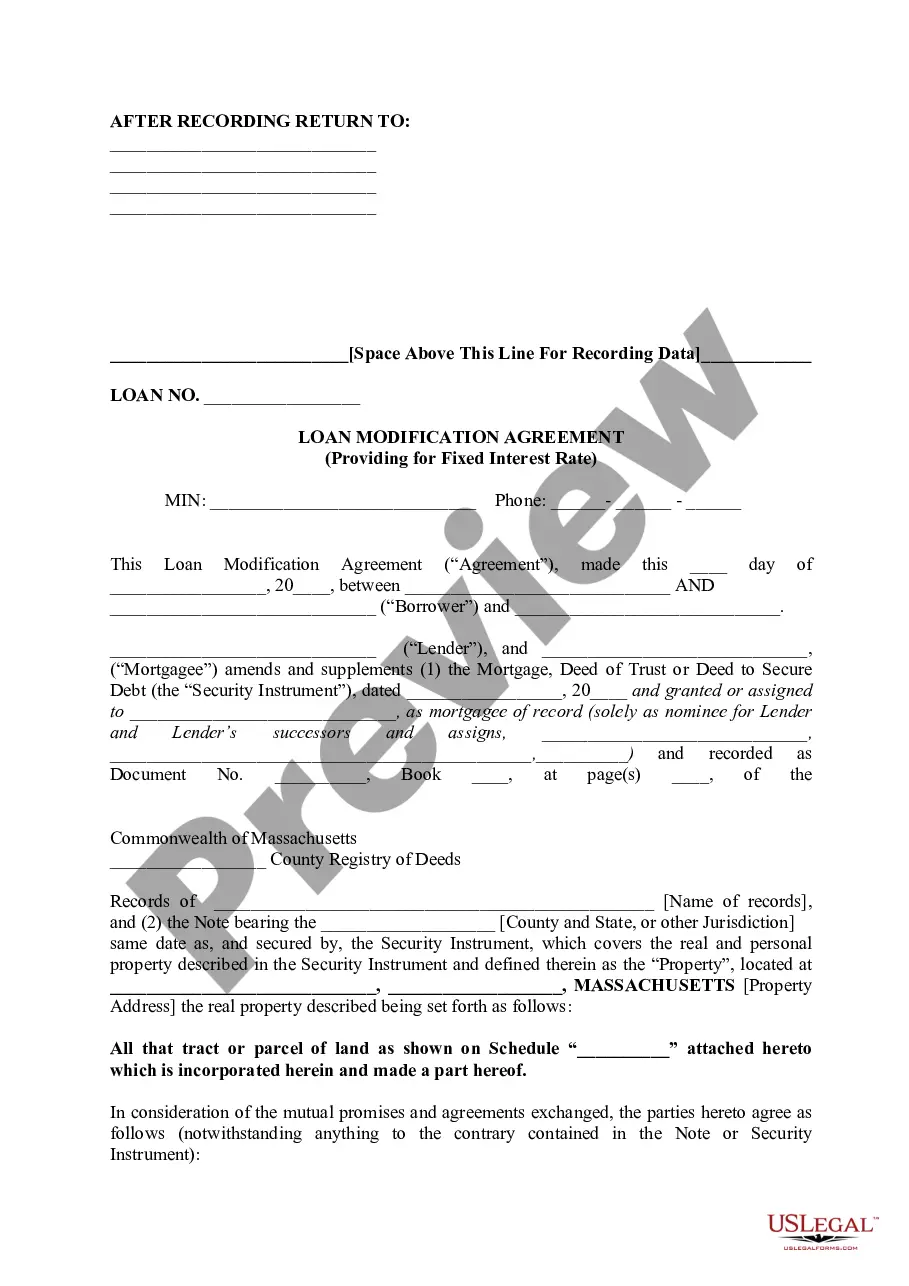

Loan Modification Agreement Form With Security

Description

How to fill out Massachusetts Loan Modification Agreement (Fixed Interest Rate)?

Individuals frequently link legal documentation with something intricate that only an expert can handle.

In some respect, this is accurate, as composing Loan Modification Agreement Form With Security necessitates considerable knowledge of subject criteria, including state and county laws.

However, with the US Legal Forms, everything has become simpler: pre-made legal templates for any life and business circumstance tailored to state laws are gathered in a single online directory and are currently accessible to everyone.

All templates in our catalog are reusable: once purchased, they remain stored in your profile. You can access them anytime needed via the My documents tab. Discover all the advantages of using the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85k current forms organized by state and field of application, making it easy to find Loan Modification Agreement Form With Security or any other specific template in just minutes.

- Prior registered users with an active subscription must Log In to their account and click Download to receive the form.

- New users to the service will first need to create an account and subscribe before they can download any documentation.

- Here is the detailed guide on how to acquire the Loan Modification Agreement Form With Security.

- Scrutinize the page content carefully to ensure it meets your needs.

- Examine the form description or review it through the Preview option.

- Search for another example using the Search bar in the header if the previous one doesn’t meet your requirements.

- Click Buy Now once you find the suitable Loan Modification Agreement Form With Security.

- Choose a pricing plan that satisfies your needs and budget.

- Register for an account or Log In to continue to the payment page.

- Complete your subscription payment through PayPal or with your credit card.

- Choose the format for your file and click Download.

- Print your document or transfer it to an online editor for faster completion.

Form popularity

FAQ

The loan modification process typically takes 6 to 9 months, depending on your lender.

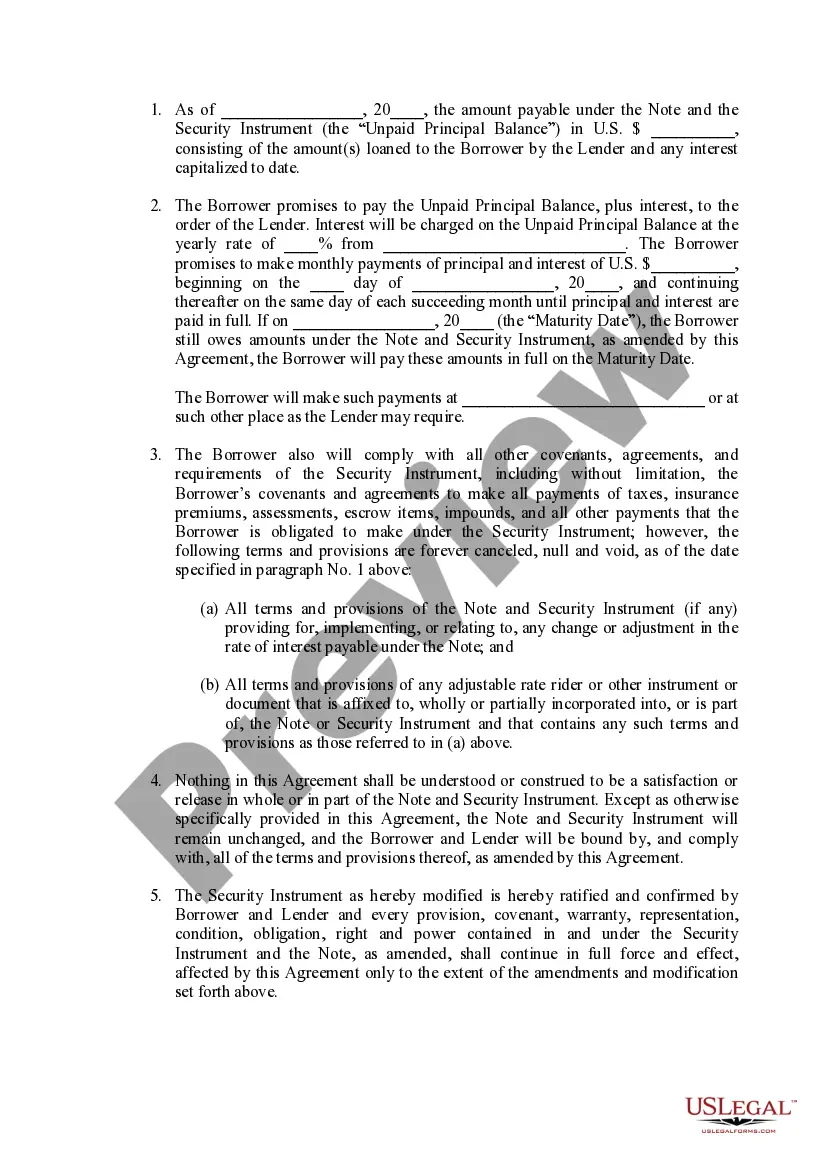

A modification involves one or more of the following: Changing the mortgage loan type (e.g., changing an Adjustable Rate Mortgage to a Fixed-Rate Mortgage) Extending the term of the mortgage (e.g., from a 30-year term to a 40-year term) Reducing the interest rate.

COVID-19: How to Write a Mortgage Loan Modification Request...Keep your letter to a single page.Include income and asset documentation such as pay stubs, bank statements, and other relevant paperwork.Stick to the facts.Let the lender know the specific concession you are requesting.15-Apr-2020

What Is A Loan Modification? A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesn't pay off your current mortgage and replace it with a new one. Instead, it directly changes the conditions of your loan.