Dissolution Dissolve Company With Debt

Description

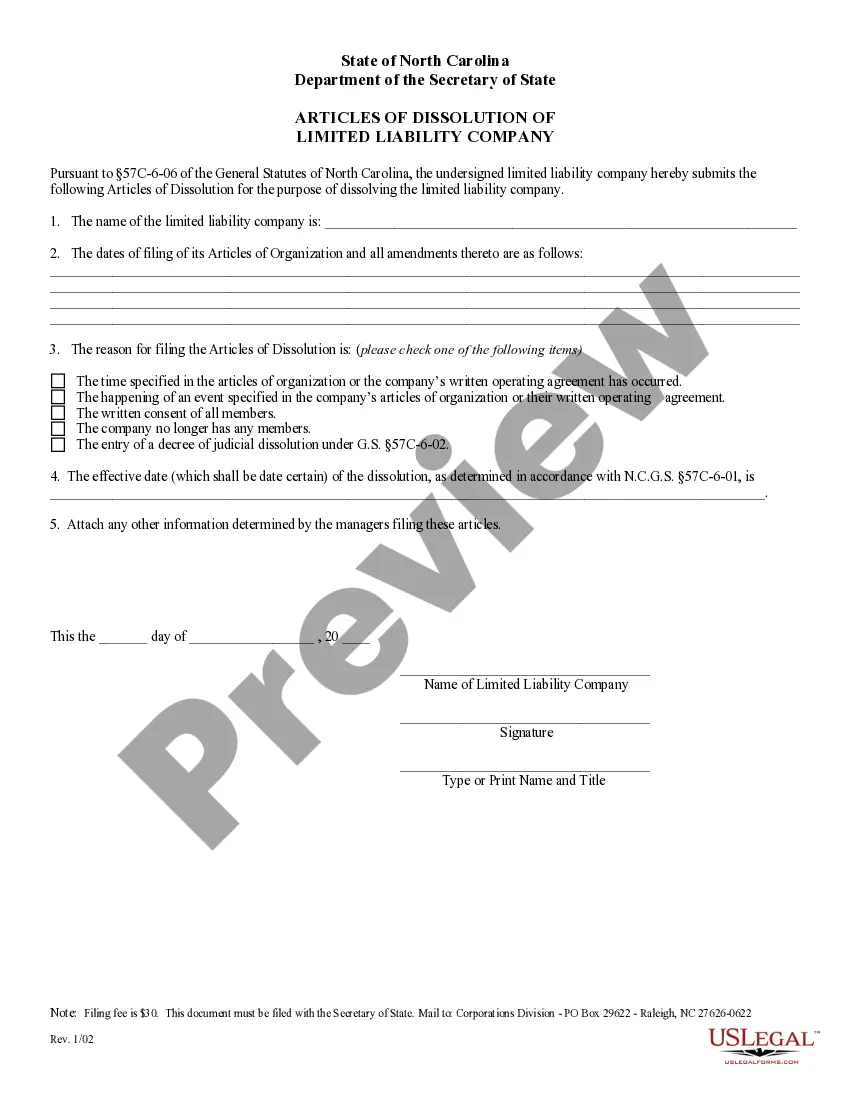

How to fill out North Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

It’s widely recognized that you cannot transform into a legal specialist in an instant, nor can you quickly learn how to effectively compose Dissolution Dissolve Company With Debt without possessing a distinct range of abilities.

Drafting legal documents is a labor-intensive endeavor necessitating specific education and expertise.

So why not entrust the drafting of the Dissolution Dissolve Company With Debt to the experts.

You can access your documents again from the My documents section at any time. If you’re an existing client, you can easily Log In, and locate and download the template from the same section.

Regardless of the reason for your documentation—whether it’s financial and legal, or personal—our platform has you covered. Explore US Legal Forms today!

- Find the document you require using the search bar at the top of the page.

- Examine it (if this feature is available) and review the accompanying description to determine if Dissolution Dissolve Company With Debt is what you need.

- Begin your search anew if you require a different document.

- Sign up for a complimentary account and select a subscription option to acquire the document.

- Click Buy now. Once the transaction is completed, you can download the Dissolution Dissolve Company With Debt, complete it, print it, and send or mail it to the appropriate individuals or entities.

Form popularity

FAQ

Yes, you can dissolve a company that has debts, but the process may be complicated. Creditors will still expect repayment, and you may need to negotiate settlements. To streamline the dissolution process and address your debts effectively, consider utilizing resources from US Legal Forms to guide you through the necessary steps and legal requirements.

You can dissolve a business even if it has outstanding debts. However, this action requires careful planning and compliance with legal requirements to avoid future liabilities. Using services like US Legal Forms can help you understand the necessary steps to properly handle the dissolution of your company with debt while safeguarding your interests.

Yes, you can dissolve a company with debt, but it's important to consider the implications. The dissolution process does not automatically erase your obligations to creditors. It is advisable to consult with a legal expert or use a platform like US Legal Forms to navigate the complexities of dissolving a company with debt while minimizing potential repercussions.

Closing a business with debt can lead to serious consequences. Creditors may pursue you for payment, and this can affect your personal credit if you personally guaranteed any debts. Additionally, you may need to file for bankruptcy to resolve outstanding obligations. Understanding how to properly handle the dissolution of a company with debt is essential to protect your financial future.

Dissolved corporations could have their assets seized and liquidated to pay off debts, and companies or individuals that dissolve their corporations in an attempt to avoid taxes could be subject to fines, penalties, interest payments and even jail time.

When a corporation dissolves, it generally must stop conducting all business, and liquidate its assets to pay off creditors and shareholders. When a corporation's assets are liquidated they first must be used to pay off any outstanding debts the corporation owes, including those owed to shareholders.

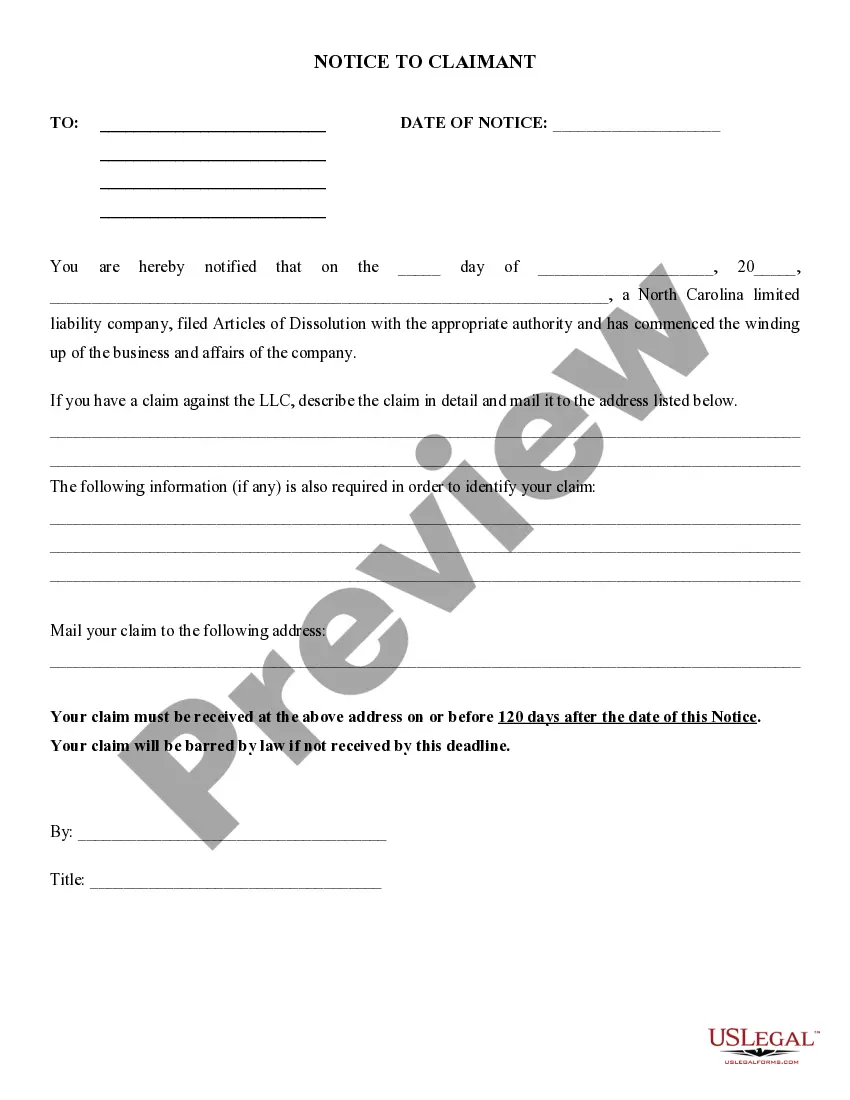

Creditors respond to the notice by submitting claims to the dissolved corporation for the money that they are owed. Holders of senior debt and other types of debts that are secured by specific assets like inventory will likely be given priority, followed by unsecured creditors.

How Can You Dissolve a Company With Debt? Take on no further business. Repay any loans taken by the directors. Pay back all debts. Keep the company bank account open until all the debts clear. Deal with any company vehicles by contacting the leasing or selling companies. Run the final payroll and make a return.

Can I Dissolve a Business With Debt? When a business has outstanding debts that it cannot pay, the company may be liquidated or close under administrative dissolution by the state. With liquidation, the company sells its assets to pay off debts before it closes.