Letter Of Attornment Nj Withholding Tax

Description

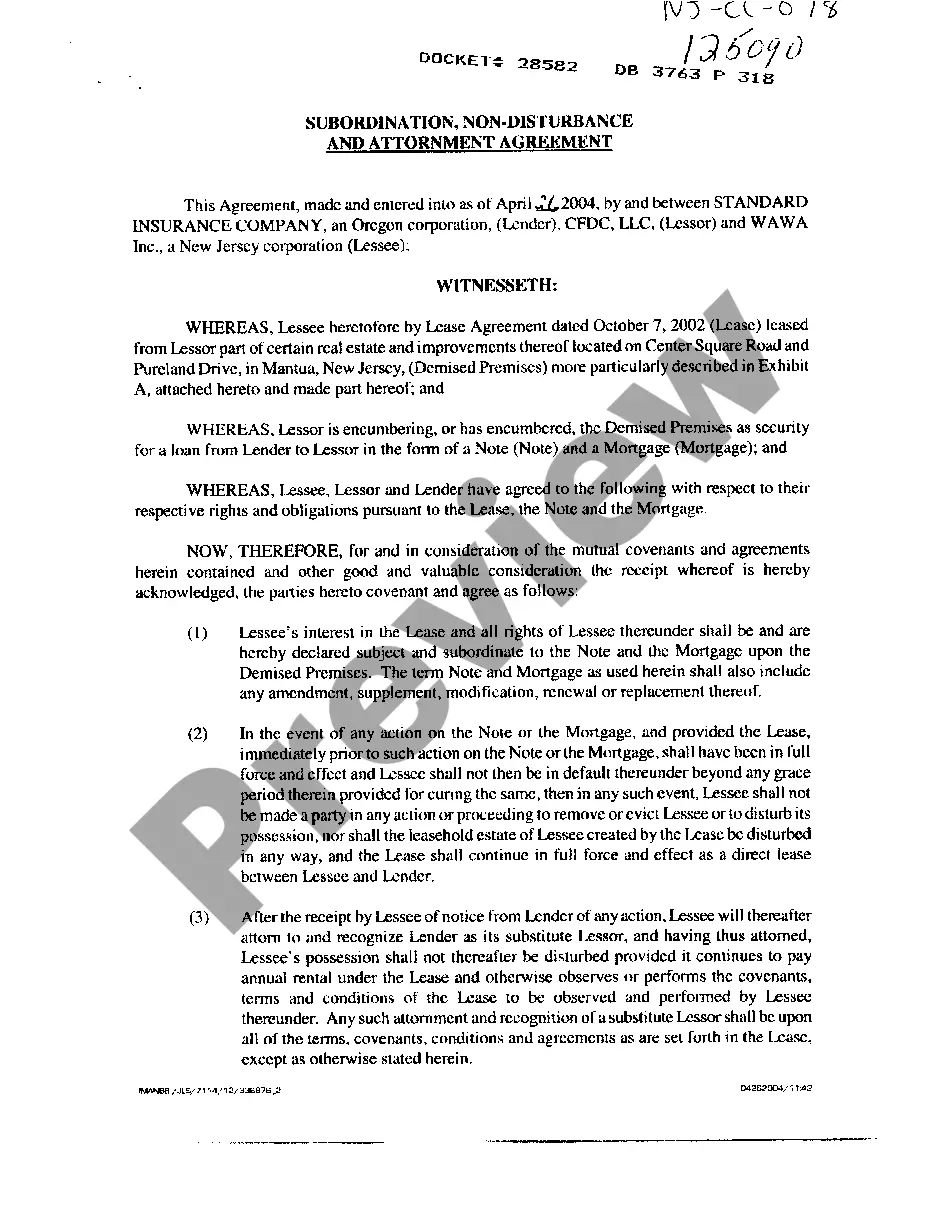

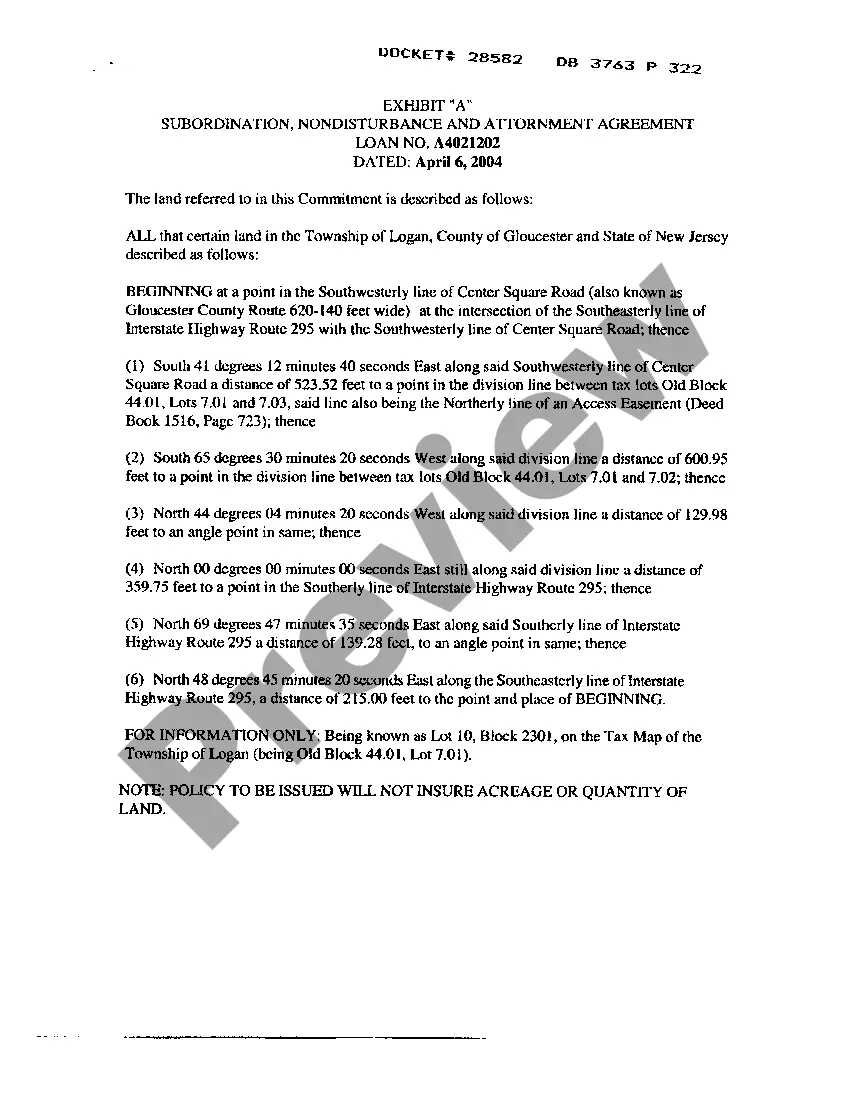

How to fill out New Jersey Subordination, Nondisturbance And Attornment Agreement?

Handling legal documents can be daunting, even for the most proficient experts.

If you're seeking a Letter Of Attornment Nj Withholding Tax and lack the time to hunt for the correct and updated version, the process can be troubling.

Access legal and business forms that are state- or county-specific.

US Legal Forms addresses any needs you may have, ranging from individual to business documentation, all in one location.

If you're new to US Legal Forms, create an account and gain unlimited access to all the platform's benefits. Here are the steps to follow after locating the form you require.

- Utilize advanced tools to complete and manage your Letter Of Attornment Nj Withholding Tax.

- Tap into a resource hub filled with articles, guides, and references pertinent to your situation and requirements.

- Save time and effort in searching for the forms you need, using US Legal Forms’ sophisticated search and Review function to locate and obtain your Letter Of Attornment Nj Withholding Tax.

- If you maintain a monthly subscription, Log In to your US Legal Forms account, search for the needed form, and acquire it.

- Check the My documents tab to review the documents you've previously downloaded and manage your folders as you see fit.

- A robust online form directory can be a transformative solution for anyone looking to efficiently handle these matters.

- US Legal Forms stands as a frontrunner in online legal forms, offering more than 85,000 state-specific legal documents available to you at any moment.

- With US Legal Forms, you can do the following.

Form popularity

FAQ

We've got the steps here; plus, important considerations for each step. Step 1: Enter your personal information. ... Step 2: Account for all jobs you and your spouse have. ... Step 3: Claim your children and other dependents. ... Step 4: Make other adjustments. ... Step 5: Sign and date your form.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

All wages and employee compensation paid to a resident working in New Jersey is subject to withholding. If you employ New Jersey residents working in New Jersey, you must register, file, and pay New Jersey employer withholdings.

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

NJ Form W4 indicates your tax filing status (i.e. single, or married); it also permits you to have additional money withheld for New Jersey State Gross Income Tax purposes. The State of New Jersey has a reciprocal agreement only with the Commonwealth of Pennsylvania relative to state income taxes.