Dissolution Dissolve Company Fort Worth

Description

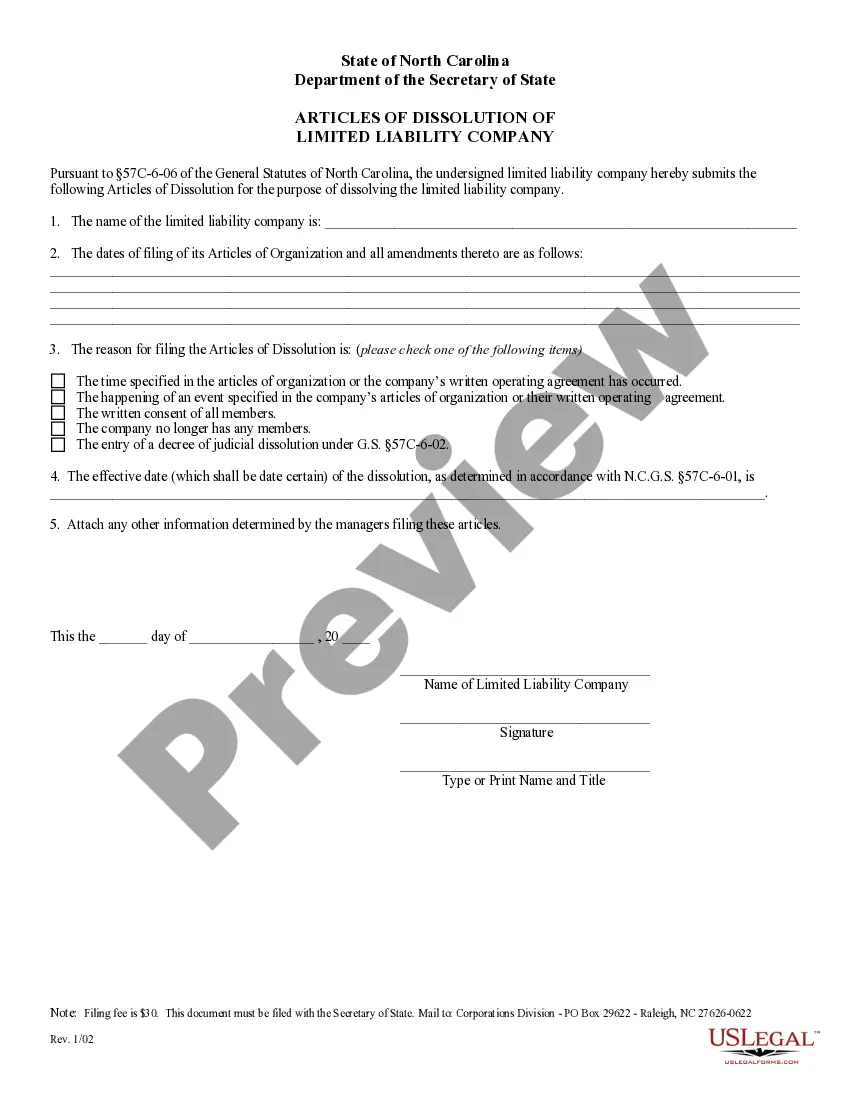

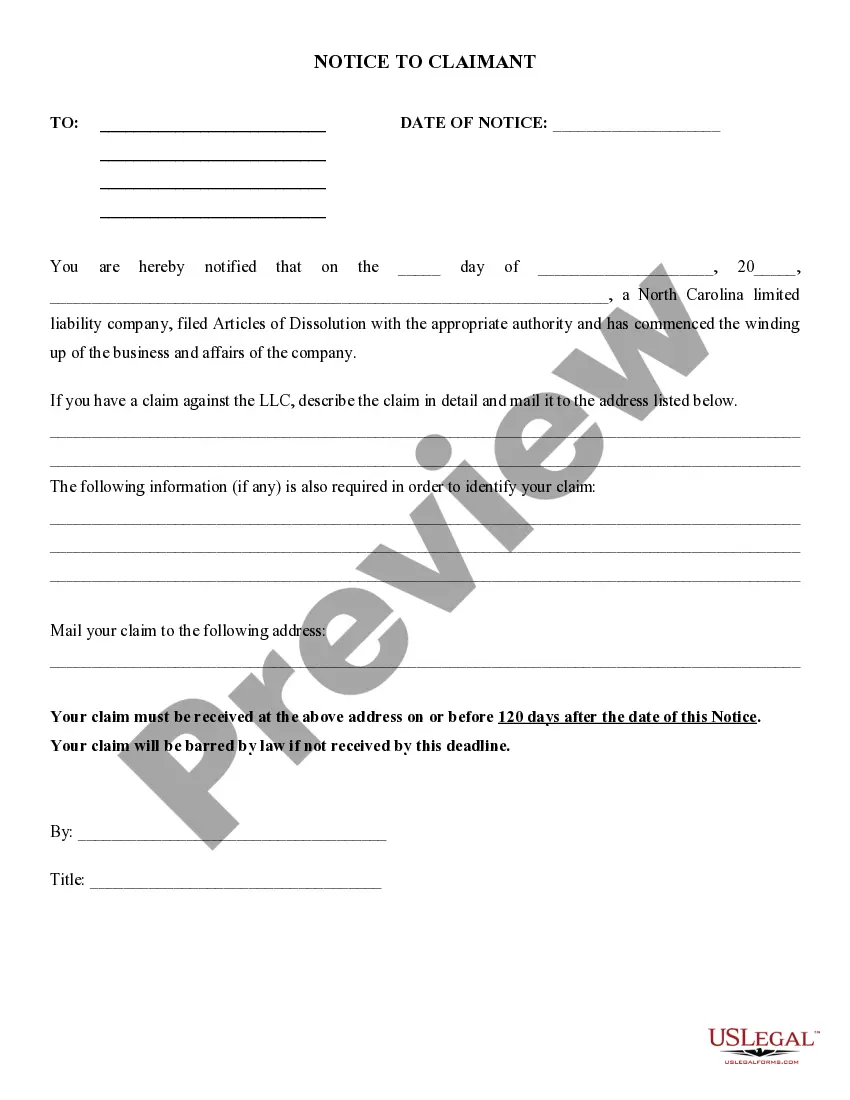

How to fill out North Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

Creating legal documents from scratch can occasionally be a bit daunting.

Certain cases may require extensive research and considerable expenses.

If you’re looking for an easier and more cost-effective method of preparing Dissolution Dissolve Company Fort Worth or similar documents without unnecessary complications, US Legal Forms is always available at your service.

Our online collection of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal affairs.

However, before jumping straight into downloading Dissolution Dissolve Company Fort Worth, consider these tips: Review the document preview and details to confirm that you are looking at the document you need. Ensure that the template you select meets the regulations of your state and county. Select the appropriate subscription plan to purchase the Dissolution Dissolve Company Fort Worth. Download the file, then complete, sign, and print it out. US Legal Forms has a pristine reputation and over 25 years of expertise. Join us today and make document processing simple and efficient!

- With just a few clicks, you can swiftly obtain state- and county-specific forms meticulously organized for you by our legal professionals.

- Utilize our platform whenever you require trustworthy and dependable services to find and download the Dissolution Dissolve Company Fort Worth.

- If you’re familiar with our site and have previously registered an account with us, simply Log In, find the template, and download it now or re-download it later from the My documents section.

- Don’t have an account? No problem. It takes just a few minutes to set one up and discover the library.

Form popularity

FAQ

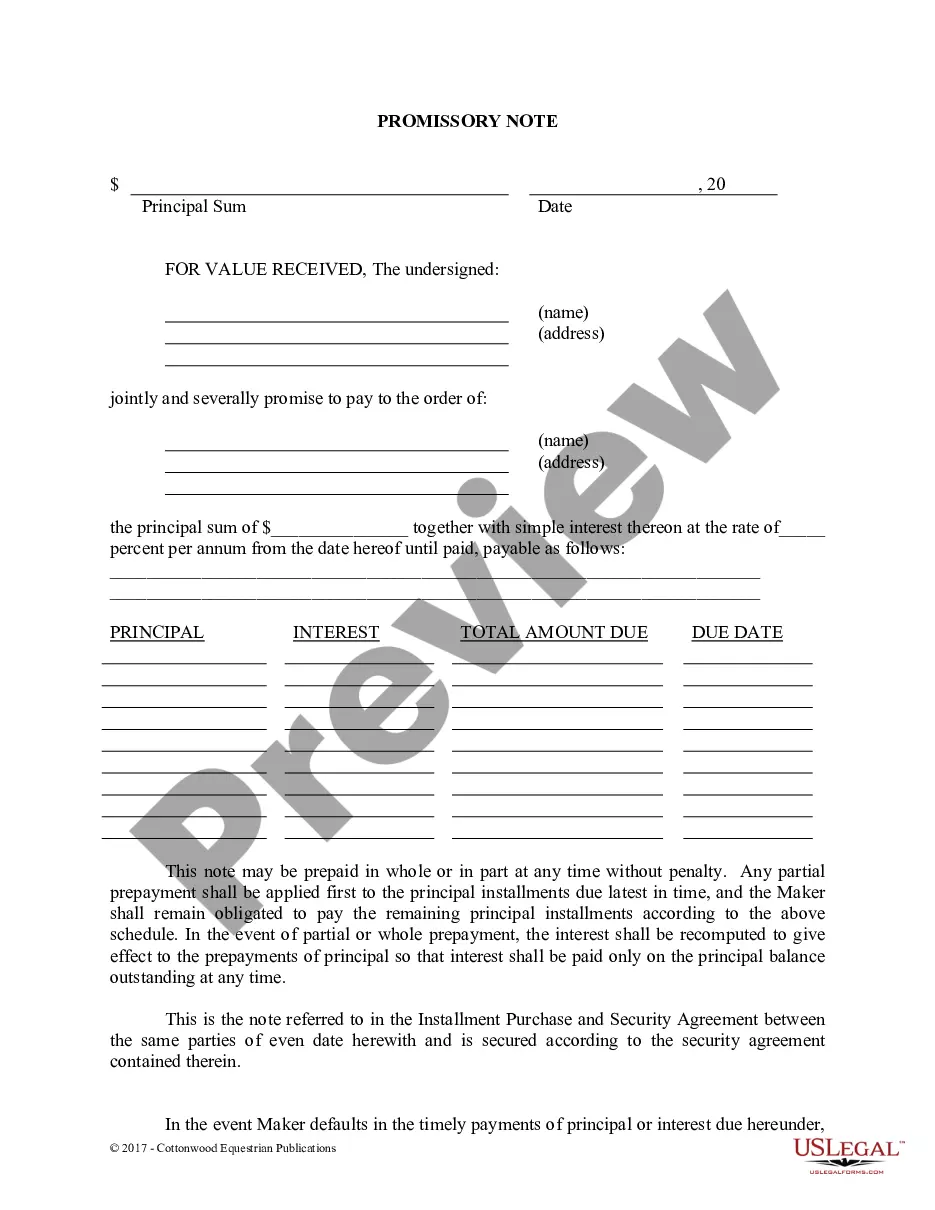

To dissolve a company in Fort Worth, you must first hold a meeting with the owners or shareholders to agree on the dissolution. Next, file the necessary paperwork with the Texas Secretary of State, which includes submitting Form 601 and paying the required fees. After that, settle any outstanding debts and notify creditors about the dissolution. Finally, make sure to distribute any remaining assets among the owners, completing the dissolution process efficiently through the right channels.

To dissolve a company in Texas, you must first hold a meeting with your board of directors and shareholders to approve the dissolution. After obtaining the necessary approvals, you need to file a Certificate of Termination with the Texas Secretary of State. It's important to settle all debts and obligations before completing the dissolution process. For a smooth experience, consider using USLegalForms, which provides the necessary forms and guidance for the dissolution process to ensure you comply with all legal requirements.

Legally dissolving a company in Fort Worth requires you to file the appropriate paperwork with the Texas Secretary of State. First, ensure that all debts and obligations are settled, and notify creditors of the dissolution. After completing these steps, you can submit the Certificate of Termination to officially dissolve your company. US Legal Forms can assist you in navigating this process, making it easier to ensure compliance with all legal requirements for dissolution.

To force the dissolution of an LLC in Fort Worth, you usually need to follow specific state procedures. This often involves filing a lawsuit against the LLC if the members cannot agree to dissolve it voluntarily. You may also need to provide valid reasons for the dissolution, such as the LLC not conducting business as intended. For a smoother process, consider using US Legal Forms, which provides resources and guidance tailored to dissolve a company in Fort Worth effectively.

Hear this out loud PauseGenerally, a charitable nonprofit corporation seeking to dissolve or terminate must vote to do so, pay all debts, distribute any remaining assets to a charity with the same or similar charitable purpose ing to a plan of distribution, and file a certificate of termination with the Texas Secretary of State.

The Secretary of State charges a $40 filing fee for dissolving an LLC. If submitting via the website, you can pay online when you submit the forms. Checks should be payable to the secretary of state, and if you're paying by credit card via fax, make sure you also attach Form 807.

Hear this out loud PauseWhile both words are concerned with the end of a business partnership, dissolution refers to the process itself, and usually to the departure (or death) of one or more individuals from the entity, while termination refers to the cessation of all operations, including the disposal of all assets.

The entity must: Take the necessary internal steps to wind up its affairs. ... Submit two signed copies of the certificate of termination. ... Unless the entity is a nonprofit corporation, attach a Certificate of Account Status for Dissolution/Termination issued by the Texas Comptroller. ... Pay the appropriate filing fee.

Hear this out loud PauseIf you formed your LLC in Texas, you will file two signed copies of a Certificate of Termination of a Domestic Entity (Form 651), and pay a $40 filing fee. Form 651 must be signed by an authorized manager or authorized member-manager. The Certificate of Account Status must be attached to your Form 651.