Personal Representative Deed Of Distribution

Description

How to fill out North Carolina Personal Representative's Deed To A Trust?

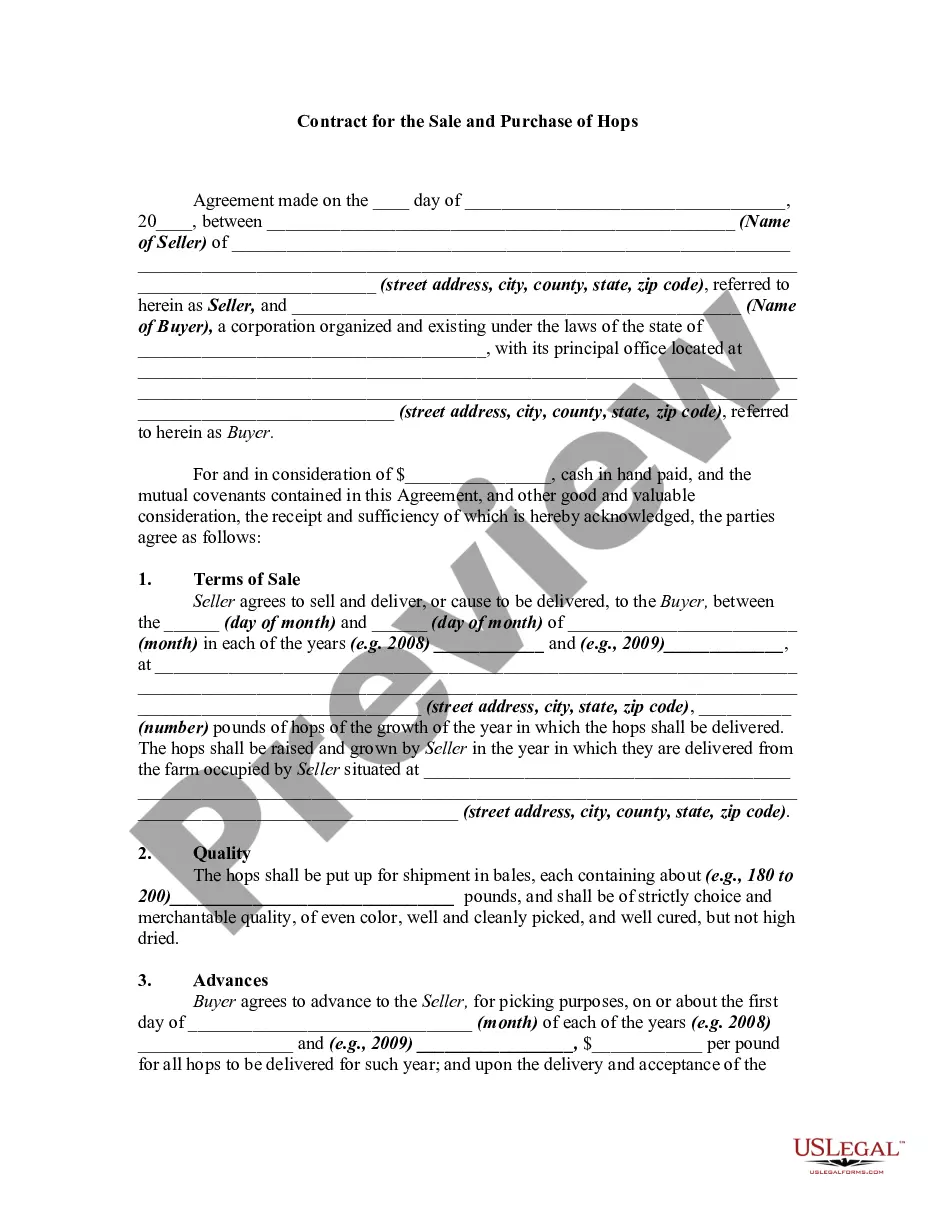

Maneuvering through the red tape of standard documents and forms can be challenging, particularly if one is not doing that as a profession.

Even selecting the appropriate template for a Personal Representative Deed of Distribution will be labor-intensive, as it needs to be valid and accurate to the smallest detail.

However, you will find that you can spend significantly less time obtaining a suitable template from a resource you can rely on.

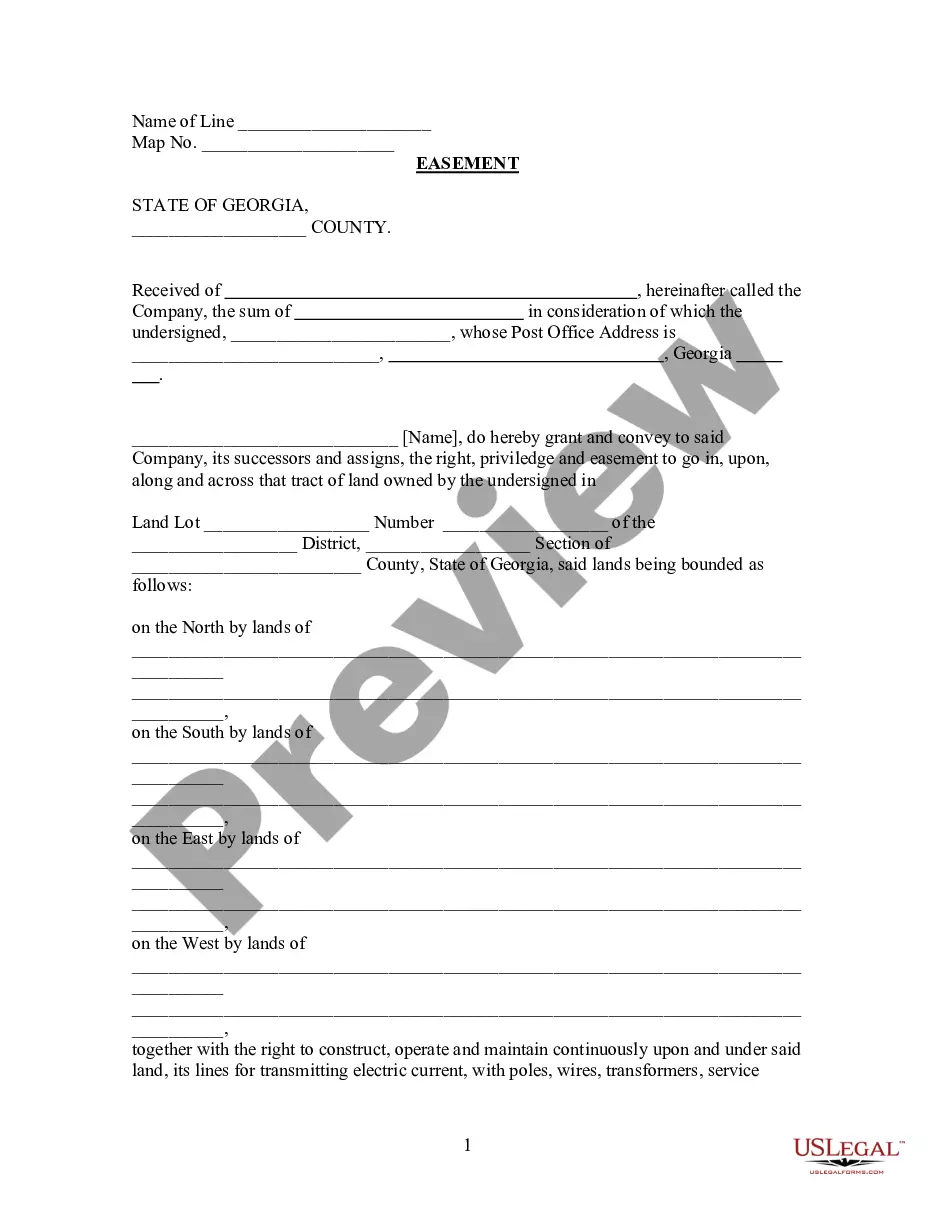

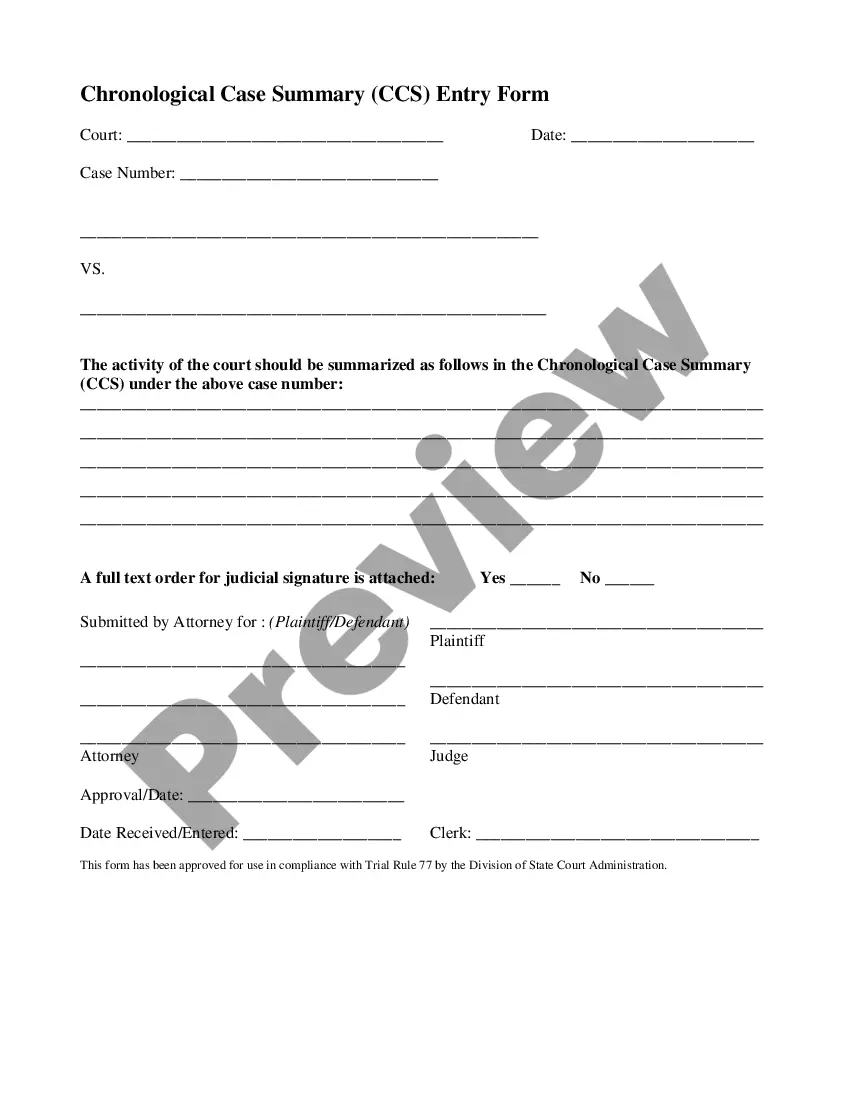

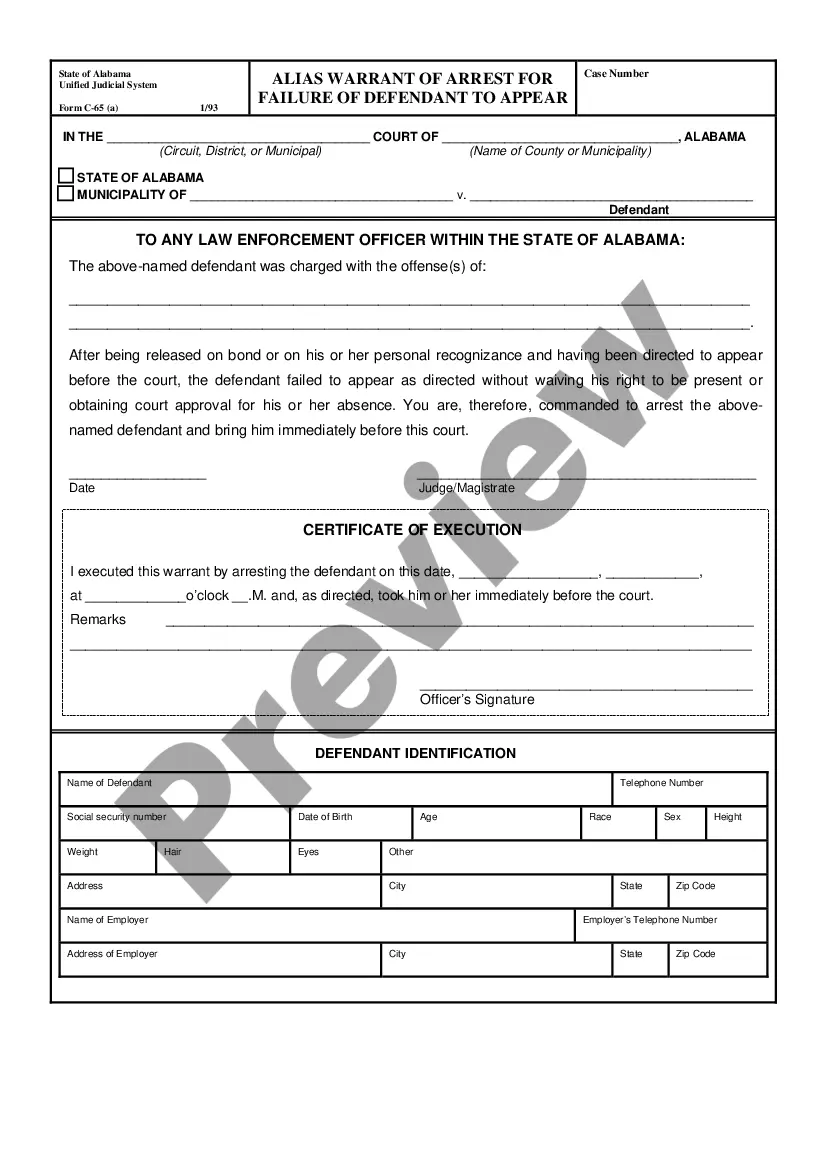

Acquire the correct document in a few straightforward steps: Enter the document name into the search box, select the right Personal Representative Deed of Distribution from the results, review the sample description or open its preview. If the template meets your needs, click Buy Now. Then choose your subscription plan, use your email to create a password and register an account at US Legal Forms. Select a credit card or PayPal payment option and save the template document on your device in your preferred format. US Legal Forms will save you considerable time verifying whether the form you found online is appropriate for your needs. Register for an account and gain unlimited access to all the templates you require.

- US Legal Forms is a service that streamlines the process of finding the correct documents online.

- US Legal Forms is the sole location you need to access the most current samples of paperwork, confirm their use, and download these samples for completion.

- It is an archive containing over 85,000 forms relevant in various sectors.

- When searching for a Personal Representative Deed of Distribution, you can rest assured of its authenticity as all forms are validated.

- An account with US Legal Forms guarantees that you have all the necessary samples at your fingertips.

- Store them in your history or add them to the My documents collection.

- You can retrieve your saved documents from any device by clicking Log In on the library site.

- If you still lack an account, you can always search again for the template you require.

Form popularity

FAQ

No, a successor is not the same as a trustee; they serve different functions in managing estates. A trustee manages trust assets for beneficiaries, while a successor refers to someone who takes over responsibilities, possibly including those of a personal representative. If you are dealing with trust issues and need clarity, consider utilizing services like uslegalforms to assist with the necessary documentation and legal guidance.

A personal representative is an individual or entity designated to handle the affairs of a deceased person's estate. This role includes tasks such as collecting assets, paying debts, and executing the terms outlined in the personal representative deed of distribution. Understanding this function can provide clarity if you're involved in estate planning or administration.

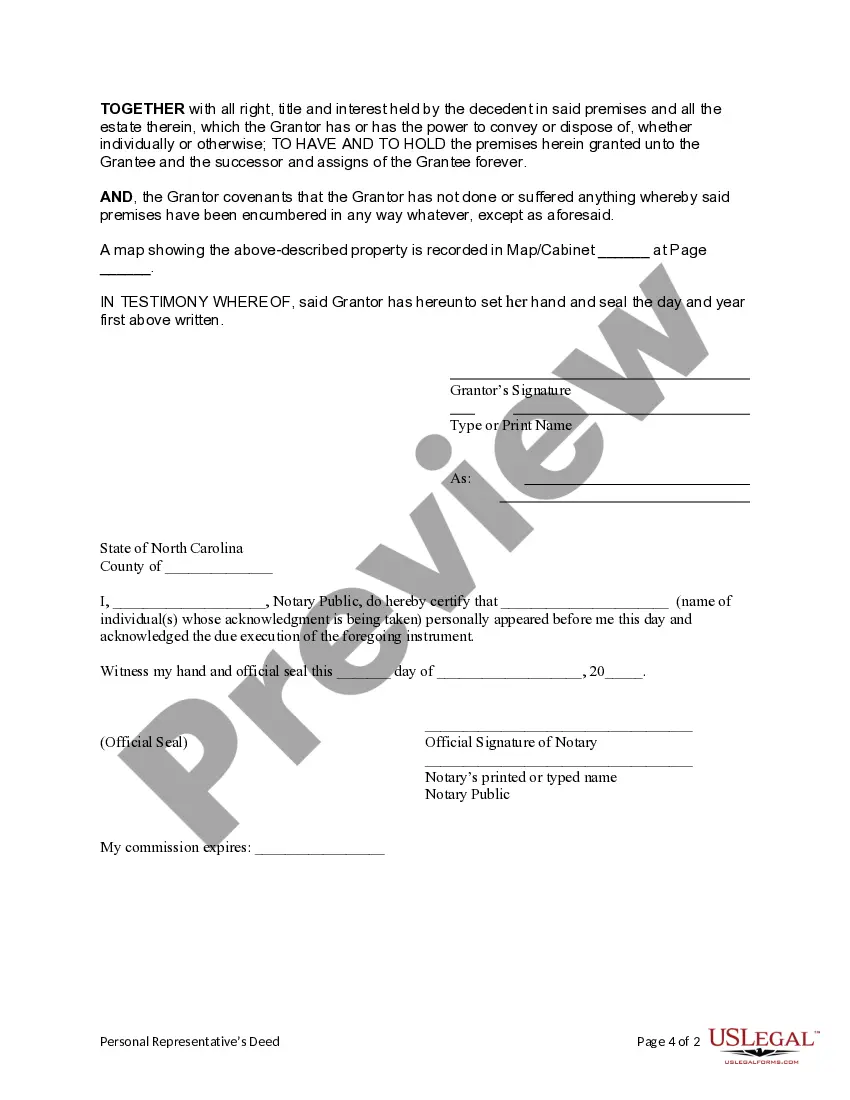

You become a personal representative when appointed through a will or by a court for intestate estates. This role entails managing the estate's assets, settling debts, and distributing property according to the personal representative deed of distribution. If you find yourself in this position, be ready to navigate important responsibilities in estate management.

A successor can refer to anyone who follows another in a role, whereas a personal representative is specifically designated to administer an estate. The personal representative carries legal authority to execute the personal representative deed of distribution, ensuring that the deceased's wishes are honored. Therefore, while all personal representatives can be successors, not all successors fulfill the role of personal representatives.

A successor is not the same as an executor, although they often play related roles in estate administration. An executor is appointed by a will to manage the distribution of assets, while a successor takes over duties if the executor cannot serve. Understanding the nuances between these roles is vital when drafting a personal representative deed of distribution.

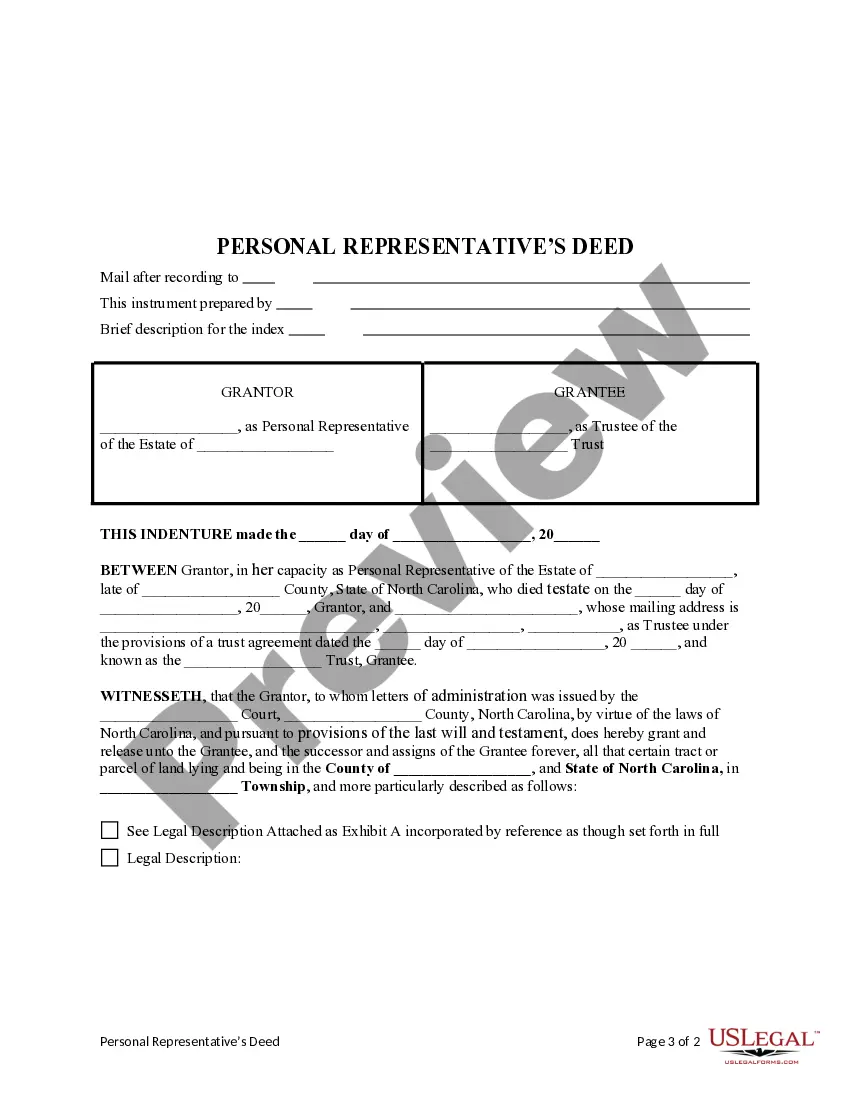

When writing the grantee in estate transfers, it is essential to accurately identify the person receiving the property. The personal representative deed of distribution should clearly state the full legal name of the grantee, including any middle names if applicable. Furthermore, ensure to include their address for clarity and legal purposes. If you need assistance, USLegalForms offers a comprehensive guide to help you through the process of estate transfers, ensuring that your documents meet all legal requirements.

A personal representative's deed of distribution is a legal document that a personal representative uses to convey property from the estate of the deceased to heirs or beneficiaries. This deed details the transfer and ensures that the property is distributed as intended. Employing this deed simplifies the estate settlement process by providing clear documentation for the beneficiaries, making it an essential tool for managing estate transitions.

Another name for a personal representative is an executor or administrator, depending on the jurisdiction. This individual is responsible for managing the estate, including the distribution of assets according to the will or state law. The role often involves executing documents like a personal representative deed of distribution, ensuring that property is properly allocated to beneficiaries.

The owner of the property in a personal representative's deed is typically the estate of the deceased person. The personal representative administers the estate and may transfer property to heirs or beneficiaries through this deed. This legal transfer ensures the distribution adheres to the deceased's wishes and meets state laws. Understanding this process is vital when dealing with a personal representative deed of distribution.

You can obtain personal representative papers from the probate court in the county where the deceased person lived. These papers, which officially appoint an individual to manage the estate, are crucial for executing a personal representative deed of distribution. For convenience and efficiency, many find it helpful to use online legal platforms, such as US Legal Forms, to access required documents.