Installment Payment Agreement With Irs

Description

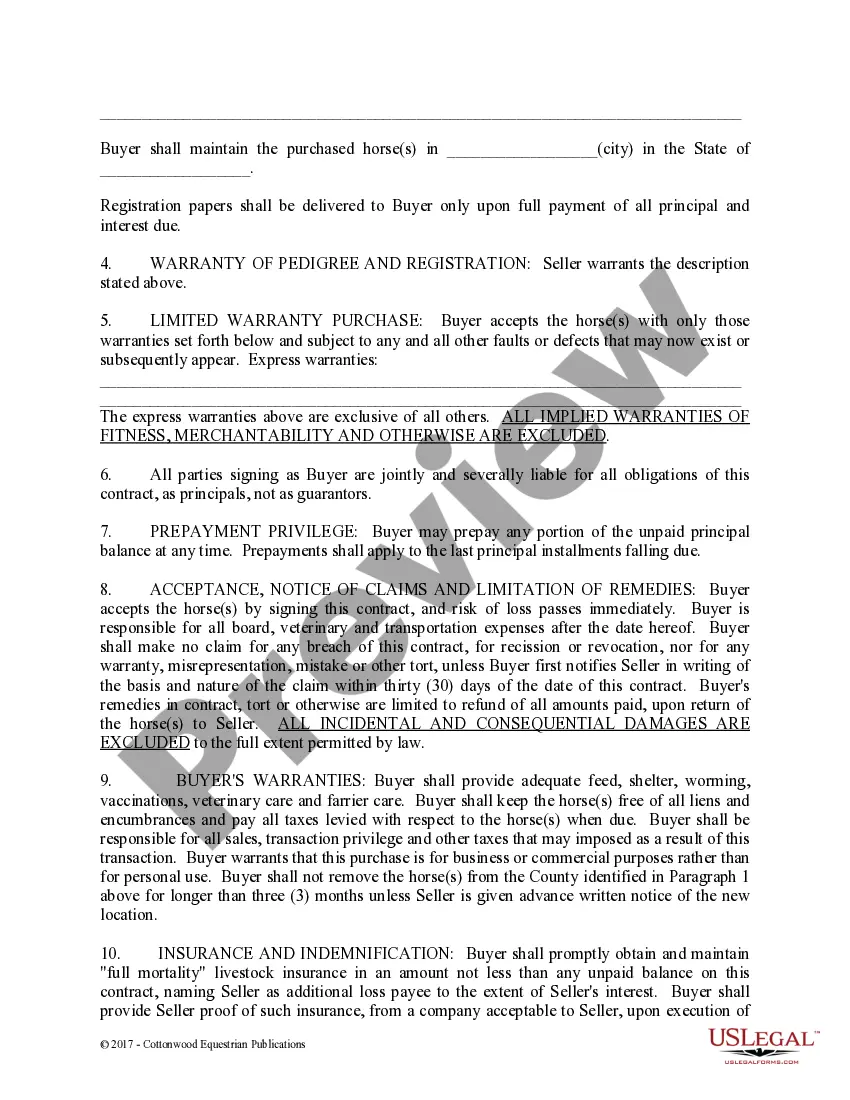

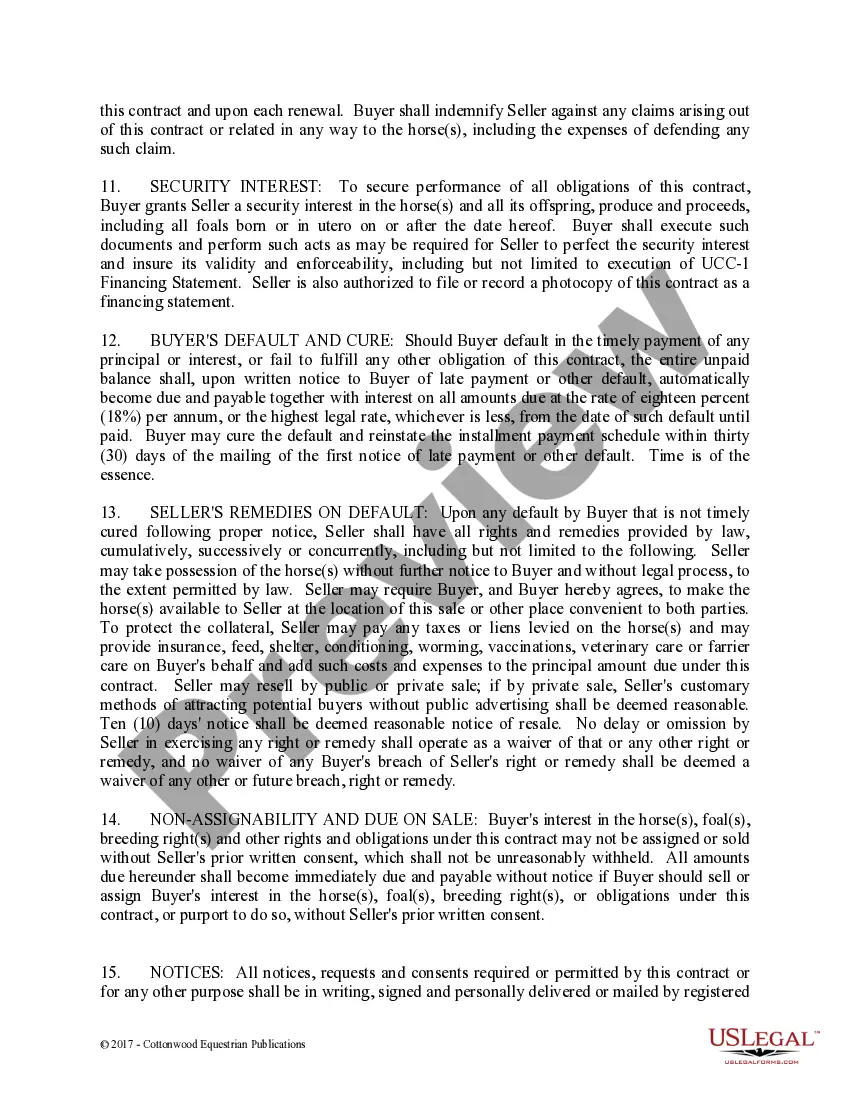

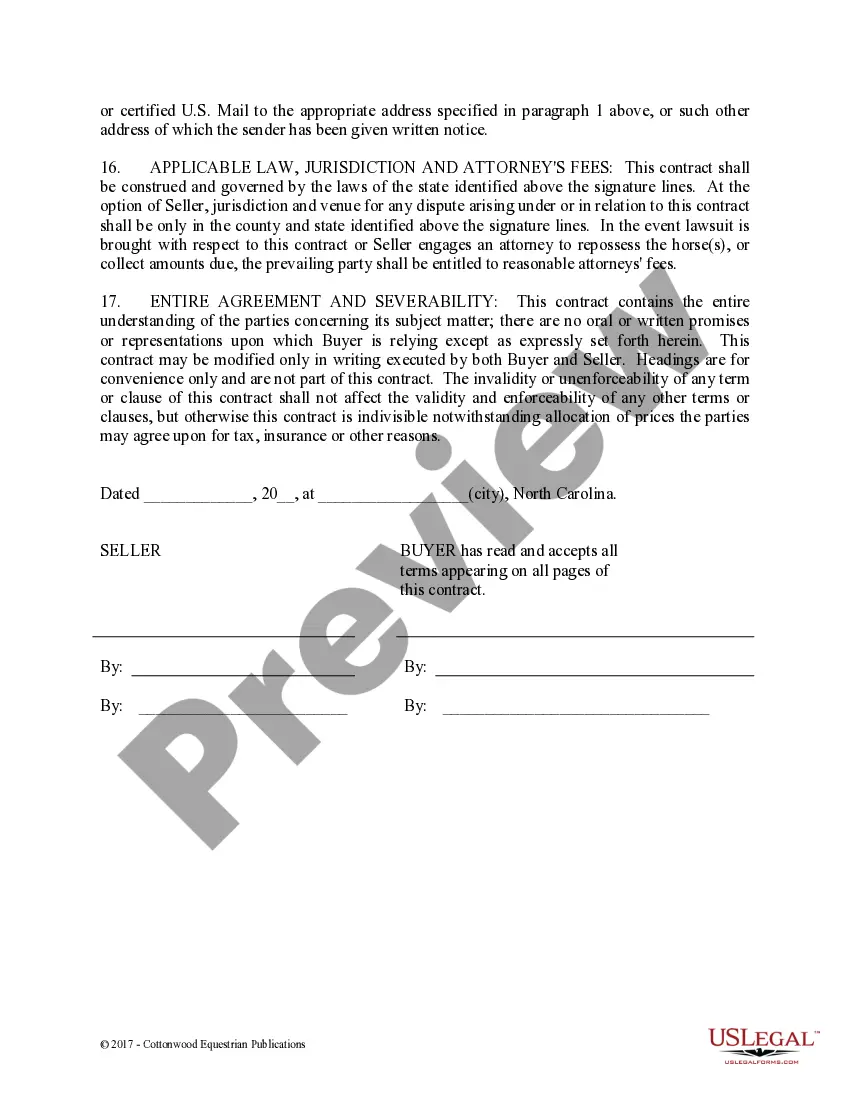

How to fill out North Carolina Installment Purchase And Security Agreement With Limited Warranties - Horse Equine Forms?

What is the most reliable service to obtain the Installment Payment Agreement With Irs and other current variations of legal documentation? US Legal Forms is the solution! It boasts the largest collection of legal forms for any purpose. Each template is expertly drafted and validated for adherence to federal and local laws and regulations. They are organized by field and jurisdiction, making it simple to find the one you require.

Experienced users of the site only need to Log In to the system, verify their subscription status, and click the Download button next to the Installment Payment Agreement With Irs to access it. Once saved, the template is accessible for future use in the My documents section of your profile. If you do not yet have an account with our library, here are the steps you need to follow to create one.

US Legal Forms is an outstanding choice for anyone needing to manage legal documents. Premium users can benefit further as they can fill out and sign previously saved files electronically at any time using the built-in PDF editing tool. Try it today!

- Form compliance review. Before obtaining any template, you should ensure it meets your use case requirements and aligns with your state or county's regulations. Examine the form description and utilize the Preview if it’s available.

- Alternative document search. If there are any discrepancies, use the search bar in the page header to locate a different template. Click Buy Now to select the right one.

- Account registration and subscription purchase. Select the most suitable pricing plan, Log In or create an account, and process your subscription payment via PayPal or credit card.

- Downloading the documents. Choose the format you prefer to save the Installment Payment Agreement With Irs (PDF or DOCX) and click Download to retrieve it.

Form popularity

FAQ

If you are an individual, you may qualify to apply online if: Long-term payment plan (installment agreement): You owe $50,000 or less in combined tax, penalties and interest, and filed all required returns. Short-term payment plan: You owe less than $100,000 in combined tax, penalties and interest.

Apply With the New Form 656An offer in compromise allows you to settle your tax debt for less than the full amount you owe. It may be a legitimate option if you can't pay your full tax liability or doing so creates a financial hardship.

Your minimum payment will be your balance due divided by 72, as with balances between $10,000 and $25,000.

Call the IRS at 1-800-829-1040 weekdays from 7am to 7pm local time. At the first prompt press 1 for English. At the next menu press 2 for questions about your personal income taxes. At the next menu press 1 for questions about a form you have already submitted, your tax history, or payment.

Form 9465 is available in all versions of TaxAct® and can be electronically filed with your return. If you have already filed your return or you are filing this form in response to a notice from the IRS, Form 9465 may be paper filed by itself.