Promissory Note Secured By Real Estate Form

Description

How to fill out Maryland Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

There's no longer a requirement to spend countless hours searching for legal documents to adhere to your local state laws.

US Legal Forms has gathered all of them in a single location and made their accessibility more straightforward.

Our platform offers over 85k templates for various business and personal legal situations categorized by state and purpose.

Completing formal documentation in compliance with federal and state statutes is quick and effortless with our collection. Experience US Legal Forms now to organize your documentation!

- All forms are expertly crafted and validated for authenticity, allowing you to rely on obtaining an up-to-date Promissory Note Secured By Real Estate Form.

- If you are already acquainted with our service and possess an account, you need to verify that your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents at any time by accessing the My documents tab in your profile.

- If you are a new user, the procedure will require a few additional steps to finalize.

- Here's how newcomers can find the Promissory Note Secured By Real Estate Form in our inventory.

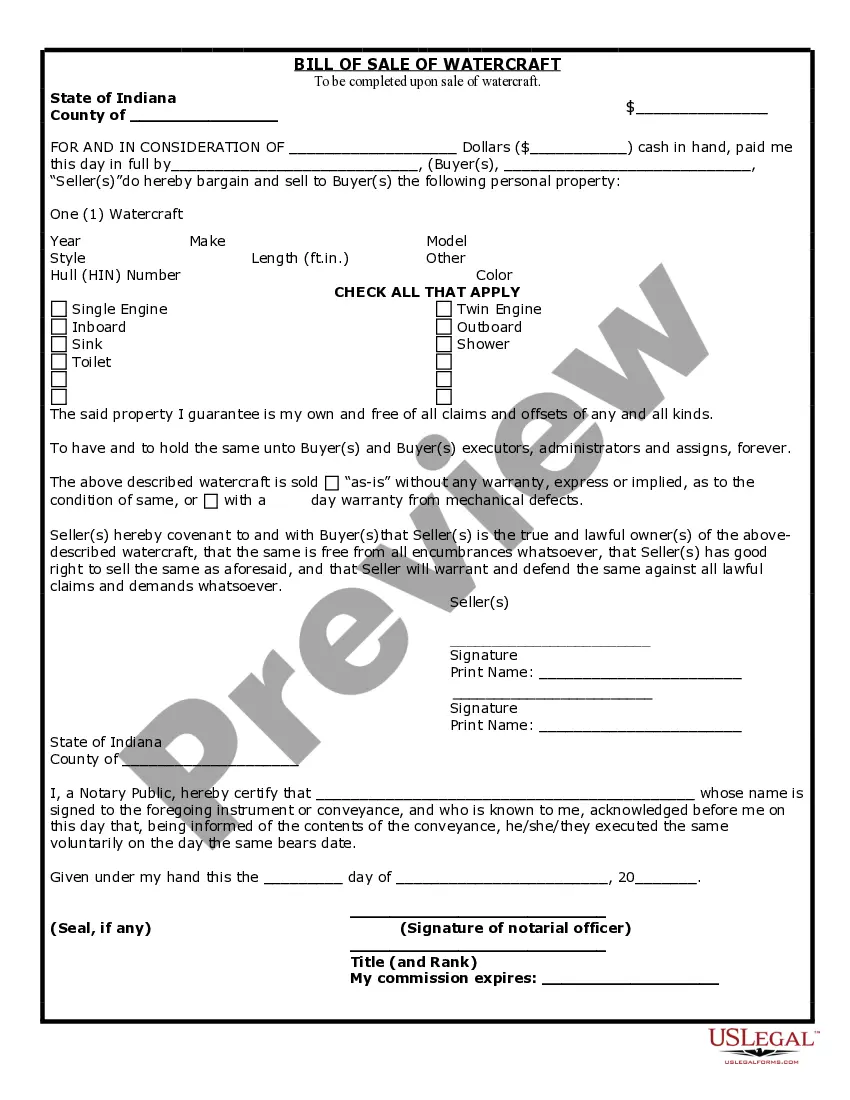

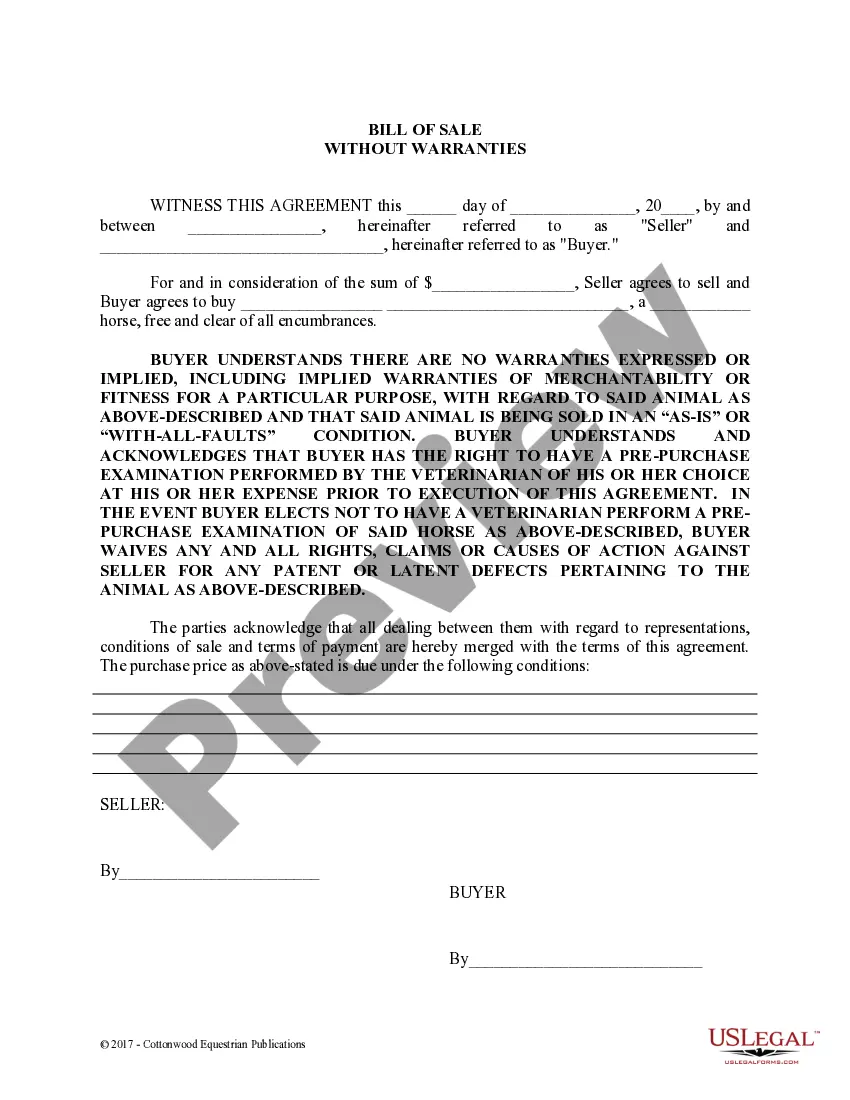

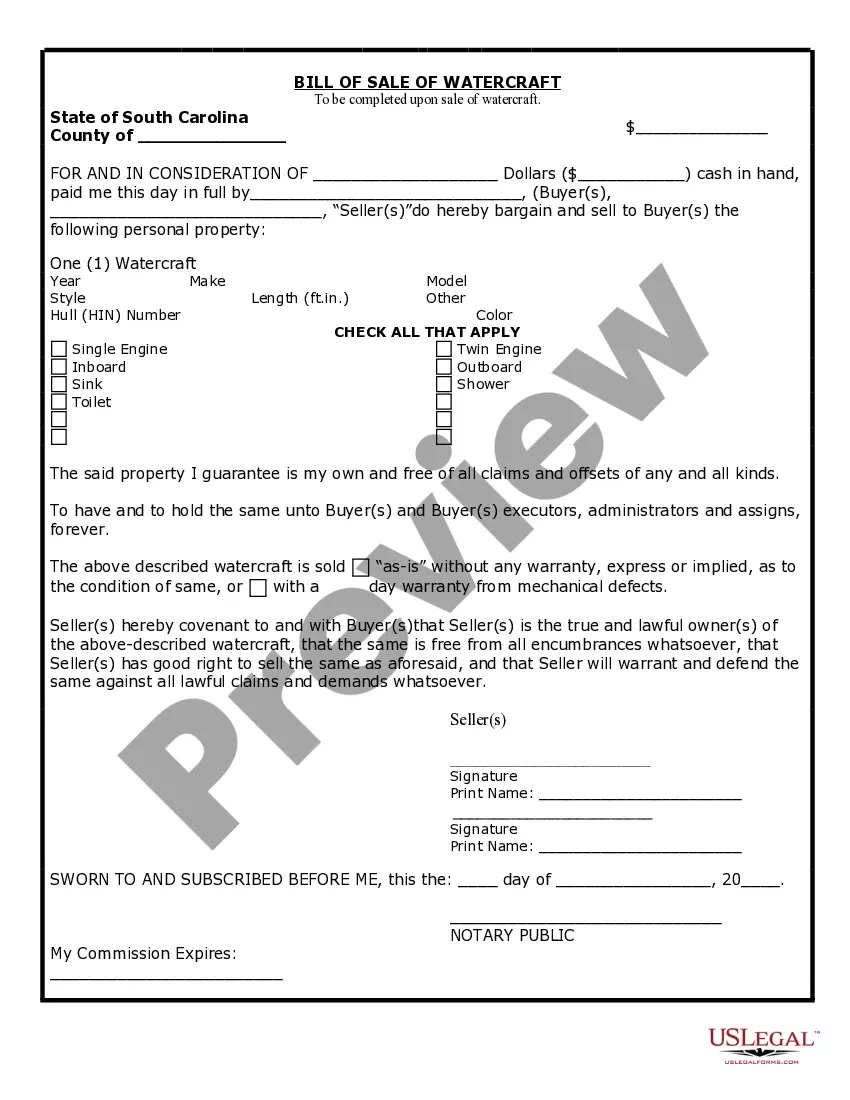

- Examine the page content attentively to ensure it includes the sample you need.

- To assist with this, utilize the form description and preview options if available.

Form popularity

FAQ

With a secured promissory note, the borrower is required to put up some form of collateral, usually property or assets. If the borrower fails to pay back the lender, they will receive the collateral to make up for the lost payments. Loans are typically accompanied by unsecured promissory notes.

Generally, a Secured Promissory Note will be secured using an additional document. If the property being used as collateral is personal property, the Note will be secured using a Security Agreement. If the property being used as collateral is real property, the Note will be secured using a Deed of Trust.

What is a Secured Promissory Note? A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.