Minnesota Transfer On Death Within 2 Years Iht

Description

How to fill out Minnesota Transfer On Death Deed - Individual To Individual?

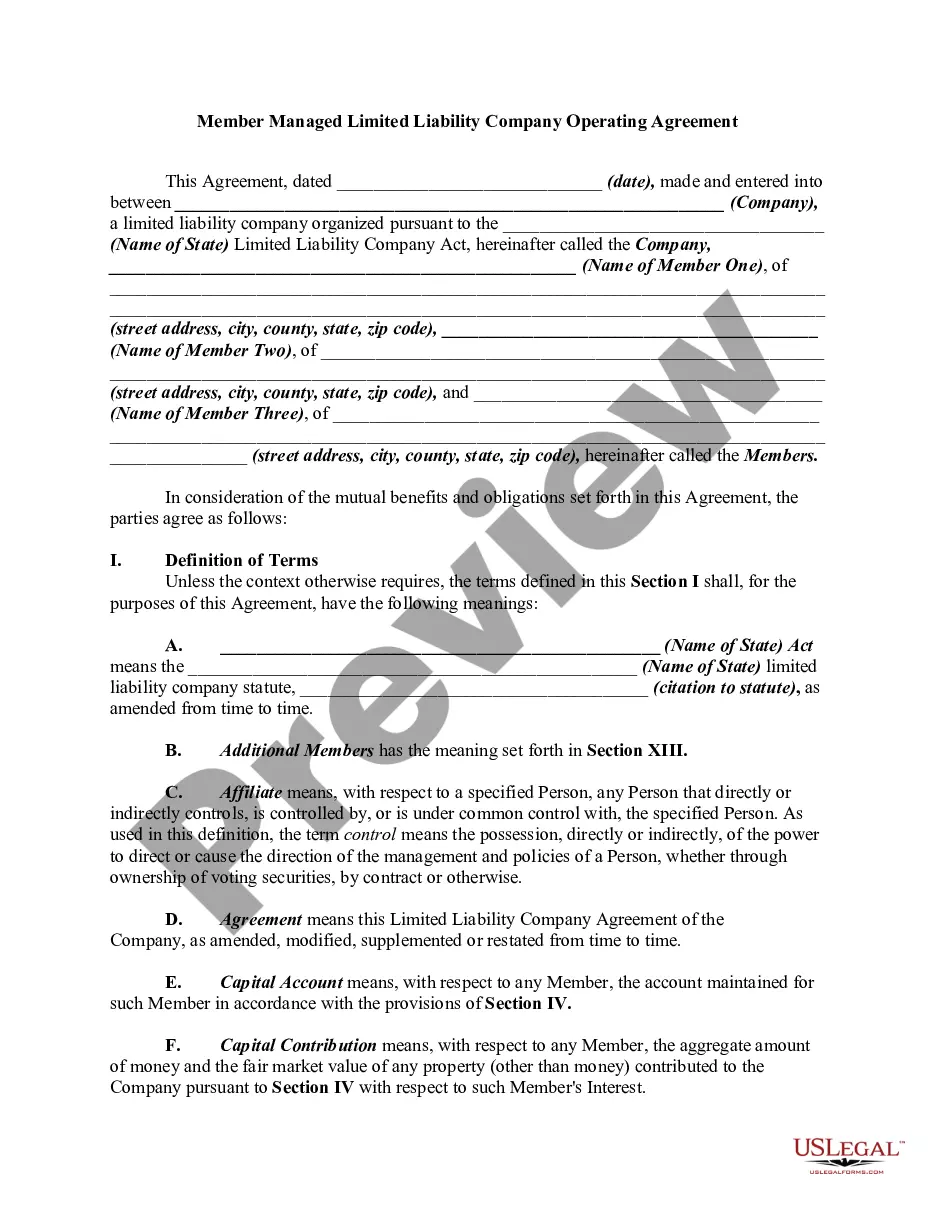

Legal managing might be mind-boggling, even for the most skilled professionals. When you are looking for a Minnesota Transfer On Death Within 2 Years Iht and do not have the a chance to spend in search of the correct and up-to-date version, the operations may be demanding. A strong online form library might be a gamechanger for anybody who wants to handle these situations successfully. US Legal Forms is a market leader in web legal forms, with over 85,000 state-specific legal forms accessible to you whenever you want.

With US Legal Forms, you can:

- Access state- or county-specific legal and business forms. US Legal Forms covers any requirements you may have, from personal to organization documents, all-in-one spot.

- Use advanced tools to finish and deal with your Minnesota Transfer On Death Within 2 Years Iht

- Access a resource base of articles, instructions and handbooks and resources connected to your situation and needs

Help save time and effort in search of the documents you will need, and use US Legal Forms’ advanced search and Preview feature to discover Minnesota Transfer On Death Within 2 Years Iht and acquire it. In case you have a monthly subscription, log in for your US Legal Forms account, search for the form, and acquire it. Take a look at My Forms tab to view the documents you previously saved as well as to deal with your folders as you see fit.

Should it be your first time with US Legal Forms, make an account and acquire unlimited access to all benefits of the library. Listed below are the steps to take after getting the form you want:

- Validate this is the proper form by previewing it and looking at its description.

- Be sure that the sample is acknowledged in your state or county.

- Pick Buy Now once you are ready.

- Choose a subscription plan.

- Pick the formatting you want, and Download, complete, sign, print out and send out your papers.

Take advantage of the US Legal Forms online library, backed with 25 years of experience and trustworthiness. Transform your everyday papers managing in to a smooth and easy-to-use process right now.

Form popularity

FAQ

You must complete the form IHT400, as part of the probate or confirmation process if there's Inheritance Tax to pay, or the deceased's estate does not qualify as an 'excepted estate'.

The timeframe for this process in Minnesota can vary widely, typically ranging from several months to over a year, depending on factors such as the size and complexity of the estate, the clarity of the will, and whether or not the probate process is contested.

Minnesota does not have an inheritance tax. It's is a tax on the beneficiaries of an estate (a tax on what you inherit). If you are a beneficiary, you generally do not have to include inheritance on your income tax return.

To get title to the property after your death, the beneficiary must record the following documents in the county where the property is located: (1) an affidavit of identity and survivorship, (2) a certified death certificate, and (3) a clearance certificate (showing that the county will not seek reimbursement for ...

A transfer on death deed is valid if the deed is recorded in a county in which at least a part of the real property described in the deed is located and is recorded before the death of the grantor owner upon whose death the conveyance or transfer is effective.