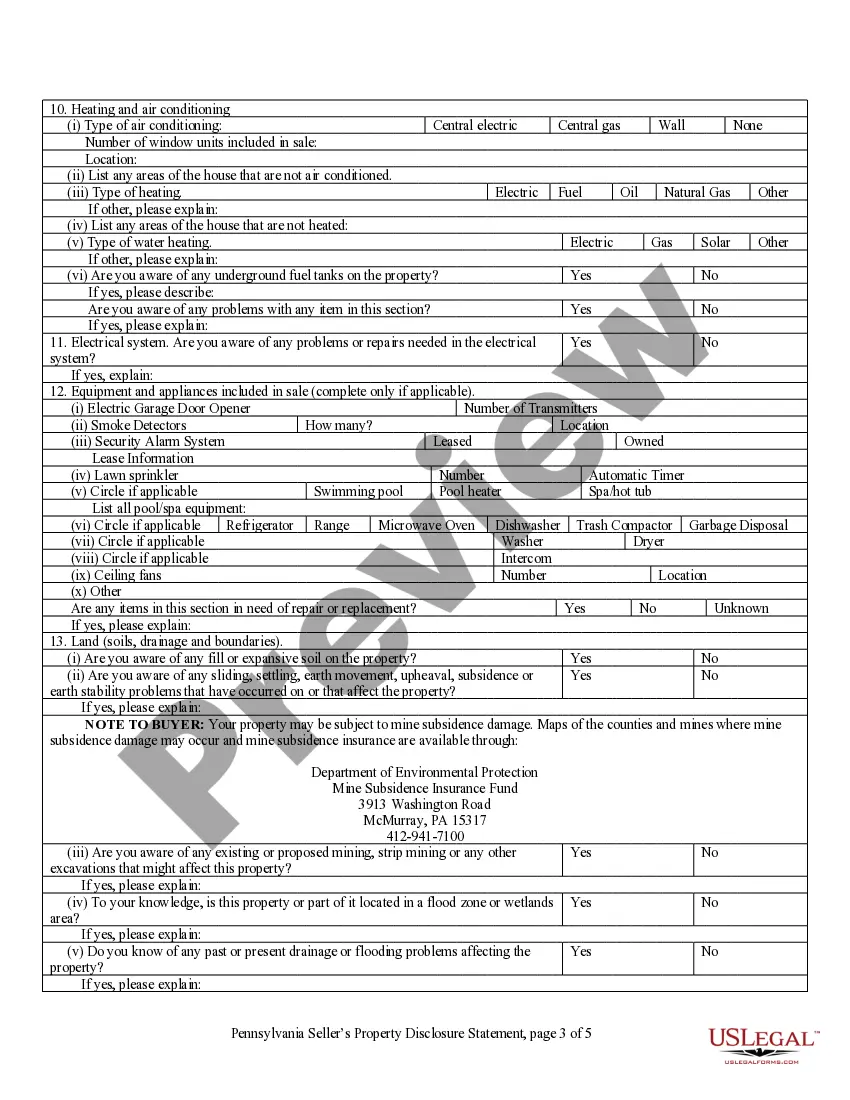

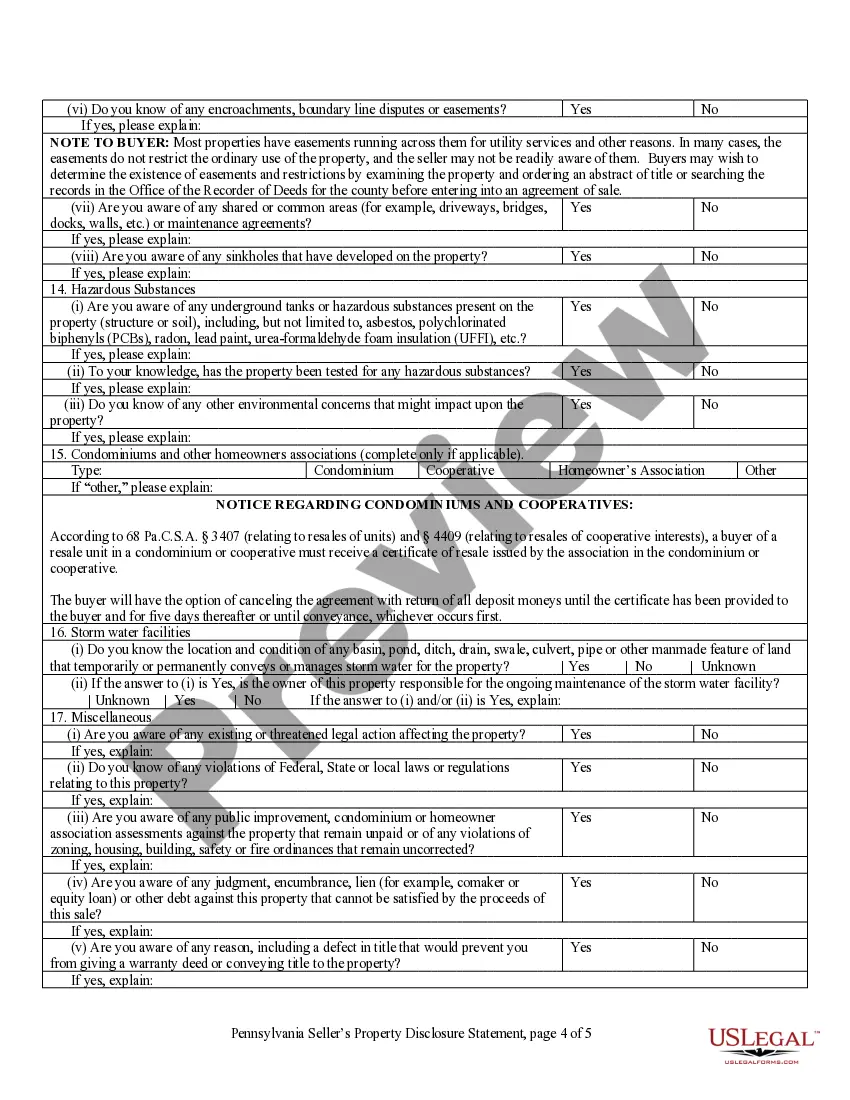

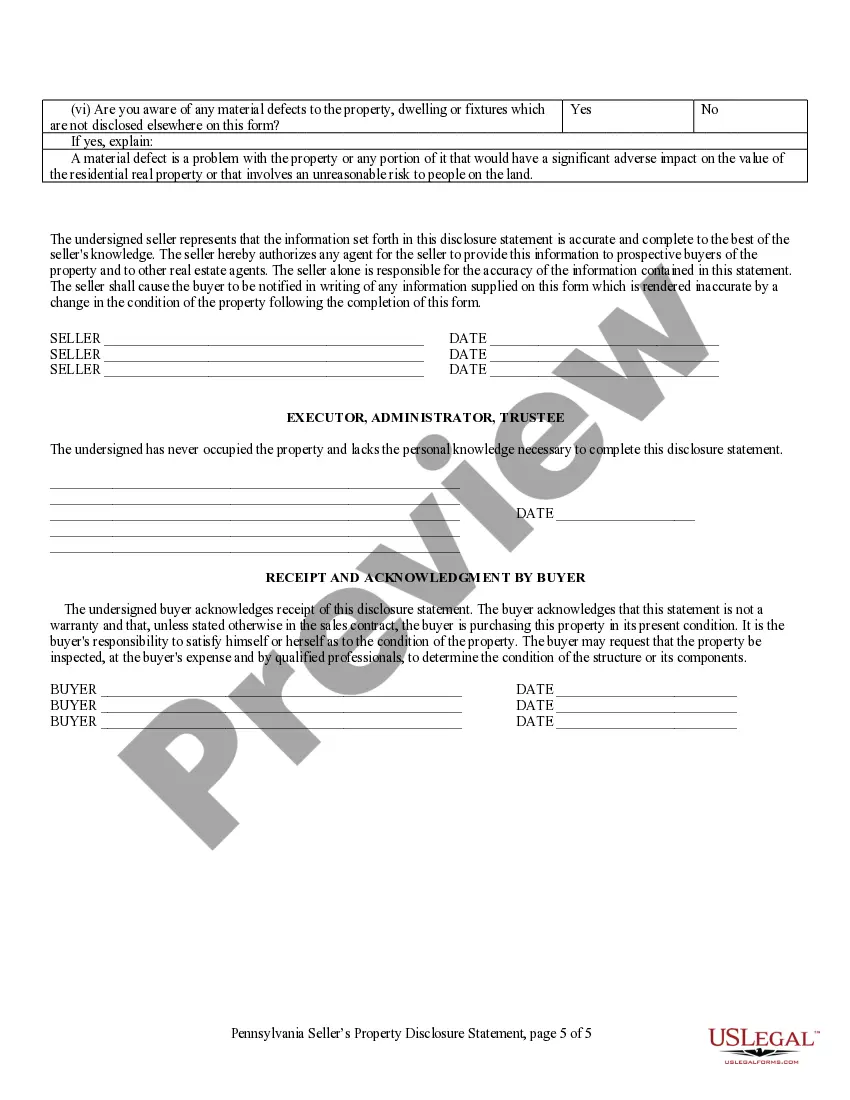

How to fill out Pennsylvania Residential Real Estate Sales Disclosure Statement?

Accessing legal document samples that meet the federal and regional laws is essential, and the internet offers many options to pick from. But what’s the point in wasting time looking for the right Pennsylvania Estate Form Withdrawal sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by lawyers for any professional and personal situation. They are simple to browse with all papers arranged by state and purpose of use. Our professionals stay up with legislative updates, so you can always be confident your form is up to date and compliant when obtaining a Pennsylvania Estate Form Withdrawal from our website.

Obtaining a Pennsylvania Estate Form Withdrawal is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the preferred format. If you are new to our website, follow the guidelines below:

- Take a look at the template utilizing the Preview option or through the text outline to make certain it meets your needs.

- Look for another sample utilizing the search function at the top of the page if needed.

- Click Buy Now when you’ve found the correct form and opt for a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Pennsylvania Estate Form Withdrawal and download it.

All documents you find through US Legal Forms are reusable. To re-download and fill out previously saved forms, open the My Forms tab in your profile. Benefit from the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

Estates and trusts use PA-41 Schedule D to report the sale, exchange or other dispositions of real or personal tangible and intangible property.

If you are a PA resident, nonresident or a part-year PA resident, you must file a 2022 PA tax return if: ? You received total PA gross taxable income in excess of $33 during 2022, even if no tax is due with your PA return; and/or ? You incurred a loss from any transaction as an individual, sole proprietor, partner in a ...

Use PA-40 Schedule O to report the amount of deductions for contributions to Medical Savings or Health Savings Ac- counts and/or the amount of contributions to an IRC Section 529 Qualified Tuition Program and/or IRC Section 529A Pennsylvania ABLE Savings Program by the taxpayer and/or spouse.

Where do I mail my personal income tax (PA-40) forms? For RefundsPA DEPT OF REVENUE REFUND OR CREDIT REQUESTED 3 REVENUE PLACE HARRISBURG PA 17129-0003For Balance DuePA DEPT OF REVENUE PAYMENT ENCLOSED 1 REVENUE PLACE HARRISBURG PA 17129-00012 more rows ?

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).