Power Of Attorney For Business

Description

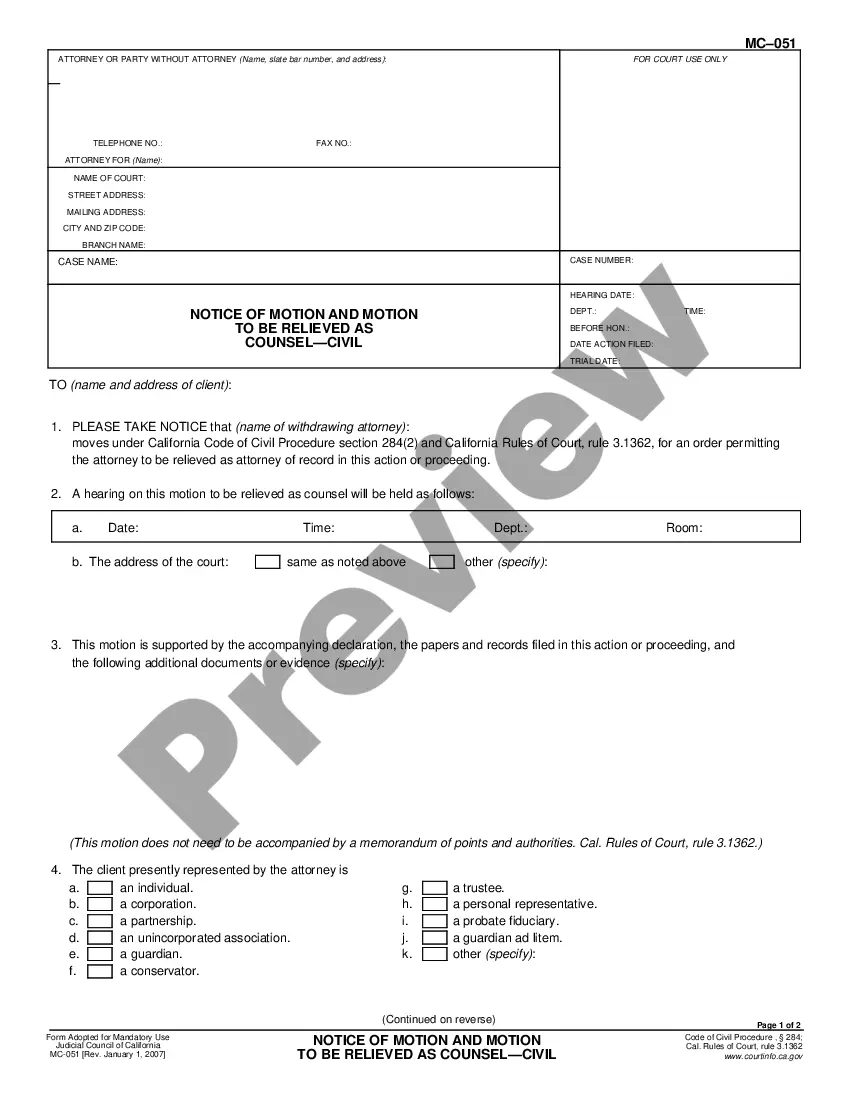

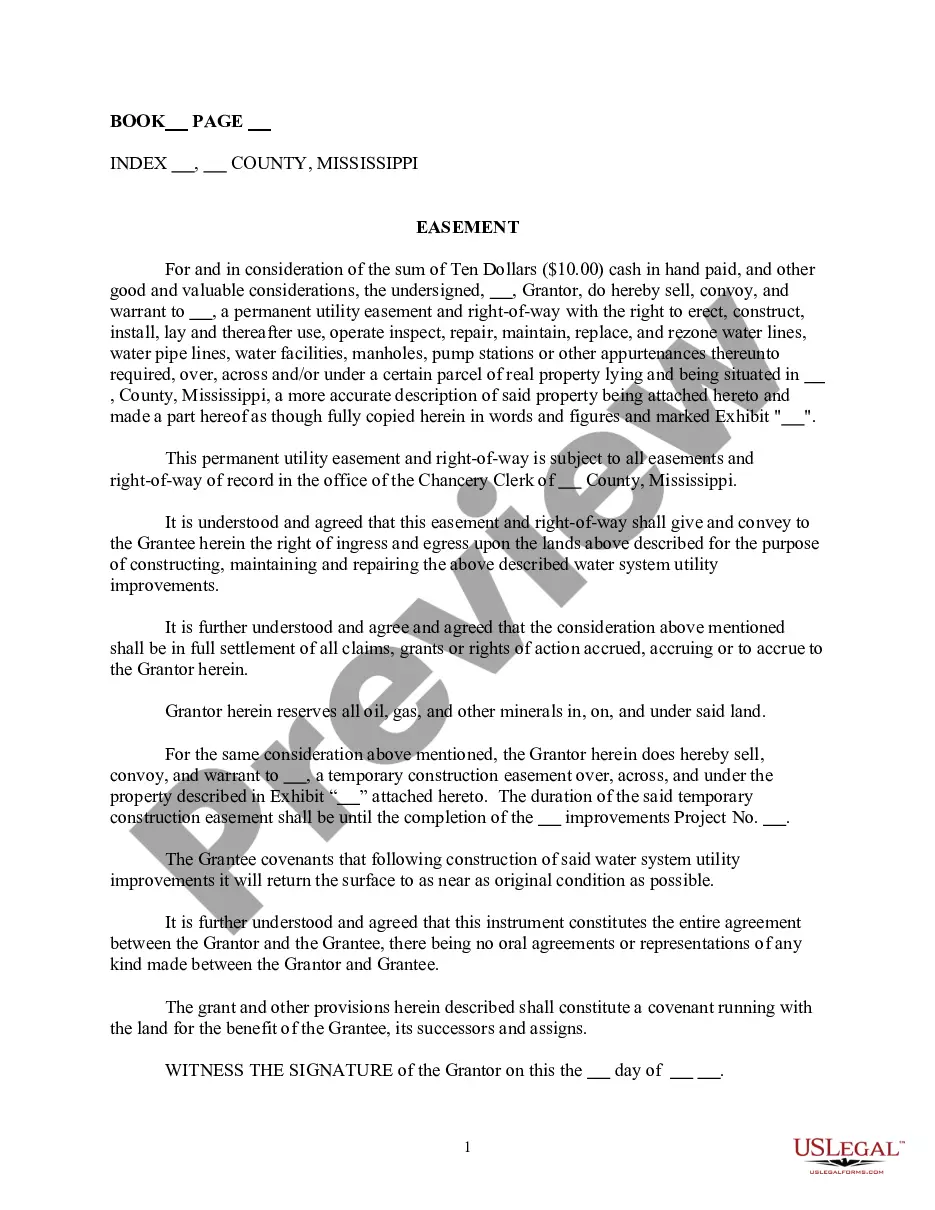

How to fill out Michigan Power Of Attorney Forms Package?

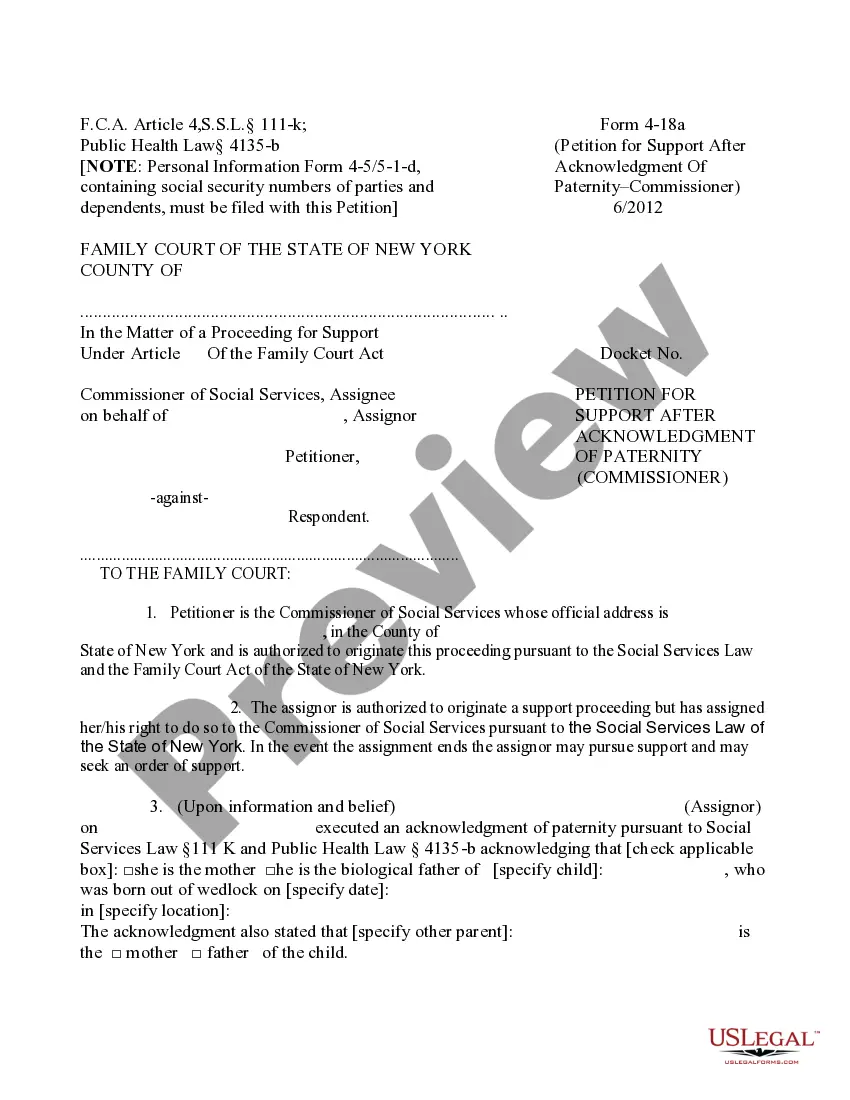

- Log in to your US Legal Forms account if you're an existing user. Make sure your subscription is active for seamless access to form templates.

- Preview the power of attorney forms available. Ensure the selected template aligns with your legal needs and complies with your local jurisdiction.

- Use the search function if needed to find another form. It's crucial that the document accurately fits your specifications before proceeding.

- Select the document you wish to purchase. Click the ‘Buy Now’ button and select a suitable subscription plan. Create an account to unlock the full library of resources.

- Complete your purchase by entering your payment details through credit card or PayPal.

- Download your completed form to your device. You'll also find it saved in the 'My Forms' section of your profile for future reference.

In conclusion, US Legal Forms streamlines the document creation process with an expansive library and professional support. Take the first step towards confidently managing your business needs with a power of attorney today!

Explore our services now to empower your legal journey.

Form popularity

FAQ

A power of attorney for business works with bank accounts by allowing the designated agent to conduct transactions on behalf of the business owner. This includes making deposits, withdrawals, or managing payments. It’s crucial to ensure that the bank has a current copy of the POA to prevent any issues when accessing the account.

Filling out power of attorney paperwork involves several clear steps. First, choose the correct form for your needs, specifying that it is for business purposes. Next, accurately provide the names of both the principal and the agent, outline the powers granted, and ensure everyone involved signs and dates the document. If you prefer, you can use platforms like uslegalforms to guide you through the process.

Yes, a power of attorney can be attached to a business account to authorize someone to manage financial transactions. The designated agent can access the account, write checks, or make deposits as specified in the POA. It is essential to provide your bank with the appropriate documentation to ensure they recognize the authority granted by the POA.

Yes, an LLC can use a power of attorney for business. This allows the LLC to designate someone to handle specific tasks or make decisions, particularly in financial matters or legal representation. When properly executed, the POA can significantly streamline operations for business owners, giving them peace of mind.

In New Jersey, a power of attorney for business must be signed by the principal, typically in front of a notary public. The document should clearly specify the powers being granted and should be dated. Additionally, it’s important to ensure that the chosen agent understands their responsibilities and can act in the best interest of the business.

Yes, you can open a business account on behalf of someone else if you have a valid power of attorney for business. The POA grants you the legal authority to perform such actions. Ensure that the person you represent has provided all necessary documentation to facilitate the account opening process smoothly.

Yes, a power of attorney for business can be used on a business account. This legal document allows someone to act on behalf of the business owner in managing financial matters. However, the bank may require specific forms or documentation to validate the POA. Therefore, it’s wise to check with your bank for their requirements.

An LLC itself cannot have power of attorney, but it can appoint an authorized representative to act on its behalf. This appointed person can handle legal transactions, sign documents, and manage business affairs. By establishing power of attorney for business, LLCs enhance their operational efficiency and ensure decision-making continues smoothly. For a proactive approach, consider using legal services from companies like uslegalforms to create a solid framework for your power of attorney.

Yes, an LLC can grant power of attorney to an individual or another business entity. This arrangement allows appointed agents to act on behalf of the LLC in various legal and financial matters. By using power of attorney for business, LLCs can ensure efficient management and representation, especially when members are unavailable. It’s essential to draft this document properly to ensure it meets all legal requirements and reflects the LLC’s intentions.

The best person for power of attorney is typically someone you trust implicitly, such as a close relative, a friend, or a business partner. This individual should understand your business goals and values, ensuring your interests are safeguarded when you cannot make decisions. They will represent you in important matters, so choose someone who is responsible and capable. Using the power of attorney for business gives you peace of mind, knowing that decisions align with your best interests.