Form A Limited Liability Company With The Ability To Establish Series

Description

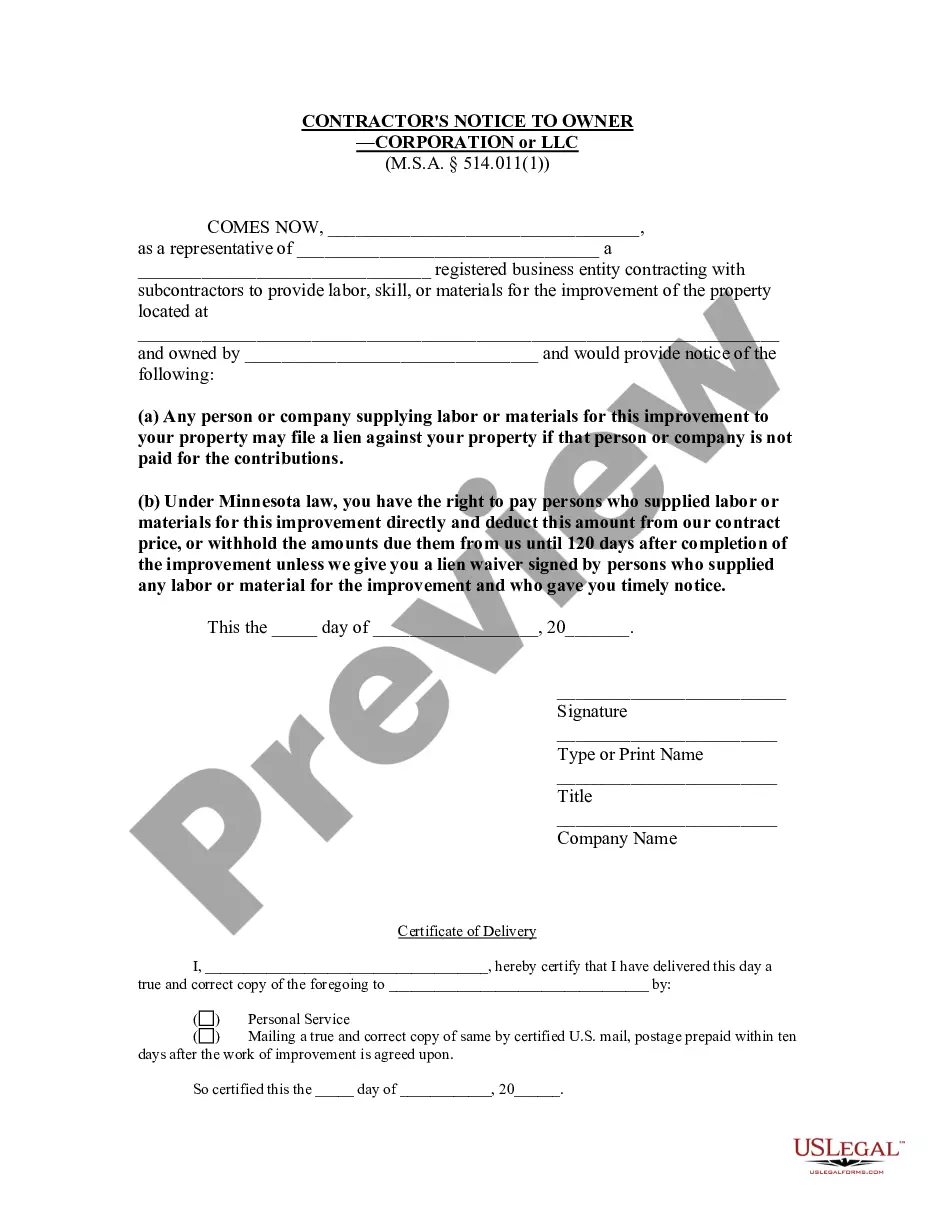

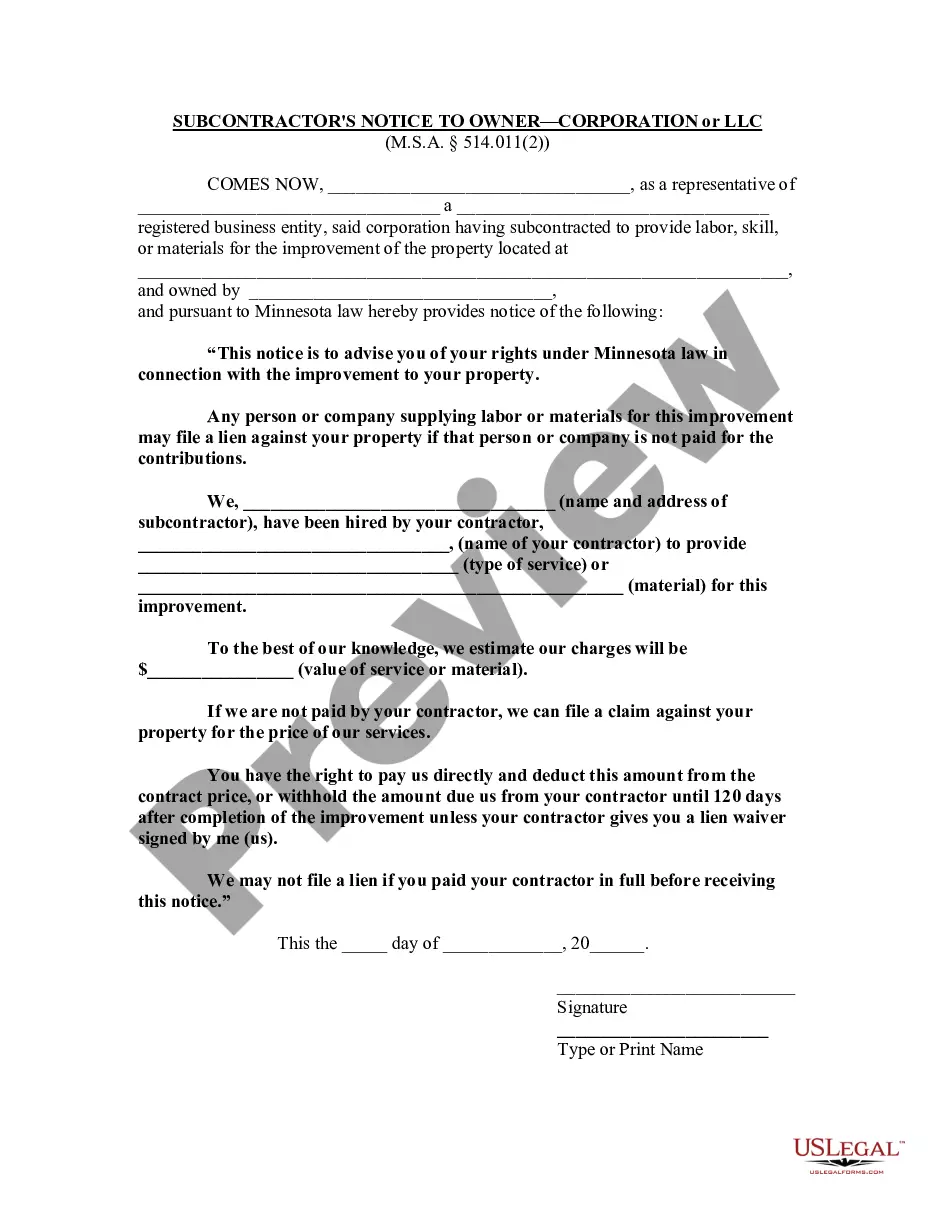

How to fill out Minnesota Contractor's Notice To Owner - Corporation Or LLC?

- If you have previously registered with US Legal Forms, log in to your account and navigate to the library to download the necessary form template.

- Ensure your subscription is current; if it's expired, proceed to renew it according to your payment plan.

- For first-time users, browse the extensive library and preview the form descriptions to find one that aligns with your requirements.

- If you require a different template, utilize the search option to locate the appropriate document.

- After selecting the correct document, click on the 'Buy Now' button and choose your desired subscription plan.

- Complete the purchase by providing either your credit card information or using PayPal for payment.

- Download the completed form to your device and access it anytime from the 'My Forms' section in your user profile.

US Legal Forms provides an exceptional array of benefits, including an extensive collection of over 85,000 customizable legal forms and direct access to experienced professionals.

With US Legal Forms, you can confidently manage your LLC's documentation needs. Take the first step today and streamline your legal processes efficiently!

Form popularity

FAQ

One potential disadvantage of a series LLC is the complexity in maintaining compliance for each series. Each series may have its own set of legal requirements and paperwork, which can be overwhelming. When you choose to form a limited liability company with the ability to establish series, it is essential to consider these complexities and potentially seek assistance from platforms like US Legal Forms to navigate the legal landscape.

Typically, LLCs do not file taxes together with personal taxes. Instead, the LLC files its taxes separately, and members report their share of profits or losses on their personal returns. If you plan to form a limited liability company with the ability to establish series, be aware of how this separation affects your overall tax strategy.

Multiple-member LLCs file taxes as partnerships. This means you will need to submit Form 1065, along with a Schedule K-1 for each member detailing their share of the income. If you aim to form a limited liability company with the ability to establish series, having clear guidelines on how each member contributes to taxes can streamline the process.

An LLC must file taxes if it has any business income, regardless of the amount. Even if your LLC earns a small sum, you are still required to report that income to the IRS. When you decide to form a limited liability company with the ability to establish series, it’s crucial to monitor your earnings closely to ensure compliance with tax obligations.

To file taxes for a Series LLC, you must first understand that each series within the LLC can be treated as a separate entity for tax purposes. You will need to file a Form 1065 for the entire LLC, and then individual series may need to file their own tax returns if they have separate income. As you consider how to form a limited liability company with the ability to establish series, remember that keeping clear financial records for each series can simplify tax filing.

Converting your LLC to a series LLC typically involves amending your existing operating agreement and filing the necessary paperwork with your state. This conversion allows you to benefit from the flexibility and protection that comes with forming a limited liability company with the ability to establish series. Engaging with professionals experienced in this process or utilizing services like US Legal Forms can ensure that you meet all legal requirements smoothly.

Each series within a series LLC may require its own EIN, especially if each series is engaged in different business activities or has separate tax obligations. Being proactive about obtaining an EIN for each series can lead to better financial management and clarity. If you are unsure, consider using the US Legal Forms platform to guide you through this process.

If you have multiple 'Doing Business As' (DBA) names under a single LLC, you can use the same EIN for all of them. This approach simplifies your tax reporting since all income is reported under one EIN. However, remember that separate businesses might have different legal implications, particularly when you form a limited liability company with the ability to establish series, which can enhance your liability protection.

While it is not always legally required, maintaining separate bank accounts for each series in a series LLC is highly advisable. Doing so helps keep finances organized and simplifies tracking income and expenses related to each series. This separation is essential for protecting the liability structure of your business, and it can also make tax reporting more straightforward.

In most cases, a series LLC does not file separate tax returns for each series. Instead, the parent LLC typically reports income and losses from all series on a single return. It is crucial to maintain accurate records for each series, though, so that the financial activities of each can be clearly understood for both tax purposes and legal compliance.