Ohio Promissory Note For Late Payment

Description

How to fill out Ohio Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

There is no longer a necessity to squander time searching for legal documents to comply with your local state laws. US Legal Forms has gathered all of them in one location and improved their availability.

Our website provides over 85,000 templates for various business and personal legal situations organized by state and purpose. All forms are properly drafted and validated for authenticity, so you can trust in acquiring a current Ohio Promissory Note For Late Payment.

If you are acquainted with our service and already possess an account, ensure your subscription is active before retrieving any templates. Log In to your account, choose the document, and click Download. You can also revisit all stored documents at any time by accessing the My documents section in your profile.

Select the file format for your Ohio Promissory Note For Late Payment and download it to your device. You can print your form to complete it manually or upload the document if you wish to do it in an online editor. Preparing official documents under federal and state regulations is quick and easy with our platform. Experience US Legal Forms now to organize your documentation!

- If you have never utilized our service before, the procedure will involve a few more steps to finalize.

- Here’s how new users can obtain the Ohio Promissory Note For Late Payment in our collection.

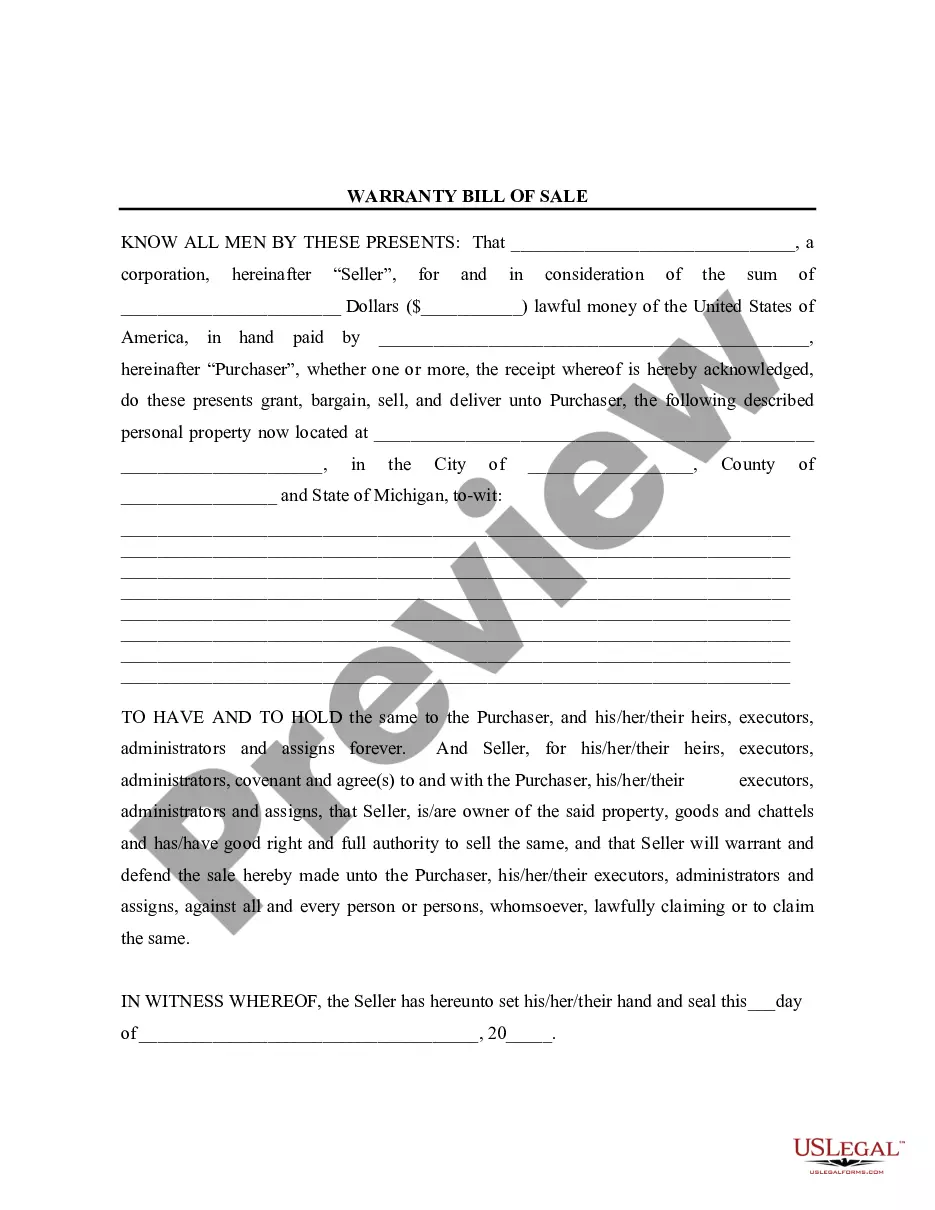

- Examine the page content meticulously to confirm it includes the sample you need.

- To do this, use the form description and preview options if available.

- Utilize the search bar above to find another template if the previous one was unsuitable.

- Click Buy Now next to the title of the template once you identify the correct one.

- Select the most appropriate subscription plan and create an account or Log In.

- Complete the payment for your subscription with a card or through PayPal to continue.

Form popularity

FAQ

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Days of grace. Every promissory note or bill of exchange which is not expressed to be payable on demand, at sight or on presentment is at maturity on the third day after the day on which it is expressed to be payable.

There is no legal requirement for promissory notes to be witnessed or notarized in Ohio. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

During a grace period, you may not be charged interest on your balance as long as you pay it off by the due date. Grace periods vary by card issuer, but must be a minimum of 21 days from the end of a billing cycle.