Transfer Death Individual Forward

Description

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Two Individuals To One Individual?

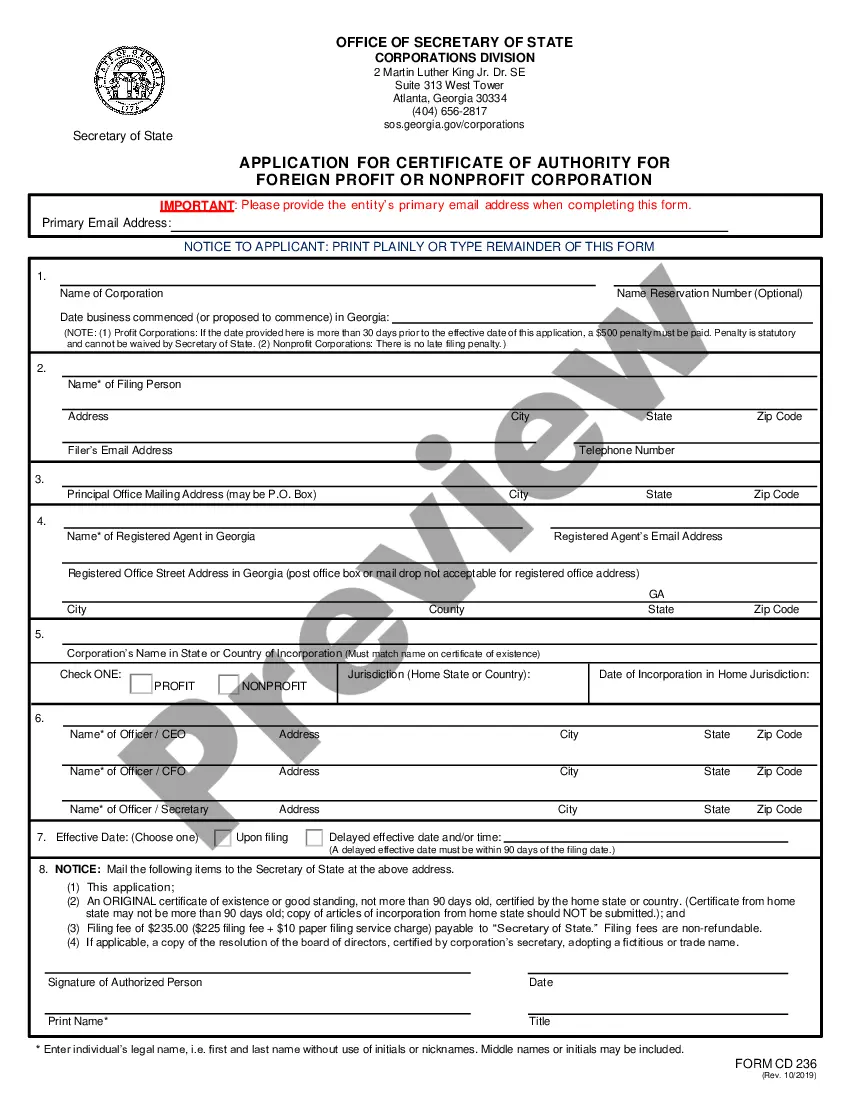

Finding a reliable source for the latest and suitable legal templates is a significant part of navigating bureaucracy.

Identifying the correct legal documents requires accuracy and diligence, which is why it's crucial to obtain Transfer Death Individual Forward samples solely from trustworthy providers like US Legal Forms. An incorrect template could waste your time and delay your current situation.

Once you have the form on your device, you can modify it using the editor or print it for manual completion. Eliminate the stress associated with your legal documents. Browse the extensive US Legal Forms catalog where you can discover legal templates, verify their applicability to your situation, and download them instantly.

- Use the library navigation or search bar to find your template.

- Review the form's details to ensure it meets your state and county's criteria.

- Preview the form, if available, to confirm it is the one you need.

- If the Transfer Death Individual Forward does not suit your needs, continue searching for the right template.

- Once you are confident about the form's suitability, download it.

- If you are a registered user, click Log in to verify and retrieve your selected templates from My documents.

- If you do not have an account yet, click Buy now to acquire the template.

- Select the pricing option that aligns with your needs.

- Proceed with the registration to complete your purchase.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format to download your Transfer Death Individual Forward.

Form popularity

FAQ

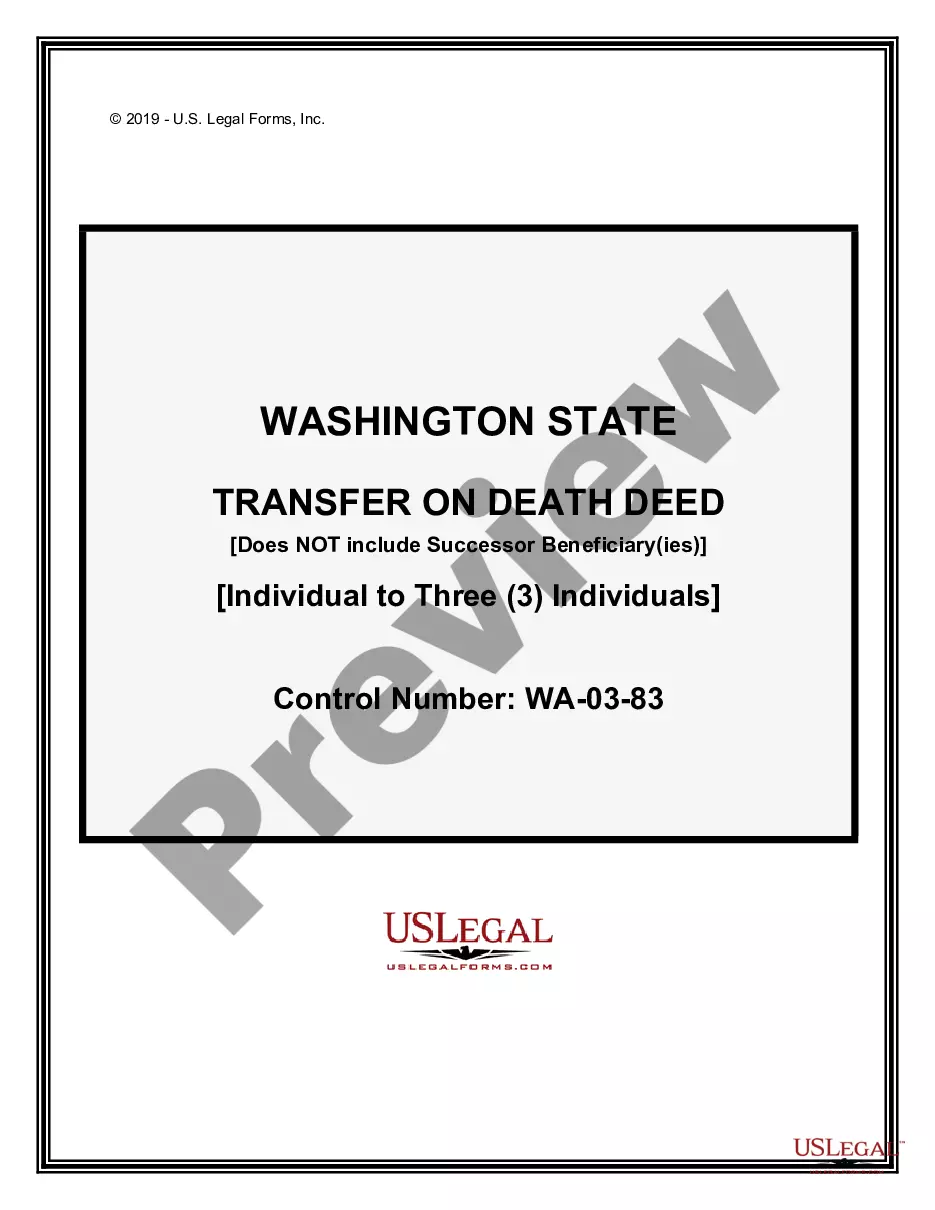

Pros and cons of a transfer on death deed Avoid probate. Property with a TOD deed typically does not have to pass through probate court to transfer to its beneficiaries. ... Avoid federal gift tax paperwork. ... Maintain Medicaid eligibility. ... It might prevent property from being used to repay Medicaid benefit costs.

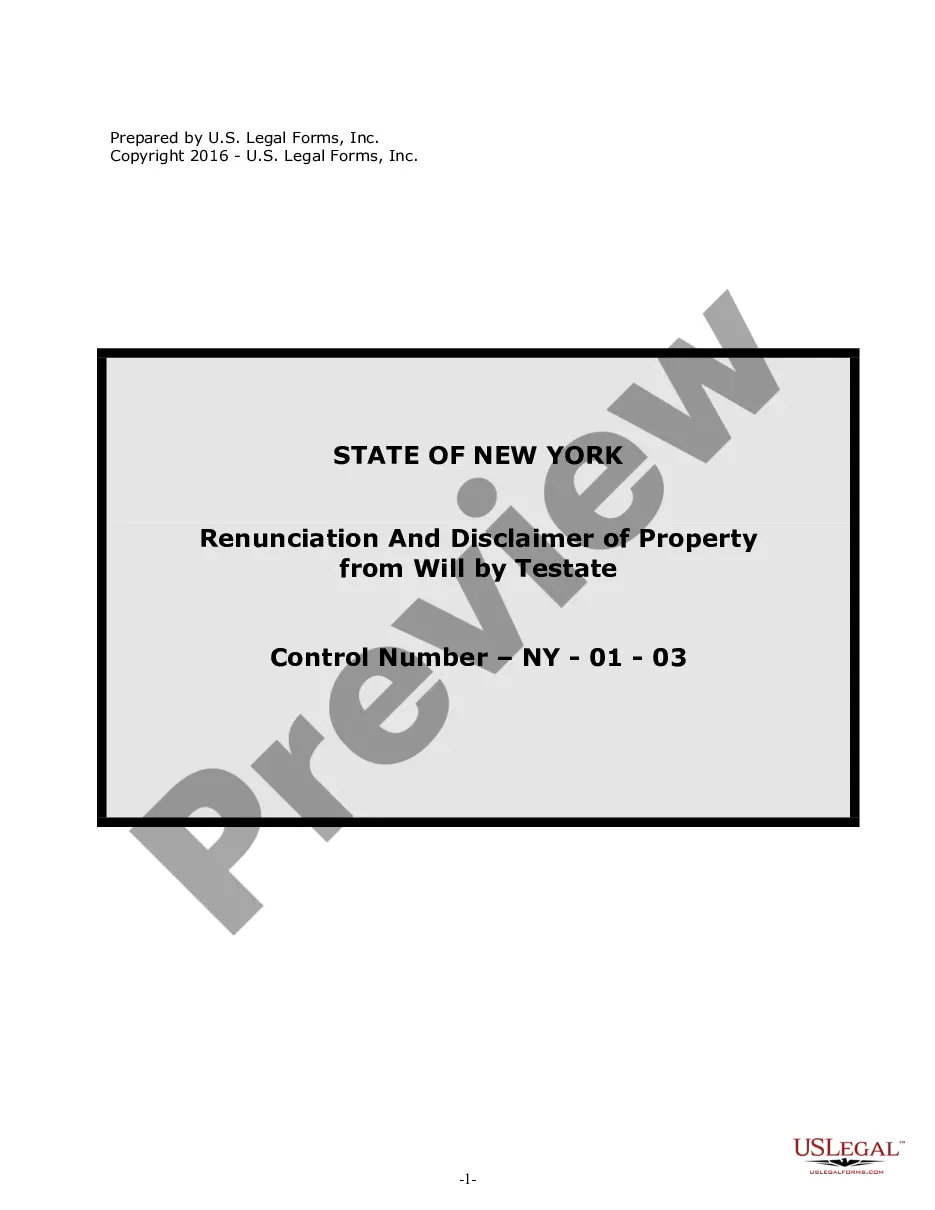

Disability: If your beneficiary has a disability or acquires one from an accident or illness before death. In that case, the POD and TOD funds could end up with the government or jeopardize their Medicaid and SSI.

There are various components to the titling of assets: One is using a transfer on death (TOD) designation, generally used for investment accounts, or a payable on death (POD) designation, used for bank accounts, which act as beneficiary designations, stating to whom account assets are to pass when the owner dies.

Transfer on death (TOD) a provision of a brokerage account that allows the account's assets to pass directly to an intended beneficiary; the equivalent of a beneficiary designation. Estate Planning and Inheritance Glossary.

A transfer on death deed can be a useful addition to your estate plan, but it may not address other concerns, like minimizing estate tax or creditor protection, for which you need a trust. In addition to a will or trust, you can also transfer property by making someone else a joint owner, or using a life estate deed.