Ohio Promissory Note Form

Description

How to fill out Ohio Installments Fixed Rate Promissory Note Secured By Personal Property?

Regardless of whether you handle documentation frequently or need to submit a legal paper occasionally, it is essential to have a reliable source where all the samples are relevant and current.

The first step you must take with an Ohio Promissory Note Form is to confirm that it is the latest edition, as this determines its eligibility for submission.

If you want to simplify your search for the most recent document samples, look for them on US Legal Forms.

To acquire a form without an account, follow these steps: Use the search menu to locate the document you need. View the preview and outline of the Ohio Promissory Note Form to ensure it is precisely what you seek. After verifying the form, click Buy Now. Choose a subscription plan that suits you. Create an account or Log In to your existing one. Use your credit card details or PayPal account to complete the transaction. Select the document format for download and confirm it. Eliminate the confusion associated with legal paperwork. All your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents that includes nearly every document template you might need.

- Search for the necessary templates, immediately assess their appropriateness, and learn more about their applications.

- With US Legal Forms, you gain access to over 85,000 document templates across various areas.

- Retrieve the Ohio Promissory Note Form samples with just a few clicks and store them anytime in your account.

- Having a US Legal Forms account will enable you to access all the necessary samples with greater ease and less stress.

- You simply need to click Log In in the website header and navigate to the My documents section where all the forms you need are readily available.

- This way, you won’t need to spend time searching for the ideal template or verifying its authenticity.

Form popularity

FAQ

There is no legal requirement for promissory notes to be witnessed or notarized in Ohio. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

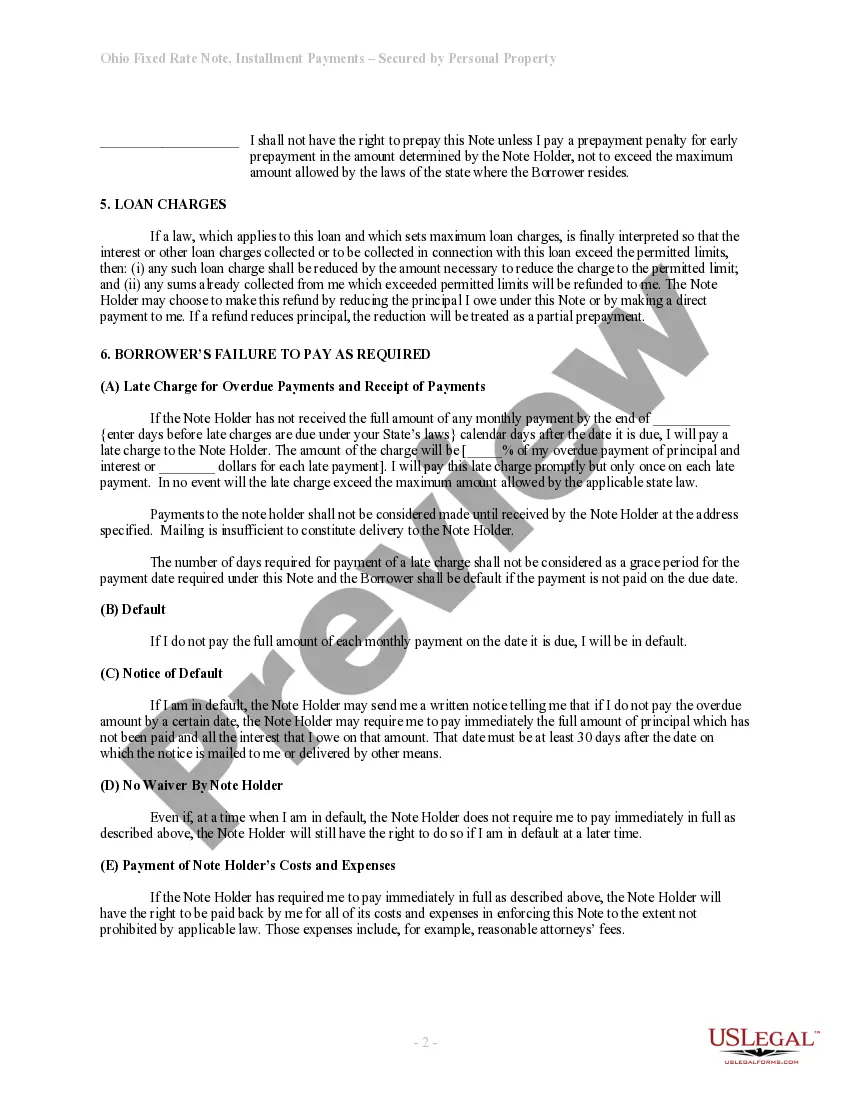

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money.

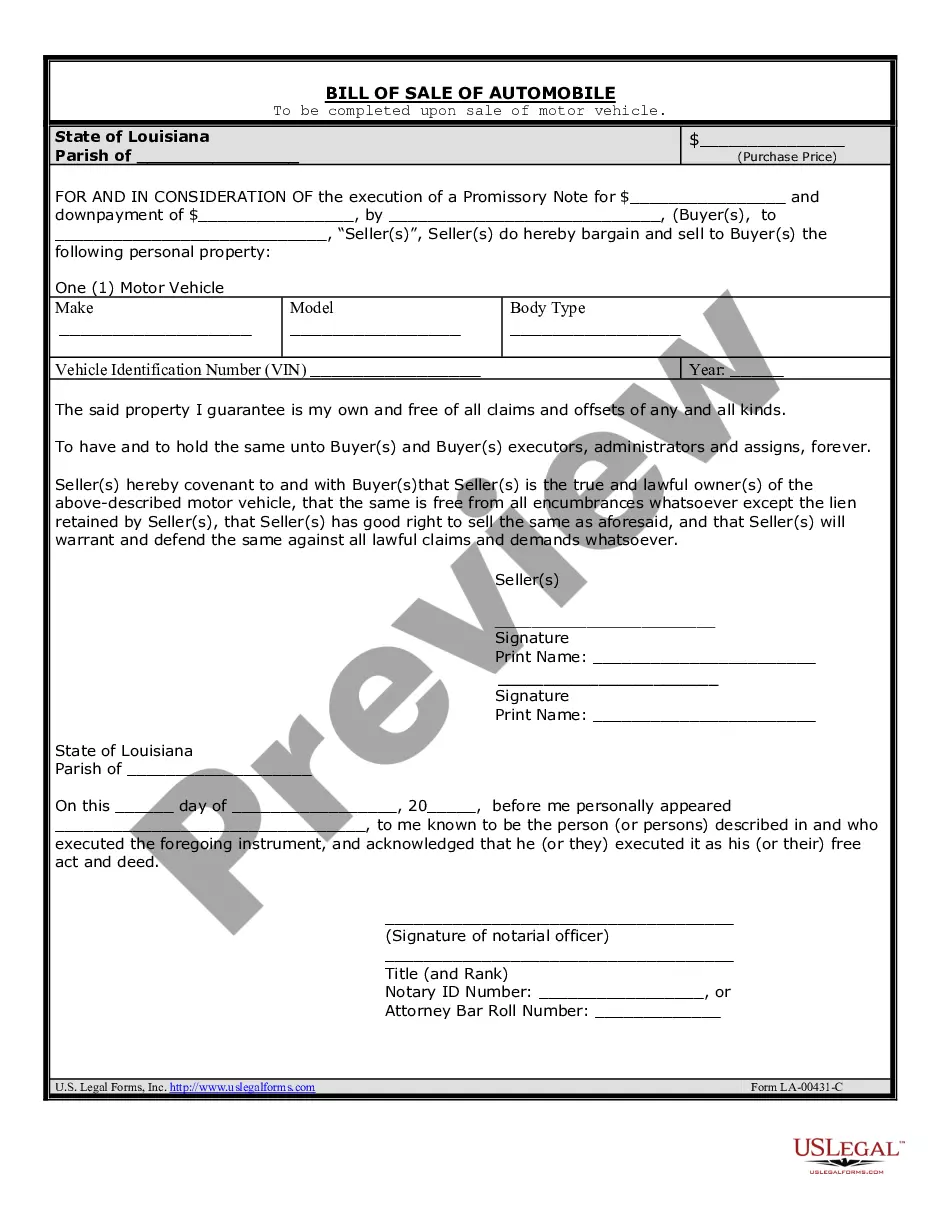

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.