Ohio Promissory Note For Car

Description

How to fill out Ohio Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Properly composed official documents are a critical assurance for steering clear of complications and lawsuits, yet acquiring them without the assistance of an attorney may require time.

Whether you need to swiftly locate a current Ohio Promissory Note For Car or other documents related to employment, family, or business matters, US Legal Forms is always available to assist.

The procedure is even more straightforward for current users of the US Legal Forms collection. If your subscription is active, you simply need to Log In to your account and click the Download button next to the chosen document. Furthermore, you can access the Ohio Promissory Note For Car anytime later, as all documents previously acquired on the platform stay available within the My documents section of your profile. Save both time and money on formal document preparation. Explore US Legal Forms today!

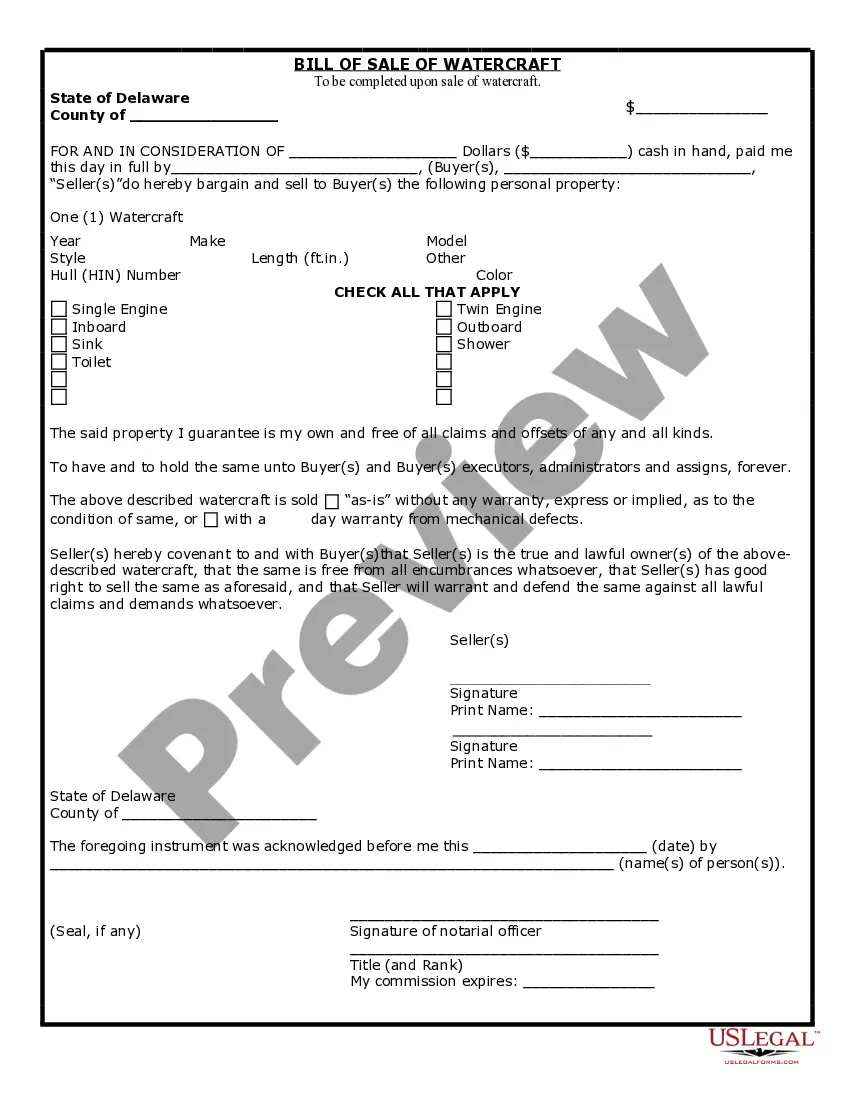

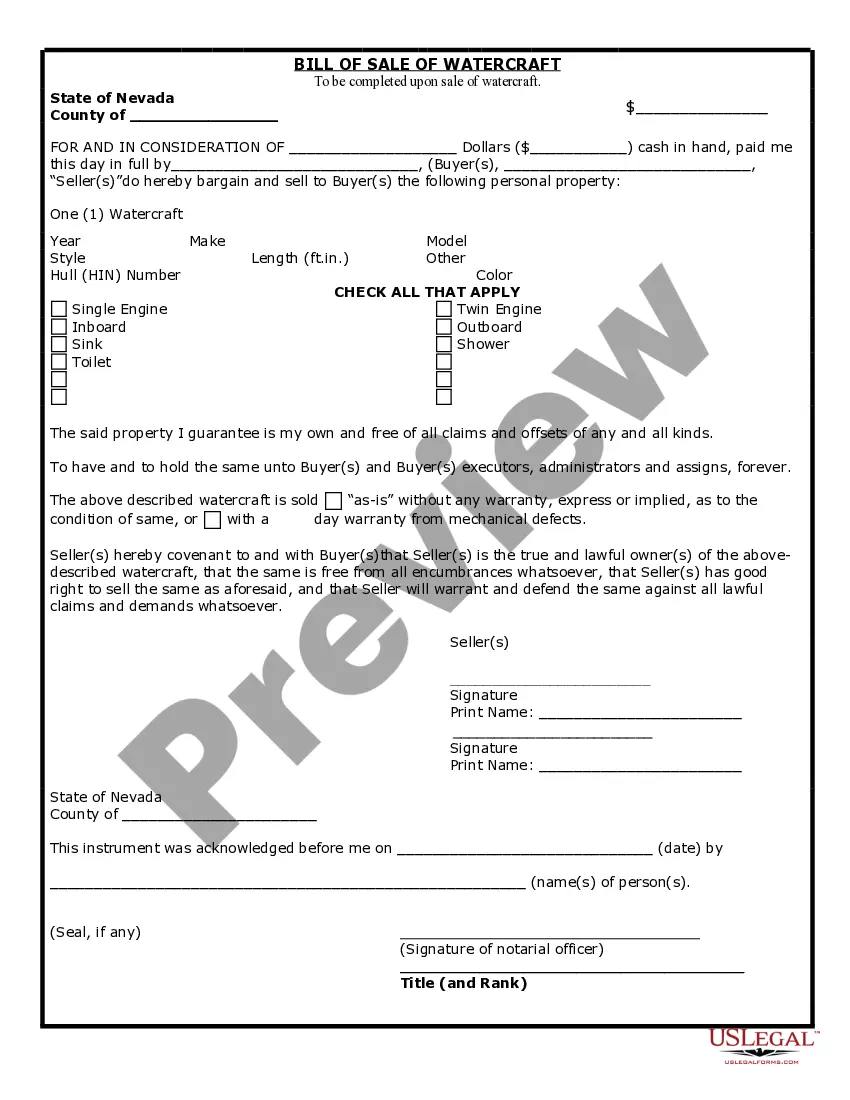

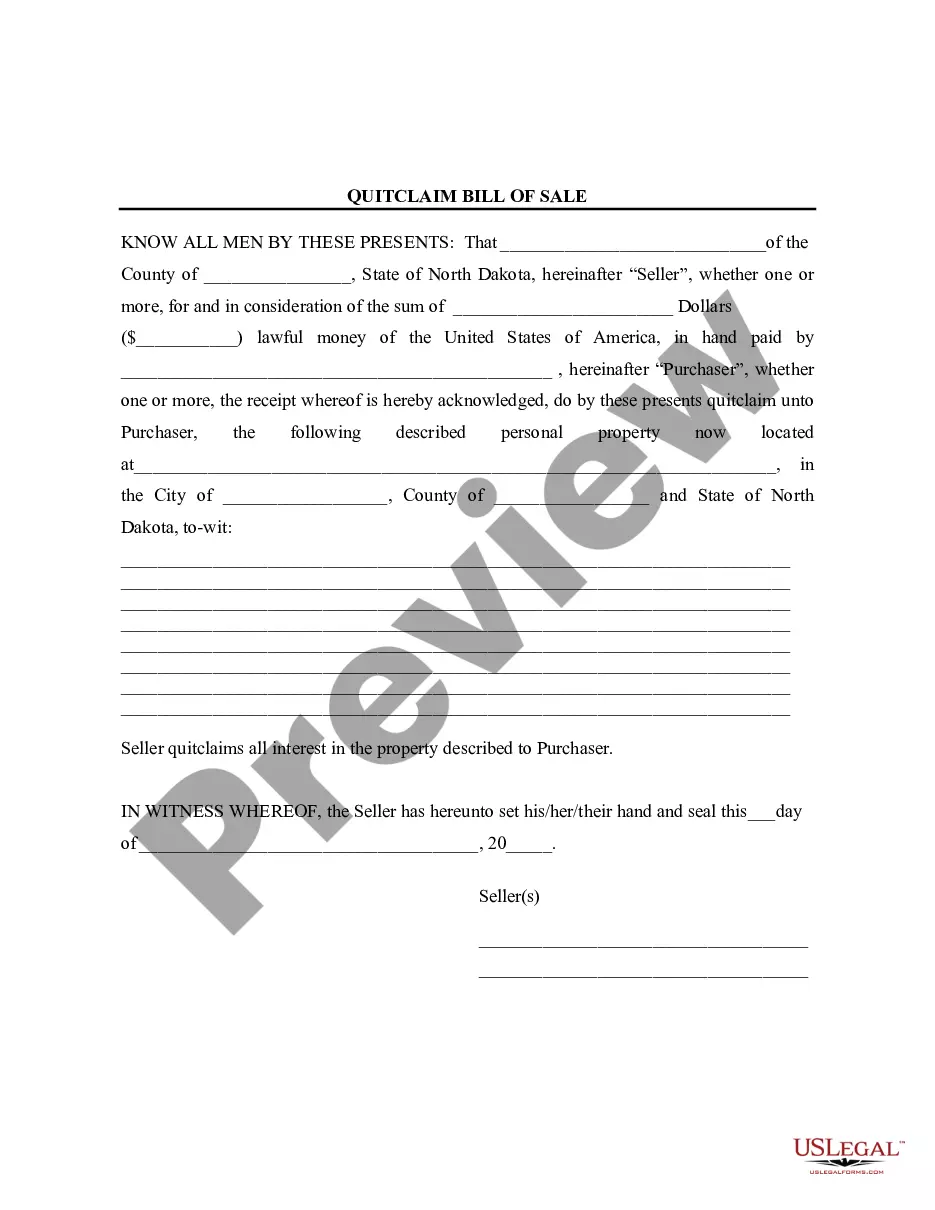

- Verify that the document suits your needs and location by reviewing the details and sample.

- Search for an alternative template (if necessary) using the Search bar at the top of the page.

- Hit Buy Now once you find the relevant template.

- Choose the pricing option, Log In to your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (either via credit card or PayPal).

- Opt for PDF or DOCX format for your Ohio Promissory Note For Car.

- Press Download, then print the template to complete it or upload it to an online editing tool.

Form popularity

FAQ

There is no legal requirement for promissory notes to be witnessed or notarized in Ohio. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

When you write the promissory note, make sure to contain the following information:Name and address of the borrower and lender.Model, year, make, and VIN of the vehicle.Loan amount, interest rate, length of the loan, and maturity date.Late fees and penalties.Collateral information.Odometer reading.More items...